Wilmington Announces 2010 Second Quarter Results

11 Agosto 2010 - 12:45PM

Marketwired

Wilmington Capital Management Inc. (TSX: WCM)(TSX: WCM.A)(TSX:

WCM.B) today announced net income for the three months ended June

30, 2010 of $79,000 compared to a net loss of $130,000 for the same

period in 2009. Net income per Class A and Class B share for the

three months ended June 30, 2010 was $0.01, compared to a net loss

of $0.02 per share for the same period in 2009.

Wilmington holds an 8% fully diluted interest in Parkbridge

Lifestyle Communities Inc. (PRK.TO), an owner and operator of

manufactured home and recreational communities. Wilmington also

owns land leased to commercial property owners which is located at

370 Third Street in San Francisco, California. Wilmington is

considering alternatives to maximize the value for shareholders of

its real estate investment, which could include the sale or

restructuring of this holding.

The company's objective is to provide its shareholders with an

attractive total return consisting of capital appreciation on its

investments and current income. In this regard, as at June 30,

2010, the fair value of the company's investment in Parkbridge of

$28.7 million reflects unrealized capital gains of $11.7 million.

During the three months ended June 30, 2010, Wilmington received

dividends of $209,000 from Parkbridge.

Subsequent to June 30, 2010, Wilmington completed the

acquisition (the "Acquisition") of a 45.45% indirect interest in a

portfolio of 12 self-storage facilities in Southwestern Ontario

(the "Property Portfolio") through the acquisition of units in a

newly formed private real estate investment trust (the "Trust").

The aggregate cost of the Property Portfolio, including closing

costs, amounted to approximately $20,700,000 and was funded with

proceeds from a $12,700,000 term facility (the "Term Facility") and

equity of approximately $8,000,000. An additional $3,000,000 of

equity was raised by the Trust for working capital to fund short

term requirements and other investment opportunities. The Term

Facility is secured by the Property Portfolio and a several

guarantee by Wilmington equal to 22.725% of the Term Facility.

Wilmington's share of the cash consideration to complete this

initiative was $5,000,000 which was funded through borrowings under

its credit facility.

On August 4, 2010, Wilmington filed a prospectus to issue and

sell an aggregate of up to 7,812,500 Class A Shares without par

value at a price of $1.28 per Class A Share (the "Offering") for

total proceeds of up to $10,000,000. After closing costs, net

proceeds are expected to be approximately $9,800,000.

Wilmington believes the Acquisition is a major step in meeting

its principal objective of acquiring and holding assets that are

capable of providing stable cash flows and value creation over the

longer term. Wilmington also believes that there will be further

opportunities to invest in additional properties in the Canadian

self-storage industry that meet its objectives.

CONSOLIDATED STATEMENTS OF OPERATIONS

Three months ended Six months ended

(unaudited) June 30 June 30

$thousands, except per share amounts 2010 2009 2010 2009

----------------------------------------------------------------------------

Income

Investment and other $ 208 $ 3 $ 210 $ 6

Foreign exchange gain 9 - - -

Income producing property 306 336 610 707

----------------------------------------------------------------------------

523 339 820 713

----------------------------------------------------------------------------

Expenses

Operating 59 74 101 121

Foreign exchange loss - 53 11 34

Interest 342 368 680 783

----------------------------------------------------------------------------

401 495 792 938

----------------------------------------------------------------------------

Net income / (loss) before income

taxes 122 (156) 28 (225)

Income tax recovery (expense) (43) 26 (20) 69

----------------------------------------------------------------------------

Net income / (loss) $ 79 $ (130) $ 8 $ (156)

----------------------------------------------------------------------------

Net income / (loss) per Class A &

Cass B share $ 0.01 $ (0.02) $ 0.00 $ (0.02)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

CONSOLIDATED BALANCE SHEETS

(unaudited)

June 30 December 31

$ thousands 2010 2009

----------------------------------------------------------------------------

Assets

Cash and cash equivalents $ 575 $ 1,569

Investment in Parkbridge Lifestyle Communities

Inc. 28,721 28,109

Income producing property 19,227 19,013

Other assets 637 143

----------------------------------------------------------------------------

$ 49,160 $ 48,834

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Liabilities & Shareholders' Equity

Accounts payable and other liabilities $ 588 $ 700

Future income taxes 2,126 1,933

Secured debt 20,190 19,962

Loan payable 10,000 10,501

----------------------------------------------------------------------------

32,904 33,096

Shareholders' equity 16,256 15,738

----------------------------------------------------------------------------

$ 49,160 $ 48,834

----------------------------------------------------------------------------

----------------------------------------------------------------------------

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

Three months ended Six months ended

(unaudited) June 30 June 30

$ thousands 2010 2009 2010 2009

----------------------------------------------------------------------------

Net income / (loss) $ 79 $ (130) $ 8 $ (156)

----------------------------------------------------------------------------

Foreign currency translation 17 - 17 (1)

Increase (decrease) in value of

available-for-sale securities (1,614) 4,306 612 5,581

Future income taxes in above items 160 (714) (119) (928)

----------------------------------------------------------------------------

(1,437) 3,592 510 4,652

----------------------------------------------------------------------------

Comprehensive income (loss) $ (1,358) $ 3,462 $ 518 $ 4,496

----------------------------------------------------------------------------

Joseph F. Killi, President and Chief Executive Officer will be

available at 416-867-9370 to answer any questions on the company's

financial results.

This news release contains forward-looking statements concerning

the company's business and operations. The company cautions that,

by their nature, forward-looking statements involve risk and

uncertainty and the company's actual results could differ

materially from those expressed or implied in such statements.

Reference should be made to the most recent Annual Information Form

for a description of the major risk factors.

Forward Looking Statements

This press release contains forward looking statements. Since

forward looking statements address future events and conditions, by

their very nature they involve inherent risks and

uncertainties.

The forward looking statements contained in this press release

are made as of the date hereof and Wilmington undertakes no

obligations to update publicly or revise any forward looking

statements or information, whether as a result of new information,

future events or otherwise, unless so required by applicable

securities laws.

Reference should also be made to the most recent annual

information form for a description of the major risk factors.

Contacts: Wilmington Capital Management Inc. Joseph F. Killi

President and Chief Executive Officer 416-867-9370

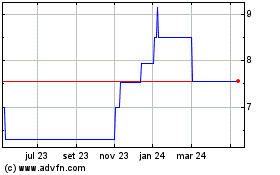

Wilmington Capital Manag... (TSX:WCM.B)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Wilmington Capital Manag... (TSX:WCM.B)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025