Savaria Corporation (TSX:SIS), Canada's leader in the accessibility

industry, today disclosed its results for the first quarter ended

March 31, 2012.

First-Quarter Highlights

-- Revenue of $15.2 million, compared with $15.5 million in 2011;

-- Earnings before interest, income taxes, depreciation and amortization

("EBITDA") of $1 million, compared with $809,000 in 2011, an increase of

26 %;

-- Net income of 1.6 cents per share(1) compared with 0.8 cent per share(1)

in 2011;

-- Declaration of a dividend of 9.4 cents ($0.094) per common share.

(1) basic and diluted

A Word from the President

"Revenue for first quarter 2012 is similar to first quarter

2011, in spite of a drop of $616,000 in revenue from the Adapted

Vehicles segment. This drop has been partially offset by an

increase of $334,000 or 3%, in revenue from the Accessibility

segment. Our EBITDA increased by 26% for first quarter 2012

compared with 2011, which is a very promising start for 2012",

declared Marcel Bourassa, President and Chief Executive Officer of

Savaria.

"To benefit from the current low interest rates and in order to

streamline our operations, Savaria has acquired, in April, a

125,000-square-foot building in Brampton, Ontario. This transaction

will allow substantial annual savings.

We are confident that our presence in North America and China

will benefit our shareholders, given the nature of our industry,

which is to bring solutions to people with mobility challenges",

concluded Mr. Bourassa.

Operating Results (Comparative Analysis with First Quarter

2011)

-- For first quarter 2012, the corporation achieved revenue of $15.2 M,

compared with $15.5 M in 2011, down by 1.8% or $282,000.

-- Gross margin is down by $279,000 for the first quarter and represents

27.8% of revenue, compared with 29.1% in 2011.

-- Operating income is slightly down, by 3.9% or $29,000, from $735,000 in

2011 to $706,000 in 2012.

-- Net income for first quarter is up by 103%, from $177,000 in 2011 to

$360,000 in 2012, an increase of $183,000.

Savaria Corporation (www.savaria.com) is Canada's leader and the

second largest North American company in the accessibility industry

focused on meeting the needs of people with mobility challenges.

Savaria designs, manufactures and distributes primarily elevators

for residential and commercial use, as well as stairlifts and

vertical and inclined platform lifts. In addition, it converts and

adapts wheelchair accessible automotive vehicles and also offers

scooters and motorized wheelchairs. The diversity of its product

line, one of the world's most comprehensive, enables the

Corporation to stand out by proposing an integrated and customized

solution for its customers' mobility needs. Its operations in China

have substantially grown since 2006 and the collaboration with

Savaria's other Canadian facilities increases its competitive edge

on the market. The Corporation records slightly over 50% of its

sales outside Canada, primarily in the United States. It has a

sales network of some 600 retailers in North America and employs

400 people at its head office in Laval and at its plants in

Montreal (Quebec), Brampton and London (Ontario), Calgary (Alberta)

and Huizhou (China).

Compliance with IFRS

The information appearing in this press release has been

prepared in accordance with IFRS. However, the Corporation uses

EBITDA for analysis purposes to measure its financial performance.

This measure has no standardized definition in accordance with IFRS

and is therefore regarded as a non-IFRS measure. This measure may

therefore not be comparable to similar measures reported by other

companies. A reconciliation between net income for the period and

EBITDA is provided in the Financial Highlights section below.

Cautionary Notice Regarding Forward-Looking Statements

Certain information in this press release may constitute

"forward-looking statement" regarding Savaria, including, without

being limited thereto, understanding of the elements that might

affect the Corporation's future, relating to its financial or

operating performance, the costs and schedule of future

acquisitions, supplementary capital expenditure requirements and

legislative matters. Most frequently, but not invariably,

forward-looking statements are identified by the use of such terms

as "plan", "expect", "should", "could", "budget", "expected",

"estimated" "forecast", "intend", "anticipate", "believe", variants

thereof (including negative variants) or statements that certain

events, results or shares "could", "should" or "will" occur or be

achieved. Such statements involve known and unknown risks,

uncertainties and other factors liable to cause Savaria's actual

results, performance or achievements to differ materially from

those set forth in or underlying the forward-looking statements.

Such factors notably include general, economic, competitive,

political and social uncertainties. Although Savaria has attempted

to identify the key elements liable to cause actual measures,

events or results to differ from those described in the

forward-looking statements, other factors could have an impact on

the reality and produce unexpected results. The forward-looking

statements contained herein are valid at the date of this press

release. As there can be no assurance that these forward-looking

statements will prove accurate, actual future results and events

could differ materially from those anticipated therein.

Accordingly, readers are strongly advised not to unduly rely on

these forward-looking statements.

Complete financial statements and the Management's Report for

the quarter ended March 31, 2012 will be available shortly on

Savaria's website and on SEDAR (www.sedar.com).

Financial Highlights

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(in thousands, except per-share

amounts, percentages and exchange Quarters Ended

rates - unaudited) March 31

---------------------------------------

2012 2011 Change

----------------------------------------------------------------------------

Revenue $15,231 $15,513 (1.8)%

----------------------------------------------------------------------------

Gross margin as a % of revenue 27.8% 29.1% n/a

----------------------------------------------------------------------------

Operating expenses $3,514 $3,775 (6.9)%

As a % of revenue 23.1% 24.3% n/a

----------------------------------------------------------------------------

Results from operating activities $706 $735 (3.9)%

As a % of revenue 4.6% 4.7% n/a

----------------------------------------------------------------------------

Loss on foreign exchange $(30) $(249) 88%

----------------------------------------------------------------------------

Net income $360 $177 103%

----------------------------------------------------------------------------

Earnings per share - basic and

diluted $0.016 $0.008 100%

----------------------------------------------------------------------------

EBITDA(2) $1,019 $809 26%

----------------------------------------------------------------------------

EBITDA per share - diluted $0.04 $0.03 33.3%

----------------------------------------------------------------------------

Dividends declared per share $0.094 $0.102 n/a

----------------------------------------------------------------------------

Average number of common shares

outstanding - diluted 23,197 22,671 2.3%

----------------------------------------------------------------------------

----------------------------------------------------------------------------

As at Dec.

As at March 31, 2012 31, 2011

----------------------------------------------------------------------------

Total assets $42,008 $42,413

----------------------------------------------------------------------------

Total liabilities $23,742 $22,268

----------------------------------------------------------------------------

Equity $18,266 $20,145

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) Calculated considering foreign exchange contracts applied to the

periods in question.

(2) Reconciliation of EBITDA with net income provided in the following

table.

Although EBITDA is not recognized according to IFRS, it is used

by management, investors and analysts to assess the Corporation's

financial and operating performance.

Reconciliation of EBITDA with Net Income

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(in thousands of dollars - Quarters Ended

unaudited) March 31

----------------------------------------

2012 2011

----------------------------------------------------------------------------

Net income $360 $177

----------------------------------------------------------------------------

Plus:

Interest on long-term debt 124 143

----------------------------------------------------------------------------

Interest expense and banking fees 25 43

----------------------------------------------------------------------------

Income tax 150 112

----------------------------------------------------------------------------

Depreciation of fixed assets 177 170

----------------------------------------------------------------------------

Amortization of intangible assets 192 182

----------------------------------------------------------------------------

Less:

Interest 9 18

----------------------------------------------------------------------------

EBITDA $1,019 $809

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Contacts: Helene Bernier, CA Vice-President, Finance

1-800-931-5655, ext. 248helene.bernier@savaria.com Marcel Bourassa

President and Chief Executive Officer

1-800-661-5112marcel.bourassa@savaria.com www.savaria.com

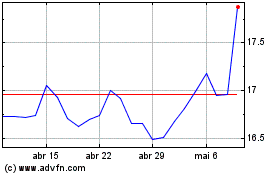

Savaria (TSX:SIS)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

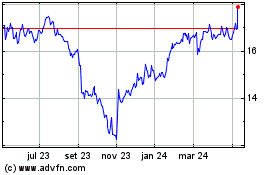

Savaria (TSX:SIS)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024