Wilmington Announces Proposed Acquisition of Interest in Self-Storage Facilities in Southwestern Ontario and Concurrent Offering

09 Julho 2010 - 5:31PM

Marketwired

Wilmington Capital Management Inc. ("Wilmington") (TSX: WCM)(TSX:

WCM.A)(TSX: WCM.B) announced today that a direct wholly-owned

subsidiary of Wilmington has entered into an agreement pursuant to

which Wilmington will acquire (the "Acquisition") a 45.45% indirect

interest in a portfolio of 12 self-storage facilities in

Southwestern Ontario (the "Property Portfolio"). The aggregate cost

of the Property Portfolio, including closing costs, will amount to

approximately $20,700,000 and is expected to be funded with

proceeds from a Term Facility and equity of approximately

$8,000,000. An additional $3,000,000 of equity will be raised for

working capital to fund short term requirements and other

investment opportunities. Wilmington's share of the cash

consideration to complete this initiative is $5,000,000. An

additional 45.45% indirect interest will be acquired by another

investor for $5,000,000, while the remaining consideration will be

funded through the subscription by the principal of the Manager of

the Property Portfolio for the remaining 9.1% interest each as

discussed below.

Wilmington, the other private investor and the principal of the

Manager will each obtain their respective interests in the Property

Portfolio by subscribing for trust units in such number as

represents a 45.45% or 9.1% interest, respectively, in a newly

formed private real estate investment trust (the "Trust"). The

Trust will itself hold the Property Portfolio through a subsidiary

limited partnership (the "Partnership").

In order to fund its component of the purchase price for the

Property Portfolio and further capital for other potential

investments, Wilmington has determined that it is in its best

interests to issue to the public by means of a short form

prospectus up to 7,812,500 class A non-voting shares without par

value ("Class A Shares") at a price of $1.28 per Class A Share on a

best-efforts basis, subject to regulatory approval (the "Offering")

for aggregate gross consideration of $10,000,000.

Potential subscribers pursuant to the Offering should be aware

that in the event that the Offering is oversubscribed, priority

will be given to subscriptions from holders of Class A Shares

("Class A Shareholders") of record as at the close of business on

July 9, 2010 (the "Record Date") (being "Existing A Shareholders")

such that any remaining Class A Shares in the Offering will be

allocated as between subscribers who are not Existing A

Shareholders at the sole discretion of management of Wilmington;

provided that if the Offering is oversubscribed by Existing A

Shareholders, then persons who are not Existing A Shareholders will

not be entitled to participate in the Offering and Existing A

Shareholders will be allocated the entire Offering pro rata as

between them based on their holdings of Class A Shares as at the

Record Date and further provided that if any Existing A Shareholder

has not subscribed for a number of Class A Shares greater than or

equal to such pro rata allocation, then any excess Class A Shares

shall be allocated to Existing A Shareholders in like fashion as

between the remaining Existing A Shareholders participating in the

Offering. Further, subscribers should be aware that management of

the Corporation has the discretion to reject all or any part of a

subscription that would, either independently or in connection with

other subscriptions received by the Corporation, result in a change

of control of the Corporation.

The Offering is being made only in the Provinces of British

Columbia, Alberta, Saskatchewan, Manitoba, Ontario and Newfoundland

and Labrador. Subscriptions will not be accepted from other

jurisdictions.

The Partnership will also enter into a term facility (the "Term

Facility") in an amount equal to the lesser of 60% of the appraised

value of the Property Portfolio and $12,700,000, to be used to fund

the remaining portion of the purchase price. Such Term Facility

will have a term of 7 years, an amortization period of 20 years and

an interest rate of approximately 5.28%. The Term Facility will be

secured by the Property Portfolio and a several guarantee equal to

50% of the Term Facility provided by each of Wilmington, the

private investor and the principal of the Manager in proportion to

their respective interests in the Trust.

The Partnership and the Property Portfolio will be

professionally managed by Real Storage Management Inc. (the

"Manager"), a newly-formed entity whose purpose is to provide

management services to the Partnership. The key executives of the

Manager have been in the self-storage business for over 12 years

and have a proven track record of developing systems and processes

for self-storage facilities developed and operated in British

Columbia, Alberta, Saskatchewan and Ontario and are expected to

apply that expertise to capitalize on significant opportunities

both within the Property Portfolio and within the self-storage

business in general and to pursue, when appropriate, acquisition

opportunities.

Wilmington believes the Acquisition is a major step in meeting

its principal objective of acquiring and holding assets that are

capable of providing stable cash flows and value creation over the

longer term. Wilmington also believes that there will be further

opportunities to invest in additional properties in the Canadian

self-storage industry that meet its objectives.

In addition, Wilmington is pleased to announce the appointment

of Francis Cooke as treasurer in conjunction with the departure of

Lisa Chu. Mr. Cooke brings to Wilmington a wide ranging background

including practicing law in New York and London, England and

consulting with the Boston Consulting Group in Toronto and

Australia. Wilmington wishes to thank Ms. Chu for her ten years of

exemplary service and wishes her well in the future.

Forward Looking Statements

This press release contains forward looking statements. More

particularly, this press release contains statements concerning the

closing of the Offering, the Term Facility and the Acquisition

(collectively, the "Transaction") and the anticipated use of the

net proceeds of the Offering. Although Wilmington believes that the

expectations reflected in these forward looking statements are

reasonable, undue reliance should not be placed on them because

Wilmington can give no assurance that they will prove to be

correct. Since forward looking statements address future events and

conditions, by their very nature they involve inherent risks and

uncertainties. The closing of the Transaction could be delayed or

frustrated if all of the conditions thereto are not satisfied or

waived, including if the Offering is delayed or fails to occur

because Wilmington is unable to obtain the necessary regulatory and

stock exchange approvals on the timelines it has anticipated. The

Offering and the Transaction will not be completed at all if these

approvals are not obtained or some other condition to the closing

is not satisfied. The intended use of the net proceeds of the

Offering might also change in certain circumstances.

The forward looking statements contained in this press release

are made as of the date hereof and Wilmington undertakes no

obligations to update publicly or revise any forward looking

statements or information, whether as a result of new information,

future events or otherwise, unless so required by applicable

securities laws.

Reference should also be made to the most recent annual

information form for a description of the major risk factors.

Contacts: Wilmington Capital Management Inc. Joseph F. Killi

President and CEO (416) 867-9370

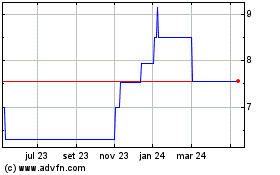

Wilmington Capital Manag... (TSX:WCM.B)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

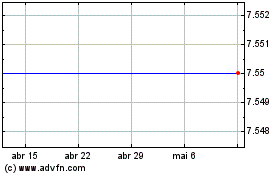

Wilmington Capital Manag... (TSX:WCM.B)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025