NuVista Energy Ltd. Announces 48% Increase to Year End 2013

Reserves and Provides Operational Update

CALGARY, ALBERTA--(Marketwired - Feb 6, 2014) - NuVista Energy

Ltd. (TSX:NVA) ("NuVista" or the "Company") is pleased to announce

a significant increase in our reserves as a result of the 2013 year

end independent reserves evaluation by GLJ Petroleum Consultants

Ltd ("GLJ") (the "GLJ Report"). We are also very pleased to provide

an operational update with several new 30-day production results on

wells recently drilled into our Wapiti Montney condensate-rich

play. This play continues to meet and exceed expectations as our

flagship play with line-of-sight to exceptional organic production,

reserves, and value growth for shareholders of the Company.

Reserves

Highlights

- Increased proved plus probable reserves ("2P") by 48% to 139

MMBoe and total proved reserves ("1P") by 36% to 80 MMBoe, despite

divestitures of non-core assets through the year. Excluding the

effect of these divestitures, the 2P and 1P reserve increases were

64% and 53% respectively;

- Increased condensate reserves by 2.7 times on a 2P basis to

24.8 MMBoe. Condensate volumes now represent 18% of total 2P

reserves, up from 10% in 2012;

- Achieved Company finding and development ("F&D") costs of

$12.31/Boe on a 2P basis, including changes in future development

costs ("FDC");

- Increased Montney 2P operating recycle ratio to 2.3x with full

year Montney operating netbacks of $27.88/Boe and Montney 2P

F&D of $12.05/Boe;

- Increased the before tax net present value discounted at 10% of

2P reserves by 70% to $1.3 billion including the effect of

divestitures;

- Organic 2P reserve additions replaced 950% of production in the

year (almost 10 times 2013 annual production), while proved

developed producing reserve additions alone replaced 147% of annual

production; and

- Increased our reserve life index(1) ("RLI") for 2P reserves

from 14.6 years to 22.2 years and the 1P RLI from 9.2 years to 12.8

years.

(1) Production for the RLI was calculated using the mid-point of

2013 Q4 guidance (annualized) and 2012 actuals.

Operations

Highlights

- Achieved four new well 30-day initial production rates

("IP30"). These results continue to build momentum in the play,

including a new record IP30 from NuVista's latest Elmworth (North)

Block Development well at 2,115 Boe/d.

New Well IP30

Results(1)

| Well |

Raw Gas |

Condensate |

Total Sales |

CGR C5+/Raw |

Notes |

|

(MMcf/d) |

(Bbls/d) |

(Boe/d) |

(Bbls/MMcf) |

|

| South Block Typecurve |

5.8 |

435 |

1,361 |

75 |

|

|

|

Well 13 (South Block) |

5.1 |

545 |

1,413 |

107 |

Post-intervention IP30 |

|

|

Well 14 (South Block) |

5.2 |

532 |

1,400 |

103 |

Post-intervention IP30 |

|

|

Well 15 (South Block) |

4.2 |

595 |

1,241 |

142 |

|

|

|

|

|

|

|

| North Block Typecurve |

5.8 |

261 |

1,222 |

45 |

|

|

|

Well 16 (North Block) |

10.4 |

395 |

2,115 |

38 |

|

(1) Well numbering refers to the numbered wells in our corporate

presentation available on our website. They are effectively in

chronological order since our inception in the play. All numbers

are based on field estimate data.

Well 13 has been included in the table despite having a

previously reported IP30. NuVista subsequently performed an

intervention on the well to clear an obstruction, which increased

the number of producing stages. The post-intervention IP30 shown is

greatly improved by 30%. Well 14 is new and had not been previously

reported. It also had a similar intervention performed and the

post-intervention IP30 is presented in the table. NuVista has

engineered changes to our completions design to alleviate these

production issues. Wells being tested and brought onto production

now have the benefit of these design changes. We now have even

stronger confidence in our typecurve, and the possibility of

proving a sustained increase to it sometime in 2014, through

continued fracture and completion optimization.

Strategic,

Infrastructure, and Operational Update

We are very pleased to announce that NuVista has exercised its

right to nominate an incremental 15 MMcf/d of raw Montney sour gas

and associated raw liquids for firm transportation and processing

service under its existing agreement with Keyera. This brings the

total firm contracted amount up from 65 MMcf/d to 80 MMcf/d of raw

gas and the associated raw condensate liquids up to 8,000 Bbl/d.

These incremental nominations were part of the planning process for

the Keyera Wapiti Gathering System and Keyera Simonette Gas Plant

expansions previously announced. The contract terms are essentially

the same as those announced by NuVista in April 2013. This contract

volume increase commences in the third quarter of 2015 and matches

the augmented sizing of the new NuVista South Block Compressor

Station which is currently under construction. The compressor

station being built by NuVista, and the raw gas and liquid

pipelines to the Simonette gas plant which are being built by

Keyera are currently in project execution and they remain on plan

for cost and for the expected startup date in the late second

quarter of 2014.

Drilling, completions, and tie-ins are proceeding such that

behind-pipe gas is accumulating as planned in preparation for the

capacity increase upon startup of these new facilities. With each

new well drilled and each passing quarter, our confidence in the

play continues to build. We have recently drilled our first 2-well

pad, with another 2-well and our first 3-well pad commencing before

spring breakup. We expect that the additional tranche of capacity

announced today is only one of several more which will continue to

be put in place several years ahead of our drilling results to

provide for certainty of future capacity which is commensurate with

our growing Field Development Plan. We have forecast to average

between 2-3 rigs drilling the Montney through 2014, although we are

currently drilling with 4 rigs temporarily ahead of spring

breakup.

2013 and 2014

Guidance

We are off to a strong start in 2014 with a busy program prior

to spring breakup and major facilities being constructed to pave

the way for our significant production volume build in the second

half of the year, particularly in the fourth quarter. We will

continue our focus and demonstrated results in reducing cost and we

will continue to pursue expansion of our typecurve through longer

horizontal wells, more fracture stages, and the many other

improvements which are strongly driven by ingenuity, engineering,

and empirical learning in a repeatable resource play. Our guidance

for 2014 remains as previously announced and as our results for

2013 are becoming finalized, we expect to be in the upper portion

of our previously announced 2013 fourth quarter production guidance

range of 17,000 Boe/d to 18,000 Boe/d. Our production entering

January 2014, after the effect of the divestiture announced in

December of 2013, is approximately 16,500 Boe/d. 2014 average

production guidance is still in the range of 17,500 Boe/d to 18,500

Boe/d, while the 2014 fourth quarter production guidance range

remains at 20,000 Boe/d to 21,000 Boe/d.

We look forward to an exciting 2014 while adding excellent value

for NuVista's shareholders, and we expect to be able to provide

another operational update along with our full 2013 year end

results in a press release in early March 2014. We would like to

take this opportunity to thank our shareholders and our staff for

their continuing support and dedication as we continue to build an

ever more valuable future for NuVista.

Summary of Corporate

Reserves Data

The following table outlines NuVista's corporate finding and

development costs in more detail:

|

3 Year-Average (1) |

2013 (1) |

2012 (1) |

|

|

Proved plus |

|

Proved plus |

|

Proved plus |

|

Proved |

probable |

Proved |

probable |

Proved |

probable |

| After reserve revisions and including changes in future

development capital |

|

|

|

|

|

|

|

Finding and development costs ($/Boe) |

$17.48 |

$14.43 |

$14.51 |

$12.31 |

$19.17 |

$15.53 |

(1) The aggregate of the exploration and development costs

incurred in the most recent financial year and the change during

the year in estimated future development costs generally will not

reflect total finding and development costs related to reserve

additions for the year.

The following table provides summary reserve information based

upon the GLJ Report using the published GLJ January 1, 2014 price

forecast set forth later in this document:

|

Natural Gas |

Condensate |

Other Liquids(2) |

Oil |

Total |

| Reserves category(1) |

Working |

Working |

Working |

Working |

Working |

|

Interest |

Interest |

Interest |

Interest |

Interest |

|

(MMcf) |

(MBbls) |

(MBbls) |

(MBbls) |

(MBoe) |

| Proved |

|

|

|

|

|

|

Developed producing |

115,174 |

3,590 |

3,425 |

1,429 |

27,640 |

|

Developed non-producing |

42,210 |

896 |

1,439 |

250 |

9,620 |

|

Undeveloped |

173,124 |

9,253 |

4,153 |

937 |

43,197 |

| Total proved |

330,507 |

13,739 |

9,017 |

2,615 |

80,456 |

| Probable |

236,152 |

11,070 |

6,102 |

2,244 |

58,775 |

| Total proved plus probable |

566,659 |

24,809 |

15,119 |

4,860 |

139,231 |

(1) Numbers may not add due to rounding. (2) Propane, Butane,

Ethane.

The following table is a summary reconciliation of the 2013 year

end working interest reserves with the working interest reserves

reported in the 2012 year end reserves report:

|

|

Natural Gas(1) (Bcf) |

Liquids(1) (MBbls) |

Oil(1) (MBbls) |

Total Oil Equivalent(1) (MBoe) |

|

Total proved |

|

|

|

|

|

Balance, December 31, 2012 |

254.2 |

11,320 |

5,471 |

59,155 |

|

Exploration and development(2) |

116.6 |

11,139 |

59 |

30,631 |

|

Technical revisions |

8.0 |

1,749 |

2 |

3,088 |

|

Economic revisions |

- |

- |

- |

- |

|

Acquisitions |

- |

- |

- |

- |

|

Dispositions |

(22.2) |

(31) |

(2,382) |

(6,108) |

|

Production |

(26.1) |

(1,421) |

(534) |

(6,310) |

|

Balance, December 31, 2013 |

330.5 |

22,756 |

2,616 |

80,456 |

|

Total proved plus probable |

|

|

|

|

|

Balance, December 31, 2012 |

401.4 |

18,159 |

9,020 |

94,072 |

|

Exploration and development(2) |

227.0 |

20,980 |

55 |

58,872 |

|

Technical revisions |

(3.5) |

2,270 |

(239) |

1,448 |

|

Economic revisions |

- |

- |

- |

- |

|

Acquisitions |

- |

- |

- |

- |

|

Dispositions |

(32.1) |

(61) |

(3,442) |

(8,850) |

|

Production |

(26.1) |

(1,421) |

(534) |

(6,310) |

|

Balance, December 31, 2013 |

566.7 |

39,928 |

4,860 |

139,231 |

(1) Numbers may not add due to rounding. (2) Reserve additions

for Drilling Extensions, Infill Drilling and Improved Recovery.

The following table summarizes the future development capital

included in the GLJ Report:

|

($ thousands, undiscounted) |

Proved |

Proved plus probable |

|

Balance, December 31, 2012 |

338,974 |

534,190 |

|

Dispositions |

(19,044) |

(26,809) |

|

Exploration and development, improved recoveries and other |

267,139 |

520,380 |

|

Balance, December 31, 2013 |

587,069 |

1,027,761 |

Summary Wapiti Montney

Play Reserves Data

The following table provides summary Wapiti Montney play reserve

information based upon the GLJ Report using the published GLJ

January 1, 2014 price forecast set forth below (with comparatives

at January 1, 2013 price forecast):

|

|

December 31, 2013 |

December 31, 2012 |

|

Reserves category |

Working Interest (MBoe) |

Working Interest (MBoe) |

|

Proved Producing |

9,716 |

2,569 |

|

Total Proved |

46,068 |

15,654 |

|

Total Proved plus Probable |

86,174 |

29,167 |

The following table summarizes the Wapiti Montney play FDC

included in the GLJ Report:

|

($ thousands, undiscounted) |

Proved |

Proved plus probable |

|

Balance, December 31, 2012 |

174,463 |

285,984 |

|

Exploration and development changes in the year |

274,553 |

515,125 |

|

Balance, December 31, 2013 |

449,016 |

801,109 |

The estimates of reserves for the Wapiti Montney play may not

reflect the same confidence level as estimates of reserves of all

NuVista's properties due to the effect of aggregation.

Summary of Corporate

Net Present Value Data

The estimated net present values of future net revenue before

income taxes associated with NuVista's reserves effective December

31, 2013 and based on published GLJ future price forecast as at

January 1, 2014 as set forth below are summarized in the following

table:

The estimated future net revenue contained in the following

table does not necessarily represent the fair market value of the

reserves. There is no assurance that the forecast price and cost

assumptions contained in the GLJ 2013 Report will be attained and

variations could be material. The recovery and reserve estimates

described herein are estimates only. Actual reserves may be greater

or less than those calculated.

|

Discount factor (%/year) |

| Reserves category (1)(2) ($ millions) |

0% |

8% |

10% |

12% |

| Proved: |

|

|

|

|

|

Developed producing |

583 |

411 |

384 |

362 |

|

Developed non-producing |

203 |

123 |

112 |

103 |

|

Undeveloped |

822 |

394 |

336 |

289 |

| Total proved |

1,608 |

928 |

833 |

754 |

| Probable |

1,413 |

581 |

490 |

418 |

| Total proved plus probable |

3,021 |

1,509 |

1,323 |

1,172 |

(1) Numbers may not add due to rounding. (2) Estimate future net

reserves do not represent the fair market value of reserves.

The following table is a summary of pricing and inflation rate

assumptions based on published GLJ forecast prices and costs as at

January 1, 2014:

|

|

Natural Gas |

Liquids |

Oil |

|

|

Year |

AECO Gas Price ($Cdn/ Mmbtu) |

Edmonton Condensate ($Cdn/Bbl) |

Edmonton Propane ($Cdn/Bbl) |

Edmonton Butane ($Cdn/Bbl) |

WTI Cushing Oklahoma ($US/Bbl) |

Edmonton Par Price 40 API ($Cdn/Bbl) |

Inflation Rates %/ Year(1) |

Exchange Rate(2) ($US/$Cdn) |

|

Forecast |

|

|

|

|

|

|

|

|

|

2014 |

4.03 |

105.20 |

57.83 |

73.22 |

97.50 |

92.76 |

2 |

0.95 |

|

2015 |

4.26 |

107.11 |

58.42 |

75.95 |

97.50 |

97.37 |

2 |

0.95 |

|

2016 |

4.50 |

107.00 |

60.00 |

78.00 |

97.50 |

100.00 |

2 |

0.95 |

|

2017 |

4.74 |

107.00 |

60.00 |

78.00 |

97.50 |

100.00 |

2 |

0.95 |

|

2018 |

4.97 |

107.00 |

60.00 |

78.00 |

97.50 |

100.00 |

2 |

0.95 |

|

2019 |

5.21 |

107.00 |

60.00 |

78.00 |

97.50 |

100.00 |

2 |

0.95 |

|

2020 |

5.33 |

107.82 |

60.46 |

78.60 |

98.54 |

100.77 |

2 |

0.95 |

|

2021 |

5.44 |

109.97 |

61.67 |

80.17 |

100.51 |

102.78 |

2 |

0.95 |

|

2022 |

5.55 |

112.17 |

62.90 |

81.77 |

102.52 |

104.83 |

2 |

0.95 |

|

2023 |

5.66 |

114.41 |

64.16 |

83.40 |

104.57 |

106.93 |

2 |

0.95 |

|

2024 |

+2%/yr |

+2%/yr |

+2%/yr |

+2%/yr |

+2%/yr |

+2%/yr |

2 |

0.95 |

(1) Inflation rate for costs. (2) Exchange rate used to generate

the benchmark reference prices in this table.

ADVISORY REGARDING OIL AND GAS INFORMATION

This news release contains the terms barrels of oil

equivalent ("Boe"). Natural gas is converted to a Boe using six

thousand cubic feet of gas to one barrel of oil. Boes may be

misleading, particularly if used in isolation. The foregoing

conversion ratio is based on an energy equivalency conversion

method primarily applicable at the burner tip and does not

represent a value equivalency at the wellhead. As well, given that

the value ratio based on the current price of crude oil to natural

gas is significantly different from the 6:1 energy equivalency

ratio, using a conversion ratio on a 6:1 basis may be misleading as

an indication of value.

Any references in this news release to initial production

rates are useful in confirming the presence of hydrocarbons,

however, such rates are not determinative of the rates at which

such wells will continue production and decline thereafter. While

encouraging, readers are cautioned not to place reliance on such

rates in calculating the aggregate production for NuVista.

ADVISORY REGARDING FORWARD-LOOKING INFORMATION AND

STATEMENTS

This press release contains forward-looking statements and

forward-looking information (collectively, "forward-looking

statements") within the meaning of applicable securities laws. The

use of any of the words "will", "expects", "believe", "plans",

"potential" and similar expressions are intended to identify

forward-looking statements. More particularly and without

limitation, this press release contains forward looking statements,

including management's assessment of: NuVista's future strategy,

plans, opportunities and operations; forecast production;

production mix; drilling, development, completion and tie-in plans

and timing and results thereof; expectations of timing of

construction of facilities and the benefits thereof; expectations

of improvements in recycle ratio; NuVista's assessment of

field conditions; typecurves; condensate and natural gas liquid

yields; the timing, allocation and efficiency of NuVista's capital

program and the results therefrom; the anticipated potential of

NuVista's asset base; reserves life indexes; timing for

press release announcing full 2013 results; and industry

conditions. By their nature, forward-looking statements are based

upon certain assumptions and are subject to numerous risks and

uncertainties, some of which are beyond NuVista's control,

including the impact of general economic conditions, industry

conditions, current and future commodity prices, currency and

interest rates, anticipated production rates, borrowing, operating

and other costs and funds from operations, the timing, allocation

and amount of capital expenditures and the results therefrom,

anticipated reserves and the imprecision of reserve estimates, the

performance of existing wells, the success obtained in drilling new

wells, the sufficiency of budgeted capital expenditures in carrying

out planned activities, competition from other industry

participants, availability of qualified personnel or services and

drilling and related equipment, stock market volatility, effects of

regulation by governmental agencies including changes in

environmental regulations, tax laws and royalties; the ability to

access sufficient capital from internal sources and bank and equity

markets; and including, without limitation, those risks considered

under "Risk Factors" in our Annual Information Form. Readers are

cautioned that the assumptions used in the preparation of such

information, although considered reasonable at the time of

preparation, may prove to be imprecise and, as such, undue reliance

should not be placed on forward-looking statements. NuVista's

actual results, performance or achievement could differ materially

from those expressed in, or implied by, these forward-looking

statements, or if any of them do so, what benefits NuVista will

derive therefrom. NuVista disclaims any intention or obligation to

update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise, except as

required by law.

NuVista Energy Ltd.Jonathan A. WrightPresident and CEO(403)

538-8501NuVista Energy Ltd.Robert F. FroeseVP, Finance and CFO(403)

538-8530

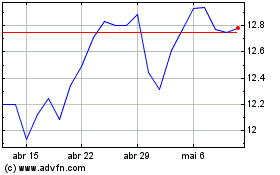

NuVista Energy (TSX:NVA)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

NuVista Energy (TSX:NVA)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024