Total Q3 2021 revenue rose 13.3% year over

year

VIA optronics AG (NYSE: VIAO) (“VIA”), a leading supplier of

interactive display systems and solutions, today announced

unaudited financial results for the third quarter ended September

30, 2021. The results have been prepared in accordance with

International Financial Reporting Standards (IFRS) as issued by the

IASB.

“We are pleased to report an increase in revenue and positive

EBITDA in the third quarter despite ongoing headwinds due to

component shortages and supply challenges,” said Jürgen Eichner,

CEO & Founder of VIA. “We plan to continue executing on our

strategy with a goal of moving towards our €500 million annual

revenue target within five years under the assumptions that current

market constraints will be resolved. We hope to continue gaining

traction in the EV market as companies build out their supply

chain, and we believe our latest business award with a British

electric vehicle manufacturer to design, develop, and produce a

bundle of three variant cameras is a great testament to the

strength of our solutions. Total third quarter revenue in the

automotive and industrial markets increased significantly year over

year and represented 42% and 41% of our total revenue,

respectively. We believe strategic investments in R&D will help

us to secure long-term growth.”

Third Quarter 2021 Financial Highlights

- Total revenue of €49.4 million increased 13.3%

year-over-year

- Display Solutions revenue of €42.1 million increased 17.3%

year-over-year

- Sensor Technologies revenue of €7.3 million decreased 5.2%

year-over-year

- Gross profit margin of 13.8% compared to 14.7% in the third

quarter of 2020

- EBITDA of €1.1 million compared to €3.5 million in the third

quarter of 2020

“We recorded significant revenue from our automotive customers,

which increased 137% year-over-year, confirming our approach of

investing in this sector. We are focused on driving top line growth

and gross margin expansion. Reduced margins in the third quarter

compared to last year were primarily due to higher component and

logistics costs, which we are working on mitigating. We remain

committed to disciplined expense management while still investing

for future growth to drive profitability,” said Dr. Markus Peters,

CFO of VIA.

Third Quarter 2021 Financial Summary

Total revenue of €49.4 million increased 13.3% from €43.6

million in the third quarter of 2020. The increase was driven by

growth in the Company’s Display Solutions segment. Display

Solutions revenue of €42.1 million increased by 17.3% from €35.9

million in the third quarter of 2020, driven primarily by growth in

automotive revenue as well as increased industrial sales. Sensor

Technologies revenue of €7.3 million decreased by 5.2% from €7.7

million in the third quarter of 2020, due to a more challenging

environment in the consumer end market caused by ongoing

uncertainty regarding LCD display supply.

Revenue from the automotive end market grew 137% year over year

and accounted for 42% of Display Solutions revenue in the third

quarter. Revenue related to the Industrial and specialized

applications end market grew 11% year over year and accounted for

41% of Display Solutions revenue, compared to 43% of revenue in the

third quarter of 2020. Revenue related to the consumer end market

accounted for 17% of Display Solutions revenue, compared to 36% of

revenue in the third quarter of 2020.

Gross profit margin decreased to 13.8% from 14.7% in the third

quarter of 2020. Display Solutions gross profit margin of 11.7%

decreased from 14.2% in the third quarter of 2020, due to sales mix

and increased costs associated with the global component shortages.

Sensor Technologies gross profit margin of 26.0% rose from 16.9% in

the third quarter of 2020, primarily driven by enhanced utilization

of existing internal production capacities.

Research and development expenses increased to €1.5 million from

€0.4 million in the third quarter of 2020 driven by increased

investments in existing R&D capacity to prepare for future

growth. Selling expenses increased to €1.2 million from €1.1

million in the third quarter of 2020 due to higher sales volumes.

General and administrative expenses of €5.1 million increased from

€3.4 million, due to public company expenses and increased

headcount to support the Company’s growth plans.

Operating loss of €0.3 million compared to operating income of

€1.7 in the third quarter 2020.

Net loss of €0.9 million, or a loss of €0.19 per basic and

diluted share, compared to net profit of €1.5 million, or earnings

of €0.47 per basic and diluted share, in the third quarter of

2020.

EBITDA of €1.1 million compared to EBITDA of €3.5 million in the

third quarter of 2020. Display Solutions EBITDA of €0.0 million

compared to €2.1 million in the third quarter of 2020. Sensor

Technologies EBITDA of €1.1 million compared to €1.4 million in the

third quarter of 2020.

For information regarding the non-IFRS financial measures

discussed in this release, please see "Non-IFRS Financial Measures"

including a reconciliation of EBITDA on a consolidated basis to

operating income (loss), the comparable IFRS measure, as well a

reconciliation of EBITDA on a segment basis in the Segment

Information section below.

Allocation of Costs

In connection with the preparation of the unaudited financial

results for the second quarter ended June 30, 2021, management

reviewed the allocation of certain expense items and, beginning in

that quarter, decided to adjust the allocation primarily resulting

in a reallocation of specific personnel costs from general and

administrative expenses to selling expenses and research and

development expenses, respectively. No adjustments were made to

historical periods as the impact of a retrospective reallocation of

expenses on the historical periods is immaterial. Historically

reported EBITDA results are not affected by the reallocation.

Specifically:

- for the three months ended September 30, 2020, a retrospective

application of the reallocations would have had no impact on gross

profit or operating (loss)/income and would have resulted in a

decrease in general and administrative expenses of approximately

€0.8 million and an increase in research and development expenses

of approximately €0.2 million and an increase in selling expenses

of approximately €0.6 million.

Outlook

For the fourth quarter of 2021, VIA expects to achieve total

revenue of €40 million to €45 million. Due to a sudden impact of

global component shortages in certain segments of the industrial

and consumer markets, the Company now expects revenue growth of

about 15% for the full year 2021 compared to 2020. While VIA is

working to mitigate these impacts, the Company’s projections will

depend significantly on the development of global component

shortages as well as constrained global shipping capacity, and

supply chain related changes, which influence the demand for VIA’s

products. The outlook also reflects continued uncertainty related

to the ongoing impact of COVID-19. These forward-looking statements

are based on current expectations and actual results may differ

materially. Please refer to the note below on the forward-looking

statements and the risks involved with such statements. VIA

optronics disclaims any obligation to update these forward-looking

statements.

Change of Auditor

VIA’s audit committee has recommended to the supervisory board

that it propose PricewaterhouseCoopers GmbH

Wirtschaftsprüfungsgesellschaft (“PWC”) and BDO AG

Wirtschaftsprüfungsgesellschaft AG with a preference for PWC as the

Company’s auditor for election at the Company’s upcoming annual

general meeting. The Company’s auditor, Ernst & Young GmbH

Wirtschaftsprüfungsgesellschaft (“EY”), resigned on September 9,

2021. The financial results for the third quarter ended September

30, 2021 have been neither audited or reviewed.

Conference Call

VIA will host a conference call to discuss its results and will

provide a corporate update at 2:30 p.m. Central European Time /

8:30 a.m. Eastern Time today, November 17, 2021. The live webcast

of the call can be accessed at the VIA Investor Relations website

at https://investors.via-optronics.com, along with the company's

earnings press release. The dial-in numbers for the call are +1

760-294-1674 (USA), +44 203-059-8128 (UK), or +49 695-660-3600

(Germany). Please ask to be connected to the VIA optronics AG call.

An archived version of the webcast will be available on the VIA

Investor Relations website.

About VIA:

VIA is a leading provider of enhanced display solutions for

multiple end-markets in which superior functionality or durability

is a critical differentiating factor. Its customizable technology

is well-suited for high-end markets with unique specifications as

well as demanding environments that pose technical and optical

challenges for displays, such as bright ambient light, vibration

and shock, extreme temperatures and condensation. VIA’s interactive

display systems combine system design, interactive displays,

software functionality, cameras and other hardware components.

VIA’s intellectual property portfolio, process know-how, and

optical bonding and metal mesh touch sensor and camera module

technologies provide enhanced display solutions that are built to

meet the specific needs of its customers.

Further information on the Company can be found in its Annual

Report on Form 20-F for the year ended December 31, 2020 (the

“Annual Report”), which the Company has filed with the U.S.

Securities and Exchange Commission (SEC). You can access a PDF

version of the Annual Report at VIA optronics’ Investors Relations

website,

https://investors.via-optronics.com/investors/financial-and-filings/annual-reports/default.aspx.

A hard copy of the audited consolidated financial statements can

also be requested free of charge by contacting the investor

relations team via the information provided below.

Forward-Looking Statements

Statements in this press release about future expectations,

plans and prospects, as well as any other statements regarding

matters that are not historical facts, may constitute

“forward-looking statements.” These statements include, but are not

limited to, statements relating to the expected trading

commencement and closing dates. The words, without limitation,

“anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,”

“intend,” “may,” “plan,” “potential,” “predict,” “project,”

“should,” “target,” “will,” “would” and similar expressions are

intended to identify forward-looking statements, although not all

forward-looking statements contain these or similar identifying

words. Forward-looking statements are based largely on our current

expectations and projections about future events and financial

trends that we believe may affect our financial condition, results

of operations, business strategy, short-term and long-term business

operations and objectives, and financial needs. These

forward-looking statements involve known and unknown risks,

uncertainties, changes in circumstances that are difficult to

predict and other important factors that may cause our actual

results, performance or achievements to be materially different

from any future results, performance or achievements expressed or

implied by the forward-looking statement,, including, without

limitation, the risks described under Item 3. “Key Information—D.

Risk Factors,” in our Annual Report on Form 20-F as filed with the

US Securities and Exchange Commission. Moreover, new risks emerge

from time to time. It is not possible for our management to predict

all risks, nor can we assess the impact of all factors on our

business or the extent to which any factor, or combination of

factors, may cause actual results to differ materially from those

contained in any forward-looking statements we may make. In light

of these risks, uncertainties and assumptions, the forward-looking

events and circumstances discussed in this release may not occur

and actual results could differ materially and adversely from those

anticipated or implied in the forward-looking statements. We

caution you therefore against relying on these forward-looking

statements, and we qualify all of our forward-looking statements by

these cautionary statements. Any forward-looking statements

contained in this press release are based on the current

expectations of VIA’s management team and speak only as of the date

hereof, and VIA specifically disclaims any obligation to update any

forward-looking statement, whether as a result of new information,

future events or otherwise.

Non-IFRS Financial Measures

Our management and supervisory boards utilize both IFRS and

non-IFRS measures in a number of ways, including to facilitate the

determination of our allocation of resources, to measure our

performance against budgeted and forecasted financial plans and to

establish and measure a portion of management's compensation.

The non-IFRS measures used by our management and supervisory

boards include:

EBITDA, which we define as net profit (loss) calculated in

accordance with IFRS before financial result, taxes, depreciation

and amortization; for purposes of our EBITDA calculation, we define

"financial result" to include financial result as calculated in

accordance with IFRS and foreign exchange gains (losses) on

intercompany indebtedness.

Our management and supervisory boards believe these non-IFRS

measures are helpful tools in understanding certain aspects of our

financial performance and are important supplemental measures of

operating performance because they eliminate items that may have

less bearing on our operating performance and highlight trends that

may not otherwise be apparent when relying solely on IFRS financial

measures. As an example, our acquisition of VTS in 2018 included

acquisition-related costs, such as costs attributable to the

consummation of the transaction and integration of VTS as a

consolidated subsidiary (composed substantially of professional

services fees, including legal, accounting and other consultants)

and any transition compensation costs, and were not considered to

be related to the continuing operation of VTS's business and are

generally not relevant to assessing or estimating the long-term

performance of VTS. We also believe that these non-IFRS measures

are useful to investors and other users of our financial statements

in evaluating our performance because these measures are the same

measures used by our management and supervisory boards for these

purposes.

VIA optronics AG Reports

Unaudited Third Quarter 2021 Results

Total Q3 2021 revenue rose

13.3% year over year

VIA optronics AG

Consolidated Statement of

Financial Position

September 30,

December 31,

Millions of EUR

2021

2020

Assets

Non-current assets

26.2

21.5

Intangible assets

4.5

4.1

Property and equipment

20.6

16.8

Other financial assets

—

0.2

Deferred tax assets

1.1

0.4

Current assets

128.8

128.4

Inventories

32.6

17.3

Trade accounts receivables

36.9

26.4

Current tax assets

0.2

0.1

Other financial assets

—

—

Other non-financial assets

4.3

3.6

Cash and cash equivalents

54.8

81.0

Total assets

155.0

149.9

Equity and liabilities

Equity attributable to equity holders

of the parent

72.6

77.6

Share capital

4.5

4.5

Subscribed capital

—

—

Capital reserve

83.3

83.4

(Accumulated Deficit) / Retained

earnings

(16.2

)

(9.9

)

Currency translation reserve

1.0

(0.4

)

Non-controlling interests

0.7

0.3

Total Equity

73.3

77.9

Non-current liabilities

10.0

9.3

Loans

1.6

1.6

Provisions

0.1

0.1

Lease liabilities

8.3

7.6

Deferred tax liabilities

—

—

Current liabilities

71.7

62.7

Loans

30.3

20.6

Trade accounts payable

28.5

30.6

Current tax liabilities

1.2

1.3

Provisions

1.0

0.6

Lease liabilities

1.8

1.6

Other financial liabilities

5.3

4.1

Other non-financial liabilities

3.6

3.9

Total equity and liabilities

155.0

149.9

VIA optronics AG

Consolidated Statements of

Operations Data

Three Months Ended

Nine Months Ended

September 30,

September 30,

Millions of EUR

2021

2020

2021

2020

Revenue

49.4

43.6

134.5

108.5

Cost of sales

(42.6

)

(37.2

)

(116.8

)

(92.4

)

Gross profit

6.8

6.4

17.7

16.1

Selling expenses

(1.2

)

(1.1

)

(3.8

)

(3.3

)

General administrative expenses

(5.1

)

(3.4

)

(14.7

)

(9.8

)

Research and development expenses

(1.5

)

(0.4

)

(4.5

)

(1.5

)

Other operating income

3.4

1.4

7.7

3.0

Other operating expenses

(2.7

)

(1.2

)

(6.3

)

(2.4

)

Operating (loss)/income

(0.3

)

1.7

(3.9

)

2.1

Financial result

(0.2

)

(0.3

)

(0.8

)

(1.0

)

(Loss)/Profit before tax

(0.5

)

1.4

(4.7

)

1.1

Income tax expenses

(0.4

)

0.1

(1.1

)

(0.5

)

Net (loss)/profit after taxes from

continuing operations

(0.9

)

1.5

(5.8

)

0.6

Adjustments:

Financial result

(0.2

)

(0.3

)

(0.8

)

(1.0

)

Foreign exchange gains (losses) on

intercompany indebtedness

—

—

—

—

Income tax expenses

(0.4

)

0.1

(1.1

)

(0.5

)

Depreciation

(1.4

)

(1.8

)

(4.5

)

(5.3

)

EBITDA

1.1

3.5

0.6

7.4

VIA optronics AG

Earnings Per Share

Three

Three

Months

Months

Ended

Ended

September 30,

September 30,

EUR

2021

2020

Income/(loss) after taxes from continuing

operations (attributable to VIA optronics AG shareholders)

(0.9

)

1.4

Weighted average of shares outstanding

4,530,701

3,068,681

Earnings/(loss) per share in EUR

(basic and diluted)

(0.19

)

0.47

VIA optronics AG

Segment Information

2021:

Nine Months Ended

September 30, 2021

Display

Sensor

Total

Consolidation

Consolidated

Millions of EUR

Solutions

Technologies

segments

adjustments

Total

External revenues

115.2

19.3

134.5

—

134.5

Inter-segment revenues

—

3.0

3.0

(3.0

)

—

Total revenues

115.2

22.3

137.5

(3.0

)

134.5

Gross profit

12.5

5.2

17.7

—

17.7

Operating income (loss)

(5.5

)

1.6

(3.9

)

(3.9

)

Depreciation and amortization

2.5

2.0

4.5

—

4.5

EBITDA

(3.0

)

3.6

0.6

—

0.6

Three Months Ended

September 30, 2021

Display

Sensor

Total

Consolidation

Consolidated

Millions of EUR

Solutions

Technologies

segments

adjustments

Total

External revenues

42.1

7.3

49.4

—

49.4

Inter-segment revenues

—

0.7

0.7

(0.7

)

—

Total revenues

42.1

8.0

50.1

(0.7

)

49.4

Gross profit

4.9

1.9

6.8

—

6.8

Operating income (loss)

(0.9

)

0.6

(0.3

)

—

(0.3

)

Depreciation and amortization

0.9

0.5

1.4

—

1.4

EBITDA

—

1.1

1.1

—

1.1

2020:

Nine Months Ended

September 30, 2020

Display

Sensor

Total

Consolidation

Consolidated

Millions of EUR

Solutions

Technologies

segments

adjustments

Total

External revenues

89.2

19.2

108.5

—

108.5

Inter-segment revenues

—

2.3

2.3

(2.3

)

—

Total revenues

89.2

21.5

110.8

(2.3

)

108.5

Gross profit

12.7

3.4

16.1

—

16.1

Operating income (loss)

1.7

0.4

2.1

—

2.1

Depreciation and amortization

1.9

3.4

5.3

—

5.3

EBITDA

3.6

3.8

7.4

—

7.4

Three Months Ended

September 30, 2020

Display

Sensor

Total

Consolidation

Consolidated

Millions of EUR

Solutions

Technologies

segments

adjustments

Total

External revenues

35.9

7.7

43.6

—

43.6

Inter-segment revenues

—

0.7

0.7

(0.7

)

—

Total revenues

35.9

8.4

44.3

(0.7

)

43.6

Gross profit

5.1

1.3

6.3

0.1

6.4

Operating income (loss)

1.5

0.2

1.7

—

1.7

Depreciation and amortization

0.6

1.2

1.8

—

1.8

EBITDA

2.1

1.4

3.5

—

3.5

View source

version on businesswire.com: https://www.businesswire.com/news/home/20211117005829/en/

Investor Relations The Blueshirt Group Lindsay Savarese

Lindsay@blueshirtgroup.com 212-331-8417

Monica Gould Monica@blueshirtgroup.com 212-871-3927

Media Contact Alexandra Müller-Pl�tz

Amueler-ploetz@via-optronics.com +49 911 597 575-302

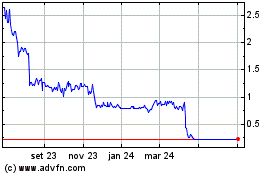

VIA optronics (NYSE:VIAO)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

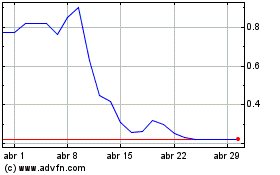

VIA optronics (NYSE:VIAO)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025