Senior Management Invests an Additional $11.2 Million in Element's Securities

19 Junho 2014 - 8:21AM

Marketwired

Senior Management Invests an Additional $11.2 Million in Element's

Securities

TORONTO, ONTARIO--(Marketwired - Jun 19, 2014) - Element

Financial Corporation (TSX:EFN) ("Element" or the "Company"), one

of North America's leading equipment finance companies, today

announced that members of the Company's senior management team and

Board of Directors purchased approximately $11.2 million worth of

Element securities in connection with the Company's recently

completed $1.42 billion offering of subscription receipts,

debentures and preferred shares (the "Offering").

"The entire senior management team and all of the members of our

Board participated in this Offering with demand from this group

exceeding the available allocation," noted Steven K. Hudson,

Element's Chairman and CEO. "A personal financial commitment of

this scale from those of us who are closest to the inner workings

of this Company is supported by the stronger than forecast

origination growth that we are seeing across each of our four

verticals," added Mr. Hudson.

All security purchases referenced above were funded by the

personal resources of the individual investor and were not

supported by loans from the Company.

About Element Financial Corporation

With total assets expected to reach $10 billion following the

closing of the previously announced acquisition of PHH

Corporation's fleet management business, Element Financial

Corporation is one of North America's leading equipment finance

companies. Element operates across North America in four verticals

of the equipment finance market - Commercial & Vendor Finance,

Aviation Finance, Railcar Finance and Fleet Management.

Forward Looking Statements

This release includes forward-looking statements regarding

Element and its business. Such statements are based on the current

expectations and views of future events of Element's management. In

some cases the forward-looking statements can be identified by

words or phrases such as "may", "will", "expect", "plan",

"anticipate", "intend", "potential", "estimate", "believe" or the

negative of these terms, or other similar expressions intended to

identify forward-looking statements. Forward-looking statements in

this release include those related to the closing of the

acquisition of PHH Corporation's fleet management business and

forecast origination growth. The forward-looking events and

circumstances discussed in this release may not occur and could

differ materially as a result of known and unknown risk factors and

uncertainties affecting Element, including risks regarding the

equipment finance industry, economic factors and many other factors

beyond the control of Element. No forward-looking statement can be

guaranteed. Forward-looking statements and information by their

nature are based on assumptions and involve known and unknown

risks, uncertainties and other factors which may cause our actual

results, performance or achievements, or industry results, to be

materially different from any future results, performance or

achievements expressed or implied by such forward-looking statement

or information. Accordingly, readers should not place undue

reliance on any forward-looking statements or information. Except

as required by applicable securities laws, forward-looking

statements speak only as of the date on which they are made and

Element undertakes no obligation to publicly update or revise any

forward-looking statement, whether as a result of new information,

future events, or otherwise.

Element Financial CorporationJohn SadlerSenior Vice

President(416) 386-1067 ext. 2313jsadler@elementfinancial.caElement

Financial CorporationMichel BelandChief Financial Officer(416)

386-1067 ext. 2225mbeland@elementfinancial.ca

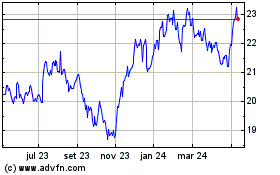

Element Fleet Management (TSX:EFN)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

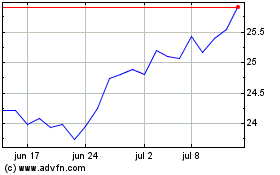

Element Fleet Management (TSX:EFN)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024