Granite

Creek Copper to Acquire

Copper North Mining

August

31,

2020,

Vancouver, BC --

InvestorsHub NewsWire -- Granite

Creek Copper Ltd. (TSXV: GCX) ("Granite

Creek")

and Copper North

Mining Corp. (TSXV: COL) ("Copper

North") announced today that they have entered into a

definitive arrangement

agreement

(the "Arrangement

Agreement") pursuant to which

Granite Creek has

agreed to acquire all of the outstanding

Copper

North common shares

(the "Copper

North Shares") not already owned by Granite

Creek through a plan of arrangement under

the British Columbia Business

Corporations Act (the "Arrangement").

Upon completion

of the Arrangement, Granite Creek will control a large regional land

package, including the advanced-stage Carmacks Copper Project and the highly

prospective Stu Copper-Gold Project, in Canada's Yukon Territory.

The combined land package will cover approximately

176

square kilometres

within the Minto Copper District.

Synergies

of the

transaction

The

transaction will combine

Copper

North's Carmacks deposit with

Granite

Creek's Stu

Project,

creating a

significant

copper-focused

exploration and development company. Expected synergies from combining the projects

include:

-

Consolidating

the second

largest land position at 17,580 hectares

in the highly

prospective Minto Copper belt.

-

Combining

the PEA

stage Carmacks deposit with

23.76

mt

(Oxide and

Sulfide combined) grading 0.85% Cu, 0.31 g/t Au, 3.14 g/t Ag, with the blue sky potential

represented by the Stu Project with multiple kilometer scale

targets including 3800 m of historic drilling

with several high grade intercepts of over 1%

Cu.1

-

Improving

the potential to quickly build resources

on the combined land packages

including mineralised zones near and potentially

overlapping existing claim

boundaries between the projects.

-

Strengthening and consolidating

management and

technical teams including resources made

available through the Metallic Group.

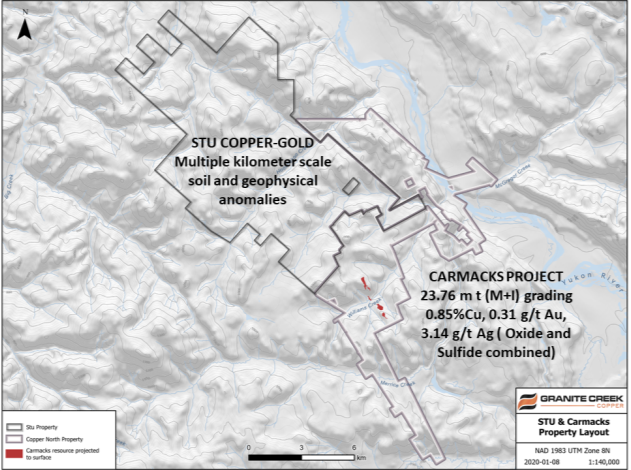

Figure 1:

Combined Project Areas

Details of

the Arrangement

Under the terms

of the Arrangement, Granite

Creek has

agreed to acquire all of the

outstanding Copper North Shares it does not already

own in an

all-share transaction in which Copper North shareholders will receive 1

(one) common share of

Granite Creek (a "Granite Creek

Share") for every two and one-half

(2.5) Copper North

Shares (the "Exchange

Ratio"). All outstanding warrants and

options of Copper North will be exchanged (or deemed to be

exchanged) for warrants and options, respectively, of Granite Creek

at the Exchange Ratio, with appropriate adjustments to the exercise

price, but shall not otherwise be

amended,

including with respect to vesting and expiry. From and

after closing of the

Arrangement, the Copper

North

options will be governed by,

and deemed to be outstanding under, Granite

Creek's existing long-term performance

incentive plan.

Based on a price

of $0.15 per Granite Creek

Share, being the

closing price of the Granite Creek

Shares

on

August

28, 2020, the

Exchange

Ratio represents an offer price of

$0.06 per Copper North

Share, being a

premium of 20% to the closing price of

Copper North Shares on the TSX Venture Exchange on August 28,

2020.

The special

committee comprised of independent directors of Copper North

has, based on such financial and legal advice as it considered

necessary, determined that the

consideration to be received by Copper North's shareholders is

fair, from a financial point of view, to the holders of Copper

North Shares (other than GCC and its affiliates).

The Board of

Directors of each of Granite Creek and Copper North have each

unanimously approved the transaction. Upon completion of the

transaction, it is expected that, based on

the outstanding Granite Creek Shares on the date hereof,

and on the basis

that Granite Creek is acquiring only the outstanding Copper North

Shares it does not already own, Granite Creek

will have

84,414,707 common shares outstanding and Granite Creek

shareholders will own

approximately 72% and Copper North

Shareholders will own

approximately 28% of the combined

company. Including the

10,529,664 Granite Creek Shares previously issued by Granite Creek

to certain Copper North shareholders to acquire its existing

26,146,233 Copper North Shares, Copper North

Shareholders will own approximately

41% of the combined

company.

Tim Johnson,

Granite Creek CEO stated: "Since early 2019, Granite

Creek has moved quickly to advance and enhance its position in

the Minto

Copper district. Upon completion of the

Arrangement, the combined

company

will have consolidated 176 square kilometers of the

district including the mineral resources previously confirmed on

the PEA-stage Carmack copper deposit and the highly prospective Stu

Project. With the second-largest land package in the district with

an advanced project, Granite Creek is positioned to rapidly develop the

overall potential of its holdings and is evaluating the potential

for initiating a diamond drill program on high-priority targets

at Stu."

Upon completion

of the Plan of Arrangement, Granite Creek will add two nominees

from Copper North to its board of directors.

Completion of the

Arrangement is subject to customary conditions, including, among

other things, receipt of required regulatory approvals, court

approvals and, subject to the court's approval, approval of the

Arrangement at a special meeting of holders of Copper North

Shares by not less than:

(i) two-thirds of the votes

cast by holders of Copper North Shares present in person or

represented by proxy at the meeting; and (ii) a majority of the

votes cast by holders of Copper North Shares present in person or

represented by proxy at the meeting in accordance with the minority

approval requirements of applicable Canadian provincial securities

laws.

Details of the

Arrangement, including a summary of the terms and conditions of

the Arrangement

Agreement, along

with the approval process undertaken by Copper North will be

disclosed in the management information circular of Copper North

which will be mailed to the shareholders of Copper North and will

also be available on SEDAR at www.sedar.com. The Arrangement is expected

to close in the fourth quarter

of 2020.

A

copy of

the

Arrangement

Agreement will be available on SEDAR at

www.sedar.com.

Copper North is

subject to Multilateral Instrument 61-101 Protection

of Minority Security Holders in Special Transactions

("MI 61-101"). MI

61-101 provides that, in certain circumstances, where a "related

party" (as defined in MI 61-101) of an issuer is

acquiring the

issuer, such transaction may be considered a "business combination"

for the purposes of MI 61-101 and may be subject to minority

shareholder approval requirements.

Granite Creek

owns approximately

30% of the Copper

North Shares and is considered to be

an "interested

party" (as defined in MI 61-101) of Copper North

for the purposes

of the Arrangement. Consequently, the Copper

North Shares owned by Granite Creek will be excluded for the

purposes of determining if minority approval of the Arrangement is

obtained.

About

Granite Creek

Granite Creek is

a Canadian exploration company focused on the 100%-owned Stu

Copper-Gold project located in the Yukon's Minto Copper District.

This 115 square kilometer property is on trend with Pembridge

Resources' high-grade Minto Copper-Gold Mine to the north and

Copper North's advanced-stage Carmacks Copper-Gold-Silver

project. The project has excellent access to

infrastructure with the paved Yukon Highway 2 within 60

km, along

with grid power within 12 km. More information about Granite Creek

and the Stu Copper-Gold Project can be viewed on

Granite

Creek's website at www.gcxcopper.com.

About

Copper North

Copper North is

a Canadian

mining exploration and development company focused on transforming

the wholly-owned,

advanced stage and high grade Carmacks Cu-Au-Ag project into a

low-cost copper and precious metals producer.

About the

Minto Copper District

The

Minto-Carmacks Copper District is a 180 km

long by 60 km wide belt of intrusion related, high-grade Cu-Au-Ag

deposits within the Dawson Range in the central Yukon Territory of

Canada. The District is host to Pembridge's operating Minto Mine and Copper North's

advanced-stage Carmacks Copper Project. Granite

Creek's Stu Project lies between these projects, with copper

mineralization contained in foliated to gneissic

granodiorite, similar to

the Minto mine

& the Carmacks Copper Deposit,

generally.

FOR FURTHER

INFORMATION PLEASE CONTACT:

|

Granite Creek

Copper Ltd.

Timothy Johnson,

President & CEO

Telephone:1 (604) 235-1982

Toll

Free:1

(888) 361-3494

E-mail:info@gcxcopper.com

Website:www.gcxcopper.com

|

Copper North

Mining Corp.

John Cumming,

President and CEO

Telephone: 1

(604) 618-4262

Email:

info@coppernorthmining.com

Website:

www.coppernorthmining.com

|

References

[1] For further

information on the Carmacks Project, please see the independent

technical report dated November 26, 2016

and prepared for

Copper North Mining Corp., and for further information on

the Stu Project, please see the independent

technical report dated November 15, 2018

and prepared for

Granite Creek Copper Ltd., both of which are available on

SEDAR at

www.sedar.com.

Qualified

Persons

Debbie

James, P.Geo., and Scott Petsel P.Geo are the Qualified

Persons for Granite Creek and

Copper

North,

respectively for this news release within

the meaning of National Instrument 43-101 – Standards

of Disclosure for Mineral Projects and have reviewed and

validated that the information contained in this news

release as

the same pertains to Granite Creek and Copper North,

respectively, is accurate.

Forward-Looking

Statements

This news release

contains forward-looking statements relating to the proposed

acquisition of Copper North, including statements regarding the

completion of the proposed Arrangement. Any statements that are not

statements of historical fact (including statements containing the

words 'believes,' 'intends', 'plans,' 'anticipates,' 'expects,'

'estimates' or similar expressions) and refer to management's

expectations or plans and should be considered to be

forward-looking statements. Such forward-looking statements are

subject to important risks, uncertainties

and assumptions.

The results or events predicted in these forward-looking statements

may differ materially from actual results or events. As a result,

you are cautioned not to place undue reliance on these

forwardlooking

statements. The

completion of the proposed Arrangement is subject to a number of

terms and conditions, including, without limitation:

(i) approval of applicable

governmental authorities, (ii) required Copper North

shareholder

approval, including approval by a "majority of the minority" in

accordance with MI 61-101, (iii) necessary court approvals, and

(iv) certain termination rights available to the parties under the

Arrangement Agreement. These approvals may not be obtained, the

other conditions to the Arrangement may not be satisfied in

accordance with their terms, and/or the parties to the Arrangement

Agreement may exercise their termination rights, in which case the

proposed Arrangement could be modified, restructured or terminated,

as applicable. The forward-looking statements are based on a number

of assumptions which may prove to be incorrect including, but not

limited to, Granite Creek

and

Copper

North being

able to successfully complete the transaction referred to herein

within the timeframe generally as anticipated and without

unforeseen significant costs or delays and there being no material

adverse changes in the affairs of Copper

North.

Readers are cautioned that the foregoing list is not exhaustive.

The forward-looking statements contained in this news release are

made as of the date of this release and, accordingly, are subject

to change after such date. Except as may be required by Canadian

securities laws, Copper North

and

Granite

Creek expressly disclaim any intention and

assume no obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise required by applicable

securities legislation. Additionally,

Copper

North and Granite Creek

undertake no

obligation to comment on expectations of, or statements made by,

third parties in respect of the proposed

Arrangement.

Neither the

TSX Venture Exchange nor its Regulation Services Provider (as that

term is defined in the policies of the TSX Venture Exchange)

accepts responsibility for the adequacy or accuracy of this

release.