CEMATRIX Corporation Reports Second Quarter Financial Results

15 Agosto 2013 - 10:25AM

Marketwired Canada

CEMATRIX Corporation (TSX VENTURE:CVX) (the "Corporation" or the "Company" or

"CEMATRIX") is pleased to announce the release of its consolidated financial

results for the quarter and six months ended June 30, 2013.

Second Quarter Highlights

-- The Company recorded second quarter sales of $2,790,218, which when

added to the first quarter's sales of $1,997,842 results in record sales

for the first six months of $4,788,060;

-- The Company reported second quarter earnings of $101,110, which when

reduced by the first quarter's loss of $5,255 results in record profits

for the first six months of $95,855. Both the record sales and profits

are the result of a significant increase in off season infrastructure

work, mainly in south western Ontario.

-- The Company added $1.1 million of sales orders bringing the total

contracted work scheduled in 2013 to $6.4 million.

Financial Results

Selected financial information for the quarters and six months ended June 30,

2013 and 2012 is as follows:

Quarter ended June 30

2013 2012 Change

---------------------------------------

Revenue $ 2,790,218 $ 2,901,844 $ (111,626)

----------- ----------- -----------

----------- ----------- -----------

Gross margin 659,399 852,273 (192,874)

Operating expenses (496,857) (498,295) 1,438

----------- ----------- -----------

Operating income (loss) 162,542 353,978 (191,436)

Finance costs and other items (21,758) (24,142) 2,384

----------- ----------- -----------

Income (loss) before income taxes 140,784 329,836 (189,052)

Provision of deferred taxes (41,244) - (41,244)

----------- ----------- -----------

Income (loss) attributable to common

shareholders 99,940 329,836 (230,296)

Unrealized foreign exchange gain on

translation of foreign subsidiary 1,570 5,608 (4,038)

----------- ----------- -----------

Comprehensive income (loss) $ 101,110 $ 335,444 $ (234,334)

----------- ----------- -----------

----------- ----------- -----------

Income (loss) per common share $ 0.003 $ 0.010 $ (0.007)

----------- ----------- -----------

----------- ----------- -----------

Six months ended June 30

2013 2012 Change

---------------------------------------

Revenue $ 4,788,060 $ 3,238,835 $ 1,549,225

----------- ----------- -----------

----------- ----------- -----------

Gross margin 1,100,935 637,234 463,701

Operating expenses (922,190) (966,691) 44,501

----------- ----------- -----------

Operating income (loss) 178,745 (329,457) 508,202

Finance costs and other items (46,535) (70,483) 23,948

----------- ----------- -----------

Income (loss) before income taxes 132,210 (399,940) 532,150

Provision of deferred taxes (41,421) - (41,421)

----------- ----------- -----------

Income (loss) attributable to common

shareholders 90,789 (399,940) $ 490,729

Unrealized foreign exchange gain on

translation of foreign subsidiary 5,066 7,645 (2,579)

----------- ----------- -----------

Comprehensive income (loss) $ 95,855 $ (392,295) $ 488,150

----------- ----------- -----------

----------- ----------- -----------

Income (loss) per common share $ 0.003 $ (0.012) $ 0.015

----------- ----------- -----------

----------- ----------- -----------

The outlook for the remainder of 2013 remains positive, however, this will

depend on the ability of the Company to contract additional 2013 sales

contracts. The Company has put in place $6.4 million of contracted work, that is

currently completed or scheduled for completion in 2013. The Company has also

placed numerous bids on other projects currently scheduled to be completed in

2013, but is unable to ascertain at this time how many of these projects, if

any, will result in 2013 contracted work for the Company.

This press release should be read in conjunction with the Corporation's

unaudited Consolidated Financial Statements and Management Discussion and

Analysis for the quarter and six months ended June 30, 2013, both of which can

be found on SEDAR.

CEMATRIX is an Alberta corporation with its head offices in Calgary, Alberta.

The Corporation, through its wholly owned subsidiary, is a manufacturer and

supplier of technologically advanced cellular concrete products with

applications in a variety of markets, including oil and gas construction and

infrastructure construction. Cellular concrete provides a cost and labour saving

solution as a replacement for rigid and other insulating materials in

frost-susceptible or permafrost conditions. Cellular concrete is also used in

void filling situations and as a replacement for granular fills and weak or

unstable soils.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term

is defined in the policies of the TSX Venture Exchange) accepts responsibility

for the adequacy or accuracy of this release.

Forward-looking information: This news release contains certain information that

is forward looking and is subject to important risks and uncertainties (such

statements are usually accompanied by words such as "anticipate", expect",

"would' or other similar words). Forward looking statements in this document are

intended to provide CEMATRIX security holders and potential investors with

information regarding CEMATRIX and its subsidiaries' future financial and

operations plans and outlook. All forward looking statements reflect CEMATRIX's

beliefs and assumptions based on information available at the time the

statements were made. Readers are cautioned not to place undue reliance on this

forward looking information. CEMATRIX undertakes no obligation to update or

revise forward looking information except as required by law. For additional

information on the assumptions made and the risks and uncertainties which may

cause actual results to differ from the anticipated results, refer the

CEMATRIX's Management Discussion and Analysis dated August 14, 2013 under

CEMATRIX's profile on SEDAR at www.sedar.com and other reports filed by CEMATRIX

with Canadian securities regulators.

FOR FURTHER INFORMATION PLEASE CONTACT:

Jeff Kendrick

President and Chief Executive Officer

(403) 219-0484

Jeff Walker

The Howard Group - Investor Relations

(888) 221-0915 or (403) 221-0915

jeff@howardgroupinc.com

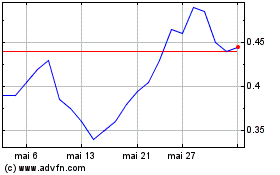

Cematrix (TSXV:CVX)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Cematrix (TSXV:CVX)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025