NuVista Energy Ltd. Announces Non-Core Asset Dispositions and Reconfirms 2014/15 Guidance

11 Dezembro 2013 - 11:10PM

Marketwired

NuVista Energy Ltd. Announces Non-Core Asset Dispositions and

Reconfirms 2014/15 Guidance

CALGARY, ALBERTA--(Marketwired - Dec 11, 2013) - NuVista Energy

Ltd. ("NuVista") (TSX:NVA) is pleased to announce the disposition

of non-core assets in its W3/W4 operating areas for gross proceeds

of $30.2 million. This transaction continues to sharpen NuVista's

focus on our condensate-rich Wapiti Montney play. The divestiture,

coupled with our year-to-date disposition proceeds of $13.2

million, brings NuVista well within our previously stated annual

target range for non-core dispositions of $25 million to $50

million.

NuVista has entered into a definitive purchase and sale

agreement with a private company for the disposition of these

non-core assets. The gross proceeds of $30.2 million consist of

$25.2 million in cash and a $5.0 million interest bearing secondary

charge debenture with a three year term. The disposition has an

effective date of September 1, 2013, an expected closing date of

December 18, 2013, and is subject to financing and customary

industry closing terms and conditions.

The disposed assets include the Northwest Saskatchewan natural

gas area and the West Central Saskatchewan and Provost heavy oil

areas. The majority of these assets are characterized by mature

shallow dry gas and high watercut heavy oil production. Current

production from these assets averages approximately 1,800 Boe/d,

comprised of 6.5 MMcf/d of natural gas and 715 Boe/d of heavy oil.

With the vast majority of NuVista's capital program going into the

Wapiti area and virtually none into the assets being disposed,

NuVista has determined that this is an opportune time to continue

our successful rationalization strategy by disposing of

non-strategic assets and applying the proceeds in Wapiti where we

are confident we can achieve much improved rates of return over

time. This transaction provides NuVista an exit from our W3/W4 area

with the exception of approximately 1,000 Boe/d of heritage assets

within the Oyen operating area.

The net proceeds from this transaction will initially be used to

reduce outstanding bank debt, then ultimately re-deployed into

profitable investment in our Wapiti Montney play. NuVista would

like to confirm that its previously announced guidance range for

full year 2013 production and funds from operations remain

unchanged post this disposition. NuVista expects production for the

fourth quarter of 2013 to be within the guidance range of 17,000

Boe/d to 18,000 Boe/d including the effect of the divestiture. 2014

annual production after the effect of this divestiture is expected

to be 17,500 Boe/d to 18,500 Boe/d, with fourth quarter 2014

production forecast to be in the range of 20,000 Boe/d to 21,000

Boe/d. This results in fourth quarter 2013 to fourth quarter 2014

pro forma absolute production growth of approximately 25% as

previously disclosed, after bringing on the new South Block

facilities, which are currently under construction. Our 2014

capital expenditure guidance at this time remains unchanged at $240

million to $260 million. With the redeployment of proceeds into the

Wapiti area over time, we also confirm there are no changes to our

previous production guidance for 2015, where we forecast at some

point in the year to exceed 25,000 Boe/d.

These dispositions move NuVista one step further along the

ongoing process of significantly sharpening the focus of the

company as a condensate-rich Montney resource growth engine. We

look forward to providing additional detail on our 2014 production

and capital plan and further Montney results in the near

future.

ADVISORY REGARDING OIL AND GAS INFORMATION

This news release contains the terms barrels of oil

equivalent ("Boe"). Natural gas is converted to a Boe using six

thousand cubic feet of gas to one barrel of oil. Boes may be

misleading, particularly if used in isolation. The foregoing

conversion ratio is based on an energy equivalency conversion

method primarily applicable at the burner tip and does not

represent a value equivalency at the wellhead. Given that the value

ratio based on the current price of crude oil as compared to

natural gas is significantly different from the energy equivalency

of 6:1, utilizing a conversion on a 6:1 basis may be misleading as

an indication of value.

NON-GAAP MEASUREMENTS

Management uses funds from operations to analyze operating

performance and leverage. Funds from operations as presented, does

not have any standardized meaning prescribed by GAAP and therefore

it may not be comparable with the calculation of similar measures

for other entities. Funds from operations as presented is not

intended to represent operating cash flow or operating profits for

the period nor should it be viewed as an alternative to cash flow

from operating activities, per the statement of cash flows, net

earnings (loss) or other measures of financial performance

calculated in accordance with GAAP. All references to funds from

operations are based on cash flow from operating activities before

changes in non-cash working capital and asset retirement

expenditures. Funds from operations per share is calculated based

on the weighted average number of common shares outstanding

consistent with the calculation of net earnings (loss) per

share.

ADVISORY REGARDING FORWARD-LOOKING INFORMATION AND

STATEMENTS

This press release contains forward-looking statements and

forward-looking information (collectively, "forward-looking

statements") within the meaning of applicable securities laws. The

use of any of the words "will", "expects", "believe", "plans",

"potential" and similar expressions are intended to identify

forward-looking statements. More particularly and without

limitation, this press release contains forward looking statements

with respect to: completion of the proposed disposition and on the

timing contemplated; the amount of and use of proceeds and the

benefits to be obtained therefrom; future dispositions, NuVista's

future strategy, plans, opportunities and operations; forecast

production; funds from operations; NuVista's planned capital

program and budget; and the anticipated potential of NuVista's

asset base. By their nature, forward-looking statements are based

upon certain assumptions and are subject to numerous risks and

uncertainties, some of which are beyond NuVista's control,

including failure to satisfy the closing conditions for the

disposition, the impact of general economic conditions, industry

conditions, current and future commodity prices, currency and

interest rates, anticipated production rates, borrowing, operating

and other costs and funds from operations, the timing, allocation

and amount of capital expenditures and the results therefrom,

anticipated reserves and the imprecision of reserve estimates, the

performance of existing and future wells, the success obtained in

drilling new wells, the sufficiency of budgeted capital

expenditures in carrying out planned activities, competition from

other industry participants, availability of qualified personnel or

services and drilling and related equipment, stock market

volatility, effects of regulation by governmental agencies

including changes in environmental regulations, tax laws and

royalties; the ability to access sufficient capital from internal

sources and bank and equity markets; and including, without

limitation, those risks considered under "Risk Factors" in our

Annual Information Form. Readers are cautioned that the assumptions

used in the preparation of such information, although considered

reasonable at the time of preparation, may prove to be imprecise

and, as such, undue reliance should not be placed on

forward-looking statements. NuVista's actual results, performance

or achievement could differ materially from those expressed in, or

implied by, these forward-looking statements, or if any of them do

so, what benefits NuVista will derive therefrom. NuVista disclaims

any intention or obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise, except as required by law.

NuVista Energy Ltd.Jonathan WrightPresident and CEO(403)

538-8501NuVista Energy Ltd.Robert F. FroeseVP, Finance and CFO(403)

538-8530

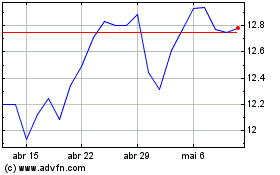

NuVista Energy (TSX:NVA)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

NuVista Energy (TSX:NVA)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024