NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN

THE UNITED STATES

Karmin Exploration Inc. ("Karmin") (TSX VENTURE:KAR) today updated its

announcement on March 19, 2010 regarding the proposed Acquisition involving

Ignite (as such terms are defined below). Under the heading, Selected Financial

Information in Karmin's March 19, 2010 news release, Karmin reported that Ignite

had a net loss of A$2,568,461 for its financial year ended December 31, 2007 and

a net loss of A$9,092,112 for the financial year ended December 31, 2008. Due to

an administrative error, Karmin reported that Ignite had net income of

A$5,290,103 for the financial year ended December 31, 2009 when such amount

should have been report as a net loss. Accordingly, the following is an amended

and restated press release announcing the Acquisition and related matters:

Karmin Exploration Inc. ("Karmin") (TSX VENTURE:KAR) today announced that it

entered into an agreement dated March 12, 2010 (the "Agreement") for the

acquisition (the "Acquisition") by Karmin of all the outstanding ordinary shares

of Ignite Energy Resources Pty Ltd ("Ignite"), an Australian company which holds

certain exploration rights to a lignite (brown coal) deposit in Gippsland in

Eastern Victoria, Australia as well as certain proprietary technology for a

catalytic hydrothermal reactor (Cat-HTR) that transforms low grade lignite into

high grade oils and higher grade coal products.

Trading in the shares of Karmin has been halted in accordance with the policies

of the TSX Venture Exchange ("TSXV") and will remain halted until such time as

all required documentation has been filed with and accepted by the TSXV and

permission to resume trading has been obtained from the TSXV.

The Acquisition

Under the Agreement, Karmin will acquire all of the outstanding ordinary shares

of Ignite in exchange for the issuance by Karmin of its common shares. Each

Ignite ordinary share will be exchanged for one common share of Karmin.

Additionally, Karmin will assume all of the issued and outstanding convertible

securities of Ignite. There are approximately 38.5 million common shares of

Karmin and approximately 168 million ordinary shares of Ignite currently

outstanding. In connection with, and immediately prior to the share exchange and

the completion of the Acquisition, Karmin will consolidate its current issued

and outstanding common shares on a 6:1 basis. On the last day prior to entering

into the Agreement, the closing price of the common shares of Karmin on the TSXV

was $0.20 per common share. As a result of the share exchange Ignite will become

a wholly-owned subsidiary of Karmin. The Acquisition will result in a reverse

take-over ("RTO") of Karmin for the purposes of the policies of the TSXV and a

new board of directors of Karmin will be elected.

Completion of the Acquisition is subject to the satisfaction or waiver of a

number of conditions, including, approval of the TSXV, there not being a

material adverse effect relating to Ignite or Karmin, completion of due

diligence, receipt of all applicable regulatory approvals including Foreign

Investment Review Board and Australian Securities and Investments Commission,

approval by Ignite's shareholders holding at least 90% of Ignite ordinary shares

at a meeting of such shareholders and approval by Karmin's shareholders of the

Acquisition and related matters by the shareholders of Karmin at a special

meeting, at which a proposal will be made to change Karmin's name to include

"Ignite" in its name.

The parties have agreed to customary deal protection measures including mutual

non-solicitation provisions. Also, each party has agreed to pay a $250,000 break

fee to the other party, if, among other things, the Acquisition does not proceed

as a result of the non-satisfaction of certain conditions by the party, the

party's board of directors withdraws its support in relation to the Acquisition,

or an acquisition proposal is made and the shareholders of the party do not

approve the Acquisition and the acquisition proposal is consummated within six

months from the date of such acquisition proposal.

A copy of the Agreement will be filed today with the applicable Canadian

provincial securities regulatory authorities and will be available under

Karmin's SEDAR profile at www.sedar.com. Karmin expects to mail a management

information circular to its shareholders in April, 2010 in connection with its

special meeting, which is scheduled to take place in May, 2010. The closing of

the Acquisition is expected to occur as soon as possible thereafter.

Karmin intends to apply to the TSXV for a waiver from the requirement to retain

a sponsor in connection with the Transaction; however, there is no assurance

that such a waiver will be granted.

The Brokered Financing

Concurrently with the Acquisition, Ignite expects to raise at least $30 million

(unless otherwise mutually agreed between the parties) in equity (the "Brokered

Financing"). It is anticipated the Brokered Financing will be completed on a

private placement basis by way of the sale of ordinary shares of Ignite, which

is expected to close immediately prior to the share exchange in connection with

the Acquisition. The net proceeds of the Brokered Financing are expected to be

used to fund the combined company's business operations and for general

corporate purposes.

Ignite and Karmin are currently in discussions with registered dealers

concerning the Brokered Financing but there is no assurance that an agreement to

undertake a financing will be reached or that such financing will be completed.

Further details regarding any Brokered Financing will be made available upon

Karmin and Ignite reaching an agreement to undertake such financing.

About Ignite

Ignite is an Australian proprietary limited company incorporated in the state of

Victoria that is subsisting under the Corporations Act 2001 (Cth) (Australia).

Ignite was originally incorporated on December 20, 2005 as Victoria Coal

Resources Pty Ltd and subsequently changed its name to Ignite Energy Resources

Pty Ltd when it merged with Ignite Energy Pty Ltd in August 2008.

Ignite has the sole beneficial interest in exploration license EL 4416 covering

approximately 3,800 square kilometres in Victoria, Australia.

The lignite resource within the three main deposits on Ignite's properties are

described below under National Instrument 43-101 - Standards of Disclosure for

Mineral Projects ("NI 43-101") as outlined in the technical report effective

January 25, 2010 that was prepared by AMC Consultants Pty Ltd ("AMC Report"):

Deposit Classification Tonnes (Millions) Ash (%) Moisture (%)

----------------------------------------------------------------------------

Gormandale Measured 2,300 4.0 65.8

Indicated 1,600 4.4 64.4

Total Measured & Indicated 3,960 4.2 65.2

Gelliondale Measured 280 6.9 64.4

Indicated 2,980 6.0 61.1

Total Measured & Indicated 3,260 6.1 61.4

Stradbroke Measured - - -

Indicated 2,580 3.4 57.0

Total Measured & Indicated 2,580 3.4 57.0

Inferred resources within the AMC Report for these three deposits account for an

additional 6.59 billion tonnes of lignite.

This resource is easily accessible with the lignite being low in sulphur, ash

and heavy metals, which Ignite believes makes it ideal for upgrading to

higher-value oils and upgraded coal via Ignite's proprietary coal to liquids

process. The above resources for each of the three deposits have been estimated

using block models based on the interpretation of coal seam structure using

State Electricity Commission of Victoria ("SECV") cross-sections and drilling.

Resources

The lignite resource estimate is based on the following data, procedures and

parameters:

-- Drillhole database of 479 holes within the lease boundary EL4416 and

provided by GHD Pty Ltd ("GHD") from data compiled by the SECV and

checked by AMC Consultants Pty Ltd ("AMC") for reasonableness and

internal consistency.

-- The geological interpretation of seams was supported by in cross

section, existing cross-section or geophysical logs of 17 drillholes.

-- A total of 302 holes were analysed for coal quality data.

-- A standard resource estimation procedure was applied involving:

-- Seam interpretation and domaining,

-- Compositing of samples, flagging and composites,

-- Statistical and geostatistical studies,

-- Establishment of quality interpolation parameters (ash less

than 10%),

-- Creation of a block model,

-- Coal quality data interpolation into blocks using inverse distance

squared method or ordinary kriging,

-- Application of bulk density factors to convert volumes to tonnages

consistent with values used by SECV and the Department of Minerals

and Energy, and

-- Resource classification based on data quantity, quality and

distribution and confidence in the geological interpretation.

The resource estimates were based on the following criteria:

-- Within the EL 4416 lease boundary.

-- Overburden less than 100m.

-- Be above 200-300m below the topographic surface.

-- Contain ash less than 10%.

There are a number of factors that affect confidence in the resource estimate

and prevent the resource from being classified as measured despite the good seam

continuity:

-- Small datasets of drillholes and quality analyses.

-- Wide drillhole spacing.

-- Problems associated with difficulties in drilling managed by AMC,

including:

-- Insufficient sampling,

-- Core loss, and

-- Poor core recovery.

Karmin intends to file the AMC report not later than 45 days following this news

release, in compliance with NI 43-101.

Geological Setting

Regional Geology

Coal deposits within EL4416 are part of the major lignite measures of the

Gippsland Basin.

The Gippsland basin containing the three deposits on EL4416 can be divided into

several distinct structural regions. Major lignite deposits exist in the Latrobe

Valley Depression, the Seaspray Depression (Gormandale and Stradbroke deposits)

and the Alberton Depression (Gelliondale deposit).

Local Geology

Tertiary strata, known as the Latrobe Valley Coal Measures, unconformably

overlie a Lower Cretaceous basement. Within the Gippsland Basin three groups of

major coal seams are developed, which are named, from oldest to youngest,

Traralgon, Morwell and Yallourn. The Yallourn Formation is not present at

Stradbroke, Gormandale or Gelliondale, while the Morwell Formation is not

present at Stradbroke. The seams at Gelliondale are equivalents of the Morwell

seams.

Gormandale Project Area Geology

The Gormandale area contains coal seams of the Morwell and Traralgon Formations.

The greater part of the coal is contained in three seams of the Traralgon while

minor amounts are present in four seams of the Morwell Formation.

Seams generally reach their maximum thickness in the southern end of the

Gormandale Syncline near the edge of the erosional surface. The T+ seam reaches

a thickness of approximately 30m whilst T1 and T2 reach thickness of 70m and 80m

respectively. The Traralgon seam can be traced continuously from the Loy Yang

area across the Baragwanath Anticline and into the Gormandale Syncline. The

Morwell seams are thinner than the Traralgon seams, generally around 20m to 30m

in thickness and are only located in southern part of the Gormandale Syncline.

Gelliondale Project Area Geology

The Gelliondale coalfield is located within the Alberton Depression in the

Gippsland Basin. Four coal seams occur, locally named Gelliondale A, B, C and D

which are equivalent to Morwell seams in the Latrobe Valley. Several of these

seams combine to form a thick sequence of coal, up to 150m thick in places. The

seams also thin and lens out as the distance from the Hedley Dome increases.

Stradbroke Project Area Geology

The Stradbroke coalfield is located in the Latrobe Valley Depression area of the

Gippsland Basin.

The two main coal seams are the T1 and T2 seams of the Traralgon Formation. They

have an average thickness of 20m and 95m respectively and an average sand/clay

interburden of 35m.

Lignite characteristics

Overall, Victorian lignite is typically low in ash, sulphur, heavy metals and

nitrogen. It ranks above deposits in Texas, Indonesia, Spain, Greece and

Germany. The following table lists the typical characteristics of Victorian

lignite:(1)

Characteristic Property

----------------------------------- -----------------------------------

Energy value (net wet) 5.8 to 11.5 Mj/kg

Energy value (gross dry) 25 to 29 Mj/kg

Moisture 50 - 70%

Carbon 64 - 70%

Oxygen 25 - 30%

Hydrogen 4.0 - 5.5%

Ash less than 4%

Nitrogen less than 1%

Sulphur less than 1%

(1) Source: Department of Primary Industry Victoria

Cat-HTR

Ignite has developed a low-carbon emission technology (Cat-HTR) which converts

low ranked energy sources such as lignite (brown coal) and cellulosic biomass

such as wood wastes, agricultural residues or algae and aquatic plants, into

non-conventional crude oil ("Ignite Oil"). The Ignite Oil shares certain

characteristics with conventional crude, including: light, medium and heavy

fractions and has a calorific value of approximately 85% of that of conventional

crude oil. An upgraded coal ("Upgraded Coal") with similar characteristics (e.g.

high carbon and low volatiles) to pulverised coal (PCI) used in the iron and

steel industries is produced when lignite is converted using Cat-HTR, as

described in the January 2010 report prepared by Australian Carbon Assets Pty

Ltd.

Technology Platform (Cat-HTR)

In mid-2008, Ignite built and continues to operate a 2.5 inch reactor bore

continuous flow Cat-HTR pilot plant module located in Somersby, Australia (north

of Sydney). Ignite has successfully processed lignite of various origins into

Ignite Oil and Upgraded Coal. Since then, the pilot plant module has operated

for hundreds of hours and the design and operation have been optimized.

Ignite and TRUenergy Development Pty Ltd ("TRUenergy") (owned by Hong Kong based

China Light & Power) signed a memorandum of understanding in June 2009 to allow

Ignite to develop a modest scale-up Cat-HTR (4 inch bore reactor). The project

envisions that up to three modules may be installed with the first module to

supply a mixture of oil and coal to TRUenergy's 1480 MWe Yallourn power plant

for testing in their existing boilers. Depending upon the mutual goals of

TRUenergy and Ignite, the plant may be expanded to include product upgrading

and/or larger through-put capacity. The Yallourn brown coal mine and power

station (open cut 18MMT/annum) is located in the Latrobe Valley, 150 kilometers

east of Melbourne. The station supplies approximately 22% of Victoria's

electricity needs and 8% of Australia's electricity needs.

Ignite has also signed an exploration joint venture ("Joint Venture") agreement

with Laxmi Resources Pty Ltd ("Laxmi"), a special purpose vehicle that intends

to develop, when feasible, an open cut lignite mine on an area of Ignite's EL

4416 known as Gelliondale.

The first stage for the Joint Venture is to apply for a mining license for

Gelliondale, to be funded by Laxmi. As part of the joint venture agreement

Ignite will receive a form of royalty pre-payment in the amount of $8 million

(Australian Dollars) within the next two months. The prepayment reflects a

proposed future royalty payable by the Joint Venture to Ignite equal to $0.50

(Australian Dollars) per tonne of lignite mined from the Gelliondale project if

developed.

Management of the Combined Company

Upon completion of the Acquisition and its related transactions, it is

contemplated that the following individuals will comprise the management team

and board of directors of Karmin. Additional directors and/or officers may be

selected prior to the completion of the Acquisition.

Directors

Dr. Leonard J. Humphreys - Proposed Director and Chief Executive Officer

Dr. Humphreys has been the Chief Executive Officer of Ignite since September

2008 when Ignite Energy Pty. Ltd was acquired by Victoria Coal Resources Pty Ltd

("VCR") to form Ignite.

In 2007 Dr. Humphreys, a chartered chemist, founded Ignite Energy Pty. Ltd and

was instrumental in the conception and development of the Catalytic

Hydro-Thermal Reactor - the core technology used by Ignite and its wholly-owned

subsidiary Licella Pty Ltd.

Dr. Humphreys has had a long career in the energy and renewable energy sector.

Dr. Humphreys also served as the Managing Director of IBA Health Ltd (now

Isoft), a healthcare information technology software provider listed on the

Australia Securities Exchange from 2002 to 2004 and Novera Energy Plc, a

renewable energy company now listed on the Alternative Investment Market ("AIM")

in London from 1999 to 2002.

Dr. Humphreys also held Managing Director and regional president roles inside

the European Invensys Group of companies based in Australia from 1996 to 1999.

European Invensys Group is one of the world's largest information technology,

industrial process and system automation companies. In Europe, Dr. Humphreys was

a senior executive inside the Mannesmann Group, the German multinational

specializing in engineering, manufacturing and telecommunications and held the

title Director of the Analytical Division of Hartmann and Braun UK from 1991 to

1996.

Dr. Steve Mahon - Proposed Director

Dr Steve Mahon was the co-founder of Low Carbon Accelerator, a leading venture

capital fund specialising in clean technology. Mr. Mahon has had a successful

career in commercialising low carbon technologies with over 15 years in the

sector and a track record in selecting and managing high growth low carbon

companies, both in the private and public markets. Mr. Mahon combines a detailed

understanding across a wide range of clean technologies with the first hand

experience of growing early stage businesses.

Prior to forming Low Carbon Accelerator, Mr. Mahon had been a main Board member

of Pursuit Dynamics plc, the technology development and licensing business,

which was a top performing small-cap engineering stock on the AIM during 2003

and 2004; and of Sentec Ltd, the smart grid technology specialist, that became

one of the fastest growing technology companies in Europe during 2001 to 2003.

Mr. Mahon started his career in QinetiQ Group PLC the defence technology

company. Mr. Mahon has a first class degree and PhD in Geophysics.

Mr. Larry Ciccarelli - Proposed Director and Chairman

Larry Ciccarelli holds a Bachelors Degree from the University of Western

Ontario. Mr. Ciccarelli is the Vice-President and Secretary of Karr Securities

Inc. ("Karr"), a private investment firm. Mr. Ciccarelli also serves as Chairman

of the board of directors of GlobeStar Mining Corporation ("GlobeStar"), a

Toronto Stock Exchange listed mining company. Since 1989 Mr. Ciccarelli has

served as senior partner and shareholder of Karr. GlobeStar was a recipient of

the 2009 Ontario Business Achievement Award for Corporate Governance issued by

the Ontario Chamber of Commerce.

Mr. Ciccarelli has served as founder and Chief Operating Officer of Sarmin

Exploration Corporation ("Sarmin") since 1997, a privately held corporation

prior to its acquisition by GlobeStar (TGW Corporation). Mr. Ciccarelli, through

Sarmin, was responsible for the acquisition of Corporacion Minera Dominicana

("CMD"), a wholly owned subsidiary of Falconbridge International Investment

Limited ("Falconbridge"). CMD was Falconbridge's Latin American exploration

company. Through CMD, Sarmin acquired Falconbridge's exploration staff, its

assets, including all the exploration data.

Mr. Ciccarelli served as director and subsequent Chairman of GlobeStar. As a

founder of GlobeStar, he was responsible for the acquisitions of the Cerro de

Maimon deposit from Falcondo (also known as Falconbridge Dominicana, C. por A.),

Falconbridge's nickel operations in the Dominican Republic.

Prof. Dr. Thomas Maschmeyer - Proposed Director

Prof. Dr. Maschmeyer is co-founder of start-up companies, Ignite and Licella Pty

Ltd. Born in Hamburg, he completed his PhD at the University of Sydney in 1995

and then moved to the United Kingdom for research appointments in London and

Cambridge. After his positions as Professor, Head of Department, and

Vice-Chairman at the Delft Institute of Chemical Technology, he returned to

Australia as Australian Research Council ("ARC") Federation Fellow in late 2003

and was recently awarded a Professorial ARC Future Fellowship. Together with Ian

Maxwell, he had a leading role in spinning out a combinatorial catalysis

company, Avantium Technologies BV, in 2000.

Prof. Dr. Maschmeyer serves on the editorial boards of five international

journals, is President of the Catalysis Society of Australia as well as advisor

and consultant to many governmental bodies and companies. He received the 2007

Le Fevre Prize of the Australian Academy of Sciences for outstanding basic

research in chemistry by scientists under 40.

Dr. Maschmeyer will also serve as technological consultant to Ignite.

Mr. Richard Kapuscinski - Proposed Director

Mr. Kapuscinski is Vice President Sales at Turbo Power Systems Inc., responsible

for business development in the Americas. Turbo Power Systems Inc. is a designer

and manufacturer of products for power generation and power conditioning. From

1986 to 1999, he worked as a Sales Marketing Manager with Tyco International

(US) Inc. (formerly Keystone Valve). Mr. Kapuscinski is a Certified Mechanical

Engineering Technologist and is a member of the Ontario Association of Certified

Engineering Technicians and Technologists and the Instrument Society of America.

Mr. Kapuscinski studied Mechanical Engineering at Lambton College in Sarnia,

Ontario, Canada focussing on the petroleum and petrochemical industry.

Mr. Kapuscinski served on the board of directors of Gastar Exploration Ltd. for

seven years from 2000 to 2007. Gastar Exploration Ltd. (AMEX and Toronto Stock

Exchange) is an exploration and production gas company focused on both

conventional deep gas and coalbed methane development.

Senior Management

Dr. John White - Senior Vice President, Carbon Bridge Division

Dr. White commenced as Chief Executive at Victoria Coal Resources ("VCR") in

2006. Dr. White had an extensive involvement with Woodside Petroleum Ltd's North

West Shelf offshore domestic gas and LNG development as Senior Engineer and

Resident Engineer from 1978 to 1983. As General Manager of Eglo Engineering Ltd,

Dr. White instigated and managed the RAN Submarine Project tenders, and

subsequently headed the teams that successfully tendered for the purchase of

Williamstown Naval Shipyard from the Australian Government in 1987, as well as

the completion of the Australian Frigate Project (two FFGs) and the $5 billion

ANZAC Frigate Project (ten ANZACs). Dr. White was chief executive officer of

Transfield Defence Systems from 1988 to 1996, Global chief executive officer of

the recycling and packaging group, Visy Industries from 1996 to 1998, Managing

Director of the building products and distribution group, Siddons Ramset Ltd

from 1998 to 2000, and chief executive officer/chairman of Global Renewables Pty

Ltd from 2000 to 2006. Dr. White has been director of a number of publicly

listed Australian companies, and was chairman of the Australian Government's

Uranium Industry Framework (2006 to 2007) and a member of the Australian

Government's Defence Procurement Board (1999 to 2003 and 2004 to 2008).

Mr. John Gulbis - Senior Vice President, Projects

Mr. Gulbis, the Project Director of Ignite, is a chemical engineer and

experienced project manager. As head of engineering operations for two of the

world's largest information technology and industrial process automation

companies, Honeywell International Inc. (1985 to 1996) and Invensys PLC (1996 to

1999). Mr. Gulbis led the implementation of numerous major technology projects

both locally and internationally. Mr. Gulbis has also held various senior

management positions in the telecommunications and health information technology

industries. Most recently from 2004 to 2007, Mr. Gulbis was project director at

Australian Biodiesel Group Limited and was responsible for the design,

construction and commissioning of Australia's largest (160 ML pa) biodiesel

production plant at Narangba, Qld. based on technology developed at the

company's Berkeley Vale NSW R&D facility.

Mr. John A. Iannozzi - Senior Vice President Finance and Chief Financial Officer

Mr. Iannozzi is the current Chief Financial Officer and a director of Karmin.

Mr. Iannozzi is a founder and a director of GlobeStar and acted as the Chief

Financial Officer of GlobeStar from September 2002 to December 2006. GlobeStar

was a recipient of the 2009 Ontario Business Achievement Award for Corporate

Governance issued by the Ontario Chamber of Commerce. In addition, Mr. Iannozzi

is president of Joranco Corporation and a director and Treasurer of Karr

Securities Inc., both of which are private investment companies where he has

served since 1993. Mr. Iannozzi has been a Chartered Accountant since 1987 after

obtaining an Honours Bachelor of Commerce degree from the University of Windsor,

Ontario in 1985. From 1987 until 1994, Mr. Iannozzi was a Manager at BDO

Dunwoody LLP and Coopers and Lybrand LLP.

Mr. Gordon Ewart - General Manager Commercial

Mr. Ewart qualified as a Chartered Accountant in 1996 having worked for KPMG

from 1990-2000. During that time Mr. Ewart established an Energy Solutions Team.

He has 11 years experience in renewable energy markets from greenfield project

development through to large scale mergers and acquisitions and project

financing with Novera Energy Limited from 2001 to 2007, a company listed on the

AIM. More recently Mr. Ewart has been working in biomass and biofuels with The

Energy Crops Company Ltd in the United Kingdom.

Dr. Ian Maxwell - Senior Vice President, Ignite New Zealand

The career of Dr. Ian Maxwell has encompassed some 29 years in research,

technology and new business development with the Royal Dutch Shell PLC group of

companies and a position at the senior global executive level from 1994 to 2000.

He was also the co-founder and chief executive officer of two successful high

technology European start-up companies, Avantium Technologies BV and Crystallics

BV. These two companies, with a focus on high throughput process technology as

applied to the energy, chemical and pharmaceutical business sectors have since

merged and are based in the Netherlands. On returning to New Zealand, he held

the position of general manager at Auckland UniServices, the commercial arm of

Auckland University, from 2003 to 2007. More recently he has been the co-founder

and chief executive officer of Maxall Energy, a non-conventional fuels company

based in New Zealand, prior to its acquisition by Ignite in 2010.

Mr. Perry Toms - Senior Vice President, Business Development

Mr. Toms has held key managerial and executive positions within the conventional

and renewable energy industry as well as direct experience in waste and water

infrastructure industry since 1990. Over the past decade Mr. Toms has played key

executive roles in taking two renewable energy companies public including the

AIM listed Novera Energy Ltd. (2000 - 2003 Executive Director, Business

Development) and the former Australian Stock Exchange listed ABG Biodiesel

Limited (2004- 2006 President, North America).

Over the past seven years, Mr. Toms has assisted energy companies through his

Canadian consultancy Ad Vantage Strategies Ltd. such as the City of Calgary's

electric energy utility ENMAX Corporation (2003- 2004 Director Business

Development) as well as a number of small manufacturing and energy technology

firms. Services offered by Ad Vantage Strategies Ltd. included turn-around

management, business development and corporate financing assistance.

During the 1990's, Mr. Toms worked with TransAlta Corporation (1990 - 1997) and

lead the development of one of North America's largest municipal solid waste to

compost (1995 - 1997 Edmonton Alberta) projects; from 1997 as Director of

Business Development of Energy Developments Ltd (Australia) and its then

Brightstar Division he developed biomass thermal gasification and waste biomass

to energy projects in Australia (Solid Waste Energy Recovery Facility,

Wollongong) and the United Kingdom. Over the course of his career, Mr. Toms has

led the development of many one-of-a-kind infrastructure projects including

Carbon Offset (JI) projects in India, China, South America and carbon

sequestration projects in North America.

Principal Shareholders

No person is expected to own or control 10% or more of the outstanding common

shares of Karmin after the completion of the Acquisition (but prior to the

Brokered Financing).

Except as set out below, no one person presently owns or controls 10% or more of

the ordinary shares of Ignite:

Name Jurisdiction of Residence Shareholding (%)

Cellulo Pte Ltd Malaysia 16.7%

CBM Resources Pty Ltd. Australia 14.9%

Non-Arms Length Parties

As of the date of this news release certain officers and directors of Karmin

indirectly hold an interest in the share capital of Ignite. Specifically, Robert

Ciccarelli, Larry Ciccarelli and John Iannozzi are the principal shareholders of

Karr Securities Inc. Karr Securities Inc. owns approximately 36% of the issued

and outstanding shares of Karmin and is the sole shareholder of Karr Capital

Inc. Karr Capital Inc. owns approximately 6.49% of the issued and outstanding

shares of Ignite. Robert Ciccarrelli is a director of Karmin and the president

of Karr Securities Inc. John Iannozzi is the chief financial officer and a

director of Karmin and a vice-president of finance for Karr Securities Inc.

Larry Ciccarelli is the vice-president of Karr Securities Inc. and brother of

Robert Ciccarelli. Accordingly, the Acquisition may be a related party

transaction for the purpose of Multilateral Instrument 61-101 - Protection of

Minority Security Holders in Special Transactions of the Canadian Securities

Administrators. However, a formal valuation will not be required because the

securities of Karmin are not listed or quoted on an exchange or market specified

in such instrument.

Selected Financial Information

The table below sets forth selected audited historical financial information for

Ignite (presented using IFRS as adopted in Australia) for the years ended

December 31, 2009, December 31, 2008 and December 31, 2007 and selected balance

sheet data as at such periods. All dollar values are presented in Australian

dollars.

Unaudited Audited Audited

Year Ended Year Ended Year Ended

December 31, 2009 December 31, 2008 December 31, 2007

Revenue, net of

royalties $1,278,249 $31,195 $7,798

Operating Expense $6,568,352 $9,123,307 $2,576,259

Net Income (Loss) ($5,290,103) ($9,092,112) ($2,568,461)

Total Assets $166,547,197 $126,297,453 $9,712,024

Total Liabilities $27,010,348 $33,869,270 $4,682,968

Cash Dividends Declared - - -

Total Shareholders' $139,536,849 $92,428,182 $5,029,055

Equity

About Karmin

The common shares of Karmin are listed on the TSXV and trade under the symbol

"KAR". The principal business of Karmin is to acquire and explore resource

properties. Karmin's main project is located at Aripuana, Brazil. Karmin owns

30% of the Aripuana zinc project, one of the largest undeveloped zinc projects

in Brazil. Aripuana covers a complete mineralized massive sulphide district,

with five areas of mineralization (Arex, Ambrex, Babacu, Massaranduba and

Mocoto) over a 25 kilometre strike length.

Following completion of the Acquisition, it is anticipated the combined company

will continue the existing operations of both Karmin and Ignite.

Mr Rod Webster MAusIMM of AMC Consultants Pty Ltd and a Qualified Person as

defined under NI 43-101, supervised the preparation of and verified the

technical information contained in this release relating to EL4416.

Disclaimer

Completion of the Acquisition is subject to a number of conditions including

TSXV acceptance and disinterested shareholder approval. The Acquisition cannot

close until the required shareholder approval is obtained. There can be no

assurance that the Acquisition will be completed as proposed or at all.

Investors are cautioned that, except as disclosed in the management information

circular to be prepared in connection with the Acquisition, any information

released or received with respect to the Acquisition may not be accurate or

complete and should not be relied upon. Trading in the securities of Karmin

should be considered highly speculatively.

This news release does not constitute an offer to sell or a solicitation of an

offer to buy any of the securities in the United States. The securities have not

been and will not be registered under the United States Securities Act of 1933,

as amended (the "U.S. Securities Act") or any state securities laws and may not

be offered or sold within the United States or to U.S. Persons unless registered

under the U.S. Securities Act and applicable state securities laws or an

exemption from such registration is available.

Forward-looking statements

This news release contains forward-looking statements relating to: the

Acquisition; the Brokered Financing; the Cat-HTR technology and its commercial

application; the application of Cat-HTR technology to lignite resources and the

potential reserves arising therefrom; the estimated resources associated with

Ignite's properties; the exchange ratio for the Acquisition and related matters;

and the receipt of all necessary regulatory approvals. Forward-looking

statements include, but are not limited to, possible events and statements. The

words "plans," "expects," "is expected," "scheduled," "estimates," "forecasts,"

"projects," "intends," "anticipates," or "believes," or variations of such words

and phrases or statements that certain actions, events or results "may,"

"could," "would," "might," or "will be taken," "occur," and similar expressions

identify forward-looking statements.

Such statements are not historical facts. Readers are cautioned not to place

undue reliance on forward-looking statements, as there can be no assurance that

the plans, intentions or expectations upon which they are based will occur. By

their nature, forward-looking statements involve numerous assumptions, known and

unknown risks and uncertainties, both general and specific, that contribute to

the possibility that the predictions, forecasts, projections in the

forward-looking statements will not occur, and that actual performance and

results in future periods may differ materially from any estimates or

projections of future performance or results expressed or implied by such

forward-looking statements. These assumptions, risks and uncertainties include,

among other things the risk: that the Acquisition will not be completed; that

all necessary approvals and/or exemptions will not obtained; that the Brokered

Financing will not be completed; that the Acquisition and Brokered Financing is

delayed; that the intended use of the net proceeds of the Brokered Financing may

change; that the scaling and commercializing technology and large scale

processing plants may be not be achievable; that the price of oil and coal and

the costs and risks of exploration and development of lignite coal may fluctuate

negatively.

The forward-looking statements contained in this news release are made as of the

date of this news release. Except as required by law, Karmin disclaims any

intention and assumes no obligation to update or revise any forward-looking

statements, whether as a result of new information, future events or otherwise.

Additionally, Karmin undertakes no obligation to comment on the expectations of,

or statements made by, third parties in respect of the matters discussed above.

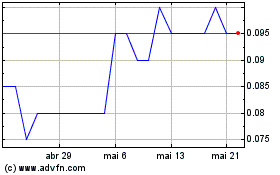

ARCpoint (TSXV:ARC)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

ARCpoint (TSXV:ARC)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024