- Scheme booklet and Registration

Statement on Form S-41 expected to be made publicly available

today;

- Bemis and Amcor shareholder meetings

scheduled for Thursday 2 May 2019;

- Combination is unanimously recommended

by the Boards of Directors of both companies; and

- Amcor Board of Directors and Senior

Leadership appointments announced.

Amcor Limited (ASX: AMC) and Bemis Company, Inc. (NYSE: BMS)

announce that further, important progress has been made towards

completion of their all-stock transaction, with the filing of

shareholder documentation and finalisation of Board of Director and

Senior Leadership appointments.

The combination of the two complementary companies offers a

transformational and unique opportunity to create the global leader

in consumer packaging, with the footprint, scale and capabilities

to deliver an industry leading value proposition for customers and

employees, and the most significant innovations for the

environment.

Substantial value is expected to be created for shareholders

through the delivery of USD 180 million in pre-tax annual net cost

synergies2, and a stronger financial profile going forward,

including higher margins and cash flow and the potential for even

stronger growth. Amcor intends to maintain a competitive,

progressive dividend which is expected to increase over time and

will have a strong investment grade balance sheet with immediate

capacity for further investment or share buy backs.

The combination is unanimously recommended by the Boards of

Directors of both companies.

Amcor CEO Ron Delia said: “Since announcing this transaction, we

have made significant progress towards closure, and further

important steps have been taken today with the finalisation of

Board of Director and Senior Leadership appointments as well as

shareholder documentation filings. As we approach the closing of

the transaction, the opportunities to further strengthen our

industry leading value proposition for customers, employees and the

environment and to create value for shareholders are even

clearer.”

Bemis President and CEO Bill Austen said: “We are one step

closer to combining our two companies to create the global leader

in consumer packaging. Bemis and Amcor are highly complementary

organizations that each possess extraordinary talent, and we are

confident that together, we will create an even stronger global

enterprise that will benefit our shareholders, employees, and

customers over the long term. This is the next exciting chapter for

Bemis, and our teams will carry forward the Bemis legacy as they

showcase their talents, knowledge, and passion for our customers

and inspired packaging solutions.”

Shareholder documentation

Under the proposed combined structure, upon closing, Amcor plc

will establish a primary listing on the New York Stock Exchange

(NYSE) and will have a listing on the Australian Securities

Exchange (ASX). Based on filing requirements in Australia and the

US, various documents are expected to be made available to

shareholders today.

A Scheme Booklet is expected to be registered with the

Australian Securities and Investments Commission (ASIC) and a

Registration Statement on Form S-41 (S-4), including a

preliminary proxy statement/prospectus, will be filed with and

available on the website of the US Securities and Exchange

Commission (SEC) today. These documents will subsequently be lodged

with the ASX.

These documents include important information relevant to the

transaction including notices of shareholder meetings, proxy

information, historical financial information, details of expected

key dates and Amcor plc Board of Directors appointments. Selected,

summarised information is provided below:

Expected key dates

Event

Date

Scheme Booklet expected to be

registered with ASIC and lodged with the ASX

Wednesday 13 March 2019

S-4 filed with the SEC

Tuesday 12 March 2019*

S-4 expected to be declared effective

by the SEC

Wednesday 27 March 2019*

Amcor shareholder meeting

Thursday 2 May 2019

Bemis shareholder meeting

Thursday 2 May 2019*

Expected completion date

Wednesday 15 May 2019

Dates reference Melbourne, Australia time

unless otherwise indicated. The transaction and the timing

estimates contained in this announcement are subject to certain

approvals and closing conditions, including court approval and

antitrust clearance. These dates are subject to change and

reasonable notice of any such variation will be provided. No

assurance can be given that the closing will occur within this

timeframe or at all.* US Eastern Time.

Financial information

Following completion of the transaction, Amcor will prepare and

present its financial results on a quarterly basis under generally

accepted accounting principles in the US (US GAAP). Amcor’s

adjusted US GAAP results are not materially different to underlying

financial results prepared in accordance with International

Financial Accounting Standards (IFRS)3 and any variations in

accounting treatment will not impact the underlying operational

performance or cash generation of the business going forward.

Further information related to Amcor’s historical US GAAP results4

can be found in section 4.4 of the Scheme Booklet.

Regulatory approvals

As announced on 12 February 2019, the process toward securing

required antitrust clearances and other regulatory consents in all

jurisdictions which are conditional to closing have either been

completed or are progressing in line with expectations.

The transaction remains subject to regulatory approval in the

United States and Brazil and the companies are in advanced

discussions with regulators in both countries. Those advanced

discussions include the potential for required remedies. Inclusive

of remedies required and announced by the European Commission on 11

February 2019, collective potential remedies would represent an

immaterial proportion of the total sales for the combined company

and would not impact the USD 180 million of net cost synergies

expected to be delivered by the end of the third year following

completion.

Board of Directors

As previously announced, upon completion of the transaction, the

Amcor plc Board of Directors will comprise 11 members. Eight of

these directors will be the current Amcor Limited directors with

the remaining three being current Bemis directors. The Bemis

directors joining Amcor’s Board on completion of the transaction

will be Arun Nayar, David Szczupak and Philip Weaver. Relevant

biographical information for Directors can be found in sections 4.2

and 5.4 of the Scheme Booklet and in the ‘Management and Corporate

Governance of New Amcor’ section of the S-4.

Senior Leadership appointments

Amcor has undertaken a thorough process of evaluating the

management talent from both companies as well as external

candidates, and several Senior Leadership appointments that will

take effect upon completion of the transaction are announced

today.

Business Group leaders

Flexibles Europe, Middle East and Africa

Peter Konieczny, currently Business Group President Amcor

Flexibles Europe, Middle East and Africa, will continue in this

role overseeing the combined Amcor and Bemis businesses in this

region. Peter joined Amcor in February 2010.

Flexibles North America

Fred Stephan, currently President, Bemis North America, will

join Amcor as Business Group President Amcor Flexibles North

America, overseeing the combined Amcor and Bemis businesses in this

region. Fred joined Bemis during 2017, after spending 20 years

leading various businesses at General Electric and at Johns

Manville, a Berkshire Hathaway company.

Flexibles Latin America

Aluisio Fonseca, currently Amcor Vice President Flexibles South

America, will be appointed Business Group President for Latin

America and will oversee the combined Amcor and Bemis businesses in

this region. Aluisio joined Amcor in 2018, after spending more than

20 years in regional and business unit leadership roles at Tetra

Pak.

Flexibles Asia Pacific

Michael Zacka, currently Amcor Chief Commercial Officer and

President Amcor Flexibles Asia Pacific, will continue in this role

overseeing the combined Amcor and Bemis businesses in this region.

Michael joined Amcor in 2017, bringing extensive experience in the

global packaging and food industries including 20 years with Tetra

Pak.

Amcor Specialty Cartons

Jerzy Czubak will continue to lead this business. Jerzy joined

Amcor in 1994.

Amcor Rigid Plastics

Eric Roegner will continue to lead this business. Eric joined

Amcor in 2018 after spending 13 years in executive roles in Arconic

Inc (previously known as Alcoa Inc).

Other leadership announcements

Sheri Edison, currently Bemis Senior Vice President and Chief

Legal Officer, will be appointed Amcor General Counsel. Sheri

joined Bemis in 2010.

Bill Jackson, currently Bemis Senior Vice President and Chief

Technology Officer, will be appointed Amcor Flexibles Chief

Technology Officer. This is a newly created role and will further

enhance the focus and alignment around innovation, research and

development across Amcor’s global Flexibles business, to drive

further competitive advantage and to meet growing consumer demand

for differentiated and sustainable packaging. Bill joined Bemis in

2013.

Bill Austen and Mike Clauer, currently Bemis’ Chief Executive

Officer and Chief Financial Officer, respectively, will no longer

continue in those positions upon completion of the transaction and

both have agreed to provide transition support to the combined

company on an interim basis, if required.

Amcor CEO Mr Ron Delia said: “The most important task in

bringing Amcor and Bemis together is creating a strong team of

leaders. As we prepare for the combination, we have the unique

opportunity to turn two strong teams into the industry’s best. I

look forward to working alongside all of our talented senior

leaders to realise the substantial growth potential of the combined

company and to build an even stronger future together.”

Amcor’s other functional leaders will continue in their existing

roles. The process of establishing the next level of management

using the same rigorous approach to evaluate candidates from both

Amcor and Bemis, as well as external candidates, is underway.

Shareholder information lines

Shareholder information lines have been established to provide

further information or assistance in connection with the

transaction.

Amcor shareholders can contact the Amcor Shareholder Information

line on 1300 302 458 (within Australia), or +61 1300 302 458

(outside Australia), Monday to Friday between 8.00am and 7.30pm

(Sydney time).

Bemis shareholders can contact Bemis’ proxy solicitor, Innisfree

M&A Incorporated, on +1 888 750 5834.

Notes:

- S-4 available under company filings for

Amcor plc; has not yet been declared effective by the SEC.

- USD 180 million pre-tax annual net cost

synergies are expected to be achieved by the end of the third year

after completion of the transaction. Reflects cost synergies only

and is incremental to benefits expected to be realised from the

Bemis ‘Agility’ improvement plan. Further details about the net

cost synergies and expected costs to achieve are set out in section

6.6 of the Scheme Booklet and in the “the Transaction’ section of

the S-4.

- Adjusted US Non-GAAP earnings are

explained in sections 4.4 and 6.7 of the Scheme Booklet.

- For the years ended 30 June 2016, 2017

and 2018 and the six months ended 31 December 2018 and 2017.

Cautionary Statement Regarding

Forward-Looking Statements

This communication contains certain statements that are

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the

Securities Exchange Act of 1934, as amended. Amcor Limited

(“Amcor”), its subsidiary Amcor plc

(f/k/a Arctic Jersey Limited) (“New

Amcor”) and Bemis Company, Inc. (“Bemis”) have identified some of these

forward-looking statements with words like “believe,” “may,”

“could,” “would,” “might,” “possible,” “will,” “should,” “expect,”

“intend,” “plan,” “anticipate,” “estimate,” “potential,” “outlook”

or “continue,” the negative of these words, other terms of similar

meaning or the use of future dates. Forward-looking statements in

this communication include, without limitation, statements about

the anticipated benefits of the contemplated transactions,

including future financial and operating results and expected

synergies and cost savings related to the contemplated

transactions, the plans, objectives, expectations and intentions of

Amcor, New Amcor or Bemis and the expected timing of the completion

of the contemplated transactions. Such statements are based on the

current expectations of the management of Amcor or Bemis, as

applicable, are qualified by the inherent risks and uncertainties

surrounding future expectations generally, and actual results could

differ materially from those currently anticipated due to a number

of risks and uncertainties. None of Amcor, New Amcor or Bemis, or

any of their respective directors, executive officers or advisors,

provide any representation, assurance or guarantee that the

occurrence of the events expressed or implied in any

forward-looking statements will actually occur. Risks and

uncertainties that could cause results to differ from expectations

include, but are not limited to: uncertainties as to the timing of

the contemplated transactions; uncertainties as to the approval of

the transactions by Bemis’s and Amcor’s shareholders, as required

in connection with the contemplated transactions; the possibility

that a competing proposal will be made; the possibility that the

closing conditions to the contemplated transactions may not be

satisfied or waived, including that a governmental entity may

prohibit, delay or refuse to grant a necessary approval; the

effects of disruption caused by the announcement of the

contemplated transactions or the performance of the parties’

obligations under the transaction agreement making it more

difficult to maintain relationships with employees, customers,

vendors and other business partners; the risk that shareholder

litigation in connection with the contemplated transactions may

affect the timing or occurrence of the contemplated transactions or

result in significant costs of defense, indemnification and

liability; uncertainties as to the availability and terms of

refinancing for the existing indebtedness of Amcor or Bemis in

connection with the contemplated transactions; uncertainties as to

whether and when New Amcor may be listed in the US S&P 500

index and the S&P / ASX 200 index; uncertainties as to whether,

when and in what amounts future dividend payments may be made by

Amcor, Bemis or New Amcor; other business effects, including the

effects of industry, economic or political conditions outside of

the control of the parties to the contemplated transactions;

transaction costs; actual or contingent liabilities; disruptions to

the financial or capital markets; other risks and uncertainties

discussed in Amcor’s disclosures to the Australian Securities

Exchange (“ASX”), including the “2018

Principal Risks” section of Amcor’s Annual Report 2018; and other

risks and uncertainties discussed in Bemis’s filings with the U.S.

Securities and Exchange Commission (the “SEC”), including the “Risk Factors” section of

Bemis’s annual report on Form 10-K for the fiscal year ended

December 31, 2018. You can obtain copies of Amcor’s disclosures to

the ASX for free at ASX’s website (www.asx.com.au). You can obtain

copies of Bemis’s filings with the SEC for free at the SEC’s

website (www.sec.gov). Forward-looking statements included herein

are made only as of the date hereof and none of Amcor, New Amcor or

Bemis undertakes any obligation to update any forward-looking

statements, or any other information in this communication, as a

result of new information, future developments or otherwise, or to

correct any inaccuracies or omissions in them which become

apparent, except as expressly required by law. All forward-looking

statements in this communication are qualified in their entirety by

this cautionary statement.

Legal Disclosures

No Offer or Solicitation

This communication is not intended to and does not constitute an

offer to sell or the solicitation of an offer to subscribe for or

buy or an invitation to purchase or subscribe for any securities or

the solicitation of any vote or approval in any jurisdiction, nor

shall there be any sale, issuance or transfer of securities in any

jurisdiction in contravention of applicable law. No offer of

securities will be made except by means of a prospectus meeting the

requirements of Section 10 of the Securities Act.

Important Information

In connection with the contemplated transactions, New Amcor will

file a Registration Statement on Form S-4 (S-4) with the SEC that

includes in preliminary form a joint proxy statement of Bemis and

prospectus of New Amcor. The joint proxy statement/prospectus will

also be sent or given to Bemis shareholders and will contain

important information about the contemplated transactions. The S-4

has not yet been declared effective by the SEC. Shareholders are

urged to read the joint proxy statement/prospectus and other

relevant documents filed or to be filed with the SEC carefully when

they become available because they will contain important

information about Bemis, Amcor, New Amcor, the contemplated

transactions and related matters. Investors and shareholders

may obtain free copies of the joint proxy statement/prospectus and

other documents filed with the SEC by Bemis, Amcor and New Amcor

through the SEC’s website (www.sec.gov).

Amcor shareholders should carefully read the Scheme Booklet

prepared in relation to the transaction in its entirety before

deciding how to vote on the Scheme of Arrangement that is part of

the transaction. Bemis shareholders should carefully read the S-4,

and any other relevant documents filed by New Amcor or Bemis before

making any voting or investment decision.

This announcement does not contain all of the information

contained in the Scheme Booklet and S-4. For example section 1.2 of

the Scheme Booklet outlines the disadvantages of the transaction

and section 7 of the Scheme Booklet contains certain risk

considerations relating to the transaction that should also be

considered by Amcor shareholders, and the ‘Risk Factors’ section of

the S-4 outlines the risks relating to the transaction that should

also be considered by Bemis shareholders.

Participants in the Solicitation

Bemis, Amcor, New Amcor and their respective directors and

executive officers may be deemed to be participants in the

solicitation of proxies from Bemis shareholders in connection with

the contemplated transactions. Information about Bemis’s directors

and executive officers is set forth in its proxy statement for its

2018 Annual Meeting of Shareholders and its annual report on Form

10-K for the fiscal year ended December 31, 2018, which may be

obtained for free at the SEC’s website (www.sec.gov). Information about Amcor’s directors and

executive officers is set forth in its Annual Report 2018, which

may be obtained for free at ASX’s website (www.asx.com.au).

Additional information regarding the interests of participants in

the solicitation of proxies in connection with the contemplated

transactions will be included in the joint proxy

statement/prospectus that New Amcor intends to file with the

SEC.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190312005750/en/

Contacts for Amcor:

InvestorsTracey WhiteheadHead of Investor RelationsAmcor

Limited+61 3 9226 9028tracey.whitehead@amcor.com

Media – AustraliaJames StrongCitadel-MAGNUS+61 448 881

174jstrong@citadelmagnus.com

Media – EuropeTR ReidHead of Global CommunicationsAmcor

Limited+41 44 316 7674tr.reid@amcor.com

Media – North AmericaDaniel YungerKekstCNC+1 212 521

4879daniel.yunger@kekstcnc.com

Contacts for Bemis:

InvestorsErin M. WintersDirector of Investor

RelationsBemis Company Inc.+1 920 527 5288

MediaMatthew Sherman / Sharon SternJoele Frank, Wilkinson

Brimmer Katcher+1 212 355 4449

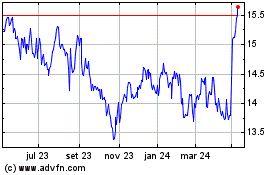

Amcor (ASX:AMC)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

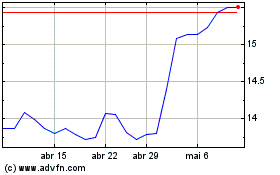

Amcor (ASX:AMC)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024