Macquarie Asset Management Acquires Alternative Investment Firm Central Park Group, Further Strengthening Commitment to Providing Alternative Investment Solutions to High-Net-Worth Investors

21 Outubro 2021 - 6:31PM

Business Wire

Macquarie Asset Management (MAM), the asset management division

of Macquarie Group (ASX: MQG), today announced that it has agreed

to acquire New York-based Central Park Group (CPG), an independent

investment advisory firm delivering private client access to

institutional hedge fund, private equity, real estate and

funds-of-funds. The agreement underscores MAM’s commitment to

offering individual investors a diversified platform of

institutional-quality alternative investments managed by Macquarie

and other leading sponsors.

With more than $US3.5 billion in assets under management,

Central Park Group is a pioneer in providing financial advisors and

their clients access to top alternative investment talent in

structures specifically designed to meet the needs of

high-net-worth and smaller institutional investors.

“We have long admired Central Park Group’s track record of

innovation and success in delivering alternative solutions to

individual investors. Given our alternatives expertise and our

significant presence in the intermediary channel, the combination

of Macquarie and Central Park Group uniquely positions us to

address the needs of individual investors by providing increased

access to alternative investments along with an enhanced client

experience,” said Ben Way, Head of Macquarie Asset Management.

The acquisition highlights Macquarie’s approach to serving

clients and becoming a leader in the US high-net-worth alternatives

sector. To support this effort, Macquarie is continuing to build

its suite of cohesive value-added services, robust educational

tools, curricula, and broad platform of alternative investment

offerings based on its deep, long-standing industry and asset-class

experience.

“The asset management industry is rapidly evolving, and

individual investor demand for alternative strategies is playing a

central role in this dramatic shift. Macquarie’s objective with the

acquisition of Central Park Group is to empower clients and their

financial advisors to invest for long-term success through access

to institutional-quality alternative investment opportunities in

thoughtful structures,” added Graeme Conway, Chief Commercial

Officer at Macquarie Asset Management.

“Joining forces with Macquarie is the natural next step in

Central Park Group’s evolution,” said Gregory Brousseau, Co-Chief

Executive Officer and Co-Chief Investment Officer of Central Park

Group. “We will continue to offer best-in-class alternative

investments and clients will benefit from the added resources,

depth and scale of a major global financial institution.”

“Macquarie is committed to democratizing alternative

investments,” said Mitchell Tanzman, Co-Chief Executive Officer and

Co-Chief Investment Officer of Central Park Group. “As part of

Macquarie, we will be able to further our mission of eliminating

many of the structural impediments to private client investment in

best-in-class alternatives, on a substantially larger scale. With a

shared vision and similar entrepreneurial spirit, we believe that

Macquarie is a great fit for Central Park Group.”

The transaction is expected to close in early 2022. Financial

terms of the transaction were not disclosed.

About Macquarie Asset Management

Macquarie Asset Management is a global asset manager that aims

to deliver positive impact for everyone. Trusted by institutions,

pension funds, governments, and individuals to manage more than

$US520 billion in assets globally, we provide access to specialist

investment expertise across a range of capabilities including fixed

income, equities, multi-asset solutions, private credit,

infrastructure, renewables, natural assets, real estate, and

transportation finance.

Macquarie Asset Management is part of Macquarie Group, a

diversified financial group providing clients with asset

management, finance, banking, advisory and risk and capital

solutions across debt, equity, and commodities. Founded in 1969,

Macquarie Group employs approximately 16,400 people in 31 markets

and is listed on the Australian Securities Exchange.

About Central Park Group, LLC

Central Park Group was founded to serve the growing demand for

alternative investments among high-net-worth and smaller

institutional investors. The Firm sources private equity, hedge

fund, real estate and fund-of-funds managers and develops offerings

that are appropriate for a broad range of qualified investors.

Committed to “education before assets®,” Central Park Group has

created a suite of educational tools and resources for financial

advisors and their clients. Central Park Group’s founders pioneered

many of the fund structures now used industrywide providing private

client access to strategies historically accessible solely to

institutional investors. Over more than 25 years, Central Park

Group’s founders have invested more than $US15 billion in hedge

funds, private equity, real estate and funds-of-funds on behalf of

investors.

All Macquarie figures as of 30 June 2021. All Central Park Group

figures as of 1 September 2021.

Macquarie Asset Management (MAM) offers a diverse range of

products including securities investment management, infrastructure

and real asset management, and fund and equity-based structured

products. Macquarie Investment Management (MIM) is the marketing

name for certain companies comprising the asset management division

of Macquarie Group. These include the following investment

advisers: Macquarie Investment Management Business Trust (MIMBT),

Macquarie Funds Management Hong Kong Limited, Macquarie Investment

Management Austria Kapitalanlage AG, Macquarie Investment

Management Global Limited, Macquarie Investment Management Europe

Limited, and Macquarie Investment Management Europe S.A.

Other than Macquarie Bank Limited (MBL), none of the entities

noted are authorized deposit-taking institutions for the purposes

of the Banking Act 1959 (Commonwealth of Australia). The

obligations of these entities do not represent deposits or other

liabilities of MBL. MBL does not guarantee or otherwise provide

assurance in respect of the obligations of these entities, unless

noted otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20211021006078/en/

Lee Lubarsky Macquarie Group Media Relations 212.231.2638

lee.lubarsky@macquarie.com

Dan Tauber Central Park Group 212.317.9262

dtauber@centralparkgroup.com

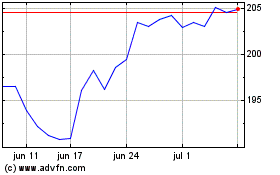

Macquarie (ASX:MQG)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Macquarie (ASX:MQG)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025