Canadian Spirit Resources Inc. Announces First Quarter 2012 Financial Results

31 Maio 2012 - 7:00AM

Marketwired Canada

Canadian Spirit Resources Inc. ("CSRI" or the "Corporation") (TSX

VENTURE:SPI)(OTCBB:CSPUF) announces the release of its interim financial results

and Management Discussion and Analysis ("MD&A") for the three month period ended

March 31, 2012.

This news release summarizes information contained in the unaudited interim

condensed financial statements and MD&A for the three month period ended March

31, 2012 and should not be considered a substitute for reading these full

disclosure documents which are available on SEDAR at www.sedar.com or the

Corporation's website at www.csri.ca.

CSRI is a natural resources company focusing on the identification and

development of opportunities in the unconventional natural gas sector of the

energy industry.

----------------------------------------------------------------------------

SUMMARY QUARTERLY DATA

(all amounts are presented in Canadian

dollars)

For the three months ended, and as at, March

31 2012 2011

----------------------------------------------------------------------------

Average sales volumes of natural gas (Mcf/d) 1,934 1,917

Average sales price of natural gas ($/Mcf) $ 2.11 $ 3.35

Natural gas sales, before royalties $ 372,252 $ 407,013

Operating netbacks, after royalty credits

applied $ 87,174 $ 364,631

Cash flow from operating activities $ (271,242) $ (64,335)

Net loss and comprehensive loss $ (942,567) $ (702,752)

Loss per share, basic & diluted $ (0.01) $ (0.01)

Net working capital $ 1,885,895 $ 18,176,642

Total assets $ 62,118,639 $ 77,574,080

Shareholders' capital $ 58,554,046 $ 74,900,078

Common shares outstanding 76,238,661 74,561,061

Total capital expenditures $ 359,732 $ 2,761,743

PRODUCTION

CSRI's natural gas sales volume averaged 1.9 MMcf/d (net) during the three

months ended March 31, 2012. The Corporation has 5 (1.75 net) Montney wells

being produced through its 10 MMcf/d (3.5 net) gas plant located on its western

lands at Farrell Creek. Due to the depressed state of natural gas prices, and

the fact that the natural gas being produced has no associated natural gas

liquids, the Corporation has no immediate plans for further development activity

on its western lands.

FARRELL CREEK NATURAL GAS & LIQUIDS RESOURCE REPORT

A Montney resource assessment of the Corporation's Farrell Creek lands in

northeastern British Columbia was prepared by GLJ Petroleum Consultants ("GLJ")

as at February 29, 2012. As previously announced (News Release April 30, 2012),

GLJ determined that gross discovered and undiscovered natural gas

initially-in-place was 5 Tcf and 5.7 Tcf, respectively. GLJ had also provided an

estimate of associated natural gas liquids within its eastern lands at Farrell

Creek with best estimates of company interest economic contingent natural gas

liquids resource of 0.77 million barrels and company interest prospective

natural gas liquids resource of 15.9 million barrels.

FARRELL CREEK OUTLOOK

CSRI continues to focus on its eastern lands due to their prospectivity for

natural gas liquids. Along with the operator, Canbriam Energy, the Corporation

intends to frac and test the previously drilled vertical well at 12-7 in the

third quarter 2012. This well will be used to help optimize where future

horizontal wells will be placed into the Montney Formation (upper, middle,

lower) such that natural gas and natural gas liquids production can be

maximized.

With a successful test at 12-7, the Corporation intends to drill and frac one,

or possibly two, horizontal wells on its eastern lands with a view to adding

incremental reserves and production. Production would require access to

Talisman's nearby gas gathering system. At this point, discussions with Talisman

indicate that they would be amenable. Frac water for the above activities would

be supplied by the water pipeline (25% owned by CSRI) that the operator had

constructed from the Williston Reservoir. This water pipeline will be

commissioned within the next few months and will be fully operational by that

time.

FINANCIAL RESOURCES

The Corporation currently has no debt, and has C$1.9 million of working capital

as at March 31. 2012. CSRI intends to fund any additional capital required for

the program outlined above through equity raises in the capital markets.

Information regarding CSRI is available on SEDAR at www.sedar.com or the

Corporation's website at www.csri.ca.

The corporate information contained in this news release may contain

forward-looking forecast information. The reader is cautioned that assumptions

used in the preparation of such information, although considered reasonably

accurate by CSRI at the time of preparation, may prove to be incorrect. The

actual results achieved during the forecast period will vary from the

information provided herein and the variations may be material. Consequently

there is no representation by CSRI that actual results achieved during the

forecast period will be the same in whole or in part as those forecast.

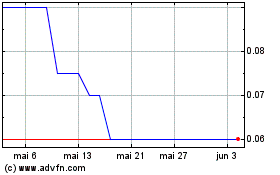

Canadian Spirit Resources (TSXV:SPI)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

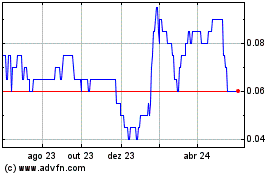

Canadian Spirit Resources (TSXV:SPI)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024