Americas Silver Corporation (TSX: USA) (NYSE American: USAS)

(“Americas Silver” or the “Company”) and Pershing Gold Corporation

(NASDAQ: PGLC) (TSX: PGLC) (FWB: 7PG1) (“Pershing Gold”) are

pleased to announce that their respective shareholders have

provided the requisite approvals in respect of the previously

announced business combination transaction (the “Transaction”)

between the two companies.

Americas Silver shareholders approved a special resolution to

amend the Company’s articles of incorporation to create a new class

of non-voting preferred shares, and an ordinary resolution to

authorize the Transaction and issuance of shares thereunder, as

described in the management information circular dated December 4,

2018. Pershing Gold shareholders voted at their meeting to approve

the Transaction as well as other related resolutions described in

its proxy statement filed with the U.S. Securities and Exchange

Commission (“SEC”) on November 30, 2018.

“The Board of Directors and management teams of both companies

are pleased that our shareholders overwhelmingly supported this

Transaction and would like to thank them for their continuing

support,” said Darren Blasutti, President and Chief Executive

Officer of Americas Silver. “Today marks another important step

forward toward our goal of creating a profitable, low‐cost precious

metal company. Upon closing of the Transaction, we will be focused

on advancing the next phase of the combined company’s growth by

financing and bringing the low-capital, high-return Relief Canyon

Mine into production.”

Completion of the Transaction remains subject to satisfaction or

waiver of certain customary conditions, including the completion of

review and approval by the Committee on Foreign Investment in the

United States (“CFIUS”) (discussed in Americas Silver’s January 2,

2019 press release). All deadlines for declarations and

transactions under review by CFIUS are currently tolled due to the

lapse in appropriations attributable to the partial U.S. government

shutdown.

“We are pleased to announce the support of our shareholders for

this transaction, which provides a clear path to the development of

Relief Canyon into a producing gold mine,” said Steve Alfers,

President and Chief Executive Officer of Pershing Gold. “I would

like to thank the Pershing Gold Board of Directors, management and

every one of our employees who have worked diligently over the past

six years to successfully advance Relief Canyon to its current

development-ready status.”

In anticipation of the closing of the Transaction, Americas

Silver has been in discussions with several parties interested in

providing financing for the development of the Relief Canyon Mine.

The Company has advanced to a short list of potential parties and

intends to announce its plans for financing the mine by the end of

the first quarter of 2019 assuming the successful closing of the

Transaction.

About Americas Silver

Corporation

Americas Silver is a precious metal mining company focused on

growth from its existing asset base and execution of targeted

accretive acquisitions. It owns and operates the Cosalá Operations

in Sinaloa, Mexico and the Galena Complex in Idaho, USA. Americas

Silver holds an option on the San Felipe development project in

Sonora, Mexico. For further information please see SEDAR or

americassilvercorp.com.

About Pershing Gold

Pershing Gold Corporation is an emerging gold producer whose

primary asset is the Relief Canyon open-pit gold mine in Pershing

County, Nevada. Pershing Gold’s landholdings cover over 29,000

acres that include Relief Canyon Mine and surrounding lands in all

directions. Pershing Gold is currently permitted to resume mining

at Relief Canyon under the existing Plan of Operations.

Cautionary Statement on Forward‐Looking Information:

This news release contains “forward-looking information” within

the meaning of applicable securities laws. Forward-looking

information includes, but is not limited to, Americas Silver’s and

Pershing Gold’s expectations, intentions, plans, assumptions and

beliefs with respect to, among other things, Americas Silver’s

financing efforts; the consummation of the Transaction;

construction, production, and development plans at Relief Canyon

Mine; the timing of the closing of the Transaction; the completion

of CFIUS review and its recommendations; and the estimated

construction timeline for Relief Canyon Mine. Often, but not

always, forward-looking information can be identified by

forward-looking words such as “anticipate”, “believe”, “expect”,

“goal”, “plan”, “intend”, “estimate”, “may”, “assume” and “will” or

similar words suggesting future outcomes, or other expectations,

beliefs, plans, objectives, assumptions, intentions, or statements

about future events or performance. Forward-looking information is

based on the opinions and estimates of Americas Silver and Pershing

Gold as of the date such information is provided and is subject to

known and unknown risks, uncertainties, and other factors that may

cause the actual results, level of activity, performance, or

achievements of Americas Silver or Pershing Gold to be materially

different from those expressed or implied by such forward-looking

information. With respect to the Transaction, these risks and

uncertainties include the risk that Americas Silver or Pershing

Gold may be unable to obtain any regulatory approvals required for

the Transaction, including CFIUS approval, or that regulatory

approvals may delay the Transaction or cause the parties to abandon

the Transaction; the risk that other conditions to closing may not

be satisfied; the length of time needed to consummate the proposed

Transaction, which may be longer than anticipated for various

reasons; the risk that the businesses will not be integrated

successfully; the diversion of management time on

Transaction‐related issues; the risk that costs associated with the

integration are higher than anticipated; and litigation risks

related to the Transaction. With respect to the businesses of

Americas Silver and Pershing Gold, these risks and uncertainties

include interpretations or reinterpretations of geologic

information; unfavorable exploration results; inability to obtain

permits required for future exploration, development or production;

general economic conditions and conditions affecting the industries

in which the Company and Pershing Gold operate; the uncertainty of

regulatory requirements and approvals; fluctuating mineral and

commodity prices; the ability to obtain necessary future financing

on acceptable terms or at all; the ability to develop and operate

the Relief Canyon property; and risks associated with the mining

industry such as economic factors (including future commodity

prices, currency fluctuations and energy prices), ground conditions

and other factors limiting mine access, failure of plant,

equipment, processes and transportation services to operate as

anticipated, environmental risks, government regulation, actual

results of current exploration and production activities, possible

variations in ore grade or recovery rates, permitting timelines,

capital expenditures, reclamation activities, labor relations,

social and political developments and other risks of the mining

industry. Although the Company has attempted to identify important

factors that could cause actual results to differ materially from

those contained in forward-looking information, there may be other

factors that cause results not to be as anticipated, estimated, or

intended. Readers are cautioned not to place undue reliance on such

information. Additional information regarding the factors that may

cause actual results to differ materially from this forward‐looking

information is available in Pershing Gold’s filings with the SEC,

including the Annual Report on Form 10‐K for the year ended

December 31, 2017 and the Proxy Statement of Pershing Gold dated

November 29, 2018, and in Americas Silver’s filings with the

Canadian Securities Administrators on SEDAR and with the SEC,

including the management information circular of Americas Silver

dated December 4, 2018. Neither Americas Silver nor Pershing Gold

undertake any obligation to update publicly or otherwise revise any

forward-looking information whether as a result of new information,

future events or other such factors which affect this information,

except as required by law. Neither Americas Silver nor Pershing

Gold gives any assurance (1) that Americas Silver and Pershing Gold

will achieve its expectations, or (2) concerning the result or

timing thereof. All subsequent written and oral forward‐looking

information concerning Pershing Gold, Americas Silver, the proposed

Transaction, the combined company or other matters attributable to

Pershing Gold or Americas Silver or any person acting on their

behalf are expressly qualified in their entirety by the cautionary

statements above.

No Offer or Solicitation

This press release is for informational purposes only and does

not constitute an offer to sell or the solicitation of an offer to

buy any securities, nor shall there be any sale of securities in

any jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such jurisdiction. No offer or sale of

securities shall be made except pursuant to registration under the

United States Securities Act of 1933, as amended (the “U.S.

Securities Act”), and any applicable state securities laws or in

compliance with an exemption therefrom.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190109005798/en/

Darren BlasuttiPresident and CEOAmericas Silver

Corporation416‐848‐9503

Steve AlfersPresident and CEOPershing Gold

Corporation720-974-7254

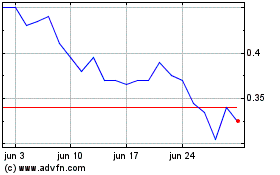

Americas Gold and Silver (TSX:USA)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Americas Gold and Silver (TSX:USA)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025