American Manganese Inc.: Artillery Peak Manganese Project Review and Update

05 Julho 2012 - 3:00PM

Marketwired Canada

Larry W. Reaugh, President and Chief Executive Officer of American Manganese

Inc. ("American Manganese" or the "Company"), (TSX

VENTURE:AMY)(PINKSHEETS:AMYZF)(FRANKFURT:2AM), is pleased to report and review

the Artillery Peak Manganese Project over the past 16 months.

The Company has been in discussions with three new companies in the steel,

manganese and battery production fields regarding potential strategic

partnerships and off-takes in the past 4 to-5 weeks.

The Company has optioned 82 patented and fee simple mineral claims (2779 acres)

and increased its unpatented holdings to 396 mineral claims entailing 7920

acres.

Kemetco Research Inc. (Kemetco) is currently developing EMD and CMD production

and testing.

Significant milestones achieved by the Company include:

June 29, 2012: The Company filed the NI 43-101 Preliminary Feasibility Technical

Report on SEDAR.

May 25, 2012: Company receives 5th Canadian NRC grant for Artillery Peak. This

grant was to advance research on CMD, EMD and lithiated manganese powder.

May 18, 2012: Jan Eigenhuis joined the Board of Directors replacing Anthony

Santelli who later resigned (May 24, 2012). Jan is a former senior executive at

Manganese Metal Company of South Africa the only producer of manganese metal,

with the exception of China. Jan has over 30 years of experience in the

electrolytic manganese industry.

May 17, 2012: Tetra Tech Wardrop delivered positive NI 43-101 preliminary

feasibility study. Utilizing the CPM expected price forecast the IRR is 19.95%;

NPV at 8% discount is $402.9 million and a payback of 4.6 years. Capital costs

are $477 million and operating costs over the first 6 years are $0.956/lb at a

grade of 3.13% Mn and average cost of $1.015/lb over the life of the mine

(represents 16% of the total resources) at a grade of 2.46% Mn. Production of

metal over the first 20 years is 999,449 tonnes (2.19 billion lbs).

March 14, 2012: The International Bureau at the World Intellectual Property

Organization based in Geneva, Switzerland published the Company's Advanced

Hydrometallurgical Process Application Patent.

February 15, 2012: Kachan & Co reports that American Manganese's

hydrometallurgical process to be a promising means of recovering low-grade

manganese.

December 21, 2011: The pilot plant testing program performed by Kemetco was

successfully completed. The work confirmed the technical viability of the

Company's patent pending hydrometallurgical manganese extraction and

electro-winning circuit on a semi-continuous operation basis of the overall flow

sheet. The process is designed to recover manganese from lower grade manganese

resources in an energy efficient and economically viable manner with low water

use, thus providing significant environmental benefits compared to the

conventional recovery process which is energy intensive and more costly although

based on high grade resources.

December 6, 2011: Strong Electrolytic Manganese Market Forecast by CPM Group.

Between 2012 and 2021 real EMM prices are forecast to average $1.92 per pound,

which will support project development activities and provide incentive pricing

for bringing new projects online to meet continued growth in demand.

November 4, 2011: Indicated and Inferred Resources Restated. NI 43-101 resources

were reinterpreted by N. Tribe & Associates from the Sept 8, 2011 release as

follows:

---------------------------------------------------------------------------

SEPTEMBER 8, 2011 NOVEMBER 4, 2011

----------------------------------------- -------------------------------

Mn POUNDS Mn POUNDS

TONNES GRADE IN TONNES GRADE IN

(T) (%Mn) BILLIONS (T) (%Mn) BILLIONS

---------------------------------------------------------------------------

INDICATED 226,463,754 2.99 14.916 220,943,518 2.84 13.830

---------------------------------------------------------------------------

INFERRED 56,421,027 2.84 3.538 56,338,329 2.84 3.531

---------------------------------------------------------------------------

September 27, 2011: The Company announced successful operation of the pilot

plant by Kemetco resulting in 92.7% recoveries from coarse particle sizes in two

hours. Expected rates of liquid/solid separation averaged 20.8 kg per hour a 4

times greater result than the estimated 3 to 5 kg per hour.

August 18, 2011: Kemetco begins pilot plant testing of Artillery Peak manganese

ores.

June 24, 2011: American Manganese receives fourth National Research (NRC) of

Canada Industrial Research Assistance Program to continue the successful

development of their hydrometallurgical process.

June 17, 2011: American Manganese completed 10,607 meters (34,800 ft.) of

reverse circulation drilling for definitive prefeasibility study on the

Artillery Peak Manganese Project. To date the Company had completed 18,160

meters (59,580 ft.) of reverse circulation diamond drilling in 154 drill holes

during 2008, 2010 and 2011. In addition previous operators completed 58 diamond

drill holes in the 1940's and 1950's.

May 24, 2011: American Manganese awards environmental and permitting contract to

the Tucson, Arizona office of Tetra Tech Inc.

April 7, 2011: American Manganese engages Kemetco for research on lithium

manganese oxide battery technology. (Kemetco had been unable to devote the

necessary time to advance this contract until all of the technical work had

recently been completed on the prefeasibility study. Kemetco is now focusing on

the production of EMD and CMD.)

March 8, 2011: American Manganese closed $5,040,000 bought deal financing at

$0.70 with Laurentian Bank Securities Inc.

February 11, 2011: American Manganese closed a non-brokered private placement at

$0.30 for $4,193,088.30.

About Manganese

China controls electrolytic manganese production supplying and producing 98% of

the world's needs (3 billion pounds per year).

There is no substitute for manganese in steel (total manganese market greater

than 33 billion pounds per year, fourth largest traded metal).

Manganese is a critical metal at risk for supply disruptions in the United

States as there is no U.S. production. EMM's greatest uses are the upgrading of

specialty steel (74%), and the manufacture of aluminum alloys (12%), electronics

(2%), and other applications (12%).

Electrolytic manganese dioxide (EMD) for the battery industry is expected to be

the fastest-growing segment of the manganese market. Ford Motors predicts

production of hybrid electric vehicles will account for 25% of its entire

vehicle line-up by 2020, and Hyundai has committed a lifetime guarantee to their

hybrid electric vehicles that use lithium ion batteries with manganese spinel.

China has a 20% export duty on EMM and the U.S. has a 14% import duty.

The current world price for electrolytic manganese metal is about $1.46 per

pound, while the U.S. price is about $1.66 per pound.

About American Manganese Inc.

American Manganese Inc. is a diversified specialty and critical metal Company

focusing on potentially becoming a producer of electrolytic manganese metal from

its Arizona Manganese Project.

On behalf of Management

AMERICAN MANGANESE INC.

Larry W. Reaugh, President and Chief Executive Officer

This news release may contain certain "Forward-Looking Statements" within the

meaning of Section 21E of the United States Securities Exchange Act of 1934, as

amended. All statements, other than statements of historical fact, included

herein are forward-looking statements that involve various risks and

uncertainties. There can be no assurance that such statements will prove to be

accurate, and actual results and future events could differ materially from

those anticipated in such statements. Important factors that could cause actual

results to differ materially from the Company's expectations are disclosed in

the Company's documents filed from time to time with the TSX-Venture Exchange,

the British Columbia Securities Commission and the US Securities and Exchange

Commission.

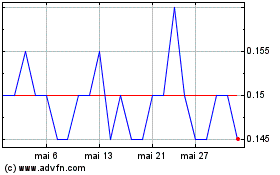

Recylico Battery Materials (TSXV:AMY)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Recylico Battery Materials (TSXV:AMY)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024