Regulatory News:

The Board of Directors of Total Gabon (Paris:EC) met on

April 4, 2019 to approve the financial statements for the year

ending December 31, 2018.

Brent averaged $71.3 per barrel ($/b) in 2018, up 32% from 54.2

$/b in 2017. Total Gabon’s equity share of oil production averaged

36,100 barrels of oil per day (b/d) in 2018, compared to 44,600 b/d

in 2017.

Revenues amounted to $905 million in 2018, down 1% compared

to 2017 ($914 million), the 33% positive price effect impacted by

the 24% decrease in volumes sold.

Net income amounted to $258 million versus

$108 million in 2017, reflecting higher oil prices, the

Company’s cost-cutting program and the disposal of the remaining

interest in the mature Rabi-Kounga field.

The Board of Directors decided that it will recommend at the

Annual Shareholders’ Meeting on May 21, 2019 that shareholders

approve the payment of a dividend of $11 per share, for a total

payout of $49.5 million. This represents a significant increase

from the previous year’s dividend of $5.5 per share.

The dividend will be payable in euros (or the equivalent in CFA

francs), based on the €/$ exchange rate on the date of the Annual

Meeting.

Main Financial

Indicators

2018

2017

2018

vs

2017

Average Brent price $/b

71.3 54.2

+32% Average Total Gabon crude price(1) $/b

66.3 49.7 +33% Crude oil production

from fields operated by Total Gabon

kb/d(2)

24.7 48.5 -49% Crude oil

production

from Total Gabon interests(3)

kb/d

36.1 44.6 -19% Sales

volumes(1) Mb(4)

12.1 15.9 -24%

Revenues(5) $M

905 914 -1% Funds

generated from operations(6) $M

398 379

+5% Capital expenditure $M

159

152 +5% Net income $M

258 108

n/a

(1) Excluding profit oil reverting to the Gabonese Republic as

per production sharing contracts.(2) kb/d: Thousand barrels per

day(3) Including profit oil reverting to the Gabonese Republic as

per production sharing contracts.(4) Mb: Million barrels.(5)

Revenue from hydrocarbon sales and services (transportation,

processing and storage), including profit oil reverting to the

Gabonese Republic as per production sharing contracts.(6) Funds

generated from operations are comprised of the operating cash flow,

the gains or losses on disposals of assets and the working capital

changes.

2018 Results

Selling Prices

Reflecting the higher Brent price, the selling price of the

Mandji and Rabi Light crude oil grades marketed by Total Gabon

averaged 66.3 $/b, up 33% compared to the previous year.

Production

Total Gabon’s equity share of operated and non-operated oil

production(1) declined by 19% from the previous year to 36,100

barrels per day in 2018, due mainly to:

- The sale of non-strategic mainly

onshore assets on October 31, 2017 and September 30, 2018;

- Damage that occurred on the Anguille

and Torpille fields’ compressors during the first half 2018;

- The natural decline of fields;

This was partly offset by:

- The impact of the increased stake in

the Baudroie-Mérou license from 50% to 100% in June 2017.

1 Including profit oil reverting to the Gabonese Republic as per

production sharing contracts.

Revenues

Revenues amounted to $905 million in 2018, down 1% compared

to 2017, the 33% positive crude price effect impacted by the 24%

decrease in volumes sold. Furthermore, revenues from services

provided to third parties also decreased, mainly due to the

disposal of the onshore Rabi-Coucal-Cap Lopez pipeline network.

Funds Generated From Operations

Cash flow from operating activities amounted to $398 million in

2018 up 5% compared to 2017. The positive effects due to the

increase in crude prices and to the Company's cost-cutting program

were impacted by the increase of working capital related to the

crude oil lifting program and by the decrease in volumes sold.

Capital Expenditure

Capital expenditure amounted to $159 million in 2018, up 5%

compared to 2017. This includes an onshore well service campaign,

integrity works offshore (Anguille, Torpille, Grondin) and onshore

(Cap Lopez terminal), geoscience and development studies and the

preparation and roll-out of the initial phase of the Torpille field

redevelopment.

Net Income

Net income amounted to $258 million, a significant

improvement compared to 2017 ($108 million) thanks to the increase

in oil price, to the Company’s cost-cutting program and to the

disposal of the remaining 32.9% interest in the mature Rabi-Kouga

field.

Highlights since the beginning of last

quarter 2018

Board of Directors Meeting of November 15, 2018

The Board of Directors reviewed and approved the budget for

2019.

Société anonyme incorporated in Gabon

with a Board of Directors and share capital of

$76,500,000Headquarters: Boulevard Hourcq, Port-Gentil, BP

525, Gabonese Republicwww.total.gaRegistered in

Port-Gentil: 2000 B 00011

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190404005673/en/

Media contact:

actionnariat-totalgabon@total.com

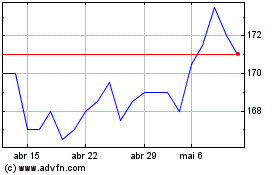

TotalEnergies EP Gabon (EU:EC)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

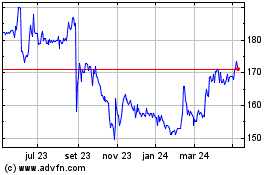

TotalEnergies EP Gabon (EU:EC)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025