Americas Gold and Silver Corporation (TSX: USA) (NYSE American:

USAS) (“Americas” or the “Company”), a growing North American

precious metals producer, reports consolidated financial and

operational results for the quarter ended June 30, 2021 along with

an operations update.

This earnings release should be read in conjunction with the

Company’s Management’s Discussion and Analysis, Financial

Statements and Notes to Financial Statements for the corresponding

period, which have been posted on the Americas Gold and Silver

Corporation SEDAR profile at www.sedar.com, and on its EDGAR

profile at www.sec.gov, and which are also available on the

Company’s website at www.americas-gold.com. All figures are in U.S.

dollars unless otherwise noted.

Operational and Second Quarter Financial Highlights

- Revenue of $9.5 million and net loss of $17.8 million for

Q2-2021 or a loss of ($0.13) per share, with the loss mostly

attributable to the continued ramp-up at Relief Canyon.

- The Company signed an agreement on July 6, 2021 with the

Mexican Ministries of Economy, Interior and Labour along with union

representatives committing to a reopening of the Cosalá Operations.

The Company anticipates that both the mine and the mill will be at

full capacity by the start of Q4-2021 assuming the compliance of

the agreement by members of the union.

- Galena’s Recapitalization Plan is proceeding well with the

Company continuing to experience higher year-over-year production

in Q2-2021 compared to Q2-2020; silver production increased by 20%

year-over-year while lead production increased by 10%.

- Phase 1 drilling of Galena’s Recapitalization Plan was

completed in the quarter and results will be incorporated into the

updated mineral reserve and resource estimate before the end of

August 2021. Phase 2 drilling has just begun with the first hole

testing the down dip extension of the high-grade Silver Vein

approximately 500 feet below the current drill station.

- Following an extensive review and a challenging ramp-up at

Relief Canyon, the operation proceeded with run-of-mine heap

leaching and continued its efforts to resolve metallurgical

challenges in Q2-2021. On August 13, 2021, the Company and the

Board of Directors decided to temporarily suspend mining operations

at Relief Canyon in order to prioritize capital for the Cosalá

Operations re-start while it continues leaching operations and

ongoing metallurgical test work.

- Consolidated year-to-date operating metrics from YTD-2021 were

generally not comparable to YTD-2020 due to the illegal blockade at

the Cosalá Operations, suspension of operating metrics during the

Galena Recapitalization Plan implementation, and the continued

ramp-up of operations at Relief Canyon to full production.

“I expect the second half of 2021 will showcase the strength of

the Company’s silver portfolio following a challenging start to the

year,” stated Americas Gold and Silver President & CEO Darren

Blasutti. “The anticipated resource update for the Galena Complex

is projected to highlight the significant potential of the asset

while silver production continues to ramp-up quarter over quarter.

Coupled with the anticipated full re-opening of the Cosalá

Operations in Mexico by the start of Q4-2021, the Company’s

profitability and cash flow is expected to improve significantly

given higher silver, zinc and lead prices. At Relief Canyon, the

Company continues to look at alternatives to improve the

metallurgical recovery of the operation and I believe there remains

significant value in the asset despite the initial challenges.”

Cosalá Operations

On July 6, 2021, the Company signed an agreement with the

Mexican Ministries of Economy, Interior and Labour along with union

representatives committing to a re-opening at the Cosalá

Operations. The agreement contemplates immediate right to

possession of the property with joint inspections coordinated by

the Ministry of Labor, so that the mine and mill can re-start

operations in a safe and sustainable manner.

Mexican government inspectors from the Mexican Ministry of

Labour have physically inspected the San Rafael mine and Los

Braceros mill and reviewed the re-start plans, which validated the

existing safe conditions at the operations and puts the Company in

position to recall employees immediately. The Company is ready to

recall all workers before the end of August so long as the union

abides by the signed agreement.

Based on the favourable condition of the mine and mill, the

Company continues to anticipate that both will be operating within

a few weeks of the re-call of employees and for the Cosalá

Operation to be at full capacity by the start of Q4-2021. The

operation also has approximately 70,000 tonnes of ore in stockpile

that can be processed as a contingency.

Upon a restart of operations, higher silver prices will allow

the Company to target the higher-grade silver ores in the Upper

Zone of San Rafael and develop the silver-copper EC120 project.

Mining these silver-rich areas of the Cosalá Operations is expected

to significantly increase silver production to over 2.5 million

ounces of silver per year.

Galena Complex

The Company has completed the Phase 1 drilling program as part

of the Galena Complex Recapitalization Plan. The Company expects to

provide an updated mineral resource estimate by the end of August

2021. The Company is confident that based on the continued

exploration success, from drilling completed during July 2020

through June 2021, that the resource estimate will increase. The

Company’s most recent mineral resource update, which was released

in September 2020, already demonstrated the significant exploration

potential at the property with measured and indicated resource

increasing by 36% and inferred resource increasing by 100%.

The initial 21-hole drill program targeting the Silver Vein at

depth is complete with all holes intersecting mineralization. Most

recent high-grade results include:

- Hole 55-183: 3,345 g/t silver and 2.8% copper (3,633 g/t silver

equivalent [1]) over 3.8 m [2] including: 13,800 g/t silver and

11.1% copper (14,900 g/t silver equivalent) over 0.5 m

- Hole 55-143: 2,460 g/t silver and 2.1% copper (2,680 g/t silver

equivalent) over 4.1 m including: 7,060 g/t silver and 5.4% copper

(7,620 g/t silver equivalent) over 0.6 m

- Hole 55-184: 3,966 g/t silver and 4.0% copper (4,372 g/t silver

equivalent) over 2.2 m including: 7,610 g/t silver and 7.6% copper

(8,390 g/t silver equivalent) over 0.5 m

- Hole 55-173: 1,747 g/t silver and 2.0% copper (1,968 g/t silver

equivalent) over 1.5 m including: 12,400 g/t silver and 16.2%

copper (14,100 g/t silver equivalent) over 0.1 m

- Hole 55-181: 1,185 g/t silver and 1.4% copper (1,330 g/t silver

equivalent) over 1.9 m and: 738 g/t silver and 0.5% copper (790 g/t

silver equivalent) over 2.1 m

- Hole 55-186: 2,264 g/t silver and 3.1% copper (2,588 g/t silver

equivalent) over 0.5 m

A full table of the drill results can be found at:

https://americas-gold.com/site/assets/files/4297/dr20210712.pdf

The Phase 2 drill program has commenced with several targets

identified. Drilling at depth will continue to focus on the three

south-east plunging veins which include the 72 Vein, the Silver

Vein and the down-dip extension of the 360 Complex. Drilling has

commenced from a newly developed drill station further east on the

5500-Level to continue to test the extension of the Silver Vein at

depth following the success of the initial 21-hole drill program.

The first drill hole from this station has commenced and is

targeting the Silver Vein approximately 500 feet below the drill

station. Subsequent drill stations are planned further east on the

5500-Level to continue to target the Silver Vein and 360 Complex.

The initial drilling success of the 360 Complex during Phase 1 is

believed to be the top of the system with the potential to extend

at depth. Phase 2 will include continued exploration in gap areas

within this south-east plunging trend to determine continuity and

potential sources of these high-grade mineralized vein systems.

The goal of Phase 2 drilling is to add significant mine life in

known vein systems and to discover new orebodies both at depth and

near surface. The Company is targeting an additional 50 million

ounces of silver from the Phase 2 drilling program, on a 100% basis

for the property.

The Company expects 2021 to be a transitional year at the Galena

Complex but the operation has already begun to benefit from the

Recapitalization Plan with silver and lead production in Q2-2021

increasing by over 20% and 10%, respectively on a year-over-year

basis. The Company is targeting to increase production to a 2

million ounce per year plan by the end of 2022 and longer term,

assuming continued exploration success, the Company anticipates the

operation will again reach peak historical annual production levels

of approximately 5 million ounces per year.

Relief Canyon

While the Company was successful in meeting several important

commissioning targets, including initial construction capital, and

planned mining and crushing rates, the ramp-up at Relief Canyon has

been and continues to be challenging since the first poured gold in

February 2020. During this period, the Company and its consultants

performed extensive analyses and implemented a number of procedural

changes to address the start-up challenges typical of a heap leach

operation. As part of this analysis, the Company has identified

naturally occurring carbonaceous material within the Relief Canyon

pit. The identification of this material was not recognized in the

feasibility study.

The Company began two small run-of-mine test pads in Q1-2021 to

evaluate the possibility of simplifying the flowsheet by by-passing

the crushing and conveying circuits and transitioned to this method

of ore placement in May 2021. Despite the encouraging initial

results, the operation has not seen a sustained material increase

in recoveries to date. Additional improvements in the predictive

ability of the resource model are progressing with incorporation of

the latest geological detail from recent pit mapping as well as new

data from an extensive re-assaying program of 13,000 historic

exploration pulp samples for the presence of carbonaceous material.

Completion of this data compilation and analysis is targeted for

late Q3-2021. Management also initiated several metallurgical test

work programs to investigate ore treatment options, including

Carbon-In-Leach processing. Several of the options present

encouraging preliminary results. Further investigation is planned

in the near term.

The Company is committed to continuing efforts to resolve these

metallurgical challenges and increase production levels at Relief

Canyon as noted above. However, the Company is in the process of

reopening the Cosalá Operations and is currently prioritizing its

capital resources to the re-start. As a result of these capital

allocation decisions, the Company has decided to temporarily

suspend mining operations at Relief Canyon pending improved

consolidated capital and the initial metallurgical test results.

During this time, the Company will continue leaching operations and

working to improve recovery and operations through an extensive

audit of drilling, sampling, ore control, and modelling,

implementing internal QA/QC programs, and metallurgy testing

program on carbonaceous material.

Notice of Intent for the Phase 2 EIS was published in the

Federal Register in Q3-2020. The Phase 2 permit will allow the

Company to continue mining at depth below the water table, expand

the footprint of both the heap leach and waste rock storage

facilities and expand the mining permit boundary. Approval of the

EIS and receipt of the Phase 2 permit is expected before the end of

Q3-2021.

About Americas Gold and Silver Corporation

Americas Gold and Silver Corporation is a high-growth precious

metals mining company with multiple assets in North America. The

Company owns and operates the Relief Canyon mine in Nevada, USA,

the Cosalá Operations in Sinaloa, Mexico and manages the 60%-owned

Galena Complex in Idaho, USA. The Company also owns the San Felipe

development project in Sonora, Mexico. For further information,

please see SEDAR or www.americas-gold.com.

Technical Information and Qualified Persons

The scientific and technical information relating to the

operation of the Company’s material operating mining properties

contained herein has been reviewed and approved by Daren Dell,

P.Eng., Chief Operating Officer of the Company. The scientific and

technical information relating to mineral resources and exploration

contained herein has been reviewed and approved by Niel de Bruin,

Director of Geology of the Company. Each of Messrs. Dell and de

Bruin are "qualified persons" for the purposes of NI 43-101.

The Company’s current Annual Information Form and the NI 43-101

Technical Reports for its other material mineral properties, all of

which are available on SEDAR at www.sedar.com, and EDGAR at

www.sec.gov contain further details regarding mineral reserve and

mineral resource estimates, classification and reporting

parameters, key assumptions and associated risks for each of the

Company’s material mineral properties, including a breakdown by

category.

The diamond drilling program used NQ-size core. Americas Gold

and Silver’s standard QA/QC practices were utilized to ensure the

integrity of the core and sample preparation at the Galena Complex

through delivery of the samples to the assay lab. The drill core

was stored in a secure facility, photographed, logged and sampled

based on lithologic and mineralogical interpretations. Standards of

certified reference materials, field duplicates and blanks were

inserted as samples shipped with the core samples to the lab.

Analytical work was carried out by American Analytical Services

Inc. (“AAS”) located in Osburn, Idaho. AAS is an independent,

ISO-17025 accredited laboratory. Sample preparation includes a

30-gram pulp sample analyzed by atomic absorption spectrometry

(“AA”) techniques to determine silver, copper, and lead, using aqua

regia for pulp digestion. Samples returning values over 514g/t Ag

are re-assayed using fire-assay techniques for silver.

Additionally, samples returning values over 23% Pb are re-assayed

using titration techniques.

Duplicate pulp samples were sent out quarterly to ALS Global, an

independent, ISO-17025 accredited laboratory based in Reno, Nevada

to perform an independent check analysis. A conventional AA

technique was used for the analysis of silver, copper and lead at

ALS Global with the same industry standard procedures as those used

by AAS. The assay results listed in this report did not show any

significant contamination during sample preparation or sample bias

of analysis.

All mining terms used herein have the meanings set forth in

National Instrument 43-101 – Standards of Disclosure for Mineral

Projects (“NI 43-101”), as required by Canadian securities

regulatory authorities. These standards differ significantly from

the requirements of the SEC that are applicable to domestic United

States reporting companies. Any mineral reserves and mineral

resources reported by the Company in accordance with NI 43-101 may

not qualify as such under SEC standards. Accordingly, information

contained in this news release may not be comparable to similar

information made public by companies subject to the SEC’s reporting

and disclosure requirements.

Cautionary Statement on Forward-Looking Information:

This news release contains “forward-looking information” within

the meaning of applicable securities laws. Forward-looking

information includes, but is not limited to, Americas Gold and

Silver’s expectations, intentions, plans, assumptions and beliefs

with respect to, among other things, estimated and targeted

production rates and results for gold, silver and other precious

metals, the expected prices of gold, silver and other precious

metals, as well as the related costs, expenses and capital

expenditures; the recapitalization plan at the Galena Complex,

including the expected production levels and potential additional

mineral resources thereat; the resumption of mining and processing

operations at the Cosalá Operations following the resolution of the

illegal blockade, including expected production levels; the

expected capital costs required in connection with the resumption

of mining and processing operations at the Cosalá Operations; the

expectations regarding the level of support from the Mexican

government with respect to the long-term stability of Cosalá

Operations, and its ability to maintain such support in the near-

and long-term; the Company’s production, development plans and

performance expectations at the Relief Canyon Mine and its ability

to finance, develop and operate Relief Canyon, including the

expected improvement of operations and overall project economics in

connection therewith, the timing and conclusions of the data

compilation and analysis occurring at Relief Canyon the length of

time of the temporary pause in mining operations at Relief Canyon

to address the capital requirements for the re-opening of its

Cosalá Operations and expected timing for the re-start of the

Relief Canyon operations after such pause;. Often, but not always,

forward-looking information can be identified by forward-looking

words such as “anticipate”, “believe”, “expect”, “goal”, “plan”,

“intend”, “potential’, “estimate”, “may”, “assume” and “will” or

similar words suggesting future outcomes, or other expectations,

beliefs, plans, objectives, assumptions, intentions, or statements

about future events or performance. Forward-looking information is

based on the opinions and estimates of Americas Gold and Silver as

of the date such information is provided and is subject to known

and unknown risks, uncertainties, and other factors that may cause

the actual results, level of activity, performance, or achievements

of Americas Gold and Silver to be materially different from those

expressed or implied by such forward-looking information. With

respect to the business of Americas Gold and Silver, these risks

and uncertainties include risks relating to widespread epidemics or

pandemic outbreak including the COVID-19 pandemic; the impact of

COVID-19 on our workforce, suppliers and other essential resources

and what effect those impacts, if they occur, would have on our

business, including our ability to access goods and supplies, the

ability to transport our products and impacts on employee

productivity, the risks in connection with the operations, cash

flow and results of the Company relating to the unknown duration

and impact of the COVID-19 pandemic; interpretations or

reinterpretations of geologic information; unfavorable exploration

results; inability to obtain permits required for future

exploration, development or production; general economic conditions

and conditions affecting the industries in which the Company

operates; the uncertainty of regulatory requirements and approvals;

fluctuating mineral and commodity prices; the ability to obtain

necessary future financing on acceptable terms or at all; the

ability to operate the Relief Canyon Project; and risks associated

with the mining industry such as economic factors (including future

commodity prices, currency fluctuations and energy prices), ground

conditions and other factors limiting mine access, failure of

plant, equipment, processes and transportation services to operate

as anticipated, environmental risks, government regulation, actual

results of current exploration and production activities, possible

variations in ore grade or recovery rates, permitting timelines,

capital and construction expenditures, reclamation activities,

labor relations or disruptions, social and political developments

and other risks of the mining industry. The potential effects of

the COVID-19 pandemic on our business and operations are unknown at

this time, including the Company’s ability to manage challenges and

restrictions arising from COVID-19 in the communities in which the

Company operates and our ability to continue to safely operate and

to safely return our business to normal operations. The impact of

COVID-19 on the Company is dependent on a number of factors outside

of its control and knowledge, including the effectiveness of the

measures taken by public health and governmental authorities to

combat the spread of the disease, global economic uncertainties and

outlook due to the disease, and the evolving restrictions relating

to mining activities and to travel in certain jurisdictions in

which it operates. Although the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in forward-looking information,

there may be other factors that cause results not to be as

anticipated, estimated, or intended. Readers are cautioned not to

place undue reliance on such information. Additional information

regarding the factors that may cause actual results to differ

materially from this forward‐looking information is available in

Americas Gold and Silver’s filings with the Canadian Securities

Administrators on SEDAR and with the SEC. Americas Gold and Silver

does not undertake any obligation to update publicly or otherwise

revise any forward-looking information whether as a result of new

information, future events or other such factors which affect this

information, except as required by law. Americas Gold and Silver

does not give any assurance (1) that Americas Gold and Silver will

achieve its expectations, or (2) concerning the result or timing

thereof. All subsequent written and oral forward‐looking

information concerning Americas Gold and Silver are expressly

qualified in their entirety by the cautionary statements above.

1 Silver equivalent was calculated using metal prices of

$20.00/oz silver, $3.00/lb copper and $1.05/lb lead and equivalent

metallurgical recoveries were assumed for all metals (silver, lead

and copper). 2 Meters represent “True Width” which is calculated

for significant intercepts only and is based on orientation axis of

core across the estimated dip of the vein.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210816005215/en/

For more information: Stefan Axell VP, Corporate

Development & Communications Americas Gold and Silver

Corporation 416-874-1708

Darren Blasutti President and CEO Americas Gold and Silver

Corporation 416‐848‐9503

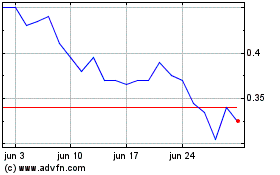

Americas Gold and Silver (TSX:USA)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Americas Gold and Silver (TSX:USA)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025