- The all-cash public tender offer

announced on August 1, 2016, by TDK’s subsidiary EPCOS to acquire

all publicly-held shares of Tronics has been successful.

- EPCOS has acquired 72.38% of the

outstanding shares at a price of EUR 13.20 per share, and has thus

exceeded the defined 65.41%1 success threshold for its offer. The

settlement of the tender offer will occur on December 27,

2016.

- Through the acquisition of Tronics, TDK

broadens its portfolio of cutting-edge sensor technologies and

strengthens its basis for faster growth in the strategic field of

sensors.

- Thales Avionics will remain a strategic

shareholder of Tronics. After the closing of the successful offer,

Thales Avionics and EPCOS will enter into a shareholders’

agreement.

- The tender offer will automatically

reopen in the beginning of January 2017 for a period of 10 trading

days.

TDK Corporation (“TDK”, TOKYO: 6762) and Tronics Microsystems SA

(“Tronics”, ISIN:FR0004175099 ALTRO) jointly announced today that

the all-cash public tender offer launched by TDK’s wholly-owned

subsidiary EPCOS AG (“EPCOS”) was successfully closed on December

14, 2016. EPCOS, a leading manufacturer of electronic components,

modules and systems based in Munich, Germany, acquired 72.38% of

the outstanding shares at a price of EUR 13.20 per share, thus

exceeding the defined 65.41% success threshold for the offer. The

acquisition of these shares represents a value of approximately EUR

33.432 million. The settlement of the tender offer will occur on

December 27, 2016.

Thales Avionics, which holds a 20.9% stake in Tronics, will

remain a strategic shareholder of Tronics. After the closing of the

successful offer, Thales Avionics and EPCOS will hold in aggregate

93.30% of the capital and 88.88% of the voting rights of Tronics.

The two companies will enter into a shareholders’ agreement to act

in concert, which will take effect at the closing of the reopened

tender offer in accordance with the terms summarized in the offer

documentation.

The tender offer will automatically reopen in the beginning of

January 2017 for a period of 10 trading days. The offer price per

share will remain unchanged at EUR 13.20 and represents a 78.4%

premium over Tronics’ closing share price on July 7, 2016, the

trading day immediately preceding the stock trading suspension, and

a 62.1% premium to the volume-weighted average price during the

last 60 trading days prior to this suspension.

The composition of the Supervisory Board of Tronics will be

revised to reflect the new shareholding structure of Tronics.

Next steps

If, at the end of the reopened tender offer, EPCOS2 holds more

than 95% of the capital and voting rights of Tronics, EPCOS

reserves its right to ask the AMF, within ten (10) trading days

from the result publication of the re-opened tender offer, or where

applicable, within three (3) months from the end of the reopened

tender offer, to implement a squeeze-out procedure by the transfer

of Tronics’ shares which would not have been tendered to the

offer.

Solid basis for future growth

With the addition of Tronics, which provides an immediate entry

to the rapidly growing market for inertial sensors, TDK has

implemented a further key element in its strategy to broaden and

strengthen its portfolio of cutting-edge sensor technologies.

Comments Joachim Zichlarz, Corporate Officer and Senior Vice

President of TDK, as well as Chairman of the Management Board, CEO

and CFO of EPCOS: “With the successful completion of the tender

offer and the conclusion of our agreement with Thales, we have

created a solid basis for further developing Tronics' business

under the roof of TDK and, at the same time, boosting our

innovativeness and market strength in one of the future’s most

promising technological fields. Moreover, TDK expects strong

synergies with its own cutting-edge thin-film and assembly

technologies.”

Pascal Langlois, Chairman of the Management Board and CEO of

Tronics comments: “Tronics’ shareholders have recognized the strong

financial and industrial merits of the acquisition by TDK. Its

solid financial basis and extensive know-how in materials and

production engineering now provide a very good basis to grow

further Tronics’ inertial products and MEMS technologies. This is a

great step in the company’s development as we will benefit from

TDK’s leading and developing position as a powerful component

manufacturer in industrial, automotive and consumer electronics

markets.”

Additional information related to the tender offer

The Autorité des Marchés Financiers (AMF) published the results

of the tender offer on December 19, 2016.

The offer documents and press releases for the tender offer can

be found on the EPCOS website under www.epcos.com/tronics and on

the Tronics website under www.tronicsgroup-bourse.com/en/. Please

note that these documents are available only in French – with the

exception of the initial press release on August 1, 2016,

announcing the tender offer.

Advisors

Kepler Cheuvreux is acting as presenting bank in the context of

the public tender offer, PwC Corporate Finance is acting as

financial advisor and Hogan Lovells is acting as legal advisor to

TDK.

Gimar & Cie is acting as financial advisor

to Tronics, and Darrois Villey Maillot Brochier is acting as legal

advisor to Tronics.

About TDK Corporation

TDK Corporation is a leading electronics company based in Tokyo,

Japan. It was established in 1935 to commercialize ferrite, a key

material in electronic and magnetic products. TDK's portfolio

includes electronic components, modules and systems* which are

marketed under the product brands TDK and EPCOS, power supplies,

magnetic application products as well as energy devices, flash

memory application devices, and others. TDK focuses on demanding

markets in the areas of information and communication technology

and consumer, automotive and industrial electronics. The company

has a network of design and manufacturing locations and sales

offices in Asia, Europe, and in North and South America.

In fiscal 2016, TDK posted total sales of USD 10.2 billion and

employed about 92,000 people worldwide.

* The product portfolio includes ceramic, aluminum electrolytic

and film capacitors, ferrites, inductors, high-frequency components

such as surface acoustic wave (SAW) filter products and modules,

piezo and protection components, and sensors.

About EPCOS

EPCOS, a TDK Group Company, develops, manufactures and markets

electronic components, modules and systems, focusing on

fast-growing leading-edge technology markets, which include

information and communications technology, automotive electronics,

industrial electronics and consumer electronics. Thanks to the

approximately 25,500 employees at more than 20 design and

production locations and an extensive sales network outside of

Europe, the company is well-equipped to work closely with customers

and create the right solutions for them. Since February 2015, the

two existing European sales channels for EPCOS and TDK products

have been merged under the one roof of TDK Europe.

In fiscal 2016 (ending in March) EPCOS posted sales of about EUR

2.5 billion.

About Tronics

Founded in 1997, Tronics is a recognized technological leader in

the sector of nano & microsystems with high added value.

Positioned at the heart of product innovation, Tronics has

technology platforms protected by a portfolio of 25 families of

patents, resulting from 15 years of R&D and more than

EUR 15 million of cumulative industrial investments.

Addressing high-growth markets relying on increasing

miniaturization of electronic devices, Tronics designs,

manufactures and sells custom or standard products to the industry,

aeronautics & security, medical and consumer markets. Located

in Crolles, near Grenoble (France) and in Dallas, Texas (United

States), Tronics posted revenue of EUR 7.8 Million in 2015. It

now has 92 employees, of whom 55 are engineers and scientists.

ISIN code: FR0004175099 ALTRO.

«Innovative Company» certification number: A1410008 V.

For more information: www.tronicsgroup-bourse.com

1 This success threshold was reduced to take into account the

shares of Tronics underlying the bons de souscription de parts de

créateur d'entreprise (BSPCE) and stock options that will be

covered by irrevocable forward sale agreements, so that the 66.67%

threshold can be reached after the offer as a result of the

delivery of these shares.

2 Acting in concert with Thales Avionics

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161221005325/en/

TDK ContactsSumio Marukawa, 81-3-6852-7102Corporate

Communicationspr@jp.tdk.comJun Hatsumi, 81-3-6852-7102Investor

Relationsir@jp.tdk.comFor EPCOS related issues:Hans-Peter Ziegler,

49-89-54020-2415Corporate

Communicationsepcoscc@epcos.comorTronics ContactsInvestor

Relations & Corporate Communications:Actus LyonFrance

Bentin/Serena Boni, 33-4-72-18-04-92fbentin@actus.frMarketing:Karl

Biasio, 33-4-76-97-29-50info@tronicsgroup.com

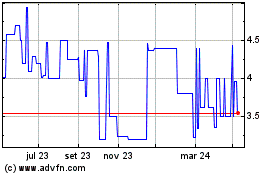

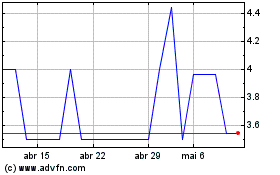

Tronic s Microsystems (EU:ALTRO)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Tronic s Microsystems (EU:ALTRO)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024