Americas Silver Corporation (TSX:USA) (NYSE American:USAS)

(“Americas Silver” or the “Company”) today reported consolidated

financial and operational results for the third quarter of

2018.

This earnings release should be read in conjunction with the

Company’s Management’s Discussion and Analysis, Financial

Statements and Notes to Financial Statements for the corresponding

period, which have been posted on the Americas Silver Corporation

SEDAR profile at www.sedar.com, on its EDGAR profile at

www.sec.gov, and are also available on the Company’s website at

www.americassilvercorp.com. All figures are in U.S. dollars unless

otherwise noted.

Third Quarter Highlights

- Production of 1.4 million consolidated

silver equivalent ounces1, an increase of 27% year-over-year,

including 0.3 million silver ounces.

- Revenue of $11.7 million and net loss

of $5.8 million for the quarter or ($0.13) per share, an increase

in revenue of 20% and an increase in net loss of 109% compared to

Q3-2017, including $3.3 million of negative provisional pricing

adjustments.

- Consolidated zinc production of 7.9

million pounds and lead production of 7.5 million pounds, increases

of 451% and 40%, respectively.

- Cost of sales of $9.08/oz. equivalent

silver, by-product cash cost2 of $4.95/oz. silver, and all-in

sustaining cost2 (“AISC”) of $15.94/oz. silver for the quarter,

representing year-over-year decreases of 1% and 61%, and an

increase of 1%, respectively. Cost of sales of $8.46/oz. equivalent

silver, by-product cash cost of negative ($1.31/oz.) silver, and

AISC of $9.03/oz. silver for the first nine months of 2018,

representing year-over-year decreases of 16%, 114%, and 31%,

respectively.

- San Rafael achieved its goal of

sustaining a milling rate of over 1,700 tonnes per operating

day.

- The Galena Complex resumed normal

operations in mid-July following hoist repairs completed late in

Q2-2018.

- The Company entered into a definitive

agreement with Pershing Gold Corporation (“Pershing Gold”) to

complete a business combination. The combination will add an

attractive gold-silver development project in Nevada with

significant precious metal growth to the Company’s production

profile.

- The Company had a cash balance of $3.1

million and working capital balance of $3.3 million as at September

30, 2018.

During the quarter, cash cost, AISC and silver equivalent

production were negatively impacted as the realized prices on sales

of zinc and lead decreased by 22% and 18%, respectively, compared

to the first half of 2018. Production at the Cosalá Operations for

the quarter was negatively impacted by an unplanned mill repair at

Los Braceros lasting approximately 10 days impacting one of the two

mills, in addition to approximately 120 hours of lost operating

time at the process plant due to periodic power outages stemming

from delivery problems originating with the electricity provider.

Galena Complex milled tonnage was lower as the mine resumed normal

operations following hoist repairs completed late in Q2, 2018.

“Despite the operational and weather-related challenges, and the

low metal prices experienced in the third quarter, the Company

continued to increase mill throughput at San Rafael through the

quarter,” said Darren Blasutti, President & CEO of Americas

Silver. “As a result, the San Rafael mill is now consistently

achieving over 1,700 tonnes per day. With capital development to

reach the Main Zone nearing completion at San Rafael and Galena

running smoothly since mid-July, we expect the fourth quarter to

achieve the highest silver and silver equivalent production quarter

of 2018.”

Mr. Blasutti continued, “Shareholders of both companies have

been enthusiastic in their support of the announced combination

with Pershing Gold Corporation, expected to close in Q1, 2019.

Pershing Gold will add a shovel-ready, low capital, gold-silver

project in Nevada to the Company’s operating platform. When it is

completed, it is expected to add 75,000 to 90,000 oz. of low-cost

gold ounces, generate post-tax cash flow of approximately $25-30

million annually over expected seven-year the life of mine, and

increase precious metal production by over 5 times to over 60% of

silver equivalent production. This is a transformational

transaction for our Company and we are looking forward to beginning

development of our next mine now that our management team has

completed the ramp-up of San Rafael.”

Consolidated

Production and Operating Costs

Consolidated Production and Cost Details

Q3 2018 Q3 2017

Total ore processed (tonnes milled) 170,379

174,677 Silver produced (ounces)

323,497 564,833 Zinc produced (pounds)

7,906,601 1,433,961 Lead produced (pounds)

7,536,660 5,369,482 Copper

produced (pounds) - 507,285

Silver equivalent produced (ounces) 1,410,909

1,107,874 Silver recovery (percent)

76.2 90.9 Silver grade (grams per tonne)

77 111 Silver sold (ounces)

309,672 542,298 Zinc sold

(pounds) 7,813,957 1,258,532

Lead sold (pounds) 7,194,207

5,224,322 Copper sold (pounds) -

460,227 Cost of sales ($ per silver equivalent ounce)1

$9.08 $9.17 Silver cash cost ($ per

silver ounce) 1 $4.95 $12.61

All-in sustaining cost ($ per silver ounce) 1

$15.94 $15.92 1 Cost of sales per

silver equivalent ounce, cash costs per silver ounce, and all-in

sustaining costs per silver ounce for Q3, 2017 excludes

pre-production of 160,128 silver ounces and 238,919 silver

equivalent ounces mined from El Cajón, respectively, and 5,146

silver ounces and 30,161 silver equivalent ounces mined from San

Rafael, respectively, during its commissioning period.

Pre-production revenue and cost of sales from El Cajón and San

Rafael are capitalized as an offset to development costs.

During Q3-2018, the Company produced 1.4 million consolidated

silver equivalent ounces including 0.3 million silver ounces,

compared to production of 1.1 million consolidated silver

equivalent ounces including 0.6 million silver ounces during

Q3-2017. Consolidated silver equivalent production increased due to

the greater output of zinc and lead by-product metals from the San

Rafael mine at the Cosalá Operations though tempered by lower

silver-lead tonnage at the Galena Complex. Consolidated production

was negatively impacted during the quarter at the Cosalá Operations

by the unplanned mill repair and the periodic power outages. As

previously announced on June 14, 2018, production at the Galena

Complex was negatively impacted by two issues affecting the No.3

Shaft: a 10-day suspension of hoisting in late April to allow the

repair of steel sets in the shaft, and a 17-day shutdown of the

hoist in June to address a mechanical failure in the brake

mechanism. Repairs were completed by the end of June 2018 and the

Galena Complex resumed normal operations in Q3-2018 by mid-July

losing roughly half a month’s production.

In Q3-2018, consolidated costs of sales were $9.08/oz.

equivalent silver, by-product cash costs were $4.95/oz. silver, and

AISC were $15.94/oz. silver, representing year-over-year decreases

of 1% and 61%, and an increase of 1%, respectively. The improvement

in cash costs was a result of the significant increase in zinc and

lead production primarily from the San Rafael mine compared to

Q3-2017 when the Company’s previous mine, Nuestra Señora, was in

production. The base metal production increases were offset by

decreases in the realized prices for zinc and lead during the

period which negatively impacted by-product cash costs, and

AISC.

Net loss of $5.8 million was recorded for the quarter, compared

to net loss of $2.8 million for the third quarter of 2017. The

increase in net loss was primarily attributable to decreases in

realized prices on the sale of silver, zinc, and lead compared to

prior periods including negative provisional price adjustments of

$3.3 million on the sale of concentrate and higher depreciation and

deletion charges. The Company generated cash from operating

activities before non-cash working capital items of $4.9 million

for the first three quarters of 2018 compared to $5.9 million in

the same period in 2017.

As announced by joint press release September 30, 2018 the

Company has entered into a definitive agreement to complete a

business combination with Pershing Gold Corporation (“Pershing

Gold”). The combination will add an attractive gold-silver

development project in Nevada with significant precious metal

growth to the Company’s production profile. Under the terms of the

transaction, shareholders of Pershing Gold will receive 0.715

common shares of the Company for each outstanding Pershing Gold

common shares held. Please see the below section “Important

Information for Investors and Stockholders”.3 A special meeting of

shareholders of Americas Silver will be held in connection with the

transaction and closing is expected to occur during the first

quarter of 2019 subject to, among other conditions, receipt of

necessary approvals, including the requisite Americas Silver and

Pershing Gold shareholder approvals and regulatory approvals.

Effective August 29, 2018, union membership at the Galena

Complex ratified a collective bargaining agreement between a

subsidiary of Americas Silver and the United Steel Workers Union.

The agreement runs until August 28, 2022 and covers substantially

all the operation’s hourly employees.

The Company experienced a number of unexpected events that have

impacted year-to-date production, specifically: Galena’s 10-day

shutdown for shaft maintenance (April); Galena’s 17-day No.3 hoist

issue (June-July) and ramp-up of production in July; at Cosalá, a

10-day shutdown for repairs to one of the primary grinding mills;

and approximately 120 hours of cumulative mill downtime due to

periodic power outages stemming from delivery problems originating

with the electricity provider. The metals industry has also

experienced a sharp decrease in spot and realized prices as

previously discussed, impacting silver equivalency, cost of sales

per ounce, cash costs per ounce, and AISC. As a result, the Company

is re-assessing its guidance for the year and intends to update the

market later in the Q4, 2018.

Further information concerning the consolidated and individual

mine operations is included in the Company’s third quarter

Condensed Interim Consolidated Financial Statements for the nine

months ended September 30, 2018 and Management’s Discussion and

Analysis for the three and nine months ended September 30,

2018.

Q3 2018 Earnings Conference

Call

President & CEO Darren Blasutti will be hosting a Q3, 2018

earnings conference call on Monday, November 5, 2018 at 8:30am EDT.

A copy of the presentation will be made available on the company’s

website at www.americassilvercorp.com.

Step 1: Dial-InCanada and USA Toll-Free

1-800-954-0584International Toll Number +1-416-981-9004

Step 2: Online

Loginhttps://cc.callinfo.com/r/1embx189mhs59&eom

Callers are advised to dial-in 10-15 minutes prior to the call.

As there is no audio on the participant URL, please dial-in to

follow along with the presentation.

About Americas Silver

Corporation

Americas Silver is a silver mining company focused on growth in

precious metals from its existing asset base and execution of

targeted accretive acquisitions. It owns and operates the Cosalá

Operations in Sinaloa, Mexico and the Galena Mine Complex in Idaho,

USA. The Company holds an option on the San Felipe development

project in Sonora, Mexico. For further information please see SEDAR

or americassilvercorp.com.

Qualified Persons

Daren Dell, Chief Operating Officer and Qualified Person under

Canadian Securities Administrators guidelines, has approved the

applicable contents of this news release. For further information

please see the “Technical Report and Estimated Resources for the

San Felipe Project, Sonora, Mexico” with an effective date of March

15, 2018, the “Americas Silver Corporation Technical Report on the

Galena Complex, Shoshone County, Idaho, USA” with an effective date

of December 23, 2016, and “Technical Report and Preliminary

Feasibility Study for the San Rafael Property, Sinaloa, Mexico”

with an effective date of March 18, 2016, as applicable, which are

available on Americas Silver’s profile on SEDAR at www.sedar.com or

at americassilvercorp.com.

All scientific and technical information related to Pershing

Gold’s Relief Canyon project has been reviewed and approved by

either Paul Tietz, Certified Professional Geologist #11720, Neil

Prenn, P.E. #7844, Carl Defilippi, registered member SME#775870RM,

or Mark Jorgensen, MMSA#01202QP who are each Qualified Persons

under the definitions established by NI 43-101. For further

information please see “Technical Report and Feasibility Study for

the Relief Canyon Project, Pershing County, Nevada, U.S.A.” with an

effective date of May 24, 2018, which is available on Pershing

Gold’s EDGAR profile at https://www.sec.gov/ and on SEDAR at

www.sedar.com.

Cautionary Statement on Forward-Looking Information:

This news release contains “forward‐looking information” within

the meaning of applicable securities laws. Forward‐looking

information includes, but is not limited to, the Company’s

expectations intentions, plans, assumptions and beliefs with

respect to, among other things, the realization of exploration,

operational, production, and development plans, the Cosalá

Operations and Galena Complex as well as the Company’s financing

efforts. Often, but not always, forward‐looking information can be

identified by forward‐looking words such as “anticipate”,

“believe”, “expect”, “goal”, “plan”, “intend”, “estimate”, “may”,

“assume” and “will” or similar words suggesting future outcomes, or

other expectations, beliefs, plans, objectives, assumptions,

intentions, or statements about future events or performance.

Forward‐looking information is based on the opinions and estimates

of the Company as of the date such information is provided and is

subject to known and unknown risks, uncertainties, and other

factors that may cause the actual results, level of activity,

performance, or achievements of the Company to be materially

different from those expressed or implied by such forward looking

information. This includes the ability to develop and operate the

Cosalá and Galena properties, risks associated with the mining

industry such as economic factors (including future commodity

prices, currency fluctuations and energy prices), ground conditions

and factors other factors limiting mine access, failure of plant,

equipment, processes and transportation services to operate as

anticipated, environmental risks, government regulation, actual

results of current exploration and production activities, possible

variations in ore grade or recovery rates, permitting timelines,

capital expenditures, reclamation activities, social and political

developments and other risks of the mining industry, as well as

statements relating to the proposed transaction with Pershing Gold,

including, potential improvements in production, cash flow, and

access to capital, references to anticipated profits, risk,

realized value and return; construction, production, and

development plans at the Relief Canyon project and estimates and

forecasts with respect to the expected project economics for the

Relief Canyon project, the timing of the respective shareholder

meetings, receipt of required approvals and the closing of the

proposed transaction. Although the Company has attempted to

identify important factors that could cause actual results to

differ materially from those contained in forward-looking

information, there may be other factors that cause results not to

be as anticipated, estimated, or intended. Readers are cautioned

not to place undue reliance on such information. By its nature,

forward-looking information involves numerous assumptions, inherent

risks and uncertainties, both general and specific that contribute

to the possibility that the predictions, forecasts, and projections

of various future events will not occur. Additional information

regarding the factors that may cause actual results to differ

materially from these forward‐looking statements is available in

Pershing Gold’s filings with the SEC, including the Annual Report

on Form 10-K for the year ended December 31, 2017, and in the

Americas Silver’s filings with on SEDAR. The Company undertakes no

obligation to update publicly or otherwise revise any

forward-looking information whether as a result of new information,

future events or other such factors which affect this information,

except as required by law.

Important Information for Investors and Stockholders:

This press release is for informational purposes only and does

not constitute an offer to sell or the solicitation of an offer to

buy any securities or a solicitation of any vote or approval with

respect to the proposed transaction between Americas Silver and

Pershing Gold or otherwise, nor shall there be any sale of

securities in any jurisdiction in which such offer, solicitation or

sale would be unlawful prior to registration or qualification under

the securities laws of any such jurisdiction. No offer of

securities shall be made except by means of a prospectus meeting

the requirements of Section 10 of the United States Securities Act

of 1933, as amended.

Pershing Gold, Americas Silver and certain of their respective

directors, executive officers and other members of management and

employees may be deemed to be participants in the solicitation of

proxies from the stockholders of Pershing Gold and Americas Silver

in connection with the proposed transaction. Information about the

directors and executive officers of Pershing Gold is set forth in

its proxy statement for its 2018 annual meeting of stockholders,

which was filed with the SEC on April 30, 2018. Information about

the directors and executive officers of Americas Silver is set

forth in its Form 6-K for its 2018 annual meeting of shareholders,

which was filed with the SEC on April 13, 2018. These documents can

be obtained free of charge from the sources indicated below. Other

information regarding those persons who are, under the rules of the

SEC, participants in the proxy solicitation and a description of

their direct and indirect interests, by security holdings or

otherwise, will be contained in Pershing Gold’s proxy

statement/prospectus and other relevant materials to be filed with

or furnished to the SEC when they become available.

The proposed transaction (or certain matters related thereto)

between Americas Silver and Pershing Gold will be submitted to the

respective stockholders of Americas Silver and Pershing Gold for

their consideration. Americas Silver will file with the SEC a

registration statement on Form F-4 that will include a proxy

statement of Pershing Gold that also constitutes a prospectus of

Americas Silver. Americas Silver will file an Information Circular

with the applicable Canadian securities administrators. Pershing

Gold will deliver the proxy statement/prospectus to its

stockholders as required by applicable law. Americas Silver will

deliver the Information Circular to its stockholders as required by

applicable law. Americas Silver and Pershing Gold also plan to file

or furnish other documents with the SEC regarding the proposed

transaction. This press release is not a substitute for any

prospectus, proxy statement, information circular or any other

document which Americas Silver and Pershing Gold may file with or

furnish to the SEC in connection with the proposed transaction.

INVESTORS AND SECURITY HOLDERS OF AMERICAS SILVER AND PERSHING GOLD

ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND INFORMATION

CIRCULAR AND ANY OTHER RELEVANT DOCUMENTS THAT WILL BE FILED WITH

THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT AMERICAS

SILVER, PERSHING GOLD, THE PROPOSED TRANSACTION AND RELATED

MATTERS. Investors and stockholders will be able to obtain free

copies of the proxy statement/prospectus and information circular

and other documents containing important information about Americas

Silver and Pershing Gold, once such documents are filed with the

SEC through the website maintained by the SEC at www.sec.gov, and

with the Canadian securities administrators, through the website at

www.sedar.com. Pershing Gold and Americas Silver will make

available free of charge at www.pershinggold.com and

www.americassilvercorp.com, respectively (in the “Investor

Relations” and “Investors” section, as applicable), copies of

materials they file with, or furnish to, the SEC and the Canadian

securities administrators.

1 Silver equivalent production throughout this press release was

calculated based on silver, zinc, lead and copper realized prices

during each respective period.2 Cash cost per ounce and all-in

sustaining cost per ounce are non-IFRS performance measures with no

standardized definition. For further information and detailed

reconciliations, please refer to the Company’s 2017 year-end and

quarterly MD&A.3 Details and other documents and information

relating to the Pershing Gold merger transaction can be found on

the Company’s website at www.americassilvercorp.com, its SEDAR

profile at www.sedar.com and EDGAR profile at www.sec.gov.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181104005047/en/

Americas Silver CorporationDarren Blasutti,

416-848-9503President and CEO

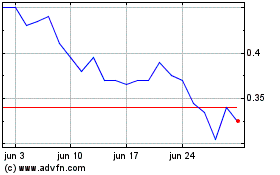

Americas Gold and Silver (TSX:USA)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Americas Gold and Silver (TSX:USA)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025