Endeavour Silver Updates Reserve and Resource Estimates

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Feb 24, 2014) -

Endeavour Silver Corp. (TSX:EDR)(NYSE:EXK) released today updated

NI 43-101 silver and gold reserve and resource estimates for its

three producing silver mines in Mexico (the Guanaceví Mine in

Durango State and the Bolañitos and El Cubo Mines in Guanajuato

State) as well as one exploration project (San Sebastián Project in

Jalisco State) as of December 31, 2013 using lower silver and gold

prices compared to December 31, 2012.

Proven and probable reserves were down year-on-year due mainly

to the lower metal prices used for the estimates. In response to

the lower metal prices last year, the mine plan was revised to

enhance cash-flow by accelerating production and deferring some

lower priority underground mine development primarily at Bolañitos

and Guanaceví, which also reduced the conversion of resources into

reserves.

Measured and indicated resources were up in 2013 thanks to the

Company's brownfields exploration programs which discovered new

resources primarily at El Cubo and upgraded some inferred resources

but, again in response to the lower metal prices, the exploration

budget was reduced last year which likely reduced the expansion of

resources.

Inferred resources were down last year as a result of the lower

metal prices and reduced exploration budget.

Endeavour normally uses the industry best practice of three year

trailing averages of silver and gold prices for estimating reserves

and resources. To the end of 2013, these trailing price averages

were approximately $1550 per ounce (oz) gold and $30 per oz silver.

Management took the view that these trailing price averages were

too aggressive in the short term for the estimation of reserves so

elected to use US$1320 per oz gold and US$22 per oz silver prices

to more accurately reflect its near term outlook.

The prices used for the resource estimates were 10% higher at

US$1452 per oz gold and $24.20 per oz silver to reflect

management's belief that the metal prices will likely be higher in

the medium and longer terms. However, they are still significantly

lower than the US$31 per oz silver and US$1550 per oz gold prices

used in the previous reserve and resource estimates as of December

31, 2012.

The December 31, 2013 reserve and resource highlights are as

follows:

2013 Reserve/Resource

Highlights (Compared to December 31, 2012)

- Silver Proven and Probable Reserves reduced by 50% to 11.6

million ounces (oz);

- Gold Proven and Probable Reserves reduced by 37% to 139,400

oz;

- Silver Equivalent Proven and Probable Reserves reduced by 41%

to 25.9 million oz;

- Silver Measured and Indicated Resources up 4% to 60.7 million

oz;

- Gold Measured and Indicated Resources up 6% to 556,300 oz;

- Silver Equivalent Measured and Indicated Resources up 11% to

94.1 million oz;

- Silver Inferred Resources reduced by 13% to 40.6 million

oz;

- Gold Inferred Resources reduced by 15% to 396,320 oz;

- Silver Equivalent Inferred Resources reduced by 9% to 64.4

million oz;

- Mineral resources are calculated exclusive of the mineral

reserves

- Proven Reserves are determined as being within 10 meters of

underground development while Probable Reserves are a further 15

meters from underground development.

- Mine plans are developed for the Proven and Probable Reserves

and discounted for Measured and Indicated Resources and further

discounted for the Inferred Resources.

- Mineral reserves have demonstrated economic viability whereas

mineral resources do not

- 2012 silver equivalents based on 50:1 silver:gold ratio, base

metals not included

- 2013 silver equivalents based on 60:1 silver:gold ratio, base

metals not included

- All assumptions used are listed at the bottom of the reserve

and resource summary table

Bradford Cooke, CEO, commented, "Reserve and resource growth

took a back seat to our operational and financial performance last

year due to the sharply lower precious metal prices. We responded

promptly to the lower metal prices by reducing all costs including

our exploration and development budgets which clearly impacted our

ability to replace reserves and expand resources."

"However, with the El Cubo capital reconstruction program

completed on time and under budget last year and all three mining

operations now running smoothly, reserve and resource growth is

back on the front burner for 2014. This year, we will continue to

hone our mining operations, boost profit margins and return our

focus to discovering and delineating ore at all of the three mining

operations as well as at the emerging new high grade discovery at

San Sebastián."

"Despite the sharp decline in precious metal prices year-on-year

and the resulting reduction in reserves and resources at lower

metal prices, we are confident that our talented exploration team

led by Luis Castro, VP of Exploration, will continue to expand

resources and our operations team led by Dave Howe, VP of

Operations, will continue to convert those resources into reserves

and enhance the mine lives of each of our mining operations."

Guanaceví

- Silver Proven and Probable Reserves down 64% to 3.3 million

ounces (oz)

- Gold Proven and Probable Reserves down 65% to 5,800 oz

- Silver Equivalent Proven and Probable Reserves down 64% to 3.7

million oz

- Silver Measured and Indicated Resources up 17.5% to 17.5

million oz

- Gold Measured and Indicated Resources up 53% to 37,200 oz

- Silver Equivalent Measured and Indicated Resources up 33% to

19.7 million oz

- Silver Inferred Resources down 2% to 12.1 million oz

- Gold Inferred Resources down 9% to 20,200 oz

- Silver Equivalent Inferred Resources down 1% to 13.3 million

oz

Bolañitos

- Silver Proven and Probable Reserves down 69% to 2.3 million

ounces (oz)

- Gold Proven and Probable Reserves down 64% to 37,300 oz

- Silver Equivalent Proven and Probable Reserves down 64% to 4.6

million oz

- Silver Measured and Indicated Resources down 50% to 4.6 million

oz

- Gold Measured and Indicated Resources down 44% to 78,100

oz

- Silver Equivalent Measured and Indicated Resources down 43% to

9.3 million oz

- Silver Inferred Resources up 31% to 9.6 million oz

- Gold Inferred Resources up 31% to 111,700 oz

- Silver Equivalent Inferred Resources up 40% to 16.3 million

oz

El Cubo

- Silver Proven and Probable Reserves down by 6% to 5.9 million

ounces (oz)

- Gold Proven and Probable Reserves down by 5% to 96,300 oz

- Silver Equivalent Proven and Probable Reserves up by 6% to 17.6

million oz

- Silver Measured and Indicated Resources up 139% to 10.6 million

oz

- Gold Measured and Indicated Resources up 115% to 165,000

oz

- Silver Equivalent Measured and Indicated Resources up 148% to

20.5 million oz

- Silver Inferred Resources down 32% to 7.7 million oz

- Gold Inferred Resources down 41% to 130,100 oz

- Silver Equivalent Inferred Resources 31% to 15.5 million

oz

San

Sebastián

- Silver Indicated Resources increased 60% to 18.2 million

oz

- Gold Indicated Resources of increased 25% to 86,300 oz

- Silver Equivalent Indicated Resources increased 57% to 23.4

million oz

- Silver Inferred Resources down 31% to 13.4 million oz

- Gold Inferred Resources down 8% to 126,800 oz

- Silver Equivalent Inferred Resources down 20 to 21.0 million

oz

Endeavour's other exploration projects in Mexico were not

drilled in 2013 (Guadalupe y Calvo and Parral Projects in Chihuahua

and Arroyo Seco Project in Michoacán) so their resource estimates

remain unchanged. The Guadalupe y Calvo resources were estimated in

2012 and the Parral and Arroyo Seco resources were estimated at the

end of 2010.

The Qualified Person for the Mineral Resource and Reserve

Estimates was Mike Munroe, BSc, MSc, SME Registered Member

4151306RM. The reports for Guanaceví, Bolañitos, El Cubo and San

Sebastián will be completed and filed on SEDAR within 45 days of

this news release. The Guadalupe y Calvo report was authored by

Charley Murahwi, M.Sc., P.Geo, FAusIMM and Alan San Martin,

MAusIMM(CP) and previously filed on SEDAR in March 2013. The Arroyo

Seco report was authored by David St. Clair Dunn B.Sc., P.Geo and

Barry Devlin M.Sc., P. Geo, both of whom are Qualified Persons, and

the report was previously filed on SEDAR in March 2011.

Godfrey Walton, M.Sc., P.Geo., President and COO of Endeavour,

is the Qualified Person who reviewed and approved the technical

information contained in this news release.

These reserve and resource statements were classified following

the definitions and guidelines of the Canadian Institute of Mining,

Metallurgy and Petroleum CIM standards and definitions on Mineral

Resources and Reserves and the guidelines of NI 43-101.

ENDEAVOUR SILVER

CORP.

About Endeavour Silver - Endeavour is a mid-tier silver mining

company focused on growing its profits, production, reserves and

resources in Mexico. Since start-up in 2004, Endeavour has posted

nine consecutive years of accretive growth of its silver mining

operations. The organic expansion programs now underway at

Endeavour's three silver-gold mines in Mexico combined with its

strategic acquisition and exploration programs should facilitate

Endeavour's goal to become a premier senior silver producer.

Cautionary Note Regarding Forward-Looking

Statements

This news release contains "forward-looking statements"

within the meaning of the United States private securities

litigation reform act of 1995 and "forward-looking information"

within the meaning of applicable Canadian securities legislation.

Such forward-looking statements and information herein include but

are not limited to statements regarding Endeavour's anticipated

performance in 2014 and the timing and results of exploration drill

programs. The Company does not intend to, and does not assume any

obligation to update such forward-looking statements or

information, other than as required by applicable law.

Forward-looking statements or information involve known and

unknown risks, uncertainties and other factors that may cause the

actual results, level of activity, performance or achievements of

Endeavour and its operations to be materially different from those

expressed or implied by such statements. Such factors include,

among others, changes in national and local governments,

legislation, taxation, controls, regulations and political or

economic developments in Canada and Mexico; operating or technical

difficulties in mineral exploration, development and mining

activities; risks and hazards of mineral exploration, development

and mining; the speculative nature of mineral exploration and

development, risks in obtaining necessary licenses and permits, and

challenges to the Company's title to properties; fluctuations in

the prices of commodities and their impact on reserves and

resources as well as those factors described in the section "risk

factors" contained in the Company's most recent form 40F/Annual

Information Form filed with the S.E.C. and Canadian securities

regulatory authorities.

Forward-looking statements are based on assumptions

management believes to be reasonable, including but not limited to:

the continued operation of the Company's mining operations, no

material adverse change in the market price of commodities, mining

operations will operate and the mining products will be completed

in accordance with management's expectations and achieve their

stated production outcomes, and such other assumptions and factors

as set out herein. Although the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in forward-looking statements or

information, there may be other factors that cause results to be

materially different from those anticipated, described, estimated,

assessed or intended. There can be no assurance that any

forward-looking statements or information will prove to be accurate

as actual results and future events could differ materially from

those anticipated in such statements or information. Accordingly,

readers should not place undue reliance on forward-looking

statements or information.

|

Silver-Gold Reserves & Resources (as of Dec 31,

2013) |

|

|

Reserves |

Tonnes |

Ag g/t |

Au g/t |

Ag oz |

Au oz |

Ag oz Eq |

|

Guanaceví |

327,800 |

281 |

0.51 |

2,961,900 |

5,300 |

3,279,900 |

|

Bolañitos |

380,530 |

156 |

2.50 |

1,910,300 |

30,500 |

3,740,300 |

|

El Cubo |

752,500 |

138 |

2.16 |

3,330,300 |

52,200 |

6,462,300 |

|

Total Proven |

1,460,830 |

175 |

1.87 |

8,202,500 |

88,000 |

13,482,500 |

|

|

|

|

|

|

|

|

|

Guanaceví |

34,600 |

342 |

0.46 |

380,800 |

500 |

410,800 |

|

Bolañitos |

98,300 |

134 |

2.17 |

424,200 |

6,800 |

832,200 |

|

El Cubo |

615,400 |

131 |

2.23 |

2,595,700 |

44,100 |

5,242,700 |

|

Total Probable |

748,300 |

141 |

2.14 |

3,400,700 |

51,400 |

6,485,700 |

|

|

|

|

|

|

|

|

|

Total Proven & Probable |

2,209,130 |

163 |

1.96 |

11,603,200 |

139,400 |

19,968,200 |

|

|

|

|

|

|

|

|

|

Resources |

Tonnes |

Ag g/t |

Au g/t |

Ag oz |

Au oz |

Ag oz Eq |

|

Guanaceví |

132,000 |

183 |

0.29 |

777,200 |

1,300 |

855,200 |

|

Bolañitos |

75,900 |

132 |

1.39 |

322,800 |

3,400 |

526,800 |

|

El Cubo |

660,100 |

158 |

2.87 |

3,357,800 |

60,800 |

7,005,800 |

|

Total Measured |

868,000 |

160 |

2.35 |

4,457,800 |

65,500 |

8,387,800 |

|

|

|

|

|

|

|

|

|

Guanaceví |

1,701,200 |

242 |

0.57 |

13,221,400 |

31,500 |

15,111,400 |

|

Bolañitos |

1,191,800 |

111 |

1.95 |

4,263,300 |

74,700 |

8,745,300 |

| El

Cubo |

1,570,500 |

144 |

2.06 |

7,263,100 |

104,200 |

13,515,100 |

|

San Sebastián |

2,476,000 |

229 |

1.08 |

18,216,200 |

86,300 |

23,394,200 |

|

Guadalupe y C |

1,861,000 |

119 |

2.38 |

7,147,300 |

142,500 |

15,697,300 |

|

Total Indicated |

8,800,500 |

177 |

1.55 |

50,111,300 |

439,200 |

76,463,300 |

|

|

|

|

|

|

|

|

|

Total Measured and Indicated |

9,668,500 |

176 |

1.62 |

54,569,100 |

504,700 |

84,851,100 |

|

|

|

|

|

|

|

|

|

Resources - Inferred |

Tonnes |

Ag g/t |

Au g/t |

Ag oz |

Au oz |

Ag oz Eq |

|

Guanaceví |

1,155,100 |

253 |

0.46 |

9,384,700 |

17,100 |

10,410,700 |

|

Bolañitos |

2,145,150 |

140 |

1.62 |

9,642,200 |

111,720 |

16,345,400 |

| El

Cubo |

1,477,900 |

174 |

3.40 |

7,729,800 |

130,100 |

15,535,800 |

|

San Sebastián |

2,376,000 |

175 |

1.66 |

13,390,600 |

126,800 |

20,998,600 |

|

Guadalupe y C |

154,000 |

94 |

2.14 |

464,600 |

10,600 |

1,100,600 |

|

Total Inferred |

7,308,150 |

173 |

1.69 |

40,611,900 |

396,320 |

64,391,100 |

|

|

|

|

|

|

|

|

|

|

Silver-Gold-Lead-Zinc Resources (as of Sept 30,

2013) |

|

|

|

|

|

|

|

|

|

Resources - Indicated |

Tonnes |

Ag g/t |

Au g/t |

Ag oz |

Au oz |

Ag oz Eq |

|

Parral |

1,631,000 |

49 |

0.90 |

2,589,900 |

47,200 |

5,421,900 |

|

Santa Cruz Mine XC-2 (Ag-Pb-Zn) |

- |

- |

- |

- |

- |

- |

|

Buena Fe (Ag-Pb-Zn) |

655,000 |

166 |

0.21 |

3,495,700 |

4,400 |

3,759,700 |

|

Total Indicated |

2,286,000 |

83 |

0.70 |

6,085,600 |

51,600 |

9,181,600 |

|

|

|

|

|

|

|

|

|

Total Indicated |

2,286,000 |

83 |

0.70 |

6,085,600 |

51,600 |

9,181,600 |

|

|

|

|

|

|

|

|

|

Resources - Inferred |

Tonnes |

Ag g/t |

Au g/t |

Ag oz |

Au oz |

Ag oz Eq |

|

Guanaceví |

646,000 |

129 |

0.15 |

2,687,300 |

3,100 |

2,873,300 |

|

Parral |

1,303,000 |

63 |

0.88 |

2,658,900 |

36,900 |

4,872,900 |

|

Arroyo Seco |

738,000 |

220 |

0.07 |

5,220,000 |

1,700 |

5,322,000 |

|

Total Inferred |

2,687,000 |

122 |

0.48 |

10,566,200 |

41,700 |

13,068,200 |

|

Total Pb-Zn |

4,973,000 |

104 |

0.58 |

16,651,800 |

93,300 |

22,249,800 |

|

|

|

|

|

|

|

|

|

Grand Total |

24,158,780 |

159 |

1.46 |

123,436,000 |

1,133,720 |

191,460,200 |

Notes:

- Reserve cut-off grade at Guanaceví is 217 gpt Ag

equivalent

- Reserve cut-off grade at Bolanitis is 155 gpt Ag

equivalent

- Reserve cut-off grade at El Cubo is 130 gpt Ag equivalent

- Minimum mining width is 0.8m at Cubo, 1.8m at Guanaceví and

2.0m at Bolañitos.

- Dilution factor at Cubo is 75% for all mining methods inclusive

of dilution to minimum mining width. At Bolañitos, the dilution

factor is 15% on cut&fill, and 25% on longhole. At Guanaceví,

dilution factor is 15% on cut&fill.

- Resource cut-off grade for all three mines is 100 g/t Ag

equivalent

- Reserves and Resources Silver Equivalents are based on a 60:1

silver to gold ratio

- Resource cut-off grade for San Sebastián is 100 g/t Ag

equivalent.

- Resource cut-off grade for the Guadalupe y Calvo property is

100 g/t Ag equivalent

- Resource cut-off grade for Parral project is an NSR of $40

using with the metal prices below

- Resource cut-off grade for Arroyo Seco is 100 g/t Ag

|

| Net Smelter Return (NSR) Cut-off Parameters for the

Parral Project |

|

Description |

Parameter |

|

Gold Price |

US $1,000 per oz |

|

Silver Price |

US $16 per oz |

|

Lead Price |

US $0.65 per lb |

|

Zinc Price |

US $0.65 per lb |

|

Gold Recovery (Overall) |

75% |

|

Silver Recovery (Overall) |

71% |

|

Lead Recovery (Overall) |

80% |

|

Zinc Recovery (Overall) |

74% |

|

Smelter Terms |

Based on generic contract |

Endeavour Silver Corp.Meghan BrownDirector Investor

RelationsToll free: (877) 685-9775 or (604)

640-4804mbrown@edrsilver.comwww.edrsilver.com

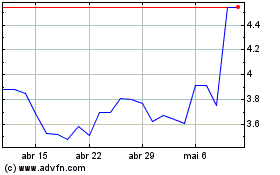

Endeavour Silver (TSX:EDR)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Endeavour Silver (TSX:EDR)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024