VIA optronics AG (NYSE: VIAO) (“VIA” or the “Company”), a

leading supplier of interactive display systems and solutions,

today announced that the Company’s 2021 annual general meeting (the

“AGM”) is planned to take place on December 29, 2021. As a result

of the ongoing COVID-19 pandemic, VIA will hold its AGM virtually

to ensure the health and safety of all parties. All information for

shareholders will be published on the investor relations section of

VIA’s website at https://investors.via-optronics.com/investors.

VIA also announced that two of the Company’s supervisory board

(the “Supervisory Board”) members, Jerome Tan and Diosdado Banatao

will resign effective as of the date of the AGM. The Supervisory

Board has conducted a criteria-based search and recruitment process

to find candidates with skills and experience that complement

existing Supervisory Board members and further support the

Company’s strategy. The Company plans to nominate Arthur Tan from

the Philippines and Shuji Aruga from Japan as Supervisory Board

members.

Mr. Jürgen Eichner, VIA’s Chief Executive Officer said, “We are

pleased to propose the nomination of Arthur and Shuji, who we are

confident will further strengthen our Supervisory Board.” Dr. Heiko

Frank, Chairman of VIA’s Supervisory Board added, “Arthur and Shuji

bring significant business experience and strong track records in

the technology sector. This is a pivotal time for the Company, as

we embark on the next stage of the implementation of our growth

strategy. Arthur and Shuji’s deep international and highly relevant

industry experience combined with strong leadership qualities will

complement our current Supervisory Board nicely. We also extend our

thanks to departing members Jerome and Diosdado for their many

contributions over the years.”

Arthur R. Tan has served as the Vice Chairman of the Board of

Integrated Micro-Electronics, Inc. since 2016 and concurrently as

Chief Executive Officer and Group President since 2001. He is also

the Chairman of the Board and Chief Executive Officer of PSi

Technologies Inc. and Merlin Solar Technologies, Inc.; President

and Chief Executive Officer of Speedy-Tech Electronics Ltd.;

Chairman of the Board of Surface Technology International (STI),

Ltd., Chairman of the Advisory Board of MT Technologies GmbH;

Chairman and Chief Executive Officer of AC Motors and Senior

Managing Director of the Ayala Corporation. He is also an

Independent Board Member of Lyceum of the Philippines University,

FEU Institute of Technology and SSI Group. He graduated with B.S.

in Electronic Communications Engineering degree from Mapua

Institute of Technology and attended post graduate programs at the

University of Idaho, Singapore Institute of Management, IMD and

Harvard Business School.

Mr. Shuji Aruga is senior advisor of Deloitte Tohmatsu Financial

Advisory LLC and an independent member of the Board of Directors of

Matsumoto Yamaga FC. Previously, he served in numerous senior

positions at Japan Display Inc. (“JDI”), which is the Japanese

display technology joint venture formed by the merger of liquid

crystal display businesses of Sony, Toshiba, and Hitachi. These

positions included Chief Business Officer, Board Member, President

and Chief Operating Officer, and Senior Advisor. Prior to joining

JDI, Mr. Aruga served as the Division Senior General Manager of

Sony Co. VP and Mobile Display Business Division, was the President

and Chief Executive Officer of Epson Imaging Device Co., Chief

Operating Officer and Board Member at Liquid Crystal Display, a

department of Seiko Epson Co. He graduated with a Master’s degree

in 1983 from the Tokyo University of Agriculture and Technology in

Tokyo, Japan.

In accordance with German corporate reporting requirements, the

Company today made a formal German statutory filing, which includes

the Company’s annual financial statements, as published in the

Company’s Form 20-F filed on April 29, 2021, and a required

management statement on the Company’s expectations for the full

year 2021. Accordingly, VIA today announced that it expects its

EBITDA for the full year 2021 to be in the range of €(2) to €(4)

million, due largely to the impact of continuing investments made

to prepare for future growth, including, among other things,

strengthening the R&D and corporate functions, and the impact

of global component shortages and shipping and supply chain related

challenges. VIA believes that overall gross margin in 2021 will

remain broadly similar to that of 2020. These projections reflect

VIA’s expectations regarding revenue development in the fourth

quarter as announced in the Company’s earnings press release on

November 17, 2021. While VIA is working to mitigate the impact of

global component shortages as well as constrained global shipping

and supply chain related challenges, which influence demand for

VIA’s products, the Company’s projections will depend significantly

on these external factors.

“We plan to continue executing on our strategy with a goal of

moving towards our €500 million annual revenue target within five

years under the assumption that current market constraints will be

resolved,” said Jürgen Eichner, VIA’s Chief Executive Officer.

About VIA:

VIA is a leading provider of interactive display solutions for

multiple end markets in which superior functionality or durability

is a critical differentiating factor. Its customizable technology

is well-suited for high-end markets with unique specifications and

demanding environments that pose technical and optical challenges

for displays, such as bright ambient light, vibration and shock,

extreme temperatures, and condensation. VIA’s interactive display

systems combine system design, interactive displays, software

functionality, cameras, and other hardware components. VIA’s

intellectual property portfolio, process know-how, optical bonding,

metal mesh touch sensor and camera module technologies provide

enhanced display solutions built to meet the specific needs of its

customers.

Further information on the Company can be found in its Annual

Report on Form 20-F for the year ended December 31, 2020 (the

“Annual Report”), which the Company has filed with the U.S.

Securities and Exchange Commission. You can access a PDF version of

the Annual Report at VIA’s Investor Relations website,

https://investors.via-optronics.com/investors/financial-and-filings/annual-reports/default.aspx.

A hard copy of the audited consolidated financial statements can

also be requested free of charge by contacting the investor

relations team via the information provided below.

Forward-Looking Statements

Statements in this press release about future expectations,

plans and prospects, as well as any other statements regarding

matters that are not historical facts, may constitute

“forward-looking statements.” These statements include, but are not

limited to, statements relating to the expected trading

commencement and closing dates. The words, without limitation,

“anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,”

“intend,” “may,” “plan,” “potential,” “predict,” “project,”

“should,” “target,” “will,” “would” and similar expressions are

intended to identify forward-looking statements, although not all

forward-looking statements contain these or similar identifying

words. Forward-looking statements are based largely on our current

expectations and projections about future events and financial

trends that we believe may affect our financial condition, results

of operations, business strategy, short-term and long-term business

operations and objectives, and financial needs. These

forward-looking statements involve known and unknown risks,

uncertainties, changes in circumstances that are difficult to

predict and other important factors that may cause our actual

results, performance or achievements to be materially different

from any future results, performance or achievements expressed or

implied by the forward-looking statement, including, without

limitation, the risks described under Item 3. “Key Information—D.

Risk Factors,” in our Annual Report on Form 20-F as filed with the

US Securities and Exchange Commission. Moreover, new risks emerge

from time to time. It is not possible for our management to predict

all risks, nor can we assess the impact of all factors on our

business or the extent to which any factor, or combination of

factors, may cause actual results to differ materially from those

contained in any forward-looking statements we may make. In light

of these risks, uncertainties and assumptions, the forward-looking

events and circumstances discussed in this release may not occur

and actual results could differ materially and adversely from those

anticipated or implied in the forward-looking statements. We

caution you therefore against relying on these forward-looking

statements, and we qualify all of our forward-looking statements by

these cautionary statements. Any forward-looking statements

contained in this press release are based on the current

expectations of VIA’s management team and speak only as of the date

hereof, and VIA specifically disclaims any obligation to update any

forward-looking statement, whether as a result of new information,

future events or otherwise.

Non-IFRS Financial Measures

Our management and supervisory boards utilize both IFRS and

non-IFRS measures in a number of ways, including to facilitate the

determination of our allocation of resources, to measure our

performance against budgeted and forecasted financial plans and to

establish and measure a portion of management's compensation.

The non-IFRS measures used by our management and supervisory

boards include:

EBITDA, which we define as net profit (loss) calculated in

accordance with IFRS before financial result, taxes, depreciation

and amortization; for purposes of our EBITDA calculation, we define

"financial result" to include financial result as calculated in

accordance with IFRS and foreign exchange gains (losses) on

intercompany indebtedness.

Our management and supervisory boards believe these non-IFRS

measures are helpful tools in understanding certain aspects of our

financial performance and are important supplemental measures of

operating performance because they eliminate items that may have

less bearing on our operating performance and highlight trends that

may not otherwise be apparent when relying solely on IFRS financial

measures. We also believe that these non-IFRS measures are useful

to investors and other users of our financial statements in

evaluating our performance because these measures are the same

measures used by our management and supervisory boards for these

purposes.

EBITDA should not be considered an alternative to income/(loss)

after taxes from continuing operations or any other measure of

financial performance calculated and presented in accordance with

IFRS. There are a number of limitations related to the use of

EBITDA rather than loss for the period attributable to shareholders

of the parent, which is the most directly comparable IFRS measure.

Some of these limitations are:

- EBITDA excludes depreciation and amortization expense and,

although these are non-cash expenses, the assets being depreciated

may have to be replaced in the future increasing our cash

requirements;

- EBITDA does not reflect interest expense, or the cash required

to service our debt, which reduces cash available to us;

- EBITDA does not reflect income tax payments that reduce cash

available to us;

- Other companies, including companies in our industry, may

calculate EBITDA differently, which reduces its usefulness as a

comparative measure.

EBITDA should not be considered in isolation or as a substitute

for financial information provided in accordance with IFRS.

VIA cannot provide a reconciliation of the EBITDA projection

above to the corresponding IFRS metric without unreasonable effort,

as VIA is unable to provide the reconciling information. These

items are not within VIA’s control, may vary greatly between

periods and could significantly impact future financial

results.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20211122006203/en/

Investor Relations for VIA optronics:

The Blueshirt Group Monica Gould Monica@blueshirtgroup.com

+1-212-871-3927

Lindsay Savarese Lindsay@blueshirtgroup.com +1-212-331-8417

Media Contact:

Alexandra Müller-Pl�tz AMueller-Ploetz@via-optronics.com

+49-911-597 575-302

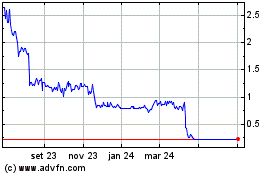

VIA optronics (NYSE:VIAO)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

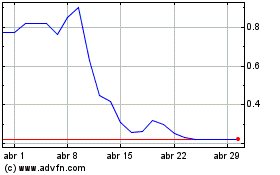

VIA optronics (NYSE:VIAO)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025