NuVista Energy Ltd. Announces Closing of Equity Financings

29 Outubro 2013 - 10:58AM

Marketwired Canada

NuVista Energy Ltd. (TSX:NVA) ("NuVista") is pleased to announce that it has

closed its previously announced private placement and public offering of an

aggregate of 5,129,000 common shares issued on a "flow-through" basis pursuant

to the Income Tax Act (Canada) for gross proceeds of approximately $39.7

million.

NuVista has completed a public offering of 3,200,000 common shares issued on a

"flow-through" basis in respect of Canadian exploration expense ("CEE Shares")

through a syndicate of underwriters co-led by Peters & Co. Limited and RBC

Capital Markets Corp. and including CIBC World Markets Inc., FirstEnergy Capital

Corp., Scotia Capital Inc., BMO Capital Markets and TD Securities Inc.

(collectively, the "Underwriters") at a price of $8.00 per CEE Share for gross

proceeds of $25.6 million.

In addition, on October 28, 2013 NuVista issued, on a private placement basis,

254,000 CEE Shares at a price of $8.00 per CEE Share and 1,675,000 common shares

issued on a "flow-through" basis with respect to Canadian development expense

(the "CDE Shares") at a price of $7.20 per CDE Share for aggregate gross

proceeds of approximately $14.1 million.

INVESTOR INFORMATION

NuVista is an independent Canadian oil and natural gas exploration, development

and production company with its Common Shares trading on the Toronto Stock

Exchange under the symbol "NVA".

FOR FURTHER INFORMATION PLEASE CONTACT:

NuVista Energy Ltd.

Jonathan Wright

President and CEO

(403) 538-8501

NuVista Energy Ltd.

Robert F. Froese

VP, Finance and CFO

(403) 538-8530

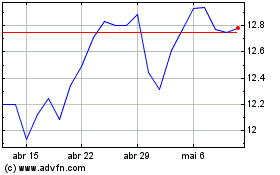

NuVista Energy (TSX:NVA)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

NuVista Energy (TSX:NVA)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024