NuVista Energy Ltd. Announces Fourth Quarter and Year End 2013

Results

CALGARY, ALBERTA--(Marketwired - Mar 6, 2014) - NuVista Energy

Ltd. ("NuVista") (TSX:NVA) is pleased to announce results for the

three and twelve months ended December 31, 2013 and provide an

update on its future business plans. 2013 was a turning point year

for NuVista, and one where all of our key business and strategic

targets were met or exceeded. We have:

- Transitioned the Bilbo (South) and Elmworth (North) sub-blocks

of our Wapiti Montney play from delineation phase to full

repeatable development;

- Continued our successful delineation and land expiry management

program in the Wapiti area;

- Continued our rolling annual non-core divestiture program

towards ever-enhanced focus;

- Significantly increased natural gas and natural gas liquids

reserves and contingent resources;

- Substantially increased condensate yields in the Wapiti Montney

play;

- Reduced well costs and cycle times, using advanced technology

to improve our drilling and completion execution;

- Created a clearer than ever line-of-sight to increasing our

Wapiti Montney typecurves and future growth initiatives; and

- Improved corporate netbacks and prudently managed our balance

sheet.

All of the above has placed NuVista in a position where our

growth outlook and financial strength have never been brighter.

Although we expect stronger gas pricing to prevail, we have now

positioned the company to provide strong long-term profitable

growth in a $3.00 to $3.50/GJ AECO natural gas price environment

due to our significant and high value condensate production. The

fiscal environment has improved significantly due to the recent gas

price increase in late 2013 and early 2014. There is a high

probability this strength will continue throughout 2014 due to very

low gas storage levels in North America, driven by the cold winter

experienced in most regions. As a result of the recent price

strength, we have increased our hedge positions to ensure a strong

baseline price underpinning our capital plans and economic

threshold. Beyond 2014, we expect natural gas prices to moderate

but retain a higher base compared to the environment of 2012 and

2013. In this environment NuVista is in an excellent position to

grow and thrive.

As we kick off 2014, our key strategies are centered upon rapid

profitable Wapiti Montney development, continued delineation

drilling, the completion and startup of our South Bilbo block

compressor station and the new Keyera Pipeline to the Simonette

Plant late in the second quarter of 2014. We will continue to

enhance our focus through our non-core asset divestiture program

and improve profitability as our higher netback Montney production

increases. We are very pleased to reach yet another turning point

for the company - where increasing cash flow and profitability

provides the ability to grow on a self-funding basis in a $3.00 to

$3.50/GJ AECO gas price environment, with any dependency on outside

funding being merely related to the optionality of choosing an

accelerated pace of growth.

Significant highlights

for the fourth quarter and full year of 2013 include:

- Continued to reach IP30's on additional Montney wells since our

last announcement on February 6, 2014 including another Bilbo

(South) block test with excellent results as shown below. Well 17,

a new record high result, is at the far Southwestern end of the

Bilbo block resulting in strong encouragement as our two strongest

Bilbo wells bracket the Northeast and Southwest edges of the

block:

| New Well IP30 Results* |

|

Well |

Raw Gas |

Condensate |

Total Sales |

CGR C5+/Raw |

|

|

(MMcf/d) |

(Bbls/d) |

(Boe/d) |

(Bbls/MMcf) |

|

Bilbo (South Blk) Typecurve |

5.8 |

435 |

1,361 |

75 |

|

Well 17 |

8.0 |

800 |

2,184 |

100 |

|

|

|

|

|

|

|

North Block Typecurve |

5.8 |

261 |

1,222 |

45 |

|

Well 18** |

5.9 |

217 |

1,201 |

37 |

| *

Well numbering refers to the numbered wells in our corporate

presentation available on our website. They are effectively in

chronological order since our inception in the play. All numbers

shown are based on field estimate data. |

| **

This is an IP30 projection based on 21 days of production thus

far. |

- Increased our Elmworth (North) block typecurve assumptions from

an ultimate recovery of 4.4 Bcf/well to 6.0 Bcf/well;

- Achieved the higher end of our annual guidance range. For the

fourth quarter of 2013, NuVista's average production was 18,034

Boe/d compared to average production of 17,692 Boe/d for the fourth

quarter of 2012 and 18,532 Boe/d for the third quarter of 2013. The

increase in production from the fourth quarter of 2012 is due to

strong performance of new and existing Wapiti Montney wells offset

by the sale of production as a result of 2012 and 2013 non-core

dispositions;

- Achieved funds from operations of $21.5 million ($0.17/share,

basic) for the three months ended December 31, 2013, a 32% increase

from $16.3 million ($0.15/share, basic) for the three months ended

December 31, 2012 due to stronger pricing and an increased

contribution of higher netback Wapiti Montney volumes. For the year

ended December 31, 2013, NuVista's funds from operations were $75.3

million ($0.63/share, basic), a slight decrease from $75.7 million

($0.75/share, basic) in the same period of 2012 due to lower oil

prices and divestitures offset by higher natural gas prices;

- Achieved corporate netbacks for the twelvemonths ended December

31, 2013 of $12.99/Boe and $11.91/Boe for the three months ended

December 31, 2013. Netbacks are expected to continue rising as the

higher netback Wapiti Montney production increasingly dominates our

corporate production;

- Successfully executed an annual capital program of $224

million. Drilled 16 wells (15.6 net) in our Montney condensate rich

resource play for 100% success rate while initiating spending on

our Bilbo block compressor station and trunk lines;

- Entered into significant firm processing contracts,

strategically providing our Wapiti Montney play with space to grow

to at least 2016, with reduced operating cost and guaranteed

downstream liquids fractionation access;

- Increased proved plus probable reserves ("2P") by 48% versus

2012, to 129 MMBoe (up 64% excluding the effect of divested

volumes) thereby increasing our proved plus probable reserves life

index from 14.6 to 22.2 years. Organic 2P reserves additions

replaced 950% of production in the year;

- Increased Montney 2P operating recycle ratio to 2.3x with full

year Montney operating netbacks of $27.88/Boe and Montney 2P

finding and development costs ("F&D") of $12.05/Boe;

- Continued our trend of efficiency improvements, with average

well drilling and completion costs, as well as well cycle times

falling significantly;

- Ensured our capital programs are funded through until at least

2015 or longer depending on the pace of capital spending, through a

combination of rolling divestitures, improved cash flows, and

equity issued in 2013;

- Completed the disposition of certain gross overriding royalty

volumes, undeveloped land, and non-core assets producing 1,800

Boe/d in our W3/W4 operating areas for gross proceeds of $43.4

million; and

- Exited 2013 with no bank debt. Net debt, including the working

capital deficiency was $48 million and net debt to annualized

fourth quarter funds from operations was 0.6x.

As noted above, on the strength of Elmworth (North) block out

performance from wells drilled in 2011 to 2013 and even stronger

IP30 production results from our recently drilled Elmworth block

wells and nearby industry wells, we have increased our internal

typecurve assumptions to 6 Bcf/well ultimate recovery compared to

our original typecurve assumption of 4.4 Bcf/well. The condensate

yield for this area remains unchanged at 45 Bbls/MMcf but the

higher overall production results in very strong economics. This

recovery applies to the Elmworth block only until more proof points

are established on other blocks, and it corresponds to initial IP30

rates of 7.4 MMcf/d compared to our original typecurve assumption

of 5.8 MMcf/d. We are very pleased to now have demonstrated proof

of this trend which we believe is the natural evolution of a

repeatable resource play where drilling and completions techniques

can be optimized over time.

|

|

|

|

|

|

| Corporate Highlights |

|

|

|

|

|

Three months ended December 31, |

|

Year ended December 31, |

|

| ($ thousands, except per share) |

2013 |

|

2012 |

|

2013 |

|

2012 |

|

| Financial |

|

|

|

|

|

|

|

|

| Oil and natural gas revenue |

57,143 |

|

48,277 |

|

213,469 |

|

242,012 |

|

| Funds from operations(1) |

21,533 |

|

16,278 |

|

75,306 |

|

75,672 |

|

|

Per basic share |

0.17 |

|

0.15 |

|

0.63 |

|

0.75 |

|

|

Per diluted share |

0.17 |

|

0.15 |

|

0.63 |

|

0.75 |

|

| Net earnings (loss) |

(47,405 |

) |

(59,042 |

) |

(61,144 |

) |

(195,200 |

) |

|

Per basic share |

(0.38 |

) |

(0.56 |

) |

(0.51 |

) |

(1.93 |

) |

|

Per diluted share |

(0.38 |

) |

(0.56 |

) |

(0.51 |

) |

(1.93 |

) |

| Adjusted net earnings (loss)(1) |

(4,245 |

) |

(10,920 |

) |

(20,133 |

) |

(52,462 |

) |

|

Per basic share |

(0.03 |

) |

(0.10 |

) |

(0.17 |

) |

(0.52 |

) |

|

Per diluted share |

(0.03 |

) |

(0.10 |

) |

(0.17 |

) |

(0.52 |

) |

| Total assets |

|

|

|

|

905,711 |

|

878,174 |

|

| Long-term debt, net of adjusted working capital(1) |

|

|

|

|

47,495 |

|

30,388 |

|

| Capital expenditures |

80,011 |

|

29,194 |

|

226,572 |

|

116,638 |

|

| Dispositions |

17,878 |

|

204,771 |

|

30,270 |

|

237,821 |

|

| Weighted average common shares outstanding

(thousands): |

|

|

|

|

|

|

|

|

|

Basic |

125,411 |

|

106,006 |

|

120,430 |

|

101,148 |

|

|

|

Diluted |

125,411 |

|

106,006 |

|

120,430 |

|

101,148 |

|

| Operating |

|

|

|

|

|

|

|

|

| Production |

|

|

|

|

|

|

|

|

|

Natural gas (MMcf/d) |

73.9 |

|

74.9 |

|

71.8 |

|

95.0 |

|

|

Condensate (Bbls/d) |

2,500 |

|

954 |

|

1,925 |

|

1,245 |

|

|

Butane (Bbls/d) |

482 |

|

527 |

|

458 |

|

534 |

|

|

Propane (Bbls/d) |

712 |

|

712 |

|

710 |

|

722 |

|

|

Ethane (Bbls/d) |

744 |

|

746 |

|

801 |

|

700 |

|

|

Oil (Bbls/d) |

1,280 |

|

2,278 |

|

1,478 |

|

3,542 |

|

|

|

Total

oil equivalent (Boe/d) |

18,034 |

|

17,692 |

|

17,329 |

|

22,577 |

|

| Average product prices(2) |

|

|

|

|

|

|

|

|

|

Natural gas ($/Mcf) |

3.40 |

|

2.79 |

|

3.28 |

|

2.35 |

|

|

Condensate ($/Bbl) |

85.26 |

|

115.01 |

|

93.27 |

|

97.46 |

|

|

Butane ($/Bbl) |

58.34 |

|

63.11 |

|

58.62 |

|

67.29 |

|

|

Propane ($/Bbl) |

40.51 |

|

25.75 |

|

28.16 |

|

26.99 |

|

|

Ethane ($/Bbl) |

10.91 |

|

4.30 |

|

9.42 |

|

7.60 |

|

|

Oil ($/Bbl) |

71.46 |

|

66.35 |

|

78.48 |

|

72.11 |

|

| Operating expenses |

|

|

|

|

|

|

|

|

|

Natural gas and natural gas liquids ($/Mcfe) |

1.67 |

|

1.78 |

|

1.78 |

|

1.87 |

|

|

Oil ($/Bbl) |

26.31 |

|

15.53 |

|

22.65 |

|

11.00 |

|

|

|

Total

oil equivalent ($/Boe) |

11.16 |

|

11.29 |

|

11.70 |

|

11.17 |

|

| Operating netback ($/Boe) |

17.99 |

|

14.82 |

|

16.54 |

|

13.36 |

|

| Funds from operations netback ($/Boe)(1) |

12.99 |

|

10.00 |

|

11.91 |

|

9.16 |

|

|

NOTES: |

|

| (1) Funds from operations, revenue, funds from

operations per share, funds from operations netback, operating

netback, adjusted net earnings, adjusted net earnings per share and

adjusted working capital are not defined by GAAP in Canada and are

referred to as non-GAAP measures. Funds from operations are based

on cash flow from operating activities as per the statement of cash

flows before changes in non-cash working capital and asset

retirement expenditures. Funds from operations per share is

calculated based on the weighted average number of common shares

outstanding consistent with the calculation of net earnings (loss)

per share. Funds from operations netback equals the total of

revenues including realized commodity derivative gains/losses less

royalties, transportation, operating, general and administrative,

restricted stock units, interest expenses and cash taxes calculated

on a Boe basis. Adjusted net earnings equals net earnings excluding

after tax unrealized gains (losses) on commodity derivatives,

impairments, impairment reversals, goodwill impairments and gains

(losses) on property divestments. Operating netback equals the

total of revenues including realized commodity derivative

gains/losses less royalties, transportation and operating expenses

calculated on a Boe basis. Adjusted working capital excludes the

current portions of the commodity derivative asset or liability.

Total Boe is calculated by multiplying the daily production by the

number of days in the period. For more details on non-GAAP

measures, including reconciliation to GAAP measures refer to

NuVista's "Management's Discussion and Analysis". |

| (2) Product prices exclude realized gains/losses

on commodity derivatives. |

2014

Guidance

2014 is the year where NuVista will enter full development mode

in the Wapiti Montney resource play. We have increased our capital

budget in 2014 compared to 2013, to the range of $240 million to

$260 million with a commensurate increase in rig count to three

rigs for most of the year. The capital will be focused

approximately 90% in the Wapiti area, with approximately 80% of

that in the condensate rich Bilbo development block. We expect to

drill and complete 16 to 18 horizontal wells in the year, complete

and start up the Bilbo compressor station, and begin delivering to

the Keyera Simonette plant late in the second quarter of 2014. This

new infrastructure will provide the capacity for significant growth

over the next few years.

Our entrance production rate in 2014 after the previously

announced December divestitures was approximately 16,500 Boe/d.

Production for 2014 is expected to be in the range of 17,500 to

18,500 Boe/d. Behind pipe capacity is continuing to build in order

to accommodate the ramp in infrastructure capacity later in the

year, with fourth quarter production expected in the range of

20,000 to 21,000 Boe/d. Cash flows for 2014 are expected in the

range of $130 million to $140 million based on current strip prices

of $4.50/GJ AECO for natural gas and US$98/Bbl for WTI.

Looking beyond 2014, we are excited about our ability to drive

and internally fund significant growth with an increased pace of

drilling and significant facility capacity. For 2015, we anticipate

annual production of approximately 23,000 Boe/d which, at $3.50/GJ

AECO gas and US$85/Bbl WTI oil prices, would drive cash flow to

approximately $170 million.

With corporate netbacks and production rising quickly, and

efficiencies continuing to be built into every aspect of our Wapiti

Montney play, NuVista is confident to continue accelerating the

pace of activity in the future. We will continue to work with area

midstreamers to provide an ever-increasing facility capacity to

underpin long-term profitable growth. We would like to thank our

shareholders for their continued support, and our exceptionally

dedicated and talented staff for their significant contributions to

the bright future we are delivering together.

Please refer to the corporate presentation on our website which

will be updated on or before the end of March 10, 2014 to include

further details and context regarding the information in this press

release.

CONSOLIDATED FINANCIAL STATEMENTS AND MD&A

December 31, 2013 audited consolidated financial statements and

notes to the consolidated financial statements and Management's

Discussion and Analysis for NuVista Energy Ltd. have been filed on

SEDAR (www.sedar.com) under NuVista Energy Ltd. and can also be

accessed on NuVista's website at www.nuvistaenergy.com.

ADVISORY REGARDING OIL AND GAS INFORMATION

This news release contains the terms barrels of oil

equivalent ("Boe"), millions of barrels of oil equivalent ("MMBoe")

and thousand cubic feet equivalent ("Mcfe") and trillion cubic feet

equivalent ("Tcfe"). Natural gas is converted to a Boe using six

thousand cubic feet of gas to one barrel of oil. In certain

circumstances natural gas liquid volumes have been converted to a

Mcfe on the basis of one barrel of natural gas liquids to six

thousand cubic feet of gas. Boes, MMBoes, Mcfes and Tcfes may be

misleading, particularly if used in isolation. The foregoing

conversion ratios are based on an energy equivalency conversion

method primarily applicable at the burner tip and does not

represent a value equivalency at the wellhead. As well, given than

the value ratio based on the current price of crude oil to natural

gas is significantly different from the 6:1 energy equivalency

ratio, using a conversion ratio on a 6:1 basis may be misleading as

an indication of value.

Any references in this news release to initial or test

production rates are useful in confirming the presence of

hydrocarbons, however, such rates are not determinative of the

rates at which such wells will continue production and decline

thereafter. Additionally, such rates may also include recovered

"load oil" fluids used in well completion stimulation. While

encouraging, readers are cautioned not to place reliance on such

rates in calculating the aggregate production for NuVista.

ADVISORY REGARDING FORWARD-LOOKING INFORMATION AND

STATEMENTS

This press release contains forward-looking statements and

forward-looking information (collectively, "forward-looking

statements") within the meaning of applicable securities laws. The

use of any of the words "will", "expects", "believe", "plans",

"potential" and similar expressions are intended to identify

forward-looking statements. More particularly and without

limitation, this press release contains forward looking statements,

including management's assessment of: NuVista's future strategy,

plans, opportunities, growth initiatives and operations; the

expectations of creating significant shareholder value from

NuVista's properties and opportunities; our ability to internally

fund these opportunities and initiatives; forecast production;

production mix; drilling, development, completion and tie-in plans

and results; plans to reduce drilling times and costs and to

optimize completions; plans relating to future access to processing

facilities, transportation and markets; expectations of future

results, including future production levels, typecurves, well

economics, and operating costs, future disposition plans, targeted

debt level; the amount, timing, allocation and efficiency of

NuVista's capital program and the results therefrom; plans and

expectations regarding facility construction and infrastructure

development, the timing thereof and the benefits to be obtained

therefrom; the anticipated potential of NuVista's asset base

including expectations regarding repeatable development and

improved drilling and completion techniques; forecast cash flow;

the source of funding of NuVista's capital program; and plans to

internally fund future growth and acceleration of our future

opportunities;

NuVista's risk management strategy; expectations regarding

future commodity prices and netbacks; industry conditions and the

timing of release of future results. By their nature,

forward-looking statements are based upon certain assumptions and

are subject to numerous risks and uncertainties, some of which are

beyond NuVista's control, including the impact of general economic

conditions, industry conditions, current and future commodity

prices, currency and interest rates, anticipated production rates,

borrowing, operating and other costs and funds from operations, the

timing, allocation and amount of capital expenditures and the

results therefrom, anticipated reserves and the imprecision of

reserve estimates, the performance of existing wells, the success

obtained in drilling new wells, the sufficiency of budgeted capital

expenditures in carrying out planned activities, access to

infrastructure and markets, competition from other industry

participants, availability of qualified personnel or services and

drilling and related equipment, stock market volatility, effects of

regulation by governmental agencies including changes in

environmental regulations, tax laws and royalties, the ability to

access sufficient capital from internal sources and bank and equity

markets; and including, without limitation, those risks considered

under "Risk Factors" in our Annual Information Form. Readers are

cautioned that the assumptions used in the preparation of such

information, although considered reasonable at the time of

preparation, may prove to be imprecise and, as such, undue reliance

should not be placed on forward-looking statements.

NuVista's actual results, performance or achievement could

differ materially from those expressed in, or implied by, these

forward-looking statements, or if any of them do so, what benefits

NuVista will derive therefrom. NuVista has included the

forward-looking statements in this press release in order to

provide readers with a more complete perspective on NuVista's

future operations and such information may not be appropriate for

other purposes. NuVista disclaims any intention or obligation to

update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise, except as

required by law.

NuVista Energy Ltd.Jonathan A. WrightPresident and CEO(403)

538-8501NuVista Energy Ltd.Robert F. FroeseVP, Finance and CFO(403)

538-8530www.nuvistaenergy.com

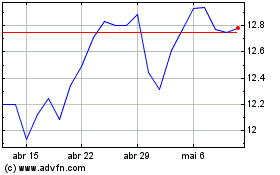

NuVista Energy (TSX:NVA)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

NuVista Energy (TSX:NVA)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024