Americas Silver Corporation (TSX: USA) (NYSE American: USAS)

(“Americas Silver” or the “Company”), a growing North American

precious metals producer, announces Q2, 2019 production and

operating cost results on a consolidated and individual basis for

its Cosalá Operations and Galena Complex and a construction update

on the Relief Canyon gold mine. All figures are in U.S.

dollars.

Second Quarter

Highlights

- Consolidated silver production of approximately 1.7 million

silver equivalenti ounces and 345,695 silver ounces, representing

an increase of 15% year-over-year to both silver and silver

equivalent.

- Consolidated cash costsii were approximately $8.28 per silver

ounce and consolidated all-in sustaining costs (“AISC”) were

approximately $16.15 per silver ounce, both representing an

increase year-over-year and from the prior quarter. These increased

costs were primarily the result of lower realized prices for zinc

and lead and lower production at the Galena Complex.

- For the first half of 2019, consolidated silver production of

approximately 3.4 million silver equivalent ounces and 740,000

silver ounces with consolidated cash costs of approximately $3.60

per silver ounce and consolidated AISC of approximately $10.50 per

silver ounce.

- Guidance for 2019 remains unchanged at 1.6 – 2.0 million silver

ounces and 6.6 – 7.0 million silver equivalent ounces at cash costs

of $4.00 to $6.00 per silver ounce and AISC of $10.00 to $12.00 per

silver ounce. The Company expects to release its second quarter

financial results on or before August 14, 2019.

- Construction is proceeding as expected at the Relief Canyon

Mine with leach pad activities progressing, mobilization of the

mining contractor expected later this week and all fabrication work

on the crusher and conveyors progressing to meet scheduled delivery

in the third quarter. First gold pour is expected in late Q4,

2019.

- Milled tonnage at the Cosalá Operations increased by 13%

year-over-year, with the San Rafael mine sustaining an average

milling rate of approximately 1,750 tonnes per operating day during

the quarter, resulting in production of approximately 1.3 million

silver equivalent ounces, including approximately 145,000 silver

ounces. Cash costs were approximately negative ($18.27) per silver

ounce and AISC were approximately negative ($11.66) per silver

ounce, representing increases of 70% and 72%, respectively, when

compared to prior year, largely due to lower zinc and lead prices

and higher treatment and refining charges.

- The Galena Complex produced approximately 383,000 silver

equivalent ounces, including approximately 200,000 silver ounces,

representing decreases of 3% and 9%, respectively, when compared to

Q2, 2018. Cash costs were approximately $27.55 per silver ounce and

AISC were approximately $36.35 per silver ounce, representing

increases of 50% and 36%, respectively, when compared to the same

period. These increases were largely due to a focus on development

over production given low metals prices during the quarter.

“The Company remains on target to achieve its full year

production and cost guidance despite the expected lower production

from the Galena Complex and lower realized metal prices in the

quarter,” said Americas Silver President and CEO Darren Blasutti.

“The second half of 2019 will be a very exciting period for our

Company as we expect not only higher silver production, but most

importantly, first gold pour from the Relief Canyon Mine.”

Consolidated Second Quarter Production

Details

Consolidated silver production for the second quarter of 2019

was 345,695 ounces and silver equivalent production was

approximately 1.7 million ounces, an increase of 15% year-over-year

for both metrics. Consolidated cash costs increased 235% to $8.28

per silver ounce year-over-year and AISC increased 199% to $16.15

per silver ounce compared year-over-year. Consolidated zinc

production increased by 27% year-over-year, while consolidated lead

production increased by 16% year-over-year.

Table 1

Consolidated Production

Highlights

Q2 2019

Q2 2018

Change

Q1 2019

Change

Processed Ore (tonnes milled)

186,310

164,313

13%

182,029

2%

Silver Production (ounces)

345,695

301,711

15%

393,824

-12%

Silver Equivalent Production (ounces)

1,683,358

1,462,170

15%

1,754,839

-4%

Silver Grade (grams per tonne)

76

77

-1%

87

-13%

Cost of Sales ($ per equiv. ounce

silver)

$8.75

$8.20

7%

$7.11

23%

Cash Costs ($ per ounce silver)

$8.28

($6.15)

>100%

($0.50)

>100%

All-in Sustaining Costs ($ per ounce

silver)

$16.15

$5.40

>100%

$5.54

>100%

Zinc Production (pounds)

11,150,174

8,756,201

27%

11,263,623

-1%

Lead Production (pounds)

7,237,607

6,216,592

16%

8,211,429

-12%

Cosalá Operations Production

Details

The Cosalá Operations produced 145,410 ounces of silver during

the second quarter of 2019 and 1.3 million ounces of silver

equivalent during the same period at cash costs of negative

($18.27) per silver ounce and AISC of negative ($11.66) per silver

ounce. Silver production increased by 54% while silver equivalent

production increased by 25% over the prior year, respectively. Cash

costs and AISC increased by 70% and 72%, respectively, compared to

Q2, 2018, despite significant increases in zinc and lead

production.

Table 2

Cosalá Operations

Highlights

Q2 2019

Q2 2018

Change

Q1 2019

Change

Processed Ore (tonnes milled)

156,998

138,708

13%

152,605

3%

Silver Production (ounces)

145,410

94,231

54%

173,169

-16%

Silver Equivalent Production (ounces)

1,300,009

1,041,246

25%

1,322,045

-2%

Silver Grade (grams per tonne)

49

42

17%

57

-14%

Cost of Sales ($ per equiv. ounce

silver)

$5.51

$5.36

3%

$4.34

27%

Cash Costs ($ per ounce silver)

($18.27)

($60.13)

-70%

($30.48)

-40%

All-in Sustaining Costs ($ per ounce

silver)

($11.66)

($41.66)

-72%

($25.85)

-55%

Zinc Production (pounds)

11,150,174

8,756,201

27%

11,263,623

-1%

Lead Production (pounds)

4,052,559

2,982,316

36%

4,626,233

-12%

Strong results were driven by sustained improvements in grade,

mill throughput and metal recovery as mining and milling operations

generally expanded at San Rafael in Q2, 2019 compared to Q2, 2018.

Ore production from the Main Zone benefited from additional working

headings providing greater operational flexibility.

Silver and lead head grades in Q2, 2019 were lower compared to

Q1, 2019 with steady zinc grades consistent with the Mining Plan

though expected to be slightly lower in the second half of 2019.

Any potential reduction in head grades over the remainder of the

year are expected to be largely offset by further gains in mill

throughput and metal recovery as additional flotation capacity was

installed during the second quarter with increased recoveries.

The increase in cash costs and AISC were largely the result of

higher treatment and refining charges and lower market prices for

both zinc and lead during the quarter. Operating costs and capital

expenditures remain in line with management expectations.

Development of the incline ramp toward the Upper Zone continues

to advance with the expectation of accessing the area prior to the

end of the year.

Galena Complex Production

Details

As previously noted in Q1, 2019, two high-tonnage stopes were

impacted by separate ground falls in late Q1, 2019 with follow-on

impact in Q2, 2019. The remaining active stopes were unable to

replace the tonnage loss associated with the impacted areas. Due to

these issues, the Galena Complex produced 200,285 ounces of silver

during Q2 2019 and 383,349 ounces of silver equivalent at cash

costs of $27.55 per silver ounce and AISC of $36.35 per silver

ounce. Silver and silver equivalent production decreased by 9% and

11%, respectively, compared to the prior quarter, and 3% and 9%,

respectively, year-over-year. Both cash costs and AISC represented

an increase of 20% due to the noted lower production and lower lead

prices during the quarter.

In order to improve mining flexibility, the Galena team

prioritized underground development and gained over 1,600 feet of

advance during the quarter. New production areas were established

on the 2400 and 3200 levels. In addition, ongoing exploration

activities continue to yield encouraging results which could

benefit production in the near term. Specifically, drilling on the

4900 level has identified new zones of mineralization (129 and 130

Veins) near existing infrastructure and further extended the strike

and vertical extent of known resources (137, 146, 167, 168 and

168HW Veins).

Table 3

Galena Complex

Highlights

Q2 2019

Q2 2018

Change

Q1 2019

Change

Processed Ore (tonnes milled)

29,312

25,605

14%

29,424

0%

Silver Production (ounces)

200,285

207,480

-3%

220,655

-9%

Silver Equivalent Production (ounces)

383,349

420,924

-9%

432,794

-11%

Silver Grade (grams per tonne)

220

263

-16%

242

-9%

Cost of Sales ($ per equiv. ounce

silver)

$19.75

$15.24

30%

$15.55

27%

Cash Costs ($ per ounce silver)

$27.55

$18.36

50%

$23.03

20%

All-in Sustaining Costs ($ per ounce

silver)

$36.35

$26.77

36%

$30.17

20%

Lead Production (pounds)

3,185,048

3,234,276

-2%

3,585,196

-11%

Relief Canyon Update

Construction is advancing well at the fully funded Relief Canyon

Mine. Preparation of the leach pad is approximately 80% complete

and installation of the liner has started. Mobilization of the

mining contractor is expected later this week. Work at the existing

processing plant has started where upgrades will be made to the

refinery and emissions controls.

Further information on the Relief Canyon development will be

made available periodically on the Company’s website as

construction progresses at www.americassilvercorp.com.

About Americas Silver Corporation

Americas Silver is a precious metal mining company focused on

growth from its existing asset base and execution of targeted

accretive acquisitions. It owns and operates the Cosalá Operations

in Sinaloa, Mexico and the Galena Complex in Idaho, USA. The

Company expects to begin producing gold in the fourth quarter of

2019 at its fully funded Relief Canyon Mine in Nevada, USA which is

currently in construction. The Company also holds an option on the

San Felipe development project in Sonora, Mexico.

Daren Dell, Chief Operating Officer and a Qualified Person under

Canadian Securities Administrators guidelines, has approved the

applicable contents of this news release. For further information

please see SEDAR or americassilvercorp.com.

Cautionary Statement on Forward-Looking Information:

This news release contains “forward-looking information” within

the meaning of applicable securities laws. Forward-looking

information includes, but is not limited to, Americas Silver’s

expectations, intentions, plans, assumptions and beliefs with

respect to, among other things, Americas Silver’s financing

efforts; production and cost performance at the Cosalá Operations

and the Galena Complex; construction, production, development plans

and performance expectations at the Relief Canyon Project and the

impact on Americas Silver’s financial performance; Often, but not

always, forward-looking information can be identified by

forward-looking words such as “anticipate”, “believe”, “expect”,

“goal”, “plan”, “intend”, “potential’, “estimate”, “may”, “assume”

and “will” or similar words suggesting future outcomes, or other

expectations, beliefs, plans, objectives, assumptions, intentions,

or statements about future events or performance. Forward-looking

information is based on the opinions and estimates of Americas

Silver as of the date such information is provided and is subject

to known and unknown risks, uncertainties, and other factors that

may cause the actual results, level of activity, performance, or

achievements of Americas Silver to be materially different from

those expressed or implied by such forward-looking information.

With respect to the business of Americas Silver, these risks and

uncertainties include interpretations or reinterpretations of

geologic information; unfavorable exploration results; inability to

obtain permits required for future exploration, development or

production; general economic conditions and conditions affecting

the industries in which the Company operates; the uncertainty of

regulatory requirements and approvals; fluctuating mineral and

commodity prices; the ability to obtain necessary future financing

on acceptable terms or at all; the ability to develop, complete

construction and operate the Relief Canyon Project; and risks

associated with the mining industry such as economic factors

(including future commodity prices, currency fluctuations and

energy prices), ground conditions and other factors limiting mine

access, failure of plant, equipment, processes and transportation

services to operate as anticipated, environmental risks, government

regulation, actual results of current exploration and production

activities, possible variations in ore grade or recovery rates,

permitting timelines, capital and construction expenditures,

reclamation activities, labor relations, social and political

developments and other risks of the mining industry. Although the

Company has attempted to identify important factors that could

cause actual results to differ materially from those contained in

forward-looking information, there may be other factors that cause

results not to be as anticipated, estimated, or intended. Readers

are cautioned not to place undue reliance on such information.

Additional information regarding the factors that may cause actual

results to differ materially from this forward‐looking information

is available in Americas Silver’s filings with the Canadian

Securities Administrators on SEDAR and with the SEC. Americas

Silver does not undertake any obligation to update publicly or

otherwise revise any forward-looking information whether as a

result of new information, future events or other such factors

which affect this information, except as required by law. Americas

Silver does not give any assurance (1) that Americas Silver will

achieve its expectations, or (2) concerning the result or timing

thereof. All subsequent written and oral forward‐looking

information concerning Americas Silver are expressly qualified in

their entirety by the cautionary statements above.

i Silver equivalent production throughout this press release was

calculated based on silver, zinc, and lead realized prices during

each respective period.

ii Cash cost per ounce and all-in sustaining cost per ounce are

non-IFRS performance measures with no standardized definition. For

further information and detailed reconciliations, please refer to

the Company’s 2018 year-end and quarterly MD&A. The performance

measures for the quarter ended June 30, 2019 are preliminary

throughout this press release subject to refinement from the

Company’s second quarter financial results to be released on or

before August 14, 2019.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190730005359/en/

For more information: Darren Blasutti President and CEO

Americas Silver Corporation 416‐848‐9503

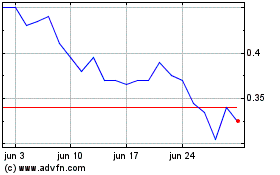

Americas Gold and Silver (TSX:USA)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Americas Gold and Silver (TSX:USA)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025