Consolidated Thompson Iron Mines Signs Rail Transportation Agreement With Arnaud Railway Company

04 Fevereiro 2010 - 12:13AM

Marketwired Canada

Consolidated Thompson Iron Mines Ltd. (TSX:CLM) ("CLM" or the "Company", or

"Consolidated Thompson") is pleased to announce that it has entered into a

renewable 10-year rail transportation agreement with Arnaud Railway Company

("ARC"), a subsidiary of Wabush Mines, for the transportation of iron ore

concentrate generated from the Bloom Lake iron ore project (the "Bloom Lake

Project").

The agreement provides that iron ore concentrate from the Bloom Lake Project

will be carried on the ARC railway from the Arnaud Junction, where the ARC

railway connects with the Quebec North Shore of Labrador Railway Company, to the

Company's unloading facilities located on lands leased from the Port of

Sept-Iles located at Pointe-Noire, Quebec, a distance of approximately 34

kilometres.

Richard Quesnel, President and Chief Executive Officer of Consolidated Thompson

said, "We are very pleased to have signed a long term rail transportation

agreement with Arnaud Railway Company. The signing of this agreement marks a

significant milestone in the completion of the development of the Bloom Lake

iron ore mine and also grants Consolidated Thompson access to the world's

largest consumers of iron ore."

"Signing this agreement is another tremendous step forward for Consolidated

Thompson. We look forward to pursuing this new business relationship with Arnaud

Railway Company" said The Hon. Brian Tobin, Executive Chairman of CLM.

The Company also announced today that it has closed with Marret Asset Management

the issue of US$ 100 million secured senior bonds in accordance with the

agreement previously disclosed on January 12, 2010.

Information on Consolidated Thompson Iron Mines Limited

Consolidated Thompson Iron Mines Limited is a development and exploration mining

company. The Company is presently developing at the expected initial rate of 8.0

million tonnes per year its Bloom Lake world class iron ore deposit located in

the Quebec/Labrador trough. The quality and size of the Bloom Lake and

Peppler/Lamelee deposits reflect the potential to expand and advance these

projects and exploit other opportunities in the iron ore industry. The Company

has approximately 230,245,000 shares outstanding and trades on the TSX under the

symbol "CLM".

Caution regarding forward-looking statement

Except for statements of historical fact relating to the Company, certain

information contained herein constitutes "forward-looking information" under

Canadian securities legislation. Forward-looking information includes, but is

not limited to, statements with respect to the closing of the Transaction;

receipt of all necessary approvals; capital required to complete the development

of the Bloom Lake mine and timing of such requirements; the conclusions,

parameters and assumptions underlying current mine plans, the development

potential and timetable of bloom Lake project; capital and operating

expenditures; iron ore prices; permitting time lines and permitting; government

regulation of mining operations; environmental risks and the impact of

management appointments; mineral reserve and resource estimates; the ability to

realize estimated mineral reserves and to convert mineral resources into mineral

reserves; terms and costs of future exploration; mineralization projections;

receipt of all necessary approvals; the parameters and assumptions underlying

the mineral resource estimates. Generally, forward-looking information can be

identified by the use of forward-looking terminology such as "plans", "expects"

or "does not expect", "is expected", "budget", "scheduled", "estimates",

"forecasts", "intends", "anticipates" or "does not anticipate", or "believes",

or variations of such words and phrases or statements that certain actions,

events or results "may", "could", "would", "might" or "will be taken", "occur"

or "be achieved".

Forward-looking statements are based on the opinions and estimates of management

as of the date such statements are made. Estimates regarding the anticipated

timing, amount and cost of mining at the Bloom Lake Project are based on

assumptions underlying mineral reserve and mineral resource estimates and the

realization of such estimates as are set out in CLM's feasibility study. Capital

and operating cost estimates are based on extensive research of the Company,

purchase orders placed by the Company to date, recent estimates of construction

and mining costs and other factors that are set out in CLM's feasibility study.

Production estimates are based on mine plans and production schedules, which

have been developed by the Company's personnel and independent consultants.

Forward-looking information is subject to known and unknown risks, uncertainties

and other factors that may cause the actual results, level of activity,

performance or achievements of Consolidated Thompson to be materially different

from those expressed or implied by such forward-looking information, including

but not limited to risks described in the annual information form of the Company

posted under the profile of the Company on SEDAR at www.sedar.com. Although

management of Consolidated Thompson has attempted to identify important factors

that could cause actual results to differ materially from those contained in

forward-looking information, there may be other factors that cause results not

to be as anticipated, estimated or intended. There can be no assurance that such

statements will prove to be accurate, as actual results and future events could

differ materially from those anticipated in such statements. Accordingly,

readers should not place undue reliance on forward-looking information.

Consolidated Thompson does not undertake to update any forward-looking

information, except in accordance with applicable securities laws.

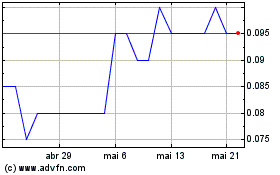

ARCpoint (TSXV:ARC)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

ARCpoint (TSXV:ARC)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024