Emera Announces Bought Deal Offering of 7,800,000 Common Shares

10 Dezembro 2013 - 9:50AM

Marketwired Canada

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE

UNITED STATES.

Emera Incorporated ("Emera") (TSX:EMA) announced today that it has entered into

an agreement with a syndicate led by Scotiabank, CIBC, RBC Capital Markets and

TD Securities Inc., under which they have agreed to purchase from Emera and sell

to the public 7,800,000 Common Shares of Emera. The underwriters will also have

the option to purchase up to an additional 865,000 Common Shares to cover

over-allotments, if any, and for market stabilization purposes, during the 30

days following the closing of the offering (the "Over-Allotment Option").

The purchase price of $28.85 per Common Share will result in gross proceeds to

Emera of $225,030,000 ($249,985,250 if the Over-Allotment Option is exercised in

full). The net proceeds of the offering will be used for general corporate

purposes to support the Company's recently announced growth initiatives and to

reduce indebtedness outstanding under Emera's credit facility. This financing

addresses Emera's near-term common equity needs. The proceeds of the issuance,

together with internal cash generation, planned project level debt and preferred

share financing activities in 2014, are expected to be sufficient to finance the

company's current capital expenditure schedule and forecast through to 2015.

The offering is subject to the receipt of all necessary regulatory and stock

exchange approvals. Closing is expected to occur on or about January 7, 2014.

The Common Shares have not been registered under the U.S. Securities Act of

1933, as amended, and may not be offered or sold in the United States absent

registration or an applicable exemption from the registration requirements. This

media release shall not constitute an offer to sell or the solicitation of an

offer to buy, nor shall there be any offer, solicitation or sale of the

securities in any province, state or jurisdiction in which such offer,

solicitation or sale would be unlawful.

Forward-Looking Information

This news release contains forward-looking information with respect to Emera. By

its nature, forward-looking information requires Emera to make assumptions and

is subject to inherent risks and uncertainties. There is significant risk that

predictions, forecasts, conclusions and projections that constitute

forward-looking information will not prove to be accurate, that Emera's

assumptions may not be correct and that actual results may differ materially

from such forward-looking information. Detailed information about these

assumptions, risks and uncertainties is included in Emera's securities

regulatory filings, which can be found on SEDAR at www.sedar.com.

About Emera

Emera is an energy and services company with $8.0 billion in assets and 2012

revenues of $2.1 billion. The company invests in electricity generation,

transmission and distribution, as well as gas transmission and utility energy

services. Emera's strategy is focused on the transformation of the electricity

industry to cleaner generation and the delivery of that clean energy to market.

Emera has investments throughout Northeastern North America, and in four

Caribbean countries. More than 80% of the company's earnings come from regulated

investments. Emera common and preferred shares are listed on the Toronto Stock

Exchange and trade respectively under the symbol EMA, EMA.PR.A., EMA.PR.C., and

EMA.PR.E. Additional information can be accessed at www.emera.com or at

www.sedar.com.

FOR FURTHER INFORMATION PLEASE CONTACT:

Investor Relations: Emera Incorporated

Jill Hennigar, CA

Manager, Investor Relations

902-428-6486

jill.hennigar@emera.com

Media: Emera Incorporated

Dina Bartolacci Seely

Senior Communications Advisor

902-428-6059

dina.bartolacci@emera.com

www.emera.com

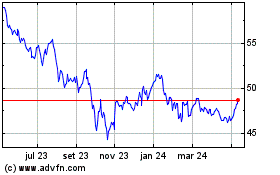

Emera (TSX:EMA)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

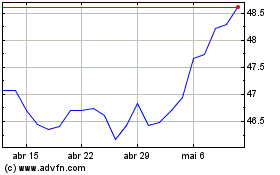

Emera (TSX:EMA)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025