Peyto Exploration & Development Corp. Announces $150 Million Equity Offering

16 Janeiro 2014 - 7:21PM

Marketwired Canada

NOT FOR DISTRIBUTION TO U.S. NEWS WIRE SERVICES OR DISSEMINATION IN THE UNITED

STATES.

Peyto Exploration & Development Corp. ("Peyto" or the "Company") (TSX:PEY) has

today entered into an agreement with a syndicate of underwriters led by BMO

Capital Markets, under which the underwriters have agreed to buy 4,420,000

common shares of the Company ("Common Shares") and sell to the public at a price

of $34.00 per Common Share, representing an aggregate amount of approximately

$150 million. The Company has granted the underwriters an option, exercisable at

any time until 30 days following the closing of the offering, to purchase up to

an additional 15% of the offering to cover over-allotments, if any.

Net proceeds from the offering will initially be used to pay down outstanding

bank debt, and subsequently to fund Peyto's ongoing capital expenditures and for

general corporate purposes. Closing is expected to occur on or about February 5,

2014. The closing is subject to the receipt of all necessary regulatory and

stock exchange approvals.

The securities offered have not been and will not be registered under the U.S.

Securities Act of 1933, as amended, and may not be offered or sold in the United

States absent registration or applicable exemption from the registration

requirements. This news release does not constitute an offer to sell or the

solicitation of any offer to buy nor will there be any sale of these securities

in any province, state or jurisdiction in which such offer, solicitation or sale

would be unlawful prior to registration or qualification under the securities

laws of any such province, state or jurisdiction.

This press release contains forward-looking statements including statements

concerning the closing date of the offering and the anticipated use of the net

proceeds of the offering. The closing of the offering could be delayed if Peyto

is not able to obtain the necessary stock exchange and other regulatory

approvals on the timelines it has planned and the intended use of the net

proceeds of the offering might change if the board of directors determines that

it would be in the best interests of Peyto to deploy the proceeds for some other

purpose. By their nature, forward-looking statements are subject to numerous

risks and uncertainties, some of which are beyond Peyto's control. Readers are

cautioned that the assumptions used in the preparation of such information,

although considered reasonable at the time of preparation, may prove to be

imprecise and, as such, undue reliance should not be placed on forward-looking

statements. Peyto's actual results, performance or achievement could differ

materially from those expressed in, or implied by, these forward-looking

statements and, accordingly, no assurance can be given that any of the events

anticipated by the forward-looking statements will transpire or occur, or if any

of them do so, what benefits that Peyto will derive therefrom. The Toronto Stock

Exchange has neither approved nor disapproved the information contained herein.

FOR FURTHER INFORMATION PLEASE CONTACT:

Peyto Exploration & Development Corp.

Darren Gee

President & Chief Executive Officer

(403) 237-8911

(403) 451-4100 (FAX)

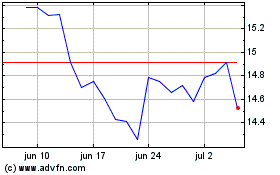

Peyto Exploration and De... (TSX:PEY)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

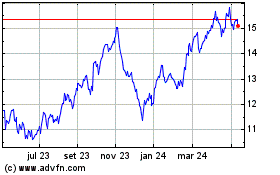

Peyto Exploration and De... (TSX:PEY)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024