/NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE

UNITED STATES/

Imperial Metals Corporation (the "Company") (TSX:III) today announced the launch

of a US$325 million senior notes offering, guidance on 2013 annual financial

results, and an update on the Red Chris project.

US$325 Million Senior Notes Offering and Associated Financings

Imperial reports it intends to offer US$325 million of senior unsecured notes

maturing in 2019 (the "Notes"). The interest rate and other terms of the Notes

will be determined based on prevailing market conditions. The Company intends to

use the net proceeds of the Notes to repay existing indebtedness, to fund

capital expenditures related to the Red Chris project, and for general corporate

purposes.

Concurrently with the consummation of the Notes offering, the Company intends to

enter into a new senior secured credit facility with a syndicate of banks. The

new facility is expected to be comprised of a $50 million tranche to be used for

general corporate purposes, and a second $150 million tranche to be used to fund

Red Chris project costs. The closing of the offering of the Notes and the

completion of the new senior secured credit facility are conditional on one

another.

In addition, concurrent with the closing of the offering of the Notes and the

completion of the new senior secured credit facility, the Company intends to

enter into a $75 million junior unsecured loan facility with Edco Capital

Corporation. This corporation is owned by Mr. N. Murray Edwards, a significant

shareholder of the Company. This junior unsecured facility is available to fund

project cost overruns associated with the Red Chris project, backstop the

payment of certain third party reimbursement obligations relating to the Iskut

extension of the Northwest Transmission Line ("NTL") and for general corporate

purposes. In connection with this facility, Edco Capital Corporation will

receive a $750,000 commitment fee and warrants to acquire 750,000 of the

Company's shares at $20 per share. These transactions with Edco Capital

Corporation are exempt from the formal valuation and minority approval

requirements of Multilateral Instrument 61-101 as they represent less than 25%

of the Company's market capitalization.

The offer and sale of the Notes will not be registered under the United States

Securities Act of 1933, as amended (the "Securities Act") or the securities laws

of any state or the securities laws of any other jurisdiction. The Notes may not

be offered or sold in the United States absent registration or an applicable

exemption from the registration requirements of the Securities Act and

applicable state securities laws. Accordingly, the Notes will be offered and

sold in the United States only to "qualified institutional buyers" in accordance

with Rule 144A under the Securities Act, and outside the United States in

reliance on Regulation S under the Securities Act. In addition, in all cases,

the Notes may only be offered and sold on a private placement basis pursuant to

an exemption from the prospectus requirements of the Securities Act (British

Columbia) and, if applicable, securities laws in other provinces and territories

in Canada. Further, the Notes may only be offered and sold outside the United

States and Canada on a private placement basis pursuant to certain exemptions

from applicable securities laws.

This press release shall not constitute an offer to sell or the solicitation of

an offer to buy the Notes, nor shall there be any offer or sale of the Notes in

any jurisdiction in which such offer, solicitation or sale would be unlawful.

The material change report in relation to the above transactions will be filed

less than 21 days before the expected date of the closing as the Company intends

to complete this transaction as soon as commercially feasible.

New Non-IFRS Financial Measures

In an offering memorandum to be distributed to prospective investors of the

Notes, the Company has disclosed certain information relating to the Company's

cash cost per pound of copper produced and Adjusted EBITDA. The Company is

furnishing such information in Schedule A to this press release.

Guidance on 2013 Annual Financial Results

The Company expects to report its financial results for the year ended December

31, 2013 in the last week of March. In connection with the Notes offering, the

Company is providing to prospective purchasers of the Notes certain preliminary

information with respect to its expected results for the year ended December 31,

2013 as set forth below:

Revenues: Sales volumes for the Mount Polley mine for the fourth quarter of 2013

were similar to the prior quarters in 2013 and therefore the Company expects

revenues to be in the range of $178 million to $196 million for the year 2013.

Adjusted EBITDA: In conjunction with the disclosure of this new non-IFRS

financial measure as disclosed in Schedule A to this press release the Company

expects Adjusted EBITDA for 2013 to be in the range of $82 million to $91

million.

Capital expenditures: The Company expects capital expenditures to be

approximately $367.0 million to $405.0 million for the year ended December 31,

2013.

The financial data set forth in the paragraphs above are preliminary and are

subject to revision based upon the completion of the Company's 2013 financial

statements and the related audit of the Company's 2013 period by its independent

chartered accountants. Once the Company has completed its 2013 financial

statements and its independent chartered accountants have completed the audit of

the Company's financial statements for 2013, the Company may report financial

results that could differ, and such differences could be material.

Red Chris Project Update

To December 31, 2013 the Company had incurred $438.8 million on the construction

of Red Chris of which $47.8 million was in accounts payable and accruals at that

date. Between October 1, 2013 and December 31, 2013, the Company had borrowed

$90.0 million under an existing line of credit facility with Edco Capital

Corporation. Between January 1, 2014 and February 28, 2014, the Company borrowed

an additional $47.5 million under such line of credit facility. These borrowings

were primarily used to fund the Red Chris project. As at February 28, 2014, the

Company had borrowed $242.5 million under its $250.0 million existing line of

credit facility with Edco Capital Corporation and expects to borrow the

remaining $7.5 million available under that facility in the coming weeks.

The 287kv NTL from Skeena substation to Bob Quinn is under construction by BC

Hydro with a targeted completion date of May 2014. The 93 kilometre Iskut

extension of the NTL from Bob Quinn to Tatogga is under construction by the

Company with a targeted completion date of June 2014.

Construction of access roads and right of way clearing for the Iskut extension

of the NTL is 100% complete. A 150 person camp and laydown yards were

established along the route to store and assemble lattice structure components.

An experienced powerline constructor has installed to date approximately 57% of

the foundations and assembled 82% of the structures; the remaining foundations

and structures, hardware and conductor will be installed in the coming months.

Red Chris on-site work began in May 2012. The current status of site work is:

-- A construction camp to house 480 employees and contractors is fully

operational;

-- truck shop, warehouse and concentrate shed is complete and currently

being used as dry storage for equipment;

-- concrete placement and structural steel erection are complete for the

coarse ore handling facilities, the primary crusher building, the

mechanically stabilized earth wall, the overland conveyor, the transfer

towers and the reclaim tunnel;

-- concrete foundations for the 287kv main substation and the reagent

building are complete;

-- pre-engineered process plant building is fully enclosed and internal

concrete is approximately 97% complete;

-- mechanical installations site wide are approximately 50% complete;

-- North Starter Dam has been built to 1097 metre elevation providing

adequate water storage for mill startup;

-- tailings and reclaim system of pipelines and booster pump house is

approximately 25% complete.

Planned activities in 2014 will include the final installation of the primary

crusher, process water tanks, interior steel, grinding mills, electrical

equipment, reagent building and tailings system. Construction of the 287kv 17

kilometre powerline from Tatogga to the mine site began in January 2014. Mine

pre-development began in January 2014 with the start of stripping of overburden

from the East zone of the Red Chris mine. The Company is targeting to commence

commissioning of the Red Chris mine in June 2014 and to achieve full operations

in the fourth quarter of 2014.

The cost of constructing the Red Chris mine is now forecast to be $540 million,

approximately 8.0% over the December 2012 estimate. The major areas of increase

are:

-- Certain contractor tenders for 2013 Request for Proposals were above the

cost estimate. These increases were mitigated in part by Red Chris

choosing to self-perform the mechanical and piping installations;

-- Tailings impoundment area earthwork construction costs overran as

additional borrow materials were excavated to uncover suitable filter

zone and till core for placement and compaction. The filter zone was

screened, hauled and placed with small equipment at extra cost. The

additional sand and gravel overburden exposed during borrow development

was placed on the future 2015-2016 dam construction footprint, which

will result in lower tailing dam construction costs in 2015 than

previously forecast. Both these activities were not budgeted in the

original estimate.

About Imperial

Imperial is an exploration, mine development and operating company based in

Vancouver, British Columbia. The Company operates the Mount Polley copper/gold

mine in British Columbia and the Sterling gold mine in Nevada. Imperial has 50%

interest in the Huckleberry copper/molybdenum mine and has 50% interest in the

Ruddock Creek lead/zinc property, both in British Columbia. The Company is in

development of its wholly owned Red Chris copper/gold property in British

Columbia.

Cautionary Note Regarding "Forward-Looking Information"

This press release contains "forward-looking information" or "forward-looking

statements" within the meaning of Canadian and United States securities laws,

which we will refer to as "forward-looking information". Except for statements

of historical fact relating to the Company, certain information contained herein

constitutes forward-looking information. When we discuss the Notes offering;

mine plans; costs and timing of current and proposed exploration or development;

development; production and marketing; capital expenditures; construction of

transmission lines; cash flow; working capital requirements and the requirement

for additional capital; operations; revenue; margins and earnings; future prices

of copper and gold; future foreign currency exchange rates; future accounting

changes; future prices for marketable securities; future resolution of

contingent liabilities; receipt of permits; or other matters that have not yet

occurred, we are making statements considered to be forward-looking information

or forward-looking statements under Canadian and United States securities laws.

We refer to them in this press release as forward-looking information. The

forward-looking information in this press release may include words and phrases

about the future, such as: plan, expect, forecast, intend, anticipate, estimate,

budget, scheduled, targeted, believe, may, could, would, might or will.

Forward-looking information includes disclosure relating to the launch of the

Notes offering and the guidance on 2013 annual financial results (including

expected revenues) and project development plans, costs and timing. We can give

no assurance the forward-looking information will prove to be accurate. It is

based on a number of assumptions management believes to be reasonable, including

but not limited to: the continued operation of the Company's mining operations,

no material adverse change in the market price of commodities or exchange rates,

that the mining operations will operate and the mining projects will be

completed in accordance with their estimates and achieve stated production

outcomes and such other assumptions and factors as set out herein. It is also

subject to risks associated with our business, including but not limited to: the

risk that the financing may not be completed on the terms expected or at all,

involving the need to negotiate and execute a purchase agreement and related

documents, the need for continued cooperation of the dealers and the need to

successfully market the Notes; risks inherent in the mining and metals business;

commodity price fluctuations and hedging; competition for mining properties;

sale of products and future market access; mineral reserves and recovery

estimates; currency fluctuations; interest rate risks; financing risks;

regulatory and permitting risks; environmental risks; joint venture risks;

foreign activity risks; legal proceedings; and other risks that are set out in

the Company's Management's Discussion & Analysis in its 2012 Annual Report. If

our assumptions prove to be incorrect or risks materialize, our actual results

and events may vary materially from what we currently expect as provided in this

press release. We recommend you review the Company's most recent Annual

Information Form and Management's Discussion & Analysis in its 2012 Annual

Report, which includes discussion of material risks that could cause actual

results to differ materially from our current expectations. Forward-looking

information is designed to help you understand management's current views of our

near and longer term prospects, and it may not be appropriate for other

purposes. We will not necessarily update this information unless we are required

to by securities laws.

SCHEDULE A

Non-IFRS Financial Measures

The Company is disclosing for the first time two non-IFRS financial measures

which are described further below. The Company expects to include these

financial measures in future quarterly and annual financial reports.

Cash Cost per Pound of Copper Produced

The cash cost per pound of copper produced, derived from the sum of cash

production costs, transportation and offsite costs, treatment and refining

costs, net of by-product and other revenues, divided by the number of pounds of

copper produced during the period, is a non-IFRS financial measure that does not

have a standardized meaning under IFRS, and as a result may not be comparable to

similar measures presented by other companies. Management uses this non-IFRS

financial measure to monitor operating costs and profitability. The Company is

primarily a copper producer and therefore calculates this non-IFRS financial

measure individually for its two copper producing mines, Mount Polley and

Huckleberry, and on a composite basis for these two mines.

Cash costs of production include direct labour, operating materials and

supplies, equipment and mill costs, and applicable overhead. Offsite costs

include transportation, warehousing, marketing, and related insurance. Treatment

and refining costs are costs for smelting and refining concentrate.

Treatment and refining costs applicable to the concentrate produced during the

period are calculated in accordance with the contracts the Company has with its

customers.

By-product and other revenues represent (i) revenue calculated based on average

metal prices for by-products produced during the period based on contained metal

in the concentrate; and (ii) other revenues as recorded during the period.

Cost of sales, as reported on the consolidated statement of comprehensive

income, includes depletion and depreciation and share based compensation,

non-cash items. These items, along with management fees charged by the Company

to Huckleberry, are removed from cash costs. The resulting cash costs are

different than the cost of production because of changes in inventory levels and

therefore inventory and related transportation and offsite costs are adjusted

from a cost of sales basis to a production basis. The cash costs for copper

produced are converted to US$ using the average US$ to Cdn$ exchange rate for

the period divided by the pounds of copper produced to obtain the cash cost per

pound of copper produced in US$.

The following tables reconcile cost of sales as shown on the consolidated

statement of comprehensive income to the cash cost per pound of copper produced

in US$:

Estimated Cash Cost per Pound of Copper Produced - Twelve Months Ended

December 31, 2012

----------------- ------------------------------- -----------

(Cdn$ in

thousands, Total per

except Huckle- Huckle- Financial

quantity berry berry Mount Statements

amounts) 100% 50% Polley Corporate (i) Composite

----------------- ------------------------------- -----------

A B C=A+B

Cost of Sales $93,154 $46,577 $142,052 $410 $142,462 $188,629

Less:

Depletion and

depreciation (11,743) (5,871) (15,112) (488) (15,600) (20,983)

Share based

compensation - - (214) - (214) (214)

Management

fees paid by

Huckleberry

to Imperial

eliminated

on

consolidation (1,096) (548) - - - (548)

----------------- ------------------------------- -----------

Cash costs

before

adjustment

to

production

basis 80,315 40,158 126,726 $(78) $126,648 166,884

----------------------

Adjust for

inventory

change 4,602 2,301 (3,663) (1,362)

Adjust

transportation

and offsite

costs 626 313 (686) (373)

Treatment and

refining

costs 13,460 6,730 6,671 13,401

By-product and

other

revenues (10,286) (5,143) (88,560) (93,703)

----------------- --------- -----------

Cash cost of

copper

produced in

Cdn$ $88,717 $44,359 $40,488 $84,847

----------------- --------- -----------

US$ to Cdn$

exchange rate 0.9994 0.9994 0.9994 0.9994

----------------- --------- -----------

Cash cost of

copper

produced in

US$ $88,664 $44,386 $40,512 $84,898

----------------- --------- -----------

Copper

produced

(000's lbs) 35,112 17,556 33,790 51,346

Cash cost per

pound of

copper

produced in

US$ $2.53 $2.53 $1.20 $1.65

(i)after giving effect to restatement for IFRS11

Estimated Cash Cost per Pound of Copper Produced - Nine Months Ended

September 30, 2013

----------------- ------------------------------- -----------

(Cdn$ in

thousands,

except Huckle- Huckle- Total per

quantity berry berry Mount Financial

amounts) 100% 50% Polley Sterling Statements Composite

----------------- ------------------------------- -----------

A B C=A+B

Cost of Sales $76,491 $38,246 $88,535 $2,980 $91,515 $126,781

Less:

Depletion and

depreciation (13,989) (6,995) (11,714) (725) (12,439) (18,709)

Share based

compensation - - (103) - (103) (103)

Management

fees paid by

Huckleberry

to Imperial

recorded as

revenue by

Imperial on

the equity

basis of

accounting

for

Huckleberry (809) (405) - - - (405)

----------------- ------------------------------- -----------

Cash costs

before

adjustment

to

production

basis 61,693 30,846 76,718 $2,255 $78,973 107,564

----------------------

Adjust for

inventory

change 1,265 633 (3,728) (3,096)

Adjust

transportation

and offsite

costs 421 210 (1,068) (858)

Treatment and

refining

costs 11,647 5,823 5,966 11,789

By-product and

other

revenues (7,868) (3,934) (53,501) (57,435)

----------------- --------- -----------

Cash cost of

copper

produced in

Cdn$ $67,158 $33,578 $24,387 $57,964

----------------- --------- -----------

US$ to Cdn$

exchange rate 1.0236 1.0236 1.0236 1.0236

----------------- --------- -----------

Cash cost of

copper

produced in

US$ $65,609 $32,803 $23,825 $56,628

----------------- --------- -----------

Copper

produced

(000's lbs) 30,833 15,417 29,264 44,681

Cash cost per

pound of

copper

produced in

US$ $2.13 $2.13 $0.81 $1.27

Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization)

We define Adjusted EBITDA as net income (loss) before interest expense, taxes

and depletion and depreciation and as adjusted for the items described in the

reconciliation table below.

Adjusted EBITDA is not necessarily comparable to similarly titled measures used

by other companies. We believe that the presentation of Adjusted EBITDA is

appropriate to provide additional information to investors about certain

non-cash or unusual items that we do not expect to continue at the same level in

the future, or other items that we do not believe to be reflective of our

ongoing operating performance. We further believe that our presentation of this

non-IFRS financial measure provides information that is useful to investors

because it is an important indicator of the strength of our operations and the

performance of our core business.

Adjusted EBITDA is not a measurement of operating performance or liquidity under

IFRS and should not be considered as a substitute for earnings from operations,

net income or cash generated by operating activities computed in accordance with

IFRS. Adjusted EBITDA has limitations as an analytical tool. Some of the

limitations are:

-- adjusted EBITDA does not reflect our cash expenditures or future

requirements for capital expenditures or contractual commitments;

-- adjusted EBITDA does not reflect changes in, or cash requirements for,

our working capital needs;

-- adjusted EBITDA does not reflect the interest expense, or the cash

requirements necessary to service interest or principal payments, on our

debt;

-- although depletion and depreciation are non-cash charges, the assets

being depleted and depreciated will often have to be replaced in the

future. Adjusted EBITDA does not reflect any cash requirements for such

replacements. In particular, as a company in the mining business, we

record the depletion of our mineral reserves as we extract minerals from

our mines, but we expect to use cash in the future to acquire other

mineral reserves in the ordinary course of our business.

-- although accretion expense is a non-cash charge, this represents the

accretion of the liability related to the future site reclamation costs,

calculated on a net present value basis, that will exist at the end of

each mine life, based on the mining area disturbed at a given statement

of financial position date. Adjusted EBITDA does not reflect any cash

requirements for such reclamation activities, as those will occur upon

the closing of each mine; and

-- other companies in our industry may calculate Adjusted EBITDA

differently that we do, limiting its usefulness as a comparative

measure.

Because of these limitations, Adjusted EBITDA should not be considered as a

measure of discretionary cash available to us to invest in the growth of our

business.

A reconciliation of net income to Adjusted EBITDA is set out below and for all

of the periods presented, the Company has given effect to the adoption of IFRS11

in order to be able to compare all periods on the same basis.

Adjusted EBITDA

Twelve

Months

Year Ended Nine Months Ended Ended

------------------------------------------------------

Dec 31 Dec 31 Dec 31 Sept 30 Sept 30 Sept 30

(Cdn$ in thousands) 2010 2011 2012 2012 2013 2013

------------------------------------------------------

Net Income (a) $38,375 $48,708 $32,626 $20,908 $32,883 $44,601

Adjustments:

Interest expense 581 1,040 667 341 35 361

Accretion of debt 154 - - - - -

Accretion of future

site reclamation

provisions 226 208 292 224 220 288

Depletion and

depreciation 21,615 20,110 15,600 11,058 12,845 17,387

Income and mining tax

expense 1,816 17,049 18,540 11,412 17,038 24,166

Unrealized losses

(gains) on

derivative

instruments 2,290 (8,031) 2,377 3,652 (141) (1,416)

Foreign exchange

losses (gains) 1,543 (1,231) 455 173 557 839

Share based

compensation 8,636 5,165 2,945 2,385 1,399 1,959

Bad debt recovery - (14,112) - - - -

Revaluation (gains)

losses on marketable

securities (168) (4) (209) (139) 343 273

Gains on sale of

mineral properties (90) (1,437) (708) (76) (48) (680)

------------------------------------------------------

Adjusted EBITDA (a) $74,978 $67,465 $72,585 $49,938 $65,131 $87,778

------------------------------------------------------

(a) Net income and Adjusted EBITDA include our 50% portion of the net income

from Huckleberry to reflect our adoption of IFRS11. For the years ended

December 31, 2010, 2011 and 2012, our 50% interest in the net income of

Huckleberry was $22.8 million, $27.7 million and $5.5 million,

respectively. For the nine months ended September 30, 2012 and 2013, our

50% interest in the net income of Huckleberry was $3.8 million and $3.9

million, respectively. However, we are not able to control the timing

and amount, if any, of cash distributions that Huckleberry may make to

us.

FOR FURTHER INFORMATION PLEASE CONTACT:

Imperial Metals Corporation

Brian Kynoch

President

604.669.8959

Imperial Metals Corporation

Andre Deepwell

Chief Financial Officer

604.488.2666

Imperial Metals Corporation

Gordon Keevil

Vice President Corporate Development

604.488.2677

Imperial Metals Corporation

Sabine Goetz

Shareholder Communications

604.488.2657

investor@imperialmetals.com

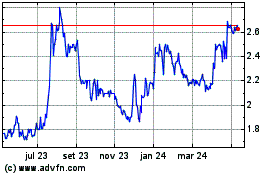

Imperial Metals (TSX:III)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

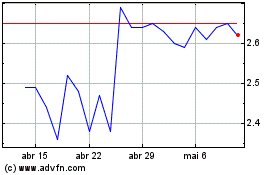

Imperial Metals (TSX:III)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025