Americas Gold and Silver Corporation (TSX: USA) (NYSE American:

USAS) (“Americas” or the “Company”), a growing North American

precious metals producer, reports consolidated financial and

operational results for the third quarter of 2020 along with an

operations update.

This earnings release should be read in conjunction with the

Company’s Management’s Discussion and Analysis, Financial

Statements and Notes to Financial Statements for the corresponding

period, which have been posted on the Americas Gold and Silver

Corporation SEDAR profile at www.sedar.com, and on its EDGAR

profile at www.sec.gov, and which are also available on the

Company’s website at www.americas-gold.com. All figures are in U.S.

dollars unless otherwise noted.

Operational and Third Quarter Financial Highlights

- Revenue of $7.3 million and a net loss of $6.2 million for

Q3-2020 or a loss of ($0.05) per share

- Year-to-date operating metrics were largely unchanged in

Q3-2020 from Q2-2020 due to the illegal blockade at the Cosalá

Operations, suspension of operating metrics during the Galena

Complex recapitalization plan (“Recapitalization Plan”), and

ongoing pre-production at Relief Canyon

- Galena Complex silver production increased by 25%

year-over-year while Galena lead production increased by 65%,

benefitting from the Recapitalization Plan described in detail

below

- At Relief Canyon, the radial stacker is expected to be

installed and operating in the coming week. The Company anticipates

the increase in production from the return of the radial stacker

will allow the Company to declare commercial production by the end

of Q4-2020

- Since placing ore on the 6W leach pad on August 4, 2020, ore

leaching has performed within expected norms

- Benefits from the Galena Complex Recapitalization Plan are

materializing including the significant increase to the mineral

resources. Measured and indicated silver resource, as of June 30,

2020, increased by 36% to 37.3 million ounces1 and inferred silver

resource increased by over 100% to 78.6 million ounces1. This is

based on only 33% of Phase 1 planned drilling and further increases

are expected as the drill program continues

- The Company finalized the option payment for the San Felipe

project and paid the remaining $3.75 million plus VAT obligation in

common shares of the Company on October 8, 2020. The San Felipe

project is now 100% owned by the Company and contains an indicated

silver resource of over 9 million ounces and an inferred silver

resource of over 3 million ounces

- The Company had a cash balance of $22.8 million as at September

30, 2020

“The return of the radial stacker, the gating item to declaring

commercial production at Relief Canyon, is underway and is expected

to be in service in the coming week. With the increased daily

production from the stacker, we are focused on declaring commercial

production at Relief Canyon before the end of Q4-2020,” stated

Americas Gold and Silver President & CEO Darren Blasutti. “The

Galena Complex Recapitalization Plan continues to pay enormous

dividends, beyond increased year-over-year production, as we saw

from the recent increase to the mineral reserves and resources. We

successfully added approximately 10 million silver ounces to the

measured and indicated resource and approximately 40 million silver

ounces to the inferred resource, representing increases of 36% and

over 100% respectfully. This increase was based on only 33% of

planned Phase 1 drilling and we are confident that we will see even

larger increases to next year’s resource update based on the

remaining drill program.”

Relief Canyon

The Company’s radial stacker, which suffered a structural

failure in Q2-2020, is in transit. Upon arrival, the stacker is

expected to resume service within a week after a brief

commissioning period. The radial ore stacker will allow ore

placement to reach the design rate of approximately 16,000 tons per

day. The increased daily stacking rate will allow the operation to

accelerate the amount of material placed on the leach pad, increase

the area under leach, increase daily gold production, and enable

the Company to declare commercial production.

The Company continues to anticipate commercial production will

be reached in Q4-2020, setting the operation up for a strong

2021.

Galena Complex

The Galena Complex is already benefitting from the renewed

exploration focus as evident from the increased year-over-year

production, updated mineral reserve and resources estimate released

on September 14, 2020 with an effective date of June 30, 2020.

Based on only 33% of the Phase 1 drilling plan, measured and

indicated silver resources on a 100% basis (60% Company/40% Eric

Sprott) increased from 27.4 million ounces to 37.3 million ounces

and inferred silver resources increased from 39.0 million ounces to

78.6 million ounces. This represents a 36% and 101% increase,

respectively, from previously reported estimates.

On October 22, 2020, the Company released an additional

exploration update highlighting the Complex’s continued successful

results. The first hole targeting the “triple point”, the

intersection of the 175, 185 and Silver Veins, crossed all three

veins approximately 75 meters below current infrastructure and 75

meters above the expected convergence point. Drilling of the second

deeper hole has commenced to pierce the projected convergence area.

Referencing Hole 55-153:

- 582 g/t silver and 30.7% lead (or 1,695 g/t AgEq2) over 2.2

meters3 (185 Vein)

- 219 g/t silver and 9.5% lead (or 564 g/t AgEq) over 1.9 meters

(175 Vein)

- 271 g/t silver and 2.3% lead (or 365 g/t AgEq) over 1.9 meters

(Silver Vein)

Earlier drilling of the 360 Complex from the 4300 Level was an

important contributor to the increase in the mineral resource

estimates as of June 30, 2020. Since this date, the Company drilled

holes 43-246 and 43-247 which intersected 8 closely spaced,

parallel veins including 4 newly discovered veins. These veins are

close to existing infrastructure with good grades and minable

widths with full assay results detailed in the 360 Complex section.

Key intercepts from 43-246 and 43-247 include and hole 43-239

include:

- Hole 43-246: 548 g/t silver and 18.9% lead (or 1,239 g/t AgEq)

over 3.4 meters

- Hole 43-247: 235 g/t silver and 19.7% lead (or 944 g/t AgEq)

over 6.6 meters

- Hole 43-239: 809 g/t silver and 37.2% lead (or 2,148 g/t AgEq)

over 0.6 meters

Continued drilling of the 72 Vein area yielded more strong

results and will be followed up from new drill stations in early

2021.

- Hole 55-152: 1,783 g/t silver and 2.3% Cu (or 2,018 g/t AgEq)

over 0.3 meters

A full table results can be found at:

https://americas-gold.com/site/assets/files/4297/dr20201022.pdf.

The Company is targeting further mineral resource additions for

the remainder of Phase 1 drilling through June 2021 with

expectations of least 50 million ounces of silver.

Cosalá Operations

In August 2020, the Company announced that the illegal blockade

had been resolved to permit some Company personnel the opportunity

to re-enter the mine operations. This access has not been

maintained. With the re-opening of Mexican government offices in

August, the Company’s employees were expected to vote in September

2020 for new union representation and did so on September 17. In

advance of the vote, a number of irregularities came to light,

which indicated that there could not be a fully democratic vote

with freedom of association.

As a result, the Company does not believe there are conditions

currently present to invest the required capital to re-start the

Cosalá Operations. The Company continues to work with all

legitimate stakeholders and remains hopeful that a resolution,

consistent with the rule of law and featuring an election free from

threats and intimidation, can be achieved so that operations can

re-commence in the near term.

Due to the illegal blockade, the Cosalá Operations did not

operate during Q3-2020 and operated for only the first 26 days of

2020. As a result, quarterly and year-to-date operating results are

not generally comparable with previous periods.

Spot silver prices have increased significantly from a low of

almost $12.00 per ounce in March 2020 to over $28.00 per ounce in

September 2020. In 2019, the Company spent approximately $1.5

million on developing into the Upper Zone of the San Rafael mine

which contains significantly higher silver grades than the Main

Zone. With the development into the Upper Zone, the Company

anticipates that it will be able to increase silver production,

allowing it to benefit from the significant increase in the silver

price upon resolution of the illegal blockade.

San Felipe

The Company finalized the option agreement for the San Felipe

project with Minera Hochschild Mexico S.A. de C.V. through payment

of the remaining the $3.75 million plus VAT obligation in common

shares of the Company issued on October 8, 2020.

The Company now owns 100% of the San Felipe project, which is

located 130 km northeast of Hermosillo, Sonora, Mexico. The San

Felipe project has an indicated mineral resource estimate of 4.7

million tonnes grading 5.36% zinc, 60 g/t silver and 2.46% lead and

a mineral inferred resource is estimate of 2.0 million tonnes

grading 3.50% zinc, 47 g/t silver and 1.41% lead with an effective

date of June 30, 2020.

Consolidated Financial and Consolidated Production

Results

Consolidated operating results from Q3-2020 were generally not

comparable to Q3-2019 due to the illegal blockade at the Cosalá

Operations, and the Recapitalization Plan at the Galena Complex.

The Cosalá Operations were put on care and maintenance in response

to the illegal blockade at the end of January 2020. Consolidated

gross revenue decreased by $5.2 million during Q3-2020 compared to

Q3-2019 primarily due to the illegal blockade preventing all access

to the Cosalá Operations.

Further information concerning the consolidated and individual

mine operations is included in the Company’s third quarter

Condensed Interim Consolidated Financial Statements for the three

months and nine months ended September 30, 2020 and Management’s

Discussion and Analysis for the three months and nine months ended

September 30, 2020.

About Americas Gold and Silver Corporation

Americas Gold and Silver Corporation is a high-growth precious

metals mining company with multiple assets in North America. The

Company’s newest asset, the Relief Canyon mine in Nevada, USA, has

poured first gold and is expected to ramp up to full production

over the course of 2021. The Company also owns and operates the

Cosalá Operations in Sinaloa, Mexico and manages the 60%-owned

Galena Complex in Idaho, USA. The Company has completed the

outstanding option acquisition agreement for the San Felipe

development project in Sonora, Mexico. For further information,

please see SEDAR or www.americas-gold.com.

Qualified Persons

Daren Dell, P.Eng., Chief Operating Officer, who is an employee

of the Company and a “qualified person” under National Instrument

43-101, has approved the applicable contents of this news

release.

Cautionary Statement on Forward-Looking Information:

This news release contains “forward-looking information” within

the meaning of applicable securities laws. Forward-looking

information includes, but is not limited to, Americas Gold and

Silver’s expectations, intentions, plans, assumptions and beliefs

with respect to, among other things, estimated production rates and

results for gold, silver and other precious metals, as well as the

related costs, expenses and capital expenditures, the Company’s

construction, production, development plans and performance

expectations at the Relief Canyon Mine, its ability to finance,

develop and operate Relief Canyon, including the anticipated timing

of commercial production at Relief Canyon, the expected timing of

delivery of the radial stacker to Relief Canyon and the timing of

resumption of service and operations of the radial stacker and

expected increase in production thereafter, the resumption of

mining and processing operations at the Company’s Cosalá Operations

following the end of the illegal blockade and expected silver

production levels at the Cosalá Operations, the effect of temporary

restrictions on all non-essential businesses in Mexico resulting

from the COVID-19 pandemic on the Company’s Cosalá Operations, the

expected drilling results and potential increase in resources to be

realized at the Galena Complex in connection with the

Recapitalization Plan, the Company’s plans with respect to the

EC120 zone and the San Felipe project. Often, but not always,

forward-looking information can be identified by forward-looking

words such as “anticipate”, “believe”, “expect”, “goal”, “plan”,

“intend”, “potential’, “estimate”, “may”, “assume” and “will” or

similar words suggesting future outcomes, or other expectations,

beliefs, plans, objectives, assumptions, intentions, or statements

about future events or performance. Forward-looking information is

based on the opinions and estimates of Americas Gold and Silver as

of the date such information is provided and is subject to known

and unknown risks, uncertainties, and other factors that may cause

the actual results, level of activity, performance, or achievements

of Americas Gold and Silver to be materially different from those

expressed or implied by such forward-looking information. With

respect to the business of Americas Gold and Silver, these risks

and uncertainties include risks relating to widespread epidemics or

pandemic outbreak including the COVID-19 pandemic; the impact of

COVID-19 on our workforce, suppliers and other essential resources

and what effect those impacts, if they occur, would have on our

business, including our ability to access goods and supplies, the

ability to transport our products and impacts on employee

productivity, the risks in connection with the operations, cash

flow and results of the Company relating to the unknown duration

and impact of the COVID-19 pandemic; interpretations or

reinterpretations of geologic information; unfavorable exploration

results; inability to obtain permits required for future

exploration, development or production; general economic conditions

and conditions affecting the industries in which the Company

operates; the uncertainty of regulatory requirements and approvals;

fluctuating mineral and commodity prices; the ability to obtain

necessary future financing on acceptable terms or at all; the

ability to develop, complete construction, bring to production and

operate the Relief Canyon Project; and risks associated with the

mining industry such as economic factors (including future

commodity prices, currency fluctuations and energy prices), ground

conditions and other factors limiting mine access, failure of

plant, equipment, processes and transportation services to operate

as anticipated, environmental risks, government regulation, actual

results of current exploration and production activities, possible

variations in ore grade or recovery rates, permitting timelines,

capital and construction expenditures, reclamation activities,

labor relations or disruptions, social and political developments

and other risks of the mining industry. The potential effects of

the COVID-19 pandemic on our business and operations are unknown at

this time, including the Company’s ability to manage challenges and

restrictions arising from COVID-19 in the communities in which the

Company operates and our ability to continue to safely operate and

to safely return our business to normal operations. The impact of

COVID-19 on the Company is dependent on a number of factors outside

of its control and knowledge, including the effectiveness of the

measures taken by public health and governmental authorities to

combat the spread of the disease, global economic uncertainties and

outlook due to the disease, and the evolving restrictions relating

to mining activities and to travel in certain jurisdictions in

which it operate. Although the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in forward-looking information,

there may be other factors that cause results not to be as

anticipated, estimated, or intended. Readers are cautioned not to

place undue reliance on such information. Additional information

regarding the factors that may cause actual results to differ

materially from this forward‐looking information is available in

Americas Gold and Silver’s filings with the Canadian Securities

Administrators on SEDAR and with the SEC. Americas Gold and Silver

does not undertake any obligation to update publicly or otherwise

revise any forward-looking information whether as a result of new

information, future events or other such factors which affect this

information, except as required by law. Americas Gold and Silver

does not give any assurance (1) that Americas Gold and Silver will

achieve its expectations, or (2) concerning the result or timing

thereof. All subsequent written and oral forward‐looking

information concerning Americas Gold and Silver are expressly

qualified in their entirety by the cautionary statements above.

1 Figures shown on 100% basis. The Galena Complex is 60% owned

by the Company and 40% owned by Eric Sprott. 2 AgEq was calculated

using metal prices of $20.00/oz silver, $3.00/lb copper and

$1.05/lb lead. 3 Meters represent “True Width” which is calculated

for significant intercepts only and based on orientation axis of

core across the estimated dip of the vein.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20201113005189/en/

For more information: Stefan Axell VP, Corporate

Development & Communications Americas Gold and Silver

Corporation 416-874-1708

Darren Blasutti President and CEO Americas Gold and Silver

Corporation 416-848-9503

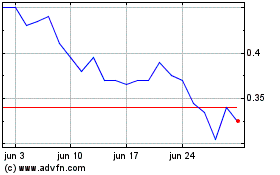

Americas Gold and Silver (TSX:USA)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Americas Gold and Silver (TSX:USA)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025