Americas Silver Corporation Announces US$10 Million Investment by Eric Sprott

19 Julho 2019 - 11:43AM

Business Wire

Americas Silver Corporation (TSX: USA) (NYSE American: USAS)

(“Americas Silver” or the “Company”) is pleased to announce that

Eric Sprott has agreed to purchase 3,955,454 common shares of the

Company at a price of CDN$3.30 per share, for a total investment of

approximately US$10 million in a non-brokered private placement the

(“Private Placement”).

The Company also announces today that the agreement to sell the

Company’s option on the San Felipe project in Sonora, Mexico (“San

Felipe”) to a subsidiary of Premier Gold Mines Limited (“Premier”)

has been terminated in accordance with its terms. The Company

previously announced the agreement with Premier on April 3, 2019

for total sales proceeds of US$10.8 million.

Following the termination of the Premier agreement, the proceeds

of the Private Placement will be used to satisfy the equity

financing condition of the loan facility from Sandstorm Gold Ltd.,

as well as ongoing San Felipe option payments and general working

capital purposes.

“We are very excited to have Eric Sprott materially increase his

ownership to above 8% and continue to support the Company as a

major shareholder,” said Darren Blasutti, President & CEO of

Americas Silver. “We are also pleased to have retained the

significant upside in the San Felipe silver-zinc project for our

shareholders.”

The Private Placement is expected to close in due course and is

subject to the satisfaction of certain conditions, including

receipt of all applicable regulatory approvals, including the

approval of the Toronto Stock Exchange and the NYSE American. The

common shares to be issued under the Private Placement will have a

hold period of four months and one day from the closing date in

accordance with applicable Canadian securities laws. Medalist

Capital Ltd. acted as an advisor on the Private Placement.

About Americas Silver Corporation

Americas Silver is a precious metal mining company focused on

growth from its existing asset base and execution of targeted

accretive acquisitions. It owns and operates the Cosalá Operations

in Sinaloa, Mexico and the Galena Complex in Idaho, USA. The

Company expects to begin producing gold in the fourth quarter of

2019 at its fully funded, Relief Canyon Project, in Nevada, USA

which is currently in construction. For further information, please

see SEDAR or americassilvercorp.com.

Cautionary Statement on Forward-Looking Information:

This news release contains “forward-looking information” within

the meaning of applicable securities laws. Forward-looking

information includes, but is not limited to, Americas Silver’s

expectations, intentions, plans, assumptions and beliefs with

respect to, among other things, Americas Silver’s expected timing

and completion of the Private Placement, including the expected use

of proceeds therefrom ; construction, production, and development

plans at the Relief Canyon Project and performance expectations for

the Relief Canyon Project and impact on Americas Silver’s financial

performance; and the estimated construction timeline and costs for

the Relief Canyon Project; and the estimated timeline for

environmental approvals for the second phase of the Relief Canyon

Project;. Often, but not always, forward-looking information can be

identified by forward-looking words such as “anticipate”,

“believe”, “expect”, “goal”, “plan”, “intend”, “potential’,

“estimate”, “may”, “assume” and “will” or similar words suggesting

future outcomes, or other expectations, beliefs, plans, objectives,

assumptions, intentions, or statements about future events or

performance. Forward-looking information is based on the opinions

and estimates of Americas Silver as of the date such information is

provided and is subject to known and unknown risks, uncertainties,

and other factors that may cause the actual results, level of

activity, performance, or achievements of Americas Silver to be

materially different from those expressed or implied by such

forward-looking information. With respect to the Sandstorm

financing, risks and uncertainties include the ability of the

Company and its subsidiaries to fulfill the conditions to drawing

all the available funds under the purchase agreement and

convertible debenture and the potential for, and consequences of,

default thereunder. With respect to the business of Americas

Silver, these risks and uncertainties include interpretations or

reinterpretations of geologic information; unfavorable exploration

results; inability to obtain permits required for future

exploration, development or production; general economic conditions

and conditions affecting the industries in which the Company

operates; the uncertainty of regulatory requirements and approvals;

fluctuating mineral and commodity prices; the ability to obtain

necessary future financing on acceptable terms or at all; the

ability to develop, complete construction and operate the Relief

Canyon Project; and risks associated with the mining industry such

as economic factors (including future commodity prices, currency

fluctuations and energy prices), ground conditions and other

factors limiting mine access, failure of plant, equipment,

processes and transportation services to operate as anticipated,

environmental risks, government regulation, actual results of

current exploration and production activities, possible variations

in ore grade or recovery rates, permitting timelines, capital and

construction expenditures, reclamation activities, labor relations,

social and political developments and other risks of the mining

industry. Although the Company has attempted to identify important

factors that could cause actual results to differ materially from

those contained in forward-looking information, there may be other

factors that cause results not to be as anticipated, estimated, or

intended. Readers are cautioned not to place undue reliance on such

information. Additional information regarding the factors that may

cause actual results to differ materially from this forward‐looking

information is available in Americas Silver’s filings with the

Canadian Securities Administrators on SEDAR and with the SEC,

including the management information circular of Americas Silver

dated December 4, 2018. Americas Silver does not undertake any

obligation to update publicly or otherwise revise any

forward-looking information whether as a result of new information,

future events or other such factors which affect this information,

except as required by law. Americas Silver does not give any

assurance (1) that Americas Silver will achieve its expectations,

or (2) concerning the result or timing thereof. All subsequent

written and oral forward‐looking information concerning Americas

Silver, the Private Placement, the Sandstorm financing package, or

other matters attributable to Americas Silver or any person acting

on its behalf are expressly qualified in their entirety by the

cautionary statements above.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190719005278/en/

Darren Blasutti President and CEO Americas Silver Corporation

416‐848‐9503

Americas Gold and Silver (TSX:USA)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

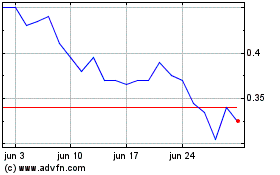

Americas Gold and Silver (TSX:USA)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025