Total Energy Services Inc. ("Total Energy" or the "Company") (TSX:TOT) announces

its consolidated financial results for the three and nine months ending

September 30, 2013.

Financial Highlights

($000's except per share data)

----------------------------------------------------------------------------

Three Months Ended Nine Months Ended

September 30 September 30

(unaudited) (unaudited)

% %

2013 2012 Change 2013 2012 Change

----------------------------------------------------------------------------

Revenue $ 89,060 $ 73,517 21% $ 252,639 $ 229,298 10%

Operating Earnings

(1) 13,698 12,979 6% 38,631 50,415 (23)%

EBITDA (1) 20,752 20,078 3% 59,800 69,333 (14)%

Cashflow (1) (5) 18,899 20,184 (6)% 36,456 69,839 (48)%

Net Income 9,109 9,456 (4)% 26,614 37,167 (28)%

Per Share Data

(Diluted) (2)

EBITDA (1) $ 0.61 $ 0.58 5% $ 1.76 $ 1.99 (12)%

Cashflow (1) (5) $ 0.55 $ 0.58 (5)% $ 1.07 $ 2.01 (47)%

Net Earnings $ 0.29 $ 0.30 (3)% $ 0.86 $ 1.16 (26)%

----------------------------------------------------------------------------

Sept. 30 Dec. 31

2013 2012 %

(unaudited) (audited) Change

----------------------------------------------------------------------------

Financial Position

Total Assets $ 494,362 $ 476,591 4%

Long-Term Debt,

Convertible

Debentures and

Obligations Under

Finance Leases

(excluding current

portion) 66,236 65,417 1%

Working Capital (3) 90,440 90,708 -

Net Debt (4) Nil Nil -

Shareholders'

Equity 329,901 306,069 8%

Shares Outstanding

(000's)

Basic 31,091 30,600 2%

Diluted (2) 34,537 34,300 1%

----------------------------------------------------------------------------

Notes 1 through 5 please refer to the Notes to the Financial Highlights set

forth at the end of this release.

Total Energy's results for the three and nine months ended September 30, 2013

reflect continued momentum in the Company's Compression and Process Services

division offset by lower completion and well servicing activity in Western

Canada as compared to the first nine months of 2012 that negatively impacted the

Rentals and Transportation Services division. While activity levels in the

Company's Contract Drilling Services division increased during the third quarter

of 2013 as compared to the third quarter of 2012, pricing in this division did

not increase to the extent necessary to offset a 7% increase in cost of

services, resulting in reduced gross margins and divisional profitability.

Total Energy's Contract Drilling Services division achieved 54% utilization

during the third quarter of 2013, recording 798 operating days (spud to release)

with a fleet of 16 rigs, compared to 677 operating days, or 49% utilization,

during the third quarter of 2012 with a fleet of 15 rigs. Revenue per operating

day decreased 2% for the third quarter of 2013 relative to the prior year

comparable period due to reduced pricing and the mix of equipment operating. The

Rentals and Transportation Services division achieved a utilization rate on

major rental equipment of 40% during the third quarter of 2013 as compared to a

44% utilization rate during the third quarter of 2012. Revenue per utilized

rental piece decreased 14% for the third quarter of 2013 compared to the same

period in 2012, due primarily to lower pricing given the current competitive

landscape. The Compression and Process Services division generated revenues of

$48.8 million for the three months ended September 30, 2013 compared to $30.2

million for the same period in 2012, an increase of 62%. The 2013 third quarter

financial results from this division include results from the process equipment

fabrication business that was acquired on January 1, 2013. This division exited

the third quarter of 2013 with a $57.6 million backlog of fabrication sales

orders as compared to $35.2 million at September 30, 2012. Included in the

September 30, 2013 fabrication sales order backlog is $46.2 million of

compression sales backlog and $11.4 million of process equipment sales backlog.

At September 30, 2013, approximately 35,700 horsepower of compression equipment

was on rent compared to 28,300 horsepower on rent at September 30, 2012. The gas

compression rental fleet operated at an average utilization rate of 85% for the

third quarter of 2013 as compared to 84% during the same period in 2012.

Negatively impacting cash flow for the first nine months of 2013 was the payment

of $15.3 million of income taxes during the first quarter that related to 2012,

as income tax installment payments were not required in 2012. Total Energy is

required to make monthly income tax installment payments that amounted to

approximately $9.5 million for the first nine months of 2013.

During the third quarter, Total Energy declared a quarterly dividend of $0.05

per share to shareholders of record on September 30, 2013. This dividend was

paid on October 31, 2013. 89,200 common shares were purchased under the

Company's normal course issuer bid during the three months ended September 30,

2013 at an average price of $16.14 per share (including commissions).

Outlook

While drilling activity levels in Western Canada during the third quarter of

2013 were modestly higher than the third quarter of 2012, well completion and

well servicing activity continued to lag behind 2012 activity levels, due in

part to extended wet weather conditions during July and the first part of

August. Current demand for the Company's drilling rigs is strong and suggests

the upcoming winter drilling season will be active. While increased drilling

activity in Western Canada is positive for the Rentals and Transportation

Services division, increased completion and well service activity will be

required to substantially improve rental equipment utilization. The substantial

fabrication sales backlog enjoyed by the Compression and Process Services

division reflects continued solid demand for the Company's compression and

process equipment.

Total Energy's financial condition remains solid with a long-term debt

(including convertible debentures) to long-term debt plus equity ratio of 0.17

to 1.0, $90.4 million of positive working capital and no net debt as at

September 30, 2013. Total Energy's $35 million operating facility is currently

fully available and undrawn. Total Energy continues to evaluate several

investment opportunities and the Company's financial position provides

significant capacity and flexibility to pursue further growth opportunities that

meet the Company's investment expectations.

Conference Call

At 2:30 p.m. MST today, Total Energy will conduct a conference call and webcast

to discuss its third quarter financial results. Daniel Halyk, President & Chief

Executive Officer, will host the conference call. The call is open to

Shareholders and all other interested persons. A live webcast of the conference

call will be accessible on Total's website at www.totalenergy.ca by selecting

"Webcasts". Persons wishing to join the conference call live may do so by

calling (866) 226-1792 or (416) 340-2216. Those who are unable to listen to the

call live may listen to a recording of it on Total Energy's website. A recording

of the conference call will also be available until November 19, 2013 by dialing

(800) 408-3053 (passcode 4497761).

Selected Financial Information

Selected financial information relating to the three and nine month periods

ended September 30, 2013 and 2012 is attached to this news release. This

information should be read in conjunction with the condensed unaudited interim

consolidated financial statements of Total Energy and the attached notes to the

consolidated financial statements and management's discussion and analysis to be

issued in due course and reproduced in the Company's third quarter report.

Condensed Interim Consolidated Statements of Financial Position

(in thousands of Canadian dollars)

----------------------------------------------------------------------------

September 30, December 31,

2013 2012

----------------------------------------------------------------------------

(unaudited) (audited)

Assets

Current assets:

Cash and cash equivalents $ 22,191 $ 50,052

Accounts receivable 71,223 63,511

Inventory 34,677 33,240

Income taxes receivable 4,410 -

Prepaid expenses and deposits 5,883 2,547

----------------------------------------------------------------------------

138,384 149,350

Property, plant and equipment 351,925 323,188

Goodwill 4,053 4,053

----------------------------------------------------------------------------

$ 494,362 $ 476,591

----------------------------------------------------------------------------

Liabilities & Shareholders' Equity

Current liabilities:

Accounts payable and accrued liabilities $ 38,495 $ 32,523

Deferred revenue 5,694 6,971

Income taxes payable - 15,098

Dividends payable 1,555 1,530

Current portion of obligations under finance

leases 2,200 2,520

----------------------------------------------------------------------------

47,944 58,642

Obligations under finance leases 2,247 2,723

Convertible debentures 63,989 62,694

Deferred tax liability 50,281 46,463

Shareholders' equity:

Share capital 82,051 76,890

Contributed surplus 6,294 5,160

Equity portion of convertible debenture 4,601 4,601

Retained earnings 236,955 219,418

----------------------------------------------------------------------------

329,901 306,069

----------------------------------------------------------------------------

$ 494,362 $ 476,591

----------------------------------------------------------------------------

Condensed Interim Consolidated Statements of Comprehensive Income

(in thousands of Canadian dollars except per share amounts)

----------------------------------------------------------------------------

Three months ended Nine months ended

September 30 September 30

2013 2012 2013 2012

----------------------------------------------------------------------------

(unaudited) (unaudited) (unaudited) (unaudited)

Revenue $ 89,060 $ 73,517 $ 252,639 $ 229,298

Cost of services 60,573 46,569 169,076 137,826

Selling, general and

administration 7,188 6,764 22,358 21,594

Share-based compensation 643 1,092 2,556 2,023

Depreciation 6,958 6,113 20,018 17,440

----------------------------------------------------------------------------

Results from operating

activities 13,698 12,979 38,631 50,415

Gain on sale of property,

plant and equipment 96 986 1,151 1,478

Finance costs (1,394) (1,149) (4,109) (3,678)

----------------------------------------------------------------------------

Net income before income

taxes 12,400 12,816 35,673 48,215

Current income tax expense 1,954 5,355 5,241 9,525

Deferred income tax

expense (recovery) 1,337 (1,995) 3,818 1,523

----------------------------------------------------------------------------

Total income tax expense

(recovery) 3,291 3,360 9,059 11,048

Net income and total

comprehensive income for

the period $ 9,109 $ 9,456 $ 26,614 $ 37,167

----------------------------------------------------------------------------

Earnings per share

Basic earnings per share $ 0.30 $ 0.31 $ 0.87 $ 1.19

Diluted earnings per share $ 0.29 $ 0.30 $ 0.86 $ 1.16

----------------------------------------------------------------------------

Condensed Interim Consolidated Statements of Cash Flows

(in thousands of Canadian dollars)

----------------------------------------------------------------------------

Three months ended Nine months ended

September 30 September 30

2013 2012 2013 2012

----------------------------------------------------------------------------

(unaudited) (unaudited) (unaudited) (unaudited)

Cash provided by (used in):

Operations:

Net income for the period $ 9,109 $ 9,456 $ 26,614 $ 37,167

Add (deduct) items not

affecting cash:

Depreciation 6,958 6,113 20,018 17,440

Share-based compensation 643 1,092 2,556 2,023

Gain on sale of

property, plant and

equipment (96) (986) (1,151) (1,478)

Finance costs 1,394 1,149 4,109 3,678

Current income tax

expense 1,954 5,355 5,241 9,525

Deferred income tax

expense (recovery) 1,337 (1,995) 3,818 1,523

Income taxes paid (2,400) - (24,749) (39)

----------------------------------------------------------------------------

18,899 20,184 36,456 69,839

Changes in non-cash

working capital items:

Accounts receivable (17,353) (4,745) (7,712) 34,735

Inventory (1,553) 1,399 1,517 2,293

Prepaid expenses and

deposits (1,385) (726) (3,336) (958)

Accounts payable and

accrued liabilities 6,674 (484) 6,435 (7,606)

Deferred revenue (1,402) (2,106) (1,277) 544

----------------------------------------------------------------------------

3,880 13,522 32,083 98,847

Investments:

Purchase of property,

plant and equipment (19,400) (18,870) (36,472) (60,291)

Acquisition of business - - (16,954) -

Proceeds on disposal of

property, plant and

equipment 841 4,460 4,351 6,207

Changes in non-cash

working capital items 5,103 2,286 880 (1,900)

----------------------------------------------------------------------------

(13,456) (12,124) (48,195) (55,984)

Financing:

Repayment of obligations

under finance leases (795) (757) (2,279) (2,500)

Dividends to shareholders (1,530) (1,550) (4,598) (4,370)

Issuance of common shares 3,277 - 4,705 1,197

Repurchase of common

shares (1,427) (3,837) (5,420) (13,634)

Interest paid (1,794) (1,740) (4,157) (3,820)

----------------------------------------------------------------------------

(2,469) (7,884) (11,749) (23,127)

----------------------------------------------------------------------------

Change in cash and cash

equivalents (12,045) (6,486) (27,861) 19,736

Cash and cash equivalents,

beginning of period 34,236 61,880 50,052 35,658

----------------------------------------------------------------------------

Cash and cash equivalents,

end of period $ 22,191 $ 55,394 $ 22,191 $ 55,394

----------------------------------------------------------------------------

Segmented Information

The Company operates in three main industry segments, which are substantially in

one geographic segment. These segments are Contract Drilling Services, which

includes the contracting of drilling equipment and the provision of labour

required to operate the equipment, Rentals and Transportation Services, which

includes the rental and transportation of equipment used in drilling, completion

and production operations and Compression and Process Services, which includes

the fabrication, sale, rental and servicing of natural gas compression and

process equipment.

As at and for

the three

months ended Contract Rentals and Compression

September 30, Drilling Transportation and Process

2013 Services Services Services Other(1) Total

----------------------------------------------------------------------------

Revenue $ 14,772 $ 25,508 $ 48,780 $ - $ 89,060

Cost of services 9,460 12,248 38,865 - 60,573

Selling, general

and

administration 841 3,250 2,048 1,049 7,188

Share-based

compensation - - - 643 643

Depreciation 1,597 3,722 1,630 9 6,958

----------------------------------------------------------------------------

Results from

operating

activities 2,874 6,288 6,237 (1,701) 13,698

Gain on sale of

property, plant

and equipment - (19) 115 - 96

Finance costs (204) (552) (241) (397) (1,394)

----------------------------------------------------------------------------

Net income

(loss) before

income taxes 2,670 5,717 6,111 (2,098) 12,400

----------------------------------------------------------------------------

Goodwill - 2,514 1,539 - 4,053

Total assets 102,233 224,203 153,071 14,855 494,362

Total

liabilities 19,583 43,570 32,388 68,920 164,461

----------------------------------------------------------------------------

Capital

expenditures $ 2,816 $ 5,255 $ 9,855 $ 1,474 $ 19,400

----------------------------------------------------------------------------

As at and for

the three

months ended Contract Rentals and Compression

September 30, Drilling Transportation and Process

2012 Services Services Services Other(1) Total

----------------------------------------------------------------------------

Revenue $ 12,782 $ 30,563 $ 30,172 $ - $ 73,517

Cost of services 7,516 14,030 25,022 1 46,569

Selling, general

and

administration 760 3,306 1,628 1,070 6,764

Share-based

compensation - - - 1,092 1,092

Depreciation 1,320 3,787 997 9 6,113

----------------------------------------------------------------------------

Results from

operating

activities 3,186 9,440 2,525 (2,172) 12,979

Gain on sale of

property, plant

and equipment 21 140 825 - 986

Finance costs (254) (583) (69) (243) (1,149)

----------------------------------------------------------------------------

Net income

(loss) before

income taxes 2,953 8,997 3,281 (2,415) 12,816

----------------------------------------------------------------------------

Goodwill - 2,514 1,539 - 4,053

Total assets 95,887 223,830 92,644 46,415 458,776

Total

liabilities 18,460 47,573 19,369 75,950 161,352

----------------------------------------------------------------------------

Capital

expenditures $ 5,144 $ 11,409 $ 2,291 $ 26 $ 18,870

----------------------------------------------------------------------------

As at and for

the nine months Contract Rentals and Compression

ended September Drilling Transportation and Process

30, 2013 Services Services Services Other(1) Total

----------------------------------------------------------------------------

Revenue $ 37,687 $ 79,225 $ 135,727 $ - $252,639

Cost of services 24,158 37,933 106,985 - 169,076

Selling, general

and

administration 2,409 10,048 6,331 3,570 22,358

Share-based

compensation - - - 2,556 2,556

Depreciation 3,907 11,414 4,668 29 20,018

----------------------------------------------------------------------------

Results from

operating

activities 7,213 19,830 17,743 (6,155) 38,631

Gain (loss) on

sale of

property, plant

and equipment (22) 216 957 - 1,151

Finance costs (608) (1,648) (658) (1,195) (4,109)

----------------------------------------------------------------------------

Net income

before income

taxes 6,583 18,398 18,042 (7,350) 35,673

----------------------------------------------------------------------------

Goodwill - 2,514 1,539 - 4,053

Total assets 102,233 224,203 153,071 14,855 494,362

Total

liabilities 19,583 43,570 32,388 68,920 164,461

----------------------------------------------------------------------------

Capital

expenditures

(2) $ 4,547 $ 12,657 $ 31,248 $ 2,020 $ 50,472

----------------------------------------------------------------------------

As at and for

the nine months Contract Rentals and Compression

ended September Drilling Transportation and Process

30, 2012 Services Services Services Other(1) Total

----------------------------------------------------------------------------

Revenue $ 39,896 $ 102,004 $ 87,398 $ - $229,298

Cost of services 22,323 42,884 72,622 (3) 137,826

Selling, general

and

administration 2,556 10,960 4,501 3,577 21,594

Share-based

compensation - - - 2,023 2,023

Depreciation 3,604 10,953 2,854 29 17,440

----------------------------------------------------------------------------

Results from

operating

activities 11,413 37,207 7,421 (5,626) 50,415

Gain on sale of

property, plant

and equipment 65 409 1,004 - 1,478

Finance costs (760) (1,740) (262) (916) (3,678)

----------------------------------------------------------------------------

Net income

before income

taxes 10,718 35,876 8,163 (6,542) 48,215

----------------------------------------------------------------------------

Goodwill - 2,514 1,539 - 4,053

Total assets 95,887 223,830 92,644 46,415 458,776

Total

liabilities 18,460 47,573 19,369 75,950 161,352

----------------------------------------------------------------------------

Capital

expenditures $ 12,433 $ 31,546 $ 14,472 $ 1,840 $ 60,291

----------------------------------------------------------------------------

(1) Other includes the Company's corporate activities, accretion of

convertible debentures and obligations pursuant to long-term credit

facilities.

(2) Includes January 1, 2013 acquisition of a process equipment fabrication

business included in Compression and Process Services segment.

Total Energy Services Inc. is a growth oriented energy services corporation

involved in contract drilling services, rentals and transportation services and

the fabrication, sale, rental and servicing of natural gas compression and

process equipment. The common shares of Total Energy are listed and trade on the

TSX under the symbol TOT.

For further information, please visit our website at www.totalenergy.ca.

Notes to Financial Highlights

(1) Operating earnings means results from operating activities and is equal

to net income before income taxes minus gain on sale of property, plant

and equipment plus finance costs. EBITDA means earnings before

interest, taxes, depreciation and amortization and is equal to net

income before income taxes plus finance costs plus depreciation.

Cashflow means cash provided by operations before changes in non-cash

working capital items. Operating earnings, EBITDA and cashflow are not

recognized measures under IFRS. Management believes that in addition to

net income, operating earnings, EBITDA and cashflow are useful

supplemental measures as they provide an indication of the results

generated by the Company's primary business activities prior to

consideration of how those activities are financed, amortized or how

the results are taxed in various jurisdictions as well as the cash

generated by the Company's primary business activities without

consideration of the timing of the monetization of non-cash working

capital items. Readers should be cautioned, however, that operating

earnings, EBITDA and cashflow should not be construed as an alternative

to net income determined in accordance with IFRS as an indicator of

Total Energy's performance. Total Energy's method of calculating

operating earnings, EBITDA and cashflow may differ from other

organizations and, accordingly, operating earnings, EBITDA and cashflow

may not be comparable to measures used by other organizations.

(2) Per share data (diluted) and the number of common shares outstanding on

a diluted basis includes the impact of the approximate 3.1 million

common shares issuable upon the entire conversion of the $69 million

principal amount of convertible debentures issued by the Company in

February 2011.

(3) Working capital equals current assets minus current liabilities.

(4) Net Debt equals long-term debt plus obligations under finance leases

plus convertible debentures plus current liabilities minus current

assets.

(5) Cashflow for the nine months ended September 30, 2013 is net of $15.3

million of income taxes paid during the period that relates to 2012

taxable income as a result of the Company not having been required to

make income tax installment payments during 2012.

Certain statements contained in this press release, including statements which

may contain words such as "could", "should", "expect", "believe", "will" and

similar expressions and statements relating to matters that are not historical

facts are forward-looking statements. Such forward-looking statements involve

known and unknown risks and uncertainties which may cause the actual results,

performances or achievements of Total Energy to be materially different from any

future results, performances or achievements expressed or implied by such

forward-looking statements. Such factors include fluctuations in the market for

oil and natural gas and related products and services, political and economic

conditions, the demand for products and services provided by Total Energy, Total

Energy's ability to attract and retain key personnel and other factors.

Reference should be made to Total Energy's most recently filed Annual

Information Form and other public disclosures (available at www.sedar.com) for a

discussion of such risks and uncertainties.

The Toronto Stock Exchange has neither approved nor disapproved of the

information contained herein.

FOR FURTHER INFORMATION PLEASE CONTACT:

Total Energy Services Inc.

Daniel Halyk

President & Chief Executive Officer

(403) 216-3921

Total Energy Services Inc.

Mark Kearl

Vice-President Finance and Chief Financial Officer

(403) 216-3920

investorrelations@totalenergy.ca

www.totalenergy.ca

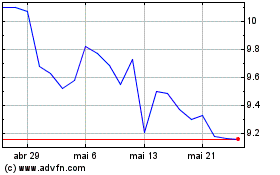

Total Energy Services (TSX:TOT)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

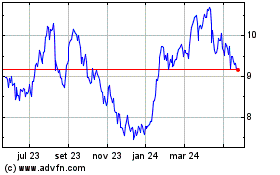

Total Energy Services (TSX:TOT)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024