Cynapsus Therapeutics Reports Second Quarter 2013 Financial Results and Recent Developments

22 Agosto 2013 - 5:17PM

Marketwired Canada

Cynapsus Therapeutics Inc. (TSX VENTURE:CTH)(OTCQX:CYNAF), a specialty

pharmaceutical company developing the only oral (sublingual) delivery of the

only approved drug (apomorphine) to be used as a rescue therapy for "off" motor

symptoms of Parkinson's disease, today announced its results for the six months

ended June 30, 2013. Unless specified otherwise, all amounts are in Canadian

dollars.

Anthony Giovinazzo, President and Chief Executive Officer of Cynapsus, stated:

"The second quarter of 2013 was very busy period for us. As previously

announced, in March 2013 the Company successfully raised $7.3 million, converted

$4 million of debt to equity, and completed a 10:1 share consolidation. These

three achievements placed the Company on a much more stable foundation and

allowed us to focus on the Michael J. Fox Foundation sponsored CTH103 pilot PK

healthy volunteer study of APL-130277, as well as preparations for an

Investigational New Drug Application to the US FDA for a clinical bioequivalence

study (CTH201). The CTH103 and CTH201 studies are the next critical de-risking

milestones that we believe will drive significant shareholder value. The CTH103

study is expected to be completed in Q4 2013, and the CTH201 study is expected

to be completed in mid-2014. We look forward to reporting our progress."

Financial Highlights

-- Cash on hand at June 30, 2013 of $4,353,053 (December 31, 2012:

$50,401).

-- Net loss of $1,324,609 for the six months ended June 30, 2013 (June 30,

2012: Net loss of $1,595,526).

-- Report 38,884,009 common shares outstanding at June 30, 2013 (December

31, 2012: 14,214,922 common shares).

Operational Highlights

The following achievements were made during the first six months of 2013:

-- Cynapsus raised $6 million in first closing of short form prospectus

offering, exchanges $4 million of debt for equity, and completes 10:1

share consolidation. On March 1, 2013, the Company announced that it

completed a first closing of a short form prospectus offering of units

for gross proceeds of $6,008,000. Concurrent with the closing of the

Offering, the Company and the holders of Series A to E debentures agreed

to convert $4,030,244 in debt for common shares and warrants. In

addition, the Company completed a share consolidation of the Company's

issued and outstanding common shares on the basis of one (1) new common

share for every ten (10) common shares issued and outstanding.

-- Cynapsus raised $1.3 million in second closing of short form prospectus

offering. On March 21, 2013, the Company announced that it completed a

second closing of its short form prospectus offering of units for gross

proceeds of $1,309,160. Total gross proceeds from the First Closing and

the Second Closing of the Offering are equal to $7,317,160.

-- Cynapsus accelerated activities for a comparative biostudy of APL-

130277. In the second quarter of 2013, the Company continued work on

CTH103, a placebo-controlled, randomized cross-over Phase 1 trial in

healthy volunteers to examine the pharmacokinetic profile of multiple

dose strengths of APL-130277 as compared to equivalent doses of

apomorphine subcutaneous injection. The study is expected to be

completed in Q4 2013. The objective of this study is to directly compare

the pharmacokinetic profile of APL-130277 to subcutaneous apomorphine in

healthy subjects in order to more precisely design the subsequent

Bioequivalence Study (CTH201). The Bioequivalence Study is expected to

be completed in mid-2014.

-- Cynapsus announced the appointment of two new Directors to the Board. On

May 9, 2013, the Company announced that Tomer Gold, the current Vice

President, Research & Development of Dexcel Pharma ("Dexcel"), and Ilan

Oren, currently Vice President, Business Development at Dexcel, joined

its Board of Directors. Following the first closing of the short form

prospectus offering on March 1st, 2013, the Board of the Company agreed

to allow Dexcel to nominate two new directors, subject to TSX Venture

Exchange approval. Dexcel nominated Mr. Gold and Mr. Oren, and the

Exchange has since reviewed and cleared their Personal Information

Forms. Dexcel is a strategic investor in the Company and subscribed for

$3,500,000 for 7,608,696 units of the Offering resulting in current

ownership of 19.6% and 24.1% of all the issued and outstanding common

shares of the Company on a basic and fully diluted basis, respectively.

Dexcel is considered a "Control Person" under the policies of the

Exchange.

-- Cynapsus published a white paper on apomorphine for "Off" periods in

Parkinson's Disease and its alternative delivery development candidate

APL-130277. On May 15, 2013, the Company announced that it had completed

a white paper providing background clinical information on apomorphine.

The paper identifies the potential benefits of APL-130277, the company's

proprietary, patented, sublingual thin-film strip system, specifically

its ability to deliver apomorphine to patients in a more convenient and

more well-tolerated manner.

-- Cynapsus began trading on the OTCQX Marketplace in the United States. On

July 18, 2013, subsequent to the end of the second quarter, the Company

announced that its common shares were approved for trading in the United

States on the OTCQX marketplace ("OTCQX"). Trading commenced immediately

on OTCQX International under the symbol CYNAF. The Corporation will

continue to trade on the TSX Venture Exchange under its existing symbol

CTH.

The TSX Venture Exchange Inc. has not reviewed and does not accept

responsibility for the adequacy or accuracy of this press release.

About Cynapsus Therapeutics

Cynapsus is a specialty pharmaceutical company developing the only oral

(sublingual) delivery of the only approved drug (apomorphine) to be used as a

rescue therapy for "off" motor symptoms of Parkinson's disease. Over one million

people in the U.S. and an estimated 5 million people globally suffer from

Parkinson's disease. Parkinson's disease is a chronic and progressive

neurodegenerative disease that impacts motor activity, and its prevalence is

increasing with the aging of the population. Based on a recent study and the

results of the Company's Global 500 Neurologists Survey, it is estimated that

between 25 percent and 50 percent of patients experience "off" episodes in which

they have impaired movement or speaking capabilities. Current medications only

control the disease's symptoms, and most drugs become less effective over time

as the disease progresses.

Cynapsus' drug candidate, APL-130277, is an easy-to-administer, fast-acting

reformulation of apomorphine, which is approved in an injection formulation to

rescue patients from "off" episodes. Cynapsus is focused on maximizing the value

of APL-130277 by completing pivotal studies in advance of a New Drug Application

expected to be submitted in 2015. Cynapsus anticipates a trade sale or

out-licensing to an appropriate global pharmaceutical partner before such an

application is submitted.

More information about Cynapsus (TSX VENTURE:CTH)(OTCQX:CYNAF) is available at

www.cynapsus.ca and at the System for Electronic Document Analysis and Retrieval

(SEDAR) at www.sedar.com.

Forward Looking Statements

This announcement contains "forward-looking statements" within the meaning of

applicable Canadian securities legislation. Generally, these forward-looking

statements can be identified by the use of forward-looking terminology such as

"plans", "expects" or "does not expect", "is expected", "budget", "scheduled",

"estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or

"believes" or variations of such words and phrases or state that certain

actions, events or results "may", "could", "would", "might" or "will be taken",

"occur" or "be achieved". Forward-looking statements are subject to known and

unknown risks, uncertainties and other factors that may cause the actual

results, level of activity, performance or achievements of Cynapsus to be

materially different from those expressed or implied by such forward-looking

statements, including but not limited to those risks and uncertainties relating

to Cynapsus' business disclosed under the heading "Risk Factors" in its Annual

Information Form filed on November 1, 2012 and its other filings with the

various Canadian securities regulators which are available online at

www.sedar.com. Although Cynapsus has attempted to identify important factors

that could cause actual results to differ materially from those contained in

forward-looking statements, there may be other factors that cause results not to

be as anticipated, estimated or intended. There can be no assurance that such

statements will prove to be accurate, as actual results and future events could

differ materially from those anticipated in such statements. Accordingly,

readers should not place undue reliance on forward-looking statements. Cynapsus

does not undertake to update any forward-looking statements, except in

accordance with applicable securities laws.

FOR FURTHER INFORMATION PLEASE CONTACT:

Cynapsus Therapeutics

Anthony Giovinazzo

President and CEO

(416) 703-2449 x225

ajg@cynapsus.ca

Andrew Williams

COO & CFO

(416) 703-2449 x253

awilliams@cynapsus.ca

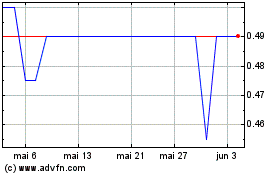

Cotec (TSXV:CTH)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Cotec (TSXV:CTH)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024