Symphony Floating Rate Senior Loan Fund Closes Over-Allotment

18 Novembro 2011 - 11:10AM

Marketwired Canada

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE

UNITED STATES.

Brompton Funds Limited (the "Manager") is pleased to announce that Symphony

Floating Rate Senior Loan Fund (TSX:SSF.UN) (the "Fund") has completed the

issuance of 450,000 Class A Units for gross proceeds of $4.5 million. This

issuance was pursuant to the exercise of the over-allotment option granted to

the agents in connection with the Fund's recently completed initial public

offering. With the exercise of the over-allotment option, total gross proceeds

raised by the Fund are approximately $54.5 million. The Class A Units trade on

the Toronto Stock Exchange under the symbol SSF.UN. The Fund also offered Class

U Units which are designed for investors wishing to make their investment in

U.S. dollars and are not listed on a stock exchange but may be converted into

Class A Units on a weekly basis.

The Fund's investment objectives are to (i) provide monthly tax-advantaged

distributions consisting primarily of returns of capital; and (ii) preserve

capital, in each case, through exposure to an actively managed, diversified

portfolio consisting primarily of short-duration floating rate senior corporate

debt instruments, including senior secured loans and other senior debt

obligations of North American non-investment grade corporate borrowers. The

Fund's initial distribution target is expected to be $0.05833 per Class A Unit

per month (US$0.05833 per Class U Unit per month), representing an initial yield

on the Unit issue price of 7% per annum, consisting primarily of returns of

capital which are not immediately taxable but which reduce a Unitholder's

adjusted cost base of its Units. The Manager intends to hedge substantially all

of the value of the portfolio attributable to the Class A Units to the Canadian

dollar and substantially all of the value of the portfolio attributable to the

Class U Units to the U.S. dollar.

The Manager has selected Symphony Asset Management LLC, a wholly owned

subsidiary of Nuveen Investments, Inc., to act as sub-advisor for SSF Trust in

connection with the selection, purchase and sale of senior loans and other

assets of the portfolio. Backed by an institutional calibre integrated credit

platform and supported by a 17-member team of experienced credit investment

professionals, Symphony manages approximately US$5.4 billion focused on senior

loans with approximately US$8.9 billion in assets under management as at June

30, 2011. Funds sub-advised by Symphony have achieved top three, five and

ten-year performance rankings by Lipper as at June 30, 2011 for the senior loan

asset class. Nuveen and its affiliates had approximately US$210 billion of

assets under management as at June 30, 2011. As at December 31, 2010, Nuveen was

the leading sponsor of U.S.-listed closed-end funds according to Morningstar

Fundamental Data as measured by the number of funds (132) and the amount of fund

assets under management (approximately US$49 billion).

The syndicate of agents for the offering was co-led by RBC Capital Markets, CIBC

and BMO Capital Markets and included Scotia Capital Inc., TD Securities Inc.,

GMP Securities L.P., HSBC Securities (Canada) Inc., Raymond James Ltd.,

Canaccord Genuity Corp., Macquarie Private Wealth Inc., Desjardins Securities

Inc., Dundee Securities Ltd., Mackie Research Capital Corporation and Manulife

Securities Incorporated.

For further information, please contact your financial advisor, call our

investor relations line at 416-642-9051, (toll-free at 1-866-642-6001) or visit

our website at www.bromptonfunds.com.

Commissions, trailing commissions, management fees and expenses all may be

associated with investment funds. Please read the Fund's publicly filed

documents which are available from SEDAR at www.sedar.com. Investment funds are

not guaranteed, their values change frequently and past performance may not be

repeated.

Certain statements contained in this news release constitute forward-looking

information within the meaning of Canadian securities laws. Forward-looking

information may relate to matters disclosed in this press release and to other

matters identified in public filings relating to the Fund, to the future outlook

of the Fund and anticipated events or results and may include statements

regarding the future financial performance of the Fund. In some cases,

forward-looking information can be identified by terms such as "may", "will",

"should", "expect", "plan", "anticipate", "believe", "intend", "estimate",

"predict", "potential", "continue" or other similar expressions concerning

matters that are not historical facts. Actual results may vary from such

forward-looking information.

The securities offered have not been registered under the U.S. Securities Act of

1933, as amended, and may not be offered or sold in the United States absent

registration or any applicable exemption from the registration requirements.

This press release does not constitute an offer to sell or the solicitation of

an offer to buy securities nor will there be any sale of such securities in any

state in which such offer, solicitation or sale would be unlawful.

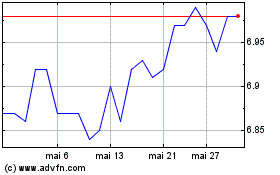

Symphony Floating Rate S... (TSX:SSF.UN)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

Symphony Floating Rate S... (TSX:SSF.UN)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024