Highlights

- Strategic combination to create the

global leader in consumer packaging

- Comprehensive global footprint with

greater scale in every region

- Industry leading R&D capabilities

and better positioned to capture sustainable packaging

opportunities

- Stronger value proposition for

shareholders, customers, employees and the environment

- Combined revenues of US$13 billion,

EBITDA of US$2.2 billion(1), annual cash flow after capital

expenditure of more than US$1 billion and an investment grade

balance sheet

- All-stock cash free transaction: Amcor

shareholders to own 71%; Bemis shareholders to own 29% of combined

company

- Double-digit pro-forma EPS(2) accretion

for all shareholders including run-rate cost synergies of US$180

million incremental to Bemis’ “Agility” improvement plan

- Amcor to establish primary listing on

NYSE with an estimated market capitalization of US$17 billion(3)

and to maintain a listing on ASX, with expected index inclusion in

both markets

Amcor Limited (ASX: AMC) and Bemis Company, Inc. (NYSE: BMS)

today announced that their respective Boards of Directors have

unanimously approved a definitive agreement under which Amcor will

acquire Bemis in an all-stock combination. Combining these two

complementary companies will create the global leader in consumer

packaging, with the footprint, scale and capabilities to drive

significant value for shareholders, offer customers and employees

the most compelling value proposition in the packaging industry and

deliver the most sustainable innovations for the environment.

The transaction will be effected at a fixed exchange ratio of

5.1 Amcor shares for each Bemis share, resulting in Amcor and Bemis

shareholders owning approximately 71% and 29% of the combined

company, respectively. This is equivalent to a transaction price of

US$57.75 per Bemis share based on Amcor’s closing share price of

A$15.28(4) on August 3, 2018, and represents a premium of 25% to

Bemis’ closing price of US$46.31 per share as of August 2,

2018(5).

Amcor's CEO, Ron Delia, said: "The strategic rationale for this

combination and the financial benefits are highly compelling for

both Amcor and Bemis shareholders. We are convinced this is the

right deal at the right time for both companies, and with the right

structure for both sets of shareholders to participate in a unique

value creation opportunity. Amcor identified flexible packaging in

the Americas as a key growth priority and this transaction delivers

a step change in that region.

“There are an increasing number of opportunities arising for a

leading packaging company to capitalize on shifting consumer needs,

an evolving customer landscape and the need to provide responsible

packaging solutions that protect the environment. With this

transaction, Amcor will have a stronger value proposition with the

scale, breadth and resources to unlock value from these

opportunities, for the benefit of our shareholders, customers and

employees.

"Amcor’s financial profile will be enhanced, and our existing

capital allocation framework, or shareholder value creation model,

will be maintained and strengthened with this transaction. The

combined company expects to have an investment grade balance sheet

that provides immediate capacity for further disciplined investment

as well as a compelling, progressive dividend. Amcor will draw on

our extensive merger integration experience to deliver the

substantial benefits of this combination.”

Bemis’ President and CEO, William F. Austen, said: "The

combination of Bemis and Amcor is transformational, bringing

together two highly complementary organizations to create a global

leader in consumer packaging. We believe this combination, which is

an exciting growth story for both companies, will benefit all

stakeholders. Our employees will benefit as part of a larger and

more global organization focused on a commitment to customer

service, integrity and supporting strong teams. In addition, the

combination will enable us to offer global, regional and local

customers the most compelling value proposition in the industry

through a broader product portfolio, increased product

differentiation and enhanced operating capabilities, while

leveraging Bemis’ extensive U.S. manufacturing base and strengths

in material science and innovation. Our shareholders will receive a

significant premium in this transaction, reflecting the value we’ve

built as an organization, as well as the opportunity to continue to

participate in the upside potential of a more diversified combined

company with greater scale and resources. We look forward to

working together with Amcor to ensure a seamless integration.”

Amcor's CEO, Ron Delia, concluded, “Amcor and Bemis have many

things in common starting with proud histories that date back more

than 150 years. Both companies are grounded in strong values, a

shared commitment to innovation and value-added consumer packaging,

and have talented management teams.”

“We have always had a great deal of respect for Bemis and we are

thrilled that its team in Wisconsin and around the world will be

joining Amcor. Many people at Amcor today have joined us through

acquisitions, including many of our leadership team, and we would

expect Bemis to be well represented in Amcor at all levels of the

organization.”

Strategic Rationale

After completion of the transaction, Amcor will have a stronger

and more differentiated value proposition for global, regional and

local customers through:

- Comprehensive global footprint with

more balanced, profitable exposure to emerging markets: A

global flexible packaging footprint across key geographies; a

larger, more balanced and more profitable emerging markets

business, with sales of some US$3.5 billion from around 30 emerging

markets;

- Greater scale to better serve

customers in every region: Increased economies of scale and

resources through Amcor’s leading positions in Europe, Asia and

Latin America, and Bemis’ leading positions in North America and

Brazil;

- Increased exposure to attractive end

markets and product segments: An enhanced growth profile from

greater global participation in protein and healthcare packaging,

leveraging innovative technologies in barrier films and foils;

- Best-in-class operating and

innovation capabilities: Greater differentiation to innovate

and meet customer demands for new and sustainable products through

the deployment of proven, industry-leading commercial, operational

and R&D capabilities;

- A continued strong commitment to

environmental sustainability: Enhanced capabilities behind

Amcor’s pledge to develop all recyclable or reusable packaging

products by 2025; and

- Greater depth of management

talent: A stronger combined team by bringing the significant

strengths and quality of the workforce across both companies.

Financial Rationale

The combination creates substantial value for shareholders of

both companies through:

- Compelling transaction metrics:

- all-stock acquisition at an implied

value in line with Amcor’s current trading EV/EBITDA multiple, pre

cost synergies;

- pre-tax annual cost synergies of

approximately US$180 million (representing approximately 4% to 5%

of Bemis sales) by the end of the third year from procurement,

manufacturing and G&A efficiencies(6), incremental to Bemis’

“Agility” improvement plan;

- double digit proforma EPS(2) accretion

for all shareholders inclusive of cost synergies at full run

rate(1); and

- double digit returns in excess of

Amcor’s Weighted Average Cost of Capital (WACC).

- Stronger financial profile going

forward:

- higher margins through the delivery of

cost synergies;

- potential to grow at higher rates over

the long term through a stronger customer value proposition; and

increased exposure to attractive segments, which would be additive

to the transaction metrics;

- annual cash flow, after capital

expenditure and before dividends, in excess of US$1 billion;

and

- investment grade balance sheet with

immediate capacity for further investment.

- Greater liquidity for investors:

- through a primary listing on the New

York Stock Exchange (“NYSE”) and a listing on the Australian

Securities Exchange ("ASX") via CHESS Depositary Interests

(“CDI’s”); and

- expected inclusion in both the US

S&P 500 index as well as in the S&P / ASX 200 index.

- Cash and tax free:

- cash and tax free transaction for

shareholders in a share for share exchange.

Transaction Structure

The combination will be effected through a merger of Amcor and

Bemis into a newly created holding company (‘New Amcor’)

incorporated in Jersey. It is intended that New Amcor will be tax

resident in the UK after closing. New Amcor will have a primary

listing on the NYSE and a listing on the ASX. Amcor and Bemis

shareholders will receive shares in New Amcor in a tax-free

exchange. Existing Amcor shareholders will have the option to

receive one New Amcor ASX listed CDI or one New Amcor NYSE listed

share for each Amcor share held. Bemis shareholders will receive

5.1 New Amcor NYSE shares for each Bemis share held, resulting in

Amcor and Bemis shareholders owning approximately 71% and 29% of

the combined company, respectively.

This structure has several key benefits, including:

- Listings on two major global exchanges

with primary listing on the NYSE and an ASX listing via CDIs;

- Expected index inclusion in the S&P

500 of the full market capitalization of the combined company

(estimated at US$17 billion(3)) and pro-rata inclusion of CDIs in

the S&P / ASX 200 index, resulting in greater liquidity and

considerably increased index buying; and

- Ongoing financial strength and funding

flexibility for continued investment.

Financial effects

After completion of the transaction it is expected that key

aspects of Amcor’s financial profile will remain largely unchanged,

including:

- A compelling, progressive dividend

which will continue to be an important component of annual

shareholder returns;

- Post closing, the first annual dividend

paid by New Amcor is expected to be no less than the value of the

last annual dividend per share declared by Amcor prior to

completion of the transaction, providing significant dividend per

share accretion to Bemis shareholders; and

- An on-going capital allocation

philosophy consistent with Amcor’s shareholder value creation

framework.

Governance and Community

Upon completion of the transaction, New Amcor’s Board is

expected to comprise 11 members, 8 of whom are current Amcor

directors, and 3 of whom are current Bemis directors. Amcor’s

current Chairman, Graeme Liebelt and current CEO Ron Delia will

continue in those roles after the transaction and Mr. Delia will

continue to serve as the only Executive Director on the Board.

New Amcor will continue to maintain a critical presence in

Wisconsin and other key Bemis locations. The combined company also

expects to leverage Bemis’ plant network and innovation center

while continuing to invest in the U.S. New Amcor will continue to

support the communities in which Bemis operates and announced today

a contribution of US$35,000 to the Bemis Foundation on behalf of

Amcor’s 35,000 employees world-wide.

Conditions to the Transaction and Other Terms

Closing of the transaction is conditional upon the receipt of

regulatory approvals, approval by both Amcor and Bemis

shareholders, and satisfaction of other customary conditions.

Subject to the satisfaction of the conditions to closing, the

transaction is targeted to close in the first quarter of calendar

year 2019.

Under the terms of the transaction agreement, prior to closing

each party will be permitted to continue paying dividends in an

amount and on timing consistent with past practice.

The full terms of the transaction, including the closing

conditions and other terms described herein, are set out in the

transaction agreement, which is lodged in a separate

announcement.

Analyst and investor briefing

Amcor and Bemis will hold two joint calls for analysts and

investors:

- Conference call 1 – August 6: 8:30 am

US Central Daylight Time / 9:30 am US Eastern Daylight Time / 11:30

pm Australian Eastern Standard Time. Participant code

8388696

- Conference call 2 – August 7 Australia

/ August 6 US: 10:00 am Australian Eastern Standard Time / 07:00 pm

US Central Daylight Time / 08:00 pm US Eastern Daylight Time.

Participant code 9992019

To access the presentation slides, go to www.Amcor.com and click

on the relevant link after scrolling down on the homepage or the

investors page, or go to www.Bemis.com and click on the

presentations section. We recommend participants dial in 10 to 15

minutes prior to the start of the presentation using the

teleconference details below:

Australia 1800 175 864 / +61 2 8373 3507 United

States 1855 823 0291 / +1 469 666 9932 Canada 1855 277 1647 / +1 64

7426 9741 United Kingdom 0808 234 1368 / +44 20 3651 4875 Hong Kong

800 963 435 / +852 3051 2791 All other countries +61 2 8373 3550

Advisors

UBS AG, Australia Branch and Moelis & Company LLC are acting

as joint financial advisors and Kirkland & Ellis and Herbert

Smith Freehills as legal counsel to Amcor.

Goldman Sachs & Co LLC is acting as financial advisor and

Faegre Baker Daniels LLP, Cleary Gottlieb Steen & Hamilton LLP

and MinterEllison as legal counsel to Bemis.

Overview of Amcor

Amcor is a global leader in responsible packaging solutions,

supplying a broad range of rigid and flexible packaging products

into the food, beverage, healthcare, personal care and other fast

moving consumer end markets. Amcor operates around 195 sites in

over 40 countries, with approximately 35,000 employees. For the

year ended 30 June 2017, Amcor generated revenues of US$9.1 billion

and EBITDA of US$1.4 billion.

Overview of Bemis

Bemis Company, Inc. (“Bemis”) is a supplier of flexible and

rigid plastic packaging used by leading food, consumer products,

healthcare, and other companies worldwide. Founded in 1858, Bemis

reported 2017 net sales of US$4.0 billion. Bemis has a strong

technical base in polymer chemistry, film extrusion, coating and

laminating, printing, and converting. Headquartered in Neenah,

Wisconsin, Bemis employs approximately 16,000 individuals

worldwide. More information about Bemis is available at our

website, www.Bemis.com.

FOOTNOTES

1) After taking into account US$180 million pre-tax

cost synergies. 2) Excludes the impact of purchase accounting. 3)

Excluding the value of capitalized synergies. 4) Equivalent to a US

dollar share price of US$11.32 based on a AUD:USD exchange rate of

0.7411 as of August 3, 2018. 5) August 2, 2018 being the last

trading day prior to market speculation on August 3, 2018 in

relation to a transaction between Amcor and Bemis. 6) Cost to

achieve synergies estimated to be US$150 million. These costs are

expected to be funded by capital expenditure and working capital

savings. Costs are expected to be incurred across years 1 and 2.

Cautionary Statement Regarding

Forward-Looking Statements

This communication contains certain statements that are

“forward-looking statements” within the meaning of Section 27A

of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the

Securities Exchange Act of 1934, as amended. Amcor Limited

(“Amcor”), its subsidiary Arctic

Jersey Limited (“New Amcor”) and Bemis

Company, Inc. (“Bemis”) have

identified some of these forward-looking statements with words like

“believe,” “may,” “could,” “would,” “might,” “possible,” “will,”

“should,” “expect,” “intend,” “plan,” “anticipate,” “estimate,”

“potential,” “outlook” or “continue,” the negative of these words,

other terms of similar meaning or the use of future dates.

Forward-looking statements in this communication include, without

limitation, statements about the anticipated benefits of the

contemplated transactions, including future financial and operating

results and expected synergies and cost savings related to the

contemplated transactions, the plans, objectives, expectations and

intentions of Amcor, New Amcor or Bemis and the expected timing of

the completion of the contemplated transactions. Such statements

are based on the current expectations of the management

of Amcor or Bemis, as applicable, are qualified by the

inherent risks and uncertainties surrounding future expectations

generally, and actual results could differ materially from those

currently anticipated due to a number of risks and uncertainties.

None of Amcor, New Amcor or Bemis, or any of their respective

directors, executive officers or advisors, provide any

representation, assurance or guarantee that the occurrence of the

events expressed or implied in any forward-looking statements will

actually occur. Risks and uncertainties that could cause results to

differ from expectations include, but are not limited to:

uncertainties as to the timing of the contemplated transactions;

uncertainties as to the approval of the transactions by Bemis’ and

Amcor’s shareholders, as required in connection with the

contemplated transactions; the possibility that a competing

proposal will be made; the possibility that the closing conditions

to the contemplated transactions may not be satisfied or waived,

including that a governmental entity may prohibit, delay or refuse

to grant a necessary approval; the effects of disruption caused by

the announcement of the contemplated transactions or the

performance of the parties’ obligations under the transaction

agreement making it more difficult to maintain relationships with

employees, customers, vendors and other business partners; the risk

that shareholder litigation in connection with the contemplated

transactions may affect the timing or occurrence of the

contemplated transactions or result in significant costs of

defense, indemnification and liability; uncertainties as to the

availability and terms of refinancing for the existing indebtedness

of Amcor or Bemis in connection with the contemplated transactions;

uncertainties as to whether and when New Amcor may be listed in the

US S&P 500 index and the S&P / ASX 200 index; uncertainties

as to whether, when and in what amounts future dividend payments

may be made by Amcor, Bemis or New Amcor; other business effects,

including the effects of industry, economic or political conditions

outside of the control of the parties to the contemplated

transactions; transaction costs; actual or contingent liabilities;

disruptions to the financial or capital markets; other risks and

uncertainties discussed in Amcor’s disclosures to the Australian

Securities Exchange (“ASX”), including

the “2017 Principal Risks” section of Amcor’s Annual Report 2017;

and other risks and uncertainties discussed in Bemis’ filings with

the U.S. Securities and Exchange Commission (the “SEC”), including the “Risk Factors” section of

Bemis’ annual report on Form 10-K for the fiscal year ended

December 31, 2017. You can obtain copies of Amcor’s

disclosures to the ASX for free at ASX’s website (www.asx.com.au).

You can obtain copies of Bemis’ filings with the SEC for free at

the SEC’s website (www.sec.gov). Forward-looking statements

included herein are made only as of the date hereof and none of

Amcor, New Amcor or Bemis undertakes any obligation to update any

forward-looking statements, or any other information in this

communication, as a result of new information, future developments

or otherwise, or to correct any inaccuracies or omissions in them

which become apparent, except as expressly required by law. All

forward-looking statements in this communication are qualified in

their entirety by this cautionary statement.

Legal Disclosures

No Offer or Solicitation

This communication is not intended to and does not constitute an

offer to sell or the solicitation of an offer to subscribe for or

buy or an invitation to purchase or subscribe for any securities or

the solicitation of any vote or approval in any jurisdiction, nor

shall there be any sale, issuance or transfer of securities in any

jurisdiction in contravention of applicable law. No offer of

securities will be made except by means of a prospectus meeting the

requirements of Section 10 of the Securities Act.

Important Additional Information Will Be Filed with the

SEC

In connection with the contemplated transactions, New Amcor

intends to file a registration statement on Form S-4 with the

SEC that will include a joint proxy statement of Bemis and

prospectus of New Amcor. The joint proxy statement/prospectus will

also be sent or given to Bemis shareholders and will contain

important information about the contemplated

transactions. Shareholders are urged to read the joint

proxy statement/prospectus and other relevant documents filed or to

be filed with the SEC carefully when they become available because

they will contain important information about Bemis, Amcor, New

Amcor, the contemplated transactions and related matters.

Investors and shareholders will be able to obtain free copies of

the joint proxy statement/prospectus (when available) and other

documents filed with the SEC by Bemis, Amcor and New Amcor through

the SEC’s website (www.sec.gov).

Participants in the Solicitation

Bemis, Amcor, New Amcor and their respective directors and

executive officers may be deemed to be participants in the

solicitation of proxies from Bemis shareholders in connection with

the contemplated transactions. Information about Bemis’ directors

and executive officers is set forth in its proxy statement for its

2018 Annual Meeting of Shareholders and its annual report on

Form 10-K for the fiscal year ended December 31, 2017,

which may be obtained for free at the SEC’s website

(www.sec.gov). Information about

Amcor’s directors and executive officers is set forth in its Annual

Report 2017, which may be obtained for free at ASX’s website

(www.asx.com.au). Additional information regarding the interests of

participants in the solicitation of proxies in connection with the

contemplated transactions will be included in the joint proxy

statement/prospectus that New Amcor intends to file with the

SEC.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180806005344/en/

CONTACTS FOR AMCORInvestorsAMCOR LimitedTracey

Whitehead, +61 3 9226 9028Head of Investor

Relationstracey.whitehead@amcor.comorMedia -

AustraliaCitadel-MAGNUSJames Strong, +61 4 4888

1174jstrong@citadelmagnus.comMedia – North

AmericaKekstDaniel Yunger, + 1

212-521-4879daniel.yunger@kekst.comMedia – EuropeAMCOR

LimitedTR Reid, +41 44 316 7674Head of Global

CommunicationsorCONTACTS FOR BEMISInvestorsBemis

Company Inc.Erin M. Winters, 920-527-5288Director of Investor

RelationsorMediaJoele Frank, Wilkinson Brimmer

KatcherMatthew Sherman / Sharon Stern, 212-355-4449

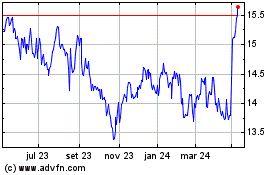

Amcor (ASX:AMC)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

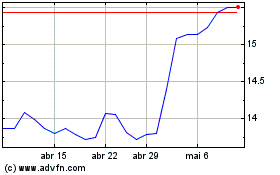

Amcor (ASX:AMC)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024