Altius Provides 2nd Quarter 2021 Project Generation Update

07 Julho 2021 - 8:45AM

Business Wire

Altius Minerals Corporation (ALS:TSX) (ATUSF: OTCQX)

(“Altius” or the “Corporation”) is pleased to update its Project

Generation (“PG”) business activities and its public junior

equities portfolio. The market value of equities in the portfolio

at June 30, 2021 was approximately $64.5 million, compared to $54.2

million at March 31, 2021. The portfolio value includes receipt of

600,000 shares of Champion Iron Limited (CIA:TSX) that were

distributed to secured debt holders as part of its acquisition of

the Kami project through a receivership process, and also 7.14

million shares of TRU Precious Metals Corp. (TRU:TSXV) that

were received as payment for the Golden Rose property during the

quarter. The portfolio value does not include equity sales amounts

of $1.9 million but does incorporate new investments made of $2.1

million during the quarter. An updated list of the public equity

holdings has been posted to the Altius website at

http://altiusminerals.com/projects/junior-equities.

Portfolio and Project Highlights

Altius PG equity companies have raised more than $150 million

from the beginning of 2020 to the end of Q1 2021. This pace

continued in Q2, with an additional $68 million closed in the

quarter, mainly by Surge Copper Corp. (SURG:TSXV) (“Surge”)

($14 million) and Uranium Royalty Corporation (URC:TSXV)

($37 million).

Adventus Mining Corporation (ADZN:TSXV) (“Adventus”)

continued to report positive high grade infill drilling results

from its copper and gold rich El Domo deposit located within the

Curipamba project. A feasibility study for El Domo is expected to

be completed in the fourth quarter of 2021. Adventus also recently

commenced exploratory drilling on targets within the broader

Curipamba project. In addition to its large equity holding in

Adventus, Altius holds a 2% net smelter return (“NSR”) royalty

covering the Curipamba project as well as royalties covering

several additional exploration projects located in Ireland and

Newfoundland that Adventus has either sold to or partnered with

third party companies including South32 and Canstar Resources..

Orogen Royalties Inc. (OGN:TSVV) (“Orogen”) reported

additional exploration project sales that included retained

royalties as well as providing insight into First Majestic Silver

Corporation’s continued advancement of the construction-stage

Ermitaño gold-silver deposit in Mexico, on which Orogen holds a 2%

NSR royalty. In addition to its equity stake in Orogen, Altius also

owns a direct 1.5% NSR royalty related to the Orogen-generated

Silicon project in Nevada, that is being advanced by AngloGold

Ashanti. Orogen also holds a 1% NSR royalty on the Silicon

project.

Surge Copper Corp. During the quarter Altius acquired

3,773,585 flow-through units in Surge at a price of 53 cents per

unit for a total investment of $2 million. Surge is a copper

exploration company with a current focus on resource definition and

exploration of its Ootsa Cu-Au porphyry project, British

Columbia.

During the quarter several precious metal projects organically

generated and vended by Altius in Newfoundland for equity stakes

and underlying project royalties in the past year saw the

commencement of summer field programs and drilling campaigns that

included:

- Sterling Metals Corp. (SAG:TSXV) at the Sail Pond

project

- Canstar Resources Inc. (ROX:TSXV) at its Golden Baie

project

- Canterra Minerals Corporation (CTM:TSXV) at its Wilding

Lake project

- TRU Precious Metals Corp. on its Newfoundland projects

including the Golden Rose project

During the quarter Altius executed an agreement to vend

its Adeline copper project in Labrador to Chesterfield Resources

(CHF:LSE) for 9.9% of the Company (10,089,199 shares) and

11,100,000 3-year warrants priced at 20p, as well as a 1.6% gross

sales royalty covering the project. Altius anticipates receipt of

the payment shares by the end of July. The value of these shares

has not been included in the quarter end portfolio value.

Altius also executed a binding Letter of Intent with

Churchill Resources Inc. (CRI:TSXV) on the sale

of the Florence Lake nickel project for the staged issuance of

approximately 8.3 million total shares of CRI and retention of a

1.6% gross sales royalty covering the project. Altius anticipates

receipt of the payment shares in the third quarter, the value of

which has also not been included in the quarter end portfolio

value.

Qualified Person

Lawrence Winter, Ph.D., P.Geo., Vice‐President of Exploration

for Altius, a Qualified Person as defined by National Instrument

43-101 - Standards of Disclosure for Mineral Projects, is

responsible for the scientific and technical data presented herein

and has reviewed, prepared and approved this release.

About Altius

Altius’s strategy is to create

per share growth through a diversified portfolio of royalty assets

that relate to long life, high margin operations. This strategy

further provides shareholders with exposures that are well aligned

with sustainability-related global growth trends including the

electricity generation transition from fossil fuel to renewables,

transportation electrification, reduced emissions from steelmaking

and increasing agricultural yield requirements. These macro-trends

each hold the potential to cause increased demand for many of

Altius’s commodity exposures including copper, renewable based

electricity, several key battery metals (lithium, nickel and

cobalt), clean iron ore, and potash. In addition, Altius runs a

successful Project Generation business that originates mineral

projects for sale to developers in exchange for equity positions

and royalties. Altius has 41,504,597 common shares issued and

outstanding that are listed on Canada’s Toronto Stock Exchange. It

is a member of both the S&P/TSX Small Cap and S&P/TSX

Global Mining Indices.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210707005332/en/

Chad Wells Email: Cwells@altiusminerals.com Tel:

1.877.576.2209 Flora Wood Email:

Fwood@altiusminerals.com Tel: 1.877.576.2209 Direct:

+1(416)346.9020

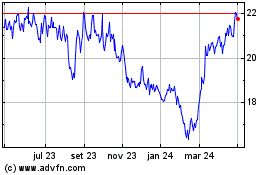

Altius Minerals (TSX:ALS)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

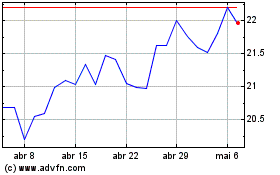

Altius Minerals (TSX:ALS)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024