A pioneer in predicting the risk of

developing serious diseases

- €3.6 million raised through the Global

Placement and Open-Price Offering

- Offering price set at €9.3 per

share

- Shares due to start trading on the

Euronext Growth market on 21 December 2018

Regulatory News:

PrediLife (Paris:ALPRE), an innovative company focusing on

personalised medicine with the aim of predicting the risk of

developing serious diseases and saving lives, today confirmed the

success of its initial public offering on the Euronext Growth Paris

market.

“We are proud to announce that our initial public offering on

Euronext Growth Paris has been a success. We would like to thank

our new shareholders for the trust they have placed in us, as well

as our existing shareholders for continuing to support us. The

funds raised will, in particular, enable PrediLife to step up the

French and international commercial roll-out of the MammoRisk®,”

said Stéphane Ragusa, Founder, Chairman and CEO of

PrediLife.

The IPO which was structured as a global offer (the “Offering”)

consisting of an open-price offering (“OPO”) to the public in

France and a global placement (“Global Placement”) mainly intended

for institutional investors in France and certain other countries.

The capital increase forming part of the IPO allowed the Company to

raise €3.6 million.

The number of new shares issued as part of the Offering was

386,154 i.e. 83.6% through the Global Placement and 16.4% through

the OPO. The Company’s board of directors set the price of the

Global Placement and the OPO at €9.30 per share, thus giving

PrediLife a market capitalisation of €25.7 million.

Settlement of the new shares issued through the Offering will

take place on Euronext Growth Paris on 20 December 2018, and the

shares will have the following ISIN code FR0010169920 and the

following ticker ALPRE.

Purpose of fundraising:

The issue of new shares is intended to finance the French and

international commercial roll-out of MammoRisk®, as well as

PrediLife’s ordinary expenditure and the repayment of loans granted

by Bpifrance, and to enable the Company to pursue its research

programmes.

Ownership structure at the end of the

Offering

After the capital increase taking place as part of the IPO,

PrediLife’s share capital will amount to €68,953.85, divided into

2,758,154 ordinary shares and held as follows:

Shareholders Number of shares

Number of votingrights

% of capital % of voting rights Stéphane Ragusa

1,526,076 2,966,076 55.33% 62.82%

Caravelle 808,571 1,220,971 29.32%

25.86% Antoine Bricard 89,414 89,414 3.24%

1.89% Clearside Holding APS 57,156 57,156

2.07% 1.21% Employees 27,200 27,200

0.99% 0.58% Treasury shares 4,800 0

0.17% 0.00% Free float 244,937 360,937

8.88% 7.64%

TOTAL 2,758,154

4,721,754 100.00% 100.00%

Each of the subscription commitments of the historical

shareholders as part of the IPO was 100% satisfied.

Offering details

Offering price

- The OPO and Global Placement were

priced at €9.30 per share.

- This means that PrediLife’s market

capitalisation will be around €25.7 million after the capital

increase.

Offering size and gross proceeds

- 386,154 new shares were issued under

the OPO and Global Placement.

- The gross proceeds of the issue

amounted to €3.6 million (including €1.6 million through the

set-off of debt).

Breakdown of shares subscribed through the Offering

- Global Placement: 322,907 new shares

(almost €3.0 million and around 83.6% of the total number of shares

allotted).

- OPO: 63,247 new shares allotted to the

public (almost €0.6 million and around 16.4% of the total number of

shares allotted).

- Under the OPO, A1 and A2 orders will be

100% fulfilled.

Indicative timetable

20 December 2018

- Capital increase formally noted by the board of directors

- Settlement of the OPO and Global Placement

21 December 2018

- Beginning of trading of the Company’s shares on the Euronext

Growth Paris market

PrediLife share identification codes

- Name: PrediLife

- ISIN code: FR0010169920

- Ticker: ALPRE

- Compartment: Euronext Growth Paris

- Business segment: 9537 - Software

Financial intermediaries involved in the IPO

SwissLife

Banque Privée

Listing Sponsor

Lead Manager and Bookrunner

Information accessible to the public – Copies of the

prospectus, approved on 4 December 2018 under number 18-545 by the

Autorité des Marchés Financiers, are available free of charge and

on request from PrediLife, (39 rue Camille Desmoulins – 94800

Villejuif, France), and on the websites of the AMF

(www.amf-france.org) and the Company (www.predilife.com).

Risk factors

PrediLife draws the public’s attention to the risks relating to

business activities described in chapter 4 “Risk factors” in the

first section of the prospectus and the risks related to the

offering described in chapter 2 “Offering-related risk factors” in

the second section of the prospectus.

About PrediLife

PrediLife develops innovative predictive medicine solutions that

combine proven medical techniques (genetic testing, medical imaging

etc.) with mathematical models using a large amount of statistical

data, which potentially allow individuals to ascertain their own

risk profile regarding the occurrence of a large number of serious

diseases.

The company markets its MammoRisk® personalised breast cancer

screening solution in Europe and the United States. The solution

combines medical imaging – using its proprietary DenSeeMammo

software for measuring breast density – with Big Data and

statistics through a scoring tool that uses patient-related data

(age, breast density, family history, biopsy results, ethnic

origin) and a study of the patient’s genetic profile through a

genetic test, to establish a polygenic risk score. The solution

addresses demand among women and medical practitioners for

screening programmes that are personalised according to the risk of

breast cancer.

PrediLife is in charge of assessing breast cancer risks as part

of the European MyPeBS reference study. The study’s main aim is to

compare the current screening approach – where age is the only

criterion used – with a new screening strategy based on each

woman’s risk level. Another aim of the MyPeBS study is to produce

European guidelines for the introduction of personalised

screening.

Personalised screening is likely to have a major impact on

public health, initially by reducing the number of cases in which

breast cancer is diagnosed only at an advanced stage, and

eventually by reducing the breast cancer mortality rate.

To find out more, visit http://www.predilife.com/home.php

Disclaimer

A prospectus approved by the Autorité des Marchés Financiers

(“AMF”) on 4 December 2018 under number I.18-545 is

available free of charge from PrediLife, and on the websites of

PrediLife (www.predilife.com) and the AMF (www.amf-france.org). The

public’s attention is drawn to the “risk factors” sections of the

prospectus.

Information relating to the issuance of shares by PrediLife may

not be communicated or disseminated to the public in a country in

which registration or approval is required. No steps to do so have

been taken or will be taken, outside France, in any country in

which such steps would be required. The issuance or subscription of

PrediLife shares may be subject to specific statutory or regulatory

restrictions in some countries. PrediLife shall bear no liability

in the event that any person breaches those restrictions.

This press release is not a prospectus within the meaning of

Directive 2003/71/EC of the European Parliament and of the Council

of 4 November 2003 as amended, in particular by Directive

2010/73/EU of the European Parliament and of the Council of 24

November 2010, as amended and as transposed into the laws of each

Member State of the European Economic Area (the “Prospectus

Directive”).

As regards Member States of the European Economic Area other

than France that have transposed the Prospectus Directive

(“Member States”), no steps have been taken or will be taken

to allow an offering of PrediLife securities to the public that

results in the requirement for a Prospectus to be published in any

Member State. As a result, PrediLife shares may be offered in

Member States only: (a) to legal entities that are qualified

investors as defined in the Prospectus Directive or (b) in other

cases that do not require PrediLife to publish a prospectus under

article 3(2) of the Prospectus Directive.

In the United Kingdom, this document is being sent to and is

intended only for persons who are “qualified investors” within the

meaning of article 2(1)(e) (i), (ii) or (iii) of the Prospectus

Directive and who are also considered to be (i) “investment

professionals” (persons with professional experience regarding

investments) within the meaning of article 19(5) of the Financial

Services and Markets Act 2000 (Financial Promotion) Order 2005 (as

amended, hereinafter the “Order”), (ii) persons falling

within the scope of article 49(2)(a) to (d) (“high net worth

companies, unincorporated associations, etc.”) of the Order, or

(iii) persons to whom an invitation or inducement to engage in

investment activity (within the meaning of article 21 of Financial

Services and Markets Act 2000) may legally be sent as part of the

issue or sale of financial securities (with all such persons

collectively being referred to as “Persons Concerned”). In the

United Kingdom, this document is being sent only to Persons

Concerned and no person other than a Person Concerned may use or

act on the basis of this document. Any investment or investment

activity to which this document refers is only accessible to

Persons Concerned and must only be carried out with Persons

Concerned.

This document is not an offering to sell PrediLife shares in the

United States. PrediLife shares may not be sold in the United

States in the absence of registration or a registration waiver with

respect to the US Securities Act of 1933, as amended. PrediLife is

not planning to register an offering in the United States or to

make any public offering of shares in the United States.

This press release does not constitute and cannot be regarded as

constituting an offering to the public or a subscription offering,

or as soliciting interest from the public with respect to a

transaction involving a public offering of PrediLife financial

securities in any country in which such an offering would breach

applicable laws and regulations.

The dissemination of this press release in certain countries may

constitute a breach of applicable laws. The information contained

in this press release does not constitute an offering of securities

in the United States, Canada, Australia, Japan or any other

country. This press release must not be published, transmitted or

distributed, directly or indirectly, in the United States, Canada,

Australia or Japan.

This press release may be drafted in French and English. In the

event of differences between the two texts, the French version

shall take precedence.

Do not disseminate, directly or indirectly, in

the United States, Canada, Australia or Japan.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181218005755/en/

PredilifeStéphane RagusaChairman and Chief Executive

OfficerPierre VerdetDeputy Chief Executive

Officerinvestisseurs@predilife.com

NewCapInvestor relationsTristan Roquet Montégon /

Mathilde BohinMedia relationsAnnie-Florence Loyer / Léa

Jacquinpredilife@newcap.eu+33 (0)1 44 71 94 94

SwissLife Banque PrivéeJean-Michel Cabriot+33 (0)1 53 29

15 61capitalmarkets@swisslifebanque.fr

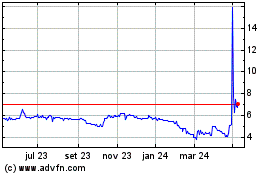

Predilife (EU:ALPRE)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

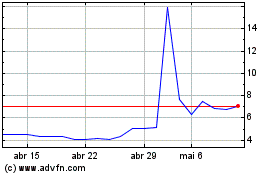

Predilife (EU:ALPRE)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025