Americas Silver Corporation (TSX:USA) (NYSE American:USAS)

(“Americas Silver” or the “Company”) today reported consolidated

financial and operational results for the fourth quarter and

year-end of 2018.

This earnings release should be read in conjunction with the

Company’s Management’s Discussion and Analysis, Financial

Statements and Notes to Financial Statements for the corresponding

period, which have been posted on the Americas Silver Corporation

SEDAR profile at www.sedar.com, on its EDGAR profile at

www.sec.gov, and are also available on the Company’s website at

www.americassilvercorp.com. All figures are in U.S. dollars unless

otherwise noted.

Fourth Quarter and Year-End

Highlights

- Revenue of $68.4 million in 2018

compared to revenue of $54.3 million in 2017, an increase of 26%,

despite significantly lower metal prices in the second half of

2018.

- Net cash generated from operating

activities in 2018 of $9.0 million compared to net cash flow

generated from operating activities of $1.6 million in 2017.

- Net loss of $10.7 million for the year

or ($0.25) per share, compared to a net loss of $3.5 million or

($0.09) per share in 2017, an increase in net loss of 208% and net

loss per share of 178% compared to fiscal 2017. The increase in net

loss was due to lower metal prices and increases in non-cash and

non-reoccurring items, including asset write-downs, a tax

contingency, and transaction costs.

- The Company entered into a definitive

agreement with Pershing Gold Corporation (“Pershing Gold”) to

complete a business combination at the end of September 2018 (the

“Transaction). The parties to the Transaction are currently

awaiting regulatory approval by the Committee of Foreign Investment

in the United States (“CFIUS”).

- Year-end production of 6.3 million

consolidated silver equivalent ounces1, an increase of 32%

year-over-year, including 1.4 million consolidated silver

ounces.

- Fourth quarter production of 1.8

million consolidated silver equivalent ounces, an increase of 32%

year-over-year, including 0.4 million consolidated silver

ounces.

- Year-end consolidated zinc production

of 34.2 million pounds and lead production of 30.5 million pounds,

increases of 194% and 20%, respectively.

- Cost of sales of $8.29/oz. equivalent

silver, by-product cash cost2 of negative ($0.63/oz.) silver, and

all-in sustaining cost3 (“AISC”) of $9.80/oz. silver for the year,

representing year-over-year decreases of 18%, 107%, and 26%,

respectively.

- Cost of sales of $7.87/oz. equivalent

silver, by-product cash cost of $1.14/oz. silver, and AISC of

$11.78/oz. silver for the fourth quarter of 2018, representing

year-over-year decreases of 22%, 87%, and 17%, respectively.

- The Company had a cash balance of $3.5

million and working capital balance of $6.4 million as at December

31, 2018.

- The Company will be hosting a

conference call subsequent to the closing of the Pershing Gold

acquisition to discuss the Transaction, financing for the

development of Relief Canyon Mine, and year-end 2018 financial

results.

“The Company had strong cash flow growth during San Rafael’s

ramp-up to full production in 2018 despite the significant decrease

in metal prices in the second half of the year,” said Darren

Blasutti, President & CEO of Americas Silver. “With the

Pershing Gold shareholder votes behind us, we are looking forward

to closing the Transaction immediately after CFIUS approval. We

expect a concurrent Board construction approval and announcement of

fully-funded financing for the Relief Canyon project. The combined

company will be focused on increasing silver production and

bringing Relief Canyon to first pour before the end of the

2019.”

Pershing Gold Acquisition

Update

Respective shareholders of Americas Silver and Pershing Gold

provided the requisite approvals for the previously announced

Transaction between the two companies on January 9, 2019. The

Transaction is currently awaiting regulatory approval from CFIUS.

The Company views discussions with CFIUS as progressing well and

expects that the necessary approvals before the end of the first

quarter.

Consolidated Production and Operating

Costs

Table 1 Consolidated Production and Cost

Details Q4 2018 Q4 2017

YTD 2018 YTD 2017 Total ore processed

(tonnes milled) 186,585 168,901 685,152

690,498 Silver produced (ounces) 395,294 409,545

1,417,537 2,056,017 Zinc produced (pounds)

10,223,692 4,895,670 34,219,472 11,623,138

Lead produced (pounds) 9,088,862 7,427,357

30,466,799 25,392,619 Copper produced (pounds) -

78,541 - 1,167,401 Silver equivalent produced

(ounces) 1,799,741 1,358,441 6,286,531

4,746,387 Silver recovery (percent) 75.8 82.8

76.6 89.0 Silver grade (grams per tonne) 87 91

84 104 Silver sold (ounces) 398,753

410,518 1,424,745 2,056,122 Zinc sold (pounds)

10,135,730 4,413,526 33,714,154 10,919,556

Lead sold (pounds) 9,177,876 7,074,875

30,620,153 25,144,192 Copper sold (pounds) -

94,544 - 1,144,385 Cost of sales ($ per silver

equivalent ounce)1 $7.87 $10.16 $8.29

$10.13 Silver cash cost ($ per silver ounce) 1 $1.14

$8.75 ($0.63) $9.45 All-in sustaining cost ($ per

silver ounce) 1 $11.78 $14.20 $9.80

$13.29 1 Cost of sales per silver equivalent ounce, cash

costs per silver ounce, and all-in sustaining costs per silver

ounce in Q4, 2017 excludes pre-production of 45,344 silver ounces

and 405,162 silver equivalent ounces mined from San Rafael during

its commissioning period, and for YTD 2017 excludes pre-production

of 50,490 silver ounces and 435,323 silver equivalent ounces mined

from San Rafael during its commissioning period, and excludes

pre-production of 245,391 silver ounces and 360,530 silver

equivalent ounces mined from El Cajón during its commissioning

period. Pre-production revenue and cost of sales from San Rafael

and El Cajón are capitalized as an offset to development costs.

During 2018, the Company produced 6.3 million consolidated

silver equivalent ounces including 1.4 million silver ounces,

compared to production of 4.7 million consolidated silver

equivalent ounces including 2.1 million silver ounces during 2017.

The significant increase in consolidated silver equivalent

production with a corresponding decrease in silver production

relative to 2017 was primarily the result of the San Rafael mine

experiencing its first full year of operation after declaring

commercial production in December 2017. San Rafael contributed over

190% greater zinc production and over 125% greater lead production,

with approximately 50% lower silver production at the Cosalá

operations due to mine sequencing in the part of the San Rafael

deposit with the lowest silver grades. Operations at the Galena

Complex were also negatively impacted by two separate operational

issues in the first of half of 2018 involving its No.3 Shaft that

inhibited normal hoisting for approximately 27 days in total as

previously disclosed that also caused reductions in silver and lead

production in 2018.

As a result of the increased silver equivalent production,

revenues increased by $14.1 million or 26% from $54.3 million

during 2017 to $68.4 million during 2018 despite low metal prices

in the second half of the year. Net loss increased by $7.8 million

from $3.5 million during 2017 to $11.3 million during 2018, largely

due to non-cash and non-reoccurring items. The increase in net loss

was primarily attributable to higher cost of sales as San Rafael

ramped up to full production in Q4, 2018, higher depletion and

amortization reflecting a full year of production from San Rafael,

Pershing Gold Transaction costs, the write-down of an asset, a

contingency on value added taxes, and higher income tax expense,

offset by higher net revenue from increased silver equivalent

production, a gain on the disposal of assets, and gains on

derivative instruments.

Consolidated costs of sales were $8.29/oz. equivalent silver,

by-product cash costs were negative ($0.63/oz.) silver, and AISC

were $9.80/oz. silver, representing year-over-year decreases of

18%, 107%, and 26%, respectively. The improvement in cash costs was

a result of the significant increase in zinc and lead production

primarily from the San Rafael mine compared to 2017 when the

Company’s previous mine, Nuestra Señora, was in production. The

base metal production increases were offset by decreases in the

realized prices for zinc and lead during the year which negatively

impacted by-product cash costs, and AISC.

Further information concerning the consolidated and individual

mine operations is included in the Company’s Consolidated Financial

Statements for the year ended December 31, 2018 and Management’s

Discussion and Analysis for the same period.

2019 Consolidated

Guidance

Table 2 Consolidated Results and Guidance

2018 Actual 2019 Guidance Silver

Production (ounces) 1.4M oz. 1.6 – 2.0M oz. Silver

Equivalent Production (ounces) 6.3M oz. 6.6 - 7.0M

oz. Cost of Sales ($ per silver equiv. ounce) $8.29/oz.

$8.00 - $10.00/oz. Cash Costs ($ per silver ounce)

$(0.59)/oz. $4.00 - $6.00/oz. All-in Sustaining Costs ($ per

silver ounce) $9.82/oz. $10.00 - $12.00/oz. Capital

Expenditures $15M $10M - $11M

Consolidated guidance for 2019 is 1.6 – 2.0 million silver

ounces and 6.6 - 7.0 million silver equivalent ounces at cash costs

of $4.00 to $6.00 per silver ounce and all-in sustaining costs of

$10.00 to $12.00 per silver ounce including budgeted capital of $10

- $11 million. The increase in silver production is due to greater

expected mill throughput at San Rafael in 2019 as the initial ramp

up in 2018 has been completed. The increase in cash cost and all-in

sustaining cost per ounce is due to the lower assumed metal prices

affecting estimated by-product metal revenue from the San Rafael

and Galena mines. The Company assumed $14.50 per ounce silver,

$1.15 per pound zinc, $0.90 per pound lead, and an exchange rate of

19 Mexican pesos to US dollar for these guidance estimates. This

guidance is supported by estimated zinc production of approximately

36-40 million lbs. and estimated lead production of 34-38 million

lbs. in 2019. The Company’s consolidated exploration budget for

fiscal 2019 is approximately $1.5 million.

This guidance excludes construction capital and exploration

spending related to Pershing Gold’s Relief Canyon Mine. The Company

intends to update guidance for Relief Canyon after the close of the

Transaction.

About Americas Silver

Corporation

Americas Silver is a precious metal mining company focused on

growth from its existing asset base and execution of targeted

accretive acquisitions. It owns and operates the Cosalá Operations

in Sinaloa, Mexico and the Galena Complex in Idaho, USA. The

Company holds an option on the San Felipe development project in

Sonora, Mexico. For further information please see SEDAR or

americassilvercorp.com.

Daren Dell, Chief Operating Officer and a Qualified Person under

Canadian Securities Administrators guidelines, has approved the

applicable contents of this news release. For further information

please see SEDAR or americassilvercorp.com.

Mineral reserve and resource estimates and exploration results

from 2018 drill programs can be found on the Company’s website at

www.americassilvercorp.com.

Cautionary Statement on Forward-Looking Information:

This news release contains “forward-looking information” within

the meaning of applicable securities laws. Forward-looking

information includes, but is not limited to, Americas Silver’s and

Pershing Gold’s expectations, intentions, plans, assumptions and

beliefs with respect to, among other things, Americas Silver’s

financing efforts; the consummation of the Transaction;

construction, production, and development plans at Relief Canyon

Mine; the timing of the closing of the Transaction; the completion

of CFIUS review and its recommendations; and the estimated

construction timeline for Relief Canyon Mine. Often, but not

always, forward-looking information can be identified by

forward-looking words such as “anticipate”, “believe”, “expect”,

“goal”, “plan”, “intend”, “estimate”, “may”, “assume” and “will” or

similar words suggesting future outcomes, or other expectations,

beliefs, plans, objectives, assumptions, intentions, or statements

about future events or performance. Forward-looking information is

based on the opinions and estimates of Americas Silver and Pershing

Gold as of the date such information is provided and is subject to

known and unknown risks, uncertainties, and other factors that may

cause the actual results, level of activity, performance, or

achievements of Americas Silver or Pershing Gold to be materially

different from those expressed or implied by such forward-looking

information. With respect to the Transaction, these risks and

uncertainties include the risk that Americas Silver or Pershing

Gold may be unable to obtain any regulatory approvals required for

the Transaction, including CFIUS approval, or that regulatory

approvals may delay the Transaction or cause the parties to abandon

the Transaction; the risk that other conditions to closing may not

be satisfied; the length of time needed to consummate the proposed

Transaction, which may be longer than anticipated for various

reasons; the risk that the businesses will not be integrated

successfully; the diversion of management time on

Transaction‐related issues; the risk that costs associated with the

integration are higher than anticipated; and litigation risks

related to the Transaction. With respect to the businesses of

Americas Silver and Pershing Gold, these risks and uncertainties

include interpretations or reinterpretations of geologic

information; unfavorable exploration results; inability to obtain

permits required for future exploration, development or production;

general economic conditions and conditions affecting the industries

in which the Company and Pershing Gold operate; the uncertainty of

regulatory requirements and approvals; fluctuating mineral and

commodity prices; the ability to obtain necessary future financing

on acceptable terms or at all; the ability to develop and operate

the Relief Canyon property; and risks associated with the mining

industry such as economic factors (including future commodity

prices, currency fluctuations and energy prices), ground conditions

and other factors limiting mine access, failure of plant,

equipment, processes and transportation services to operate as

anticipated, environmental risks, government regulation, actual

results of current exploration and production activities, possible

variations in ore grade or recovery rates, permitting timelines,

capital expenditures, reclamation activities, labor relations,

social and political developments and other risks of the mining

industry. Although the Company has attempted to identify important

factors that could cause actual results to differ materially from

those contained in forward-looking information, there may be other

factors that cause results not to be as anticipated, estimated, or

intended. Readers are cautioned not to place undue reliance on such

information. Additional information regarding the factors that may

cause actual results to differ materially from this forward‐looking

information is available in Pershing Gold’s filings with the SEC,

including the Annual Report on Form 10‐K for the year ended

December 31, 2017 and the Proxy Statement of Pershing Gold dated

November 29, 2018, and in Americas Silver’s filings with the

Canadian Securities Administrators on SEDAR and with the SEC,

including the management information circular of Americas Silver

dated December 4, 2018. Neither Americas Silver nor Pershing Gold

undertake any obligation to update publicly or otherwise revise any

forward-looking information whether as a result of new information,

future events or other such factors which affect this information,

except as required by law. Neither Americas Silver nor Pershing

Gold gives any assurance (1) that Americas Silver and Pershing Gold

will achieve its expectations, or (2) concerning the result or

timing thereof. All subsequent written and oral forward‐looking

information concerning Pershing Gold, Americas Silver, the proposed

Transaction, the combined company or other matters attributable to

Pershing Gold or Americas Silver or any person acting on their

behalf are expressly qualified in their entirety by the cautionary

statements above.

No Offer or Solicitation

This press release is for informational purposes only and does

not constitute an offer to sell or the solicitation of an offer to

buy any securities, nor shall there be any sale of securities in

any jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such jurisdiction. No offer or sale of

securities shall be made except pursuant to registration under the

United States Securities Act of 1933, as amended (the “U.S.

Securities Act”), and any applicable state securities laws or in

compliance with an exemption therefrom.

1 Silver equivalent production throughout this press release was

calculated based on silver, zinc, lead and copper realized prices

during each respective period.

2 Cash cost per ounce and all-in sustaining cost per ounce are

non-IFRS performance measures with no standardized definition. For

further information and detailed reconciliations, please refer to

the Company’s 2018 year-end and quarterly MD&A.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190304005349/en/

Darren BlasuttiPresident and CEO416‐848‐9503

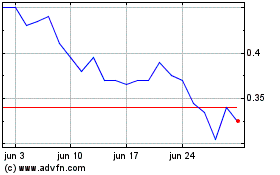

Americas Gold and Silver (TSX:USA)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Americas Gold and Silver (TSX:USA)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025