Torex Gold Resources Inc. (the "Company" or "Torex")

(TSX:TXG)(TSX:TXG.WT.A) is pleased to announce a National

Instrument ("NI") 43-101 compliant inferred mineral resource

estimate of 5.84 million gold equivalent ounces, including 3.3

million ounces of gold, at its Media Luna Project in Mexico. The

average resource grade is 4.55 g/t Au Eq. (Au - 2.63 g/t, Ag -

24.46 g/t, Cu - 0.97%) at a 2.0 g/t Au Eq. cutoff grade. The

resource is contained within a single, continuous, strongly

mineralized system, which remains open in several directions.

"Our strategy has always been to - "Get the first mine resource

up to 5 million ounces, build it, and then find a second mine on

the same property, and build that one as well". In the recent past,

the exploration team delivered on the resource upgrade for the

first mine. Today's results suggest that the team has also been

very successful in finding a second major deposit. What they have

found is a deposit that appears to have proportions comparable to

some of the larger known skarn-hosted Au-Ag-Cu deposits. The

deposit was discovered by drill testing a portion of one of three

large magnetic anomalies in the Media Luna Area. The portion that

was drill tested represents approximately 30% of the 'traditional'

area covered by those three magnetic anomalies. The entire property

has recently been re-surveyed with ZTEM and newer magnetic

technology. The early results indicate that the magnetic anomalies

in the Media Luna Area may be larger than previously interpreted.

This leaves open the potential for significant additions to the

known mineralization at Media Luna that, with additional drilling,

may support updated Mineral Resource estimates. Future exploration

work in the Media Luna Area will be to drill test the unexplored

portions of the magnetic anomalies. Currently that is being done

with three drill rigs. Targeting guidance for those drill rigs will

be enhanced by the results from the ZTEM-magnetic survey, which

will be released in the near future as the interpretive work is

completed. In closing I would like to express the appreciation of

the Board to the exploration teams and all the support teams, for

the diligent application of their expertise in making the discovery

and then for the countless things that need to be done properly and

on schedule to deliver a resource of this size and quality in the

record time of only 18 months. Well done and thank you!" said Fred

Stanford, President & CEO of Torex.

The table below summarizes the estimated tonnes, grade, and

contained ounces.

Media Luna Deposit Inferred Mineral Resource Estimate at a 2.0

g/t Au Eq. Cut-off Grade.

------------------------------------------------------------------------

------------------------------------------------------------------------

Gold Eq. Contained Gold

Resource Tonnes Grade Gold Eq. Grade

Deposit Category (Mt) g/t (Moz) (g/t)

------------------------------------------------------------------------

Media Luna Inferred 39.9 4.55 5.84 2.63

------------------------------------------------------------------------

------------------------------------------------------------------------

------------------------------------------------------------------------

------------------------------------------------------------------------

Contained Silver Contained Copper Contained

Gold Grade Silver Grade Copper

Deposit (Moz) g/t (Moz) % (Mlb)

------------------------------------------------------------------------

Media Luna 3.38 24.46 31.39 0.97 852.48

------------------------------------------------------------------------

------------------------------------------------------------------------

Notes to accompany Mineral Resource tables

1. The qualified person for the estimate is Mark Hertel, RM SME, an AMEC

employee. The estimate has an effective date of September 6th 2013

2. Au Equivalent = Au (g/t) + Cu% (i)(74.74/48.07) + Ag (g/t) (i)

(0.85/48.07)

3. Mineral Resources are reported as undiluted; grades are contained grades

4. Mineral Resources are reported using a long-term gold price of

US$1495/oz, silver price of US$26.45/oz, and copper price of US$3.39/lb. The

metal prices used for the Mineral Resources estimates are based on AMEC`s

internal guidelines which are based on long-term consensus prices

5. The assumed mining method is from underground; depending on

mineralization thicknesses, a combination of cut-and-fill and transverse

stoping methods are likely. Mining costs are assumed at US$27.68 per tonne

and processing costs at US$17.00 per tonne. General and administrative costs

are estimated at US$4.00 per tonne

6. Based on preliminary metallurgical testwork results, the metallurgical

recoveries are estimated as gold 87%, silver 73%, and copper 89%

7. Inferred blocks are located within 110 m of two drill holes, approx. 100

m drill hole grid spacing

8. Rounding as required by reporting guidelines may result in apparent

summation differences between tonnes, grade and contained metal content

Please refer to Figure 1 for resource area map and Figures 2-7

for representative simplified geological cross-sections.

The limits of the Media Luna Inferred Mineral Resource are

defined primarily on the basis of current permitting and logistical

considerations. Systematic drilling in this defined area has

identified a gold-silver-copper-mineralized skarn with approximate

dimensions of 1.6 km x 1.2 km and ranging from 4 m to greater than

70 m in thickness. The mineralized zone is exposed at the surface

along the northeastern border of the area, although it has only

been surface mapped in detail at one location due to extremely

steep topography along this margin. Skarn alteration and associated

mineralization remains open in several directions.

The geology, as currently understood, appears to continue

laterally and down-dip. In addition, the strong magnetic anomaly

that characterizes Media Luna persists to the southeast and to the

northwest of the resource estimate area. Drilling shows that the

magnetic anomaly can be explained by the presence of massive

magnetite and magnetic pyrrhotite, which are typically associated

with gold-silver-copper mineralization. Magnetite within the skarn

zone decreases significantly outside the boundary of the magnetic

anomaly, but magnetic pyrrhotite continues and is locally

associated with elevated Au-Ag-Cu grades outside the magnetic

anomaly.

The table below illustrates the sensitivity of the Inferred

Mineral Resource estimate to changes in cut-off grade. The base

case at a cut-off grade of 2.0 g/t Au equivalent is highlighted.

The table suggests that the mineral resource estimate is not

particularly sensitive to cut-off grade.

Sensitivity of Media Luna Inferred Mineral Resource Estimate to

Cut-Off Grade (base case is highlighted)

Media Luna Inferred Resource at 2.00 (g/t) Au Equivalent

Grade

---------------------------------------------------------------

Cutoff AuEq Tonnes AuEq Au Ag Cu

(g/t) (Mt) (g/t) (g/t) (g/t) (%)

---------------------------------------------------------------

1.50 48.9 4.03 2.27 22.82 0.89

---------------------------------------------------------------

1.75 44.2 4.29 2.45 23.69 0.93

---------------------------------------------------------------

2.00 39.9 4.55 2.63 24.46 0.97

---------------------------------------------------------------

2.25 35.7 4.84 2.83 25.39 1.01

---------------------------------------------------------------

2.50 32.2 5.11 3.01 26.43 1.06

---------------------------------------------------------------

3.00 26.6 5.60 3.36 28.06 1.13

---------------------------------------------------------------

---------------------------------------------------------------------

Cutoff AuEq Contained AuEq Contained Au Contained Ag Contained Cu

(g/t) (Moz) (Moz) (Moz) (Mlb)

---------------------------------------------------------------------

1.50 6.35 3.57 35.92 956.51

---------------------------------------------------------------------

1.75 6.10 3.47 33.66 904.64

---------------------------------------------------------------------

2.00 5.84 3.38 31.39 852.48

---------------------------------------------------------------------

2.25 5.56 3.26 29.18 795.94

---------------------------------------------------------------------

2.50 5.29 3.12 27.36 749.26

---------------------------------------------------------------------

3.00 4.80 2.88 24.03 665.24

---------------------------------------------------------------------

The mineral resource estimates set out above have been prepared

by AMEC E&C Services Inc. (AMEC), of Sparks, Nevada. Torex will

file a NI 43-101 Technical Report on SEDAR within 45 days of this

announcement.

Mineral Resource Estimate Methodology

Within the Media Luna project 165 drill holes (94,206) meters

support the mineral resource estimate. Assays were composited into

2.5 meter lengths for estimation into 2.5 meter cubic blocks.

MineSight® a commercially-available geologic modeling and mine

planning software package, was used to produce a three dimensional

block model. Specific gravity (SG) was assigned by rock type from

244 wax immersion density determinations. Gold, silver and copper

grades, within the Media Luna resource model, were estimated using

a geologic skarn zone solid, upper and lower grade domains, skarn

position variables, and lithologic codes. The skarn zone solid was

created from three contact surfaces: limestone-exoskarn,

exo-endoskarn, and endoskarn-granodiorite. Vertical, un-mineralized

intrusive dykes were solid modeled. Ordinary kriging was used to

interpolate grade. Mineral Resources take into account geologic,

mining, and processing constraints. AMEC reviewed underground

conceptual mining methods, and concluded that, depending on

mineralization thicknesses, a combination of cut-and-fill and

transverse stoping methods are likely. Mineral Resources are

classified in accordance with the 2010 CIM Definition Standards for

Mineral Resources and Mineral Reserves and the 2003 CIM Estimation

of Mineral Resources and Mineral Reserves Best Practice

Guidelines.

QA/QC and Qualified Persons

All of the Media Luna project analytical work is performed by

SGS de Mexico S.A. de C.V. ("SGS") in Mexico and/or Acme Analytical

Laboratories Mexico S.A. de C.V. ("ACME").

Sample preparation is done at a dedicated sample preparation

laboratory operated by SGS at the project site in Nuevo Balsas,

Guerrero, Mexico, and/or at a dedicated sample preparation

laboratory operated by ACME at Guadalajara, Mexico. The gold

analyses (fire assay with an atomic absorption or gravimetric

finish) and multi-element geochemical analyses are completed at an

analytical laboratory operated by SGS at the project site in Nuevo

Balsas, Guerrero, Mexico and at their analytical facilities in

Vancouver, British Columbia, Canada, respectively. The gold

analyses (fire assay with an atomic absorption or gravimetric

finish) and multi-element geochemical analyses are completed by

ACME at their analytical facilities in Vancouver, British Columbia,

Canada.

The Company has a Quality Assurance/Quality Control ("QA/QC")

program in place that includes 5% of each of the certified

reference materials, blanks, field duplicates and preparation

duplicates for the grassroots exploration drilling program, with

the objective of the QA/QC program being to ensure the

batch-to-batch relative bias remains constant and that absolute

accuracy at anomalous to near cut-off grades is measured and

acceptable. The QA/QC program as designed has been approved by AMEC

and is currently overseen by Cristian Puentes, Chief Exploration

Geologist for the Media Luna Project.

The Qualified Person for the resource estimate is Mark Hertel,

RM SME, an AMEC employee.

The scientific and technical data contained in this news release

pertaining to the Media Luna Project has been reviewed and approved

by Mr. Barton Suchomel as a Qualified Person under NI 43-101. Mr.

Suchomel is a Fellow of the Australasian Institute of Mining and

Metallurgy and has experience relevant to the style of

mineralization under consideration. Mr. Suchomel consents to the

inclusion in this release of said data in the form and context in

which it appears.

Torex Gold Resources Inc. is a well-funded, growth-oriented,

Canadian mining company engaged in the exploration and development

of precious metal resources with a focus on gold. It owns 100% of

the Morelos Gold Project, an advanced stage gold exploration

property, located 180km southwest of Mexico City in the highly

prospective Morelos Gold Belt. The project covers an area of

29,000ha of which more than 75% remains unexplored.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This press release contains "forward-looking information" within

the meaning of applicable Canadian securities legislation.

Forward-looking information includes, without limitation,

information with respect to mineral resource estimates and the

initial drill program at the Media Luna prospecting area.

Generally, forward-looking information can be identified by the use

of terminology such as "plans", "expects", "estimates", "intends",

"anticipates", "believes" or variations of such words, or

statements that certain actions, events or results "may", "could",

"would", "might", "will be taken", "occur" or "be achieved".

Forward-looking information is subject to known and unknown risks,

uncertainties and other factors that may cause the Company's actual

results, level of activity, performance or achievements to be

materially different from those expressed or implied by such

forward-looking information, including, without limitation, risks

related to the inability to realize resource estimates at

anticipated recovery levels or at all, assumptions underlying

resource estimates being incorrect, and those risk factors

identified in the Company's annual information form and

management's discussion and analysis. Forward-looking information

is based on the reasonable assumptions, estimates, analysis and

opinions of management made in light of its experience and

perception of trends, current conditions and expected developments,

and other factors that management believes are relevant and

reasonable in the circumstances at the date such statements are

made. Although the Company has attempted to identify important

factors that could cause actual results to differ materially from

those contained in forward-looking information, there may be other

factors that cause results not to be as anticipated. There can be

no assurance that such information will prove to be accurate, as

actual results and future events could differ materially from those

anticipated in such information. Accordingly, readers should not

place undue reliance on forward-looking information. The Company

does not undertake to update any forward-looking information,

except in accordance with applicable securities laws.

To view figure 1 to 7 please visit the following link:

http://media3.marketwire.com/docs/Figure1-7.pdf.

Contacts: Torex Gold Resources Inc. Fred Stanford President and

CEO (647) 260-1502fred.stanford@torexgold.com Torex Gold Resources

Inc. Gabriela Sanchez Vice President Investor Relations (647)

260-1503gabriela.sanchez@torexgold.com www.torexgold.com

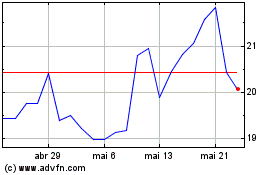

Torex Gold Resources (TSX:TXG)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Torex Gold Resources (TSX:TXG)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025