Americas Gold and Silver Corporation (TSX: USA) (NYSE American:

USAS) (“Americas” or the “Company”), is pleased to provide an

update on exploration drilling at its Galena Complex, 60% owned by

Americas and 40% owned by Mr. Eric Sprott, and an update on the

Cosalá Operations.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20201022005434/en/

Figure 1: Galena Complex (Photo: Business

Wire)

Highlights

- At the Galena Complex, the first hole targeting the “triple

point”, the intersection of the 175, 185 and Silver Veins crossed

all three veins approximately 250 feet below current infrastructure

and 250 feet above the expected convergence point. Drilling of the

second deeper hole has just commenced to pierce the projected

convergence area.

- Hole 55-153: 582 g/t silver and 30.7% lead (or 1,695 g/t AgEq1)

over 2.2 meters2 (185 Vein)

219

g/t silver and 9.5% lead (or 564 g/t AgEq) over 1.9 meters (175

Vein)

271

g/t silver and 2.3% lead (or 365 g/t AgEq) over 1.9 meters (Silver

Vein)

- Earlier drilling of the 360 Complex from the 4300 Level was an

important contributor to the increase in the Mineral Resource as of

June 30, 2020. More recent drilling continues to impress with high

grades and multiple new vein discoveries.

- Holes 43-246 and 43-247 intersected 8 closely spaced, parallel

veins including 4 newly discovered veins. These veins are close to

existing infrastructure with good grades and minable widths with

full assay results detailed in the 360 Complex section. Key

intercepts from 43-246 and 43-247 include and hole 43-239

include:

- Hole 43-246: 548 g/t silver and 18.9% lead (or 1,239 g/t AgEq)

over 3.4 meters

- Hole 43-247: 235 g/t silver and 19.7% lead (or 944 g/t AgEq)

over 6.6 meters

- Hole 43-239: 809 g/t silver and 37.2% lead (or 2,148 g/t AgEq)

over 0.6 meters

- Continued drilling of the 72 Vein area yielded more strong

results and will be followed up from new drill stations in early

2021.

- Hole 55-152: 1,783 g/t silver and 2.3% Cu (or 2,018 g/t AgEq)

over 0.3 meters

- Targeted Mineral Resource addition for the remainder of Phase 1

drilling through June 2021 is expected to be at least another 50

million ounces of silver.

“Galena Complex exploration results to date have been

tremendous,” stated Americas President and CEO Darren Blasutti. “As

of June 30, the Company added 60% of the conceptual target silver

ounces with approximately 33% of drilling completed. We are excited

to have multiple targets that are each generating significant

intercepts that have the potential to add profitable ounces. Given

the success to date, we have added a third drill to accelerate

drilling of the remaining 23,000 meters of the Phase 1 program.

Galena Complex geologists are already planning the Phase 2 program

for the second half of 2021 which is expected to include high grade

vein follow-up and potential discovery of new mine level and

district level discoveries.”

Galena Complex Exploration

The current exploration program has budgeted approximately

39,000 meters of drilling with approximately 16,000 meters (or 41%)

complete as of September 30th, 2020. Based on the success to date,

the Company added an additional in-house drill and now has a total

of three drills exploring. One drill will remain dedicated to the

“triple point”, which represents the convergence of the 175, 185

and Silver Veins. A second drill will continue to focus on the

up-dip extension of the 360 Complex. The third drill will begin

exploration on the prospective East Coeur area.

A full table of drill results can be found at:

https://americas-gold.com/site/assets/files/4297/dr20201022.pdf

Triple Point

The Company has commenced drilling from a newly developed drill

station, DDS#1, targeting what has been described as the “triple

point” where the high-grade 175, 185 and Silver Veins are projected

to converge. The first hole, 55-153 shown in Figure 2, intersected

all three veins, close to each other, approximately 250 feet below

the 5500 Level. Based on the vein angles, the convergence point is

expected approximately 250 feet below this current hole.

As shown in the Figure 2, many of the holes planned from DDS#1

are targeting the individual veins and not the convergence of the

175, 185 and Silver Veins. Based on the orientation of the “triple

point”, the Company anticipates that fully delineating this target

will require establishment of another drill station further to the

east, DDS#3 as shown in Figure 2. This drill station requires an

additional 120 meters of development which is expected to be

completed by December 2020.

360 Complex

With drift repair and rail replacement complete on the 4300

Level, the Company has been able to drill the up-dip projection of

the 360 Complex. This area is readily accessible from existing

infrastructure. The Company anticipates the discoveries to date

will quickly convert to minable tonnes.

Figure 3 includes only intercepts since June 30, 2020.

Key intercepts from recent drilling on the 4300 Level drilling

include:

Hole

From (m)

To (m)

True Width (m)

Ag (g/t)

Pb (%)

Cu (%)

AgEq (g/t)

43-238

48.5

50.6

1.6

234

6.30

0.00

461

43-239

9.6

10.4

0.7

295

10.20

0.00

662

43-239

18.0

18.8

0.6

809

37.20

0.00

2,148

43-239

25.1

27.0

1.6

139

6.40

0.00

369

43-239

41.8

44.3

2.1

232

6.90

0.10

491

including

41.8

42.5

0.6

549

17.00

0.20

1,182

43-239

56.0

57.4

1.2

726

0.10

0.30

760

including

56.0

56.2

0.1

5074

0.10

2.20

5,304

43-242

11.1

13.7

1.6

185

7.80

0.00

466

43-243

0.8

4.0

1.9

261

8.90

0.00

581

43-243

122.3

124.0

1.4

149

10.00

0.10

519

including

123.4

123.7

0.2

507

31.60

0.30

1,675

43-243

127.3

129.8

2.0

347

12.30

0.00

790

including

128.7

129.0

0.2

1714

42.10

0.00

3,230

43-243

132.6

134.7

1.8

120

8.50

0.00

426

43-243

138.5

140.4

1.6

139

11.80

0.00

564

43-243

141.6

143.8

1.9

130

7.30

0.00

393

43-244

11.8

13.8

0.8

232

8.20

0.20

548

including

11.8

12.2

0.2

758

26.00

1.00

1,797

43-246

0.5

1.3

0.5

273

9.80

0.00

626

43-246

17.3

19.2

1.4

133

5.70

0.20

359

43-246

25.5

27.3

1.4

160

9.00

0.00

484

43-246

77.0

82.0

3.7

135

7.40

0.00

401

43-246

88.6

93.9

4.0

189

11.10

0.10

599

including

91.8

92.0

0.1

891

53.50

0.80

2,899

including

92.9

93.4

0.1

754

42.50

1.20

2,407

43-246

97.1

98.5

1.0

338

24.30

0.10

1,223

including

98.3

98.5

0.1

750

49.50

0.40

2,573

43-246

103.0

104.7

1.3

158

12.00

0.00

590

43-246

120.8

125.2

3.4

548

18.90

0.10

1,239

including

121.6

121.8

0.2

1591

59.90

0.60

3,809

including

123.5

123.9

0.3

946

25.20

0.10

1,863

43-246

126.4

128.8

1.8

174

11.90

0.00

602

43-246

132.0

134.7

2.1

191

12.90

0.00

655

43-247

0.6

1.5

0.7

318

12.00

0.00

750

43-247

15.1

18.0

2.3

170

10.10

0.20

554

43-247

21.0

23.8

2.1

103

6.10

0.00

323

43-247

72.9

76.5

2.4

370

7.70

0.30

678

including

75.2

75.4

0.2

3099

0.40

4.00

3,525

43-247

78.5

83.2

2.9

213

14.60

0.00

739

including

81.2

81.7

0.3

559

44.80

0.00

2,172

43-247

85.8

90.5

2.9

225

15.50

0.00

783

including

86.4

87.2

0.5

549

38.80

0.10

1,956

43-247

91.2

100.9

6.6

235

19.70

0.00

944

including

94.0

94.8

0.5

576

51.80

0.00

2,441

including

99.3

100.9

1.0

418

37.70

0.00

1,775

43-247

100.9

105.5

3.1

110

6.80

0.00

355

43-247

112.3

114.7

1.6

281

10.00

0.10

651

43-247

125.5

129.3

2.4

154

8.10

0.00

446

East Coeur

The East Coeur target occupies the area between Galena’s

historically prolific West Argentine mining front and the Coeur

mine. The planned drill program will follow up on limited but

encouraging historical data situated in an attractive rock package.

Previous drilling included 631 g/t silver over 2.1 meters in Hole

43-159 and 1,423 g/t silver over 2.2 meters in Hole 43-153.

Cosalá Operations

In February 2020, the Company announced that an illegal blockade

was put in place at the Cosalá Operations by a group of individuals

including a small minority of the Company’s hourly workforce. As a

result, the Cosalá Operations were put on care and maintenance. The

Company has made all possible efforts with the affected workers and

the Mexican government to remove the illegal blockade in a safe and

sustainable manner. It was clear from the onset that the illegal

blockade is unrelated to any alleged existing labour issue, but

rather motivated by the self-interest of certain opportunistic

individuals. Throughout this ordeal, the Company has consistently

been supportive of a workers right to freely associate including a

democratic election to ratify legitimate union representation free

from threats and intimidation.

In August 2020, the Company announced that the illegal blockade

had been resolved to permit some Company personnel the opportunity

to re-enter the mine operations. This access has not been

maintained. With the re-opening of Mexican government offices in

August, the Company’s employees were expected to vote in September

2020 for new union representation and did so on September 17. In

advance of the vote, there were a number of irregularities that

came to light, which indicated that there could not be a fully

democratic vote with freedom of association.

As a result, the Company does not believe there are conditions

currently present to invest the required capital to re-start the

Cosalá operations. The Company continues to work with all

legitimate stakeholders and remains hopeful that a resolution,

consistent with the rule of law and featuring an election free from

threats and intimidation, can be achieved so that operations can

re-commence in the near term.

About Americas Gold and Silver Corporation

Americas Gold and Silver Corporation is a high-growth, precious

metals mining company with multiple assets in North America. The

Company’s newest asset, the Relief Canyon mine in Nevada, USA, has

poured first gold and is expected to ramp up to full production

over the course of 2020. The Company also owns the Cosalá

Operations in Sinaloa, Mexico and manages the 60%-owned Galena

Complex in Idaho, USA. The Company holds the San Felipe development

project in Sonora, Mexico. For further information, please see

SEDAR or www.americas-gold.com.

Qualified Persons

Niel de Bruin, Director of Geology, who is an employee of the

Company and a “qualified person” under National Instrument 43-101,

have approved the applicable contents of this news release.

Technical Information

The diamond drilling program used NQ-size core. Americas

standard QA/QC practices were utilized to ensure the integrity of

the core and sample preparation at the Galena Complex through

delivery of the samples to the assay lab. The drill core was stored

in a secure facility, photographed, logged and sampled based on

lithologic and mineralogical interpretations. Standards of

certified reference materials, field duplicates and blanks were

inserted as samples shipped with the core samples to the lab.

Analytical work was carried out by American Analytical Services

Inc. (“AAS”) located in Osburn, Idaho. AAS is an independent,

ISO-17025 accredited laboratory. Sample preparation includes a

30-gram pulp sample analyzed by atomic absorption spectrometry

(“AA”) techniques to determine silver, copper, and lead, using aqua

regia for pulp digestion. Samples returning values over 514g/t Ag

are re-assayed using fire-assay techniques for silver.

Additionally, samples returning values over 23% Pb are re-assayed

using titration techniques.

Duplicate pulp samples were sent out quarterly to ALS Global, an

independent, ISO-17025 accredited laboratory based in Reno, Nevada

to perform an independent check analysis. A conventional AA

technique was used for the analysis of silver, copper and lead at

ALS Global with the same industry standard procedures as those used

by AAS. The assay results listed in this report did not show any

significant contamination during sample preparation or sample bias

of analysis.

Cautionary Statement on Forward-Looking Information:

This news release contains “forward-looking information” within

the meaning of applicable securities laws. Forward-looking

information includes, but is not limited to, Americas Gold and

Silver’s expectations, intentions, plans, assumptions and beliefs

with respect to, among other things, estimated production rates and

results for gold, silver and other precious metals, as well as the

related costs, expenses and capital expenditures, the Company’s

construction, production, development plans and performance

expectations at the Relief Canyon Mine, its ability to finance,

develop and operate Relief Canyon, including the anticipated timing

of commercial production at Relief Canyon, the anticipated increase

in production levels realized by the return of the radial stacker,

the Company’s liability for repairs relating to the previous

stacker failure, pregnant solution grade and leach recovery levels

and trends and the expected generation of meaningful sustainable

free cash flow at Relief Canyon and the expected timing thereof.

Often, but not always, forward-looking information can be

identified by forward-looking words such as “anticipate”,

“believe”, “expect”, “goal”, “plan”, “intend”, “potential’,

“estimate”, “may”, “assume” and “will” or similar words suggesting

future outcomes, or other expectations, beliefs, plans, objectives,

assumptions, intentions, or statements about future events or

performance. Forward-looking information is based on the opinions

and estimates of Americas Gold and Silver as of the date such

information is provided and is subject to known and unknown risks,

uncertainties, and other factors that may cause the actual results,

level of activity, performance, or achievements of Americas Gold

and Silver to be materially different from those expressed or

implied by such forward-looking information. With respect to the

business of Americas Gold and Silver, these risks and uncertainties

include risks relating to widespread epidemics or pandemic outbreak

including the COVID-19 pandemic; the impact of COVID-19 on our

workforce, suppliers and other essential resources and what effect

those impacts, if they occur, would have on our business, including

our ability to access goods and supplies, the ability to transport

our products and impacts on employee productivity, the risks in

connection with the operations, cash flow and results of the

Company relating to the unknown duration and impact of the COVID-19

pandemic; interpretations or reinterpretations of geologic

information; unfavorable exploration results; inability to obtain

permits required for future exploration, development or production;

general economic conditions and conditions affecting the industries

in which the Company operates; the uncertainty of regulatory

requirements and approvals; fluctuating mineral and commodity

prices; the ability to obtain necessary future financing on

acceptable terms or at all; the ability to develop, complete

construction, bring to production and operate the Relief Canyon

Project; and risks associated with the mining industry such as

economic factors (including future commodity prices, currency

fluctuations and energy prices), ground conditions and other

factors limiting mine access, failure of plant, equipment,

processes and transportation services to operate as anticipated,

environmental risks, government regulation, actual results of

current exploration and production activities, possible variations

in ore grade or recovery rates, permitting timelines, capital and

construction expenditures, reclamation activities, labor relations

or disruptions, social and political developments and other risks

of the mining industry. The potential effects of the COVID-19

pandemic on our business and operations are unknown at this time,

including the Company’s ability to manage challenges and

restrictions arising from COVID-19 in the communities in which the

Company operates and our ability to continue to safely operate and

to safely return our business to normal operations. The impact of

COVID-19 on the Company is dependent on a number of factors outside

of its control and knowledge, including the effectiveness of the

measures taken by public health and governmental authorities to

combat the spread of the disease, global economic uncertainties and

outlook due to the disease, and the evolving restrictions relating

to mining activities and to travel in certain jurisdictions in

which it operate. Although the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in forward-looking information,

there may be other factors that cause results not to be as

anticipated, estimated, or intended. Readers are cautioned not to

place undue reliance on such information. Additional information

regarding the factors that may cause actual results to differ

materially from this forward‐looking information is available in

Americas Gold and Silver’s filings with the Canadian Securities

Administrators on SEDAR and with the SEC. Americas Gold and Silver

does not undertake any obligation to update publicly or otherwise

revise any forward-looking information whether as a result of new

information, future events or other such factors which affect this

information, except as required by law. Americas Gold and Silver

does not give any assurance (1) that Americas Gold and Silver will

achieve its expectations, or (2) concerning the result or timing

thereof. All subsequent written and oral forward‐looking

information concerning Americas Gold and Silver are expressly

qualified in their entirety by the cautionary statements above.

1 AgEq was calculated using metal prices of $20.00/ oz silver,

$3.00/lb copper and $1.05/lb lead 2 Meters represent “True Width”

which is calculated for significant intercepts only and based on

orientation axis of core across the estimated dip of the vein

View source

version on businesswire.com: https://www.businesswire.com/news/home/20201022005434/en/

Stefan Axell VP, Corporate Development & Communications

Americas Gold and Silver Corporation 416-874-1708

Darren Blasutti President and CEO Americas Gold and Silver

Corporation 416‐848‐9503

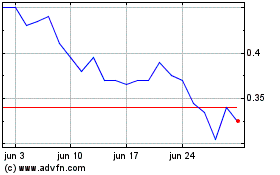

Americas Gold and Silver (TSX:USA)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Americas Gold and Silver (TSX:USA)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025