Annual Recurring Revenue (“ARR”) growth of 55%

and positive Adjusted EBITDA

Docebo Inc. (TSX:DCBO) (“Docebo” or the

“Company”), a leading AI-powered learning platform, today

announced financial results for the three and nine months ended

September 30, 2020. All amounts are expressed in US dollars unless

otherwise stated.

“Customer momentum remained strong in the third quarter as we

reported 55% year over year growth in ARR and 54% year over year

growth in subscription revenue, driven by another quarter of record

new logo and upsell performance,” said Claudio Erba, CEO and

Founder of Docebo. “This resulted in our first quarter of positive

Adjusted EBITDA as a public company as we are seeing strong returns

from our investments in growth. We will continue to focus on

increasing our sales reach, expanding our relationships with our

customers and broadening our product offering to capitalize on the

tailwinds we are seeing for Docebo and the LMS industry.”

Third Quarter 2020 Financial Highlights

- Revenue of $16.1 million, an increase of 52.0% from the

comparative period in the prior year

- Subscription revenue of $15.1 million, representing 93.8% of

total revenue, and an increase of 54.1% from the comparative period

in the prior year

- Annual Recurring Revenue1,2 as at September 30, 2020 of $64.6

million, an increase of $22.9 million from $41.7 million at the end

of the third quarter of 2019, or an increase of 55%

- Gross profit of $13.2 million, or 82.1% of revenue, a 200 bps

improvement from the comparative period in the prior year

- Net loss of $1.2 million, compared to net loss of $3.7 million

for the comparative period in the prior year

- Positive Adjusted EBITDA2 of $0.6 million, or 3.6% of revenue,

compared to ($1.4) million, or (13.1%) of revenue, for the

comparative period in the prior year

- Positive cash flow generated from operating activities of $0.5

million, compared to $(1.9) million for the comparative period in

the prior year

- Free cash flow2 was near break-even at ($0.140) million

compared to $(1.986) million for the comparative period in the

prior year

- Completed bought deal offering comprised of 500,000 common

shares issued from treasury for net proceeds of $18.1 million

(C$23.8 million) and 1,225,000 common shares sold by the certain

shareholders, including the exercise in full by the underwriters of

their overallotment option to purchase 225,000 common shares

- Cash and cash equivalents of $60.8 million as at September 30,

2020

1 Please refer to “Key Performance Indicators” section of

this press release. 2 Please refer to “Non-IFRS Measures and

Reconciliation of Non-IFRS Measures” section of this press

release.

Third Quarter 2020 Business Highlights

- Docebo is now used by 2,025 customers, an increase from 1,632

customers at the end of September 30, 20191

- Strong growth in average contract value, calculated as total

Annual Recurring Revenue divided by the number of active customers,

increasing from $25,551 to $31,9011

- Signed a customer expansion agreement with one of the largest

operators of quick-service restaurants in the world to scale their

learning across the globe. Originally signed in November of 2018 to

train in 3,000 restaurant locations, Docebo will now extend

training across 24,000 locations worldwide beginning in 2021, and

will include some of world’s most prominent and iconic

quick-service restaurant brands

- Signed a customer expansion agreement with Syngenta Group, the

world's largest agrochemical company, to scale internal training

across multiple departments across their global organization

- Signed a new customer agreement with Amazon Web Services

(“AWS”) to power its training and certification products across the

globe

- Added new customer agreements with Economical Insurance,

SiriusXM and the World Anti-Doping Agency (WADA) during the third

quarter of 2020

- Received first revenues from a second OEM partner, just one

month after completing the agreement

- In the third quarter of 2020, Docebo received 14 Learning

Excellence awards with Brandon Hall Group alongside their

customers

- Docebo has also been recognized as the #1 Learning Management

System of 2020 by eLearningIndustry and has been included on the

list of Canada’s top growing companies for 2020 by The Globe and

Mail Report on Business

- Subsequent to quarter end, launched Docebo Learning Impact

following the completion of the acquisition of forMetris Société

par Actions Simplifiée, a leading SaaS-based learning impact

evaluation platform

1 Historically, in calculating average contract value,

all references to the number of customers or companies we serve

included separate accounts per customer based on their

installation(s) count. For the third quarter of the fiscal year

ended December 31, 2020 and going forward, any separate accounts

that our customers may have will be aggregated and counted as one

customer based on the contracted customer for the purposes of

calculating our average contract value to provide a more precise

understanding of this metric. The following table outlines our

average contract value from the start of fiscal year 2019 using

this updated calculation method and historically reported

values:

Q1 2019

Q2 2019

Q3 2019

Q4 2019

Q1 2020

Q2 2020

$

$

$

$

$

$

Updated Methodology

Number of customers

1,491

1,549

1,632

1,725

1,831

1,923

Average contract value (in thousands of US

dollars)

$22,468

$23,848

$25,551

$27,362

$28,454

$29,616

As Previously Reported

Number of customers

1,596

1,651 1

1,712 1

1,808

1,938

2,046

Average contract value (in thousands of US

dollars)

$20,990

$22,374

$24,357

$26,106

$26,883

$27,835

1 Includes number of customers from OEM

contracts

Third Quarter 2020 Results

Selected Financial Measures

Three months ended September

30,

Nine months ended September

30,

2020

2019

Change

Change

2020

2019

Change

Change

$

$

$

%

$

$

$

%

Subscription Revenue

15,101

9,802

5,299

54.1

%

40,699

26,036

14,663

56.3

%

Professional Services

995

784

211

26.9

%

3,462

3,109

353

11.3

%

Total Revenue

16,096

10,586

5,510

52.0

%

44,161

29,145

15,016

51.5

%

Gross Profit Margin

13,213

8,476

4,737

55.9

%

35,597

23,087

12,510

54.2

%

Percentage of Total Revenue

82.1

%

80.1

%

80.6

%

79.2

%

Key Performance Indicators

As at September 30,

2020

2019

Change

Change %

Annual Recurring Revenue (in millions of

US dollars)

64.6

41.7

22.9

54.9

%

Average Contract Value (in thousands of US

dollars)

31.9

25.6

6.3

24.6

%

Customers

2,025

1,632

393

24.1

%

Non-IFRS Metrics

Three months ended September

30,

Nine months ended September

30,

2020

2019

Change

Change

2020

2019

Change

Change

$

$

$

%

$

$

$

%

Adjusted EBITDA

577

(1,388

)

1,965

(142

)

(2,698

)

(4,552

)

1,854

(40.7

)%

Free Cash Flow

(140

)

(1,986

)

1,846

(93.0

)%

(2,882

)

(1,395

)

(1,487

)

106.6

%

Conference Call

Management will host a conference call on Thursday, November 12,

2020 at 8:00 am ET to discuss these third quarter results.

To access the conference call, please dial 416-764-8688 or

1-888-390-0546. The audited financial statements for the three and

nine months ended September 30, 2020 and Management’s Discussion

& Analysis for the same period have been filed on SEDAR at

www.sedar.com. Alternatively, these documents along with a

presentation in connection with the conference call can be accessed

online at https://investors.docebo.com.

An archived recording of the conference call will be available

until November 19, 2020 and for 90 days on our website. To listen

to the recording, call 416-764-8677 or 1-888-390-0541 and enter

passcode 296548.

Forward-looking Information

This press release contains “forward-looking information” and

“forward-looking statements” (collectively, “forward-looking

information”) within the meaning of applicable securities laws.

Forward-looking information may relate to our future financial

outlook and anticipated events or results and may include

information regarding our financial position, business strategy,

the impact of COVID-19 on our business, growth strategies,

addressable markets, budgets, operations, financial results, taxes,

dividend policy, plans and objectives. Particularly, information

regarding our expectations of future results, performance,

achievements, prospects or opportunities or the markets in which we

operate is forward-looking information.

In some cases, forward-looking information can be identified by

the use of forward-looking terminology such as “plans”, “targets”,

“expects”, “is expected”, “an opportunity exists”, “budget”,

“scheduled”, “estimates”, “outlook”, “forecasts”, “projection”,

“prospects”, “strategy”, “intends”, “anticipates”, “believes”, or

variations of such words and phrases or statements that certain

actions, events or results “may”, “could”, “would”, “might” or,

“will”, “occur” or “be achieved”, and similar words or the negative

of these terms and similar terminology. In addition, any statements

that refer to expectations, intentions, projections or other

characterizations of future events or circumstances contain

forward-looking information. Statements containing forward-looking

information are not historical facts but instead represent

management’s expectations, estimates and projections regarding

future events or circumstances.

This forward-looking information includes, but is not limited

to, statements regarding industry trends; our growth rates and

growth strategies; addressable markets for our solutions; the

achievement of advances in and expansion of our platform;

expectations regarding our revenue and the revenue generation

potential of our platform and other products; our business plans

and strategies; and our competitive position in our industry.

Forward-looking information is necessarily based on a number of

opinions, estimates and assumptions that, while considered by the

Company to be appropriate and reasonable as of the date of this

press release, are subject to known and unknown risks,

uncertainties, assumptions and other factors that may cause the

actual results, level of activity, performance or achievements to

be materially different from those expressed or implied by such

forward-looking information, including but not limited to:

- the Company’s ability to execute on its growth strategies;

- the impact of changing conditions in the global corporate

e-learning market;

- increasing competition in the global corporate e-learning

market in which the Company operates;

- fluctuations in currency exchange rates and volatility in

financial markets;

- the extent of the impact of COVID-19 and measures taken to

contain the virus on our results of operations and overall

financial performance;

- changes in the attitudes, financial condition and demand of our

target market;

- developments and changes in applicable laws and regulations;

and

- such other factors discussed in greater detail under the “Risk

Factors” section of our Annual Information Form dated March 11,

2020 (“AIF”), which is available under our profile on SEDAR at

www.sedar.com.

If any of these risks or uncertainties materialize, or if the

opinions, estimates or assumptions underlying the forward-looking

information prove incorrect, actual results or future events might

vary materially from those anticipated in the forward-looking

information. The opinions, estimates or assumptions referred to

above and described in greater detail in the “Summary of Factors

Affecting our Performance” section of our MD&A for the three

and nine months ended September 30, 2020 and in the “Risk Factors”

section of our AIF, should be considered carefully by prospective

investors.

Although we have attempted to identify important risk factors

that could cause actual results to differ materially from those

contained in forward-looking information, there may be other risk

factors not presently known to us or that we presently believe are

not material that could also cause actual results or future events

to differ materially from those expressed in such forward-looking

information. There can be no assurance that such information will

prove to be accurate, as actual results and future events could

differ materially from those anticipated in such information. No

forward-looking statement is a guarantee of future results.

Accordingly, you should not place undue reliance on forward-looking

information, which speaks only as of the date made. The

forward-looking information contained in this press release

represents our expectations as of the date specified herein, and

are subject to change after such date. However, we disclaim any

intention or obligation or undertaking to update or revise any

forward-looking information whether as a result of new information,

future events or otherwise, except as required under applicable

securities laws.

All of the forward-looking information contained in this press

release is expressly qualified by the foregoing cautionary

statements.

Additional information relating to Docebo, including our Annual

Information Form, can be found on SEDAR at www.sedar.com.

About Docebo

Docebo is redefining the way enterprises learn by applying new

technologies to the traditional corporate learning management

system market. Docebo provides an easy-to-use, highly configurable

learning platform with the end-to-end capabilities designed to make

customers, partners, and employees love their learning

experience.

Results of Operations The following table outlines our

consolidated statements of loss and comprehensive loss for the

following periods:

Three months ended September

30,

Nine months ended September

30,

(In thousands of US dollars, except per

share data)

2020

2019

2020

2019

$

$

$

$

Revenue

16,096

10,586

44,161

29,145

Cost of revenue

2,883

2,110

8,564

6,058

Gross profit

13,213

8,476

35,597

23,087

Operating expenses

General and administrative

3,575

3,219

11,260

9,342

Sales and marketing

5,796

5,711

17,559

13,104

Research and development

3,265

2,175

9,476

6,434

Share-based compensation

512

99

1,317

251

Foreign exchange (gain) loss

440

148

(1,607

)

102

Depreciation and amortization

279

207

771

594

13,867

11,559

38,776

29,827

Operating loss

(654

)

(3,083

)

(3,179

)

(6,740

)

Finance expense, net

78

228

37

707

Loss on change in fair value of

convertible promissory notes

—

—

—

776

Other income

(19

)

(18

)

(57

)

(57

)

Loss before income taxes

(713

)

(3,293

)

(3,159

)

(8,166

)

Income tax expense

445

449

754

449

Net loss for the year

(1,158

)

(3,742

)

(3,913

)

(8,615

)

Other comprehensive loss

Item that may be reclassified subsequently

to income:

Foreign currency translation loss

(gain)

117

(471

)

2,035

(69

)

Item not subsequently reclassified to

income:

Actuarial loss

—

10

—

30

117

(461

)

2,035

(39

)

Comprehensive loss

(1,275

)

(3,281

)

(5,948

)

(8,576

)

Loss per share - basic and diluted

(0.04

)

(0.16

)

(0.14

)

(0.37

)

Weighted average number of common shares

outstanding - basic and diluted

28,748,652

23,760,149

28,560,806

23,122,698

Key Statement of Financial Position Information

(In thousands of US dollars, except

percentages)

September 30,

2020

December 31,

2019

Change

Change

$

$

$

%

Cash and cash equivalents

60,835

46,278

14,557

31.5

%

Total assets

88,738

63,860

24,878

39.0

%

Total liabilities

43,740

32,479

11,261

34.7

%

Total long-term liabilities

4,477

3,938

539

13.7

%

Non-IFRS Measures and Reconciliation of Non-IFRS

Measures

This press release makes reference to certain non-IFRS measures

including key performance indicators used by management and

typically used by our competitors in the software-as-a-service

(“SaaS”) industry. These measures are not recognized measures under

IFRS and do not have a standardized meaning prescribed by IFRS and

are therefore not necessarily comparable to similar measures

presented by other companies. Rather, these measures are provided

as additional information to complement those IFRS measures by

providing further understanding of our results of operations from

management’s perspective. Accordingly, these measures should not be

considered in isolation nor as a substitute for analysis of our

financial information reported under IFRS. These non-IFRS measures

and SaaS metrics are used to provide investors with supplemental

measures of our operating performance and liquidity and thus

highlight trends in our business that may not otherwise be apparent

when relying solely on IFRS measures. We also believe that

securities analysts, investors and other interested parties

frequently use non-IFRS measures, including SaaS industry metrics,

in the evaluation of companies in the SaaS industry. Management

also uses non-IFRS measures and SaaS industry metrics in order to

facilitate operating performance comparisons from period to period,

the preparation of annual operating budgets and forecasts and to

determine components of executive compensation. The non-IFRS

measures and SaaS industry metrics referred to in this press

release include “Annual Recurring Revenue”, “Adjusted EBITDA” and

“Free Cash Flow”.

Key Performance Indicators

We recognize subscription revenues ratably over the term of the

subscription period under the provisions of our agreements with

customers. The terms of our agreements, combined with high customer

retention rates, provides us with a significant degree of

visibility into our near-term revenues. Management uses a number of

metrics, including the ones identified below, to measure the

Company’s performance and customer trends, which are used to

prepare financial plans and shape future strategy. Our key

performance indicators may be calculated in a manner different than

similar key performance indicators used by other companies.

Annual Recurring Revenue. We define Annual Recurring Revenue as

the annualized equivalent value of the subscription revenue of all

existing contracts (including Original Equipment Manufacturer

(“OEM”) contracts) as at the date being measured, excluding

non-recurring implementation, support and maintenance fees. Our

customers generally enter into one to three year contracts which

are non-cancellable or cancellable with penalty. All the customer

contracts, including those for one-year terms, automatically renew

unless cancelled by our customers. Accordingly, our calculation of

Annual Recurring Revenue assumes that customers will renew the

contractual commitments on a periodic basis as those commitments

come up for renewal. Subscription agreements may be subject to

price increases upon renewal reflecting both inflationary increases

and the additional value provided by our solutions. In addition to

the expected increase in subscription revenue from price increases

over time, existing customers may subscribe for additional

features, learners or services during the term. We believe that

this measure provides a fair real-time measure of performance in a

subscription-based environment. Annual Recurring Revenue provides

us with visibility for consistent and predictable growth to our

cash flows. Our strong total revenue growth coupled with increasing

Annual Recurring Revenue indicates the continued strength in the

expansion of our business and will continue to be our target on a

go-forward basis.

Annual Recurring Revenue was as follows as at September 30:

2020

2019

Change

Change %

Annual Recurring Revenue (in millions of

US dollars)

64.6

41.7

22.9

54.9%

Adjusted EBITDA

Adjusted EBITDA is used by management as a supplemental measure

to review and assess operating performance and, in conjunction with

the financial statements, provides a more comprehensive picture of

factors and trends affecting our business. Management believes that

Adjusted EBITDA is a useful measure of operating performance and

our ability to generate cash-based earnings, as it provides a

useful view of operating results by excluding the effects of

financing and investing activities which removes the effects of

interest, depreciation and amortization expenses as non-cash items

that are not reflective of our underlying business performance, and

other one-time or non-recurring expenses. The Company defines

Adjusted EBITDA as net loss excluding taxes (if applicable), net

finance expense, depreciation and amortization, loss on change in

fair value of convertible promissory notes, loss on disposal of

assets (if applicable), share based compensation, transaction

related expenses and foreign exchange gains and losses. Management

believes that these adjustments are appropriate in making Adjusted

EBITDA an approximation of cash-based earnings from operations

before capital replacement, financing, and income tax charges.

Adjusted EBITDA does not have a standardized meaning under IFRS and

is not a measure of operating income, operating performance or

liquidity presented in accordance with IFRS and is subject to

important limitations. The Company’s definition of Adjusted EBITDA

may be different than similarly titled measures used by other

companies.

The following table reconciles Adjusted EBITDA to net loss for

the periods indicated:

Three months ended September

30,

Nine months ended September

30,

(In thousands of US dollars)

2020

2019

2020

2019

$

$

$

$

Net loss

(1,158

)

(3,742

)

(3,913

)

(8,615

)

Finance (income) expense, net(1)

78

228

37

707

Depreciation and amortization(2)

279

207

771

594

Income tax expense

445

449

754

449

Loss on change in fair value of

convertible promissory notes(3)

—

—

—

776

Share-based compensation(4)

512

99

1,317

251

Other income(5)

(19

)

(18

)

(57

)

(57

)

Foreign exchange (gain) loss(6)

440

148

(1,607

)

102

Transaction related expenses(7)

—

1,241

—

1,241

Adjusted EBITDA

577

(1,388

)

(2,698

)

(4,552

)

Notes:

- Finance expense for the three and nine months ended September

30, 2019 is primarily related to interest and accretion expense on

the secured debentures and convertible promissory notes. As these

were repaid in October 2019 with the net proceeds from the IPO, no

further interest expenses on debt have been incurred during the

three and nine months ended September 30, 2020. In fiscal 2020

interest income was earned on the net proceeds from the IPO as the

funds are held within short-term investments in highly liquid

marketable securities which is offset by interest expenses incurred

on lease obligations.

- Depreciation and amortization expense is primarily related to

depreciation expense on right-of-use assets (“ROU assets”) and

property and equipment. As a result of the adoption of IFRS 16 –

Leases effective January 1, 2019 depreciation and amortization

expense for the three and nine months ended September 30, 2020

includes amortization expense on ROU assets of $190 and $523,

respectively (2019 - $150 and $432).

- These costs are related to the change in valuation of our

convertible promissory notes from period to period, which is a

non-cash expense and is thus not indicative of our operating

profitability. These costs should be adjusted for in accordance

with management’s view of Adjusted EBITDA as an approximation of

cash-based earnings from operations before capital replacement,

financing, and income tax charges. In May 2019, these convertible

promissory notes were converted into common shares. There will be

no further impact on our results of operations from such

convertible promissory notes and the Company does not currently

intend to issue any additional convertible promissory notes.

- These expenses represent non-cash expenditures recognized in

connection with the issuance of share-based compensation to our

employees and directors.

- Other income is primarily comprised of rental income from

subleasing office space.

- These non-cash losses relate to foreign exchange (gain)

loss.

- These expenses are related to our IPO and include professional,

legal, consulting and accounting fees that are non-recurring and

would otherwise not have been incurred and are not considered an

expense indicative of continuing operations.

Free Cash Flow

Free Cash Flow is defined as cash used in operating activities

less additions to property and equipment and non-current assets.

The following table reconciles our cash flow used in operating

activities to Free Cash Flow:

Three months ended September

30,

Nine months ended September

30,

(In thousands of US dollars)

2020

2019

2020

2019

$

$

$

$

Cash flow used in operating

activities

455

(1,893

)

(1,891

)

(1,089

)

Additions to property and equipment and

non-current assets

(595

)

(93

)

(991

)

(306

)

Free Cash Flow

(140

)

(1,986

)

(2,882

)

(1,395

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20201112005187/en/

Dennis Fong, Investor Relations (416) 283-9930

investors@docebo.com

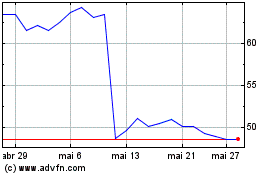

Docebo (TSX:DCBO)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Docebo (TSX:DCBO)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025