Vanguard Extended Duration Treasury Index Fund Now Available

10 Dezembro 2007 - 12:04PM

Business Wire

The VanguardÔŅĹ Extended Duration Treasury Index Fund, a low-cost

fund designed for pension plans that follow a liability-driven

investing strategy, has begun accepting investments. Institutional

investors can purchase shares of the fund directly from Vanguard,

or can purchase the VanguardÔŅĹ Extended Duration Treasury ETF, which

today began trading on the American Stock Exchange under the ticker

EDV. Vanguard offers the lowest cost long-duration ETF in the

industry. (source: Lipper). Share Class ÔŅĹ Minimum Initial

Investment ÔŅĹ Estimated Expense Ratio Institutional $5 million 0.11%

Institutional Plus $100 million 0.08% Extended Duration Treasury

ETF (EDV) N/A 0.14% The VanguardÔŅĹ Extended Duration Treasury Index

Fund seeks to match the performance of the Lehman Brothers Treasury

Strips 20-30 Year Equal Par Bond Index, and has a duration

generally ranging from 22 to 27 years. The fund was specifically

designed for institutions and pension plan providers who are

seeking to balance their portfolio assets to pension liabilities.

Funds with longer durations are more sensitive to interest rate

fluctuations than shorter duration funds. Therefore, rising

interest rates may cause a steep decline in the value of the FundÔŅĹs

investments. Because of this potential volatility, the fund is

generally not appropriate for individual investors. The new fund is

managed by Vanguard Fixed Income Group, which oversees $374 billion

in assets, including more than $80 billion in bond index fund

assets. Vanguard, headquartered in Valley Forge, Pennsylvania, is

one of the worldÔŅĹs largest investment management companies.

Vanguard manages nearly $1.3 trillion in U.S. mutual fund assets,

including more than $325 billion in employer-sponsored retirement

plans. Vanguard offers more than 140 funds to U.S. investors and

more than 40 additional funds in foreign markets. All asset figures

are as of November 30, 2007, unless otherwise noted. All mutual

funds and ETF products are subject to stock market risk, which may

result in the loss of principal. Investments in Treasury bond funds

and ETFs are subject to interest rate and inflation risk.

Diversification does not ensure a profit or protect against a loss

in a declining market. Vanguard ETF Shares can be bought and sold

only through a broker (who will charge a commission) and cannot be

redeemed with the issuing fund. The market price of Vanguard ETF

Shares may be more or less than net asset value. Vanguard Extended

Duration Treasury ETF is not sponsored, endorsed, sold or promoted

by Lehman Brothers. Lehman Brothers makes no representation or

warranty, express or implied, to the owners of Vanguard Extended

Duration Treasury ETF or any member of the public regarding the

advisability of investing in securities generally or in Vanguard

Extended Duration Treasury ETF particularly or the ability of the

Lehman Brothers Index to track general bond market performance.

Lehman Brothers hereby expressly disclaims all warranties of

merchantability and fitness for a particular purpose with respect

to the Lehman index and any data included therein. LehmanÔŅĹs only

relationship to Vanguard and Vanguard Extended Duration Treasury

ETF is the licensing of the Lehman index, which is determined,

composed, and calculated by Lehman without regard to Vanguard or

the Vanguard Extended Duration Treasury ETF. Lehman is not

responsible for and has not participated in the determination of

the timing of, prices at, or quantities of Vanguard Extended

Duration Treasury ETF to be issued. The Fund is subject to interest

rate risk, which is the chance that bond prices overall will

decline because of rising interest rates. Interest rate risk is

expected to be extremely high for the Fund because it invests

mainly in zero coupon long-term bonds, which have prices that are

very sensitive to interest rate changes. Because the Fund invests

mainly in Treasury STRIPS with maturities ranging from 20 to 30

years, rising interest rates may cause the value of the Fund's

investments to decline significantly. Vanguard and Vanguard ETFs

are trademarks of The Vanguard Group, Inc. All other marks are the

exclusive property of their respective owners. Vanguard Marketing

Corporation, Distributor.

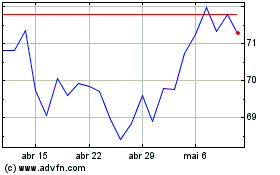

Vanguard Extended Durati... (AMEX:EDV)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

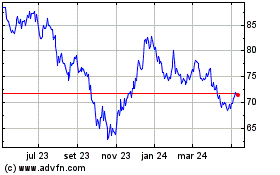

Vanguard Extended Durati... (AMEX:EDV)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025

Notícias em tempo-real sobre Vanguard Extended Duration Treasury da American Stock Exchange bolsa de valores: 0 artigos recentes

Mais Notícias de Vanguard