News Corp Announces Private Offering of $500 Million of Senior Notes Due 2032

08 Fevereiro 2022 - 9:30AM

Business Wire

News Corporation (“News Corp”) announced today that it is

offering $500 million aggregate principal amount of Senior Notes

due 2032 (the “Notes”) in a private offering, subject to market and

other conditions.

News Corp plans to use the net proceeds from the offering for

general corporate purposes, including to fund the acquisitions of

the Base Chemicals and Oil Price Information Service businesses

from S&P Global Inc. and IHS Markit Ltd.

News Corp will make the offering pursuant to an exemption under

the Securities Act of 1933, as amended (the “Securities Act”). The

initial purchasers of the Notes will offer the Notes only to

persons reasonably believed to be qualified institutional buyers in

reliance on Rule 144A under the Securities Act or to non-U.S.

persons outside the United States in reliance on Regulation S under

the Securities Act. The Notes have not been and will not be

registered under the Securities Act of 1933 or under any state

securities laws. Therefore, News Corp may not offer or sell the

Notes within the United States to, or for the account or benefit

of, any United States person unless the offer or sale would qualify

for a registration exemption from the Securities Act and applicable

state securities laws.

This press release does not constitute an offer to sell or a

solicitation of an offer to buy the Notes described in this press

release, nor shall there be any sale of the Notes in any state or

jurisdiction in which such an offer, sale or solicitation would be

unlawful prior to registration or qualification under the

securities laws of any such jurisdiction.

About News Corp

News Corp (Nasdaq: NWS, NWSA; ASX: NWS, NWSLV) is a global,

diversified media and information services company focused on

creating and distributing authoritative and engaging content and

other products and services. The company comprises businesses

across a range of media, including: digital real estate services,

subscription video services in Australia, news and information

services and book publishing. Headquartered in New York, News Corp

operates primarily in the United States, Australia, and the United

Kingdom, and its content and other products and services are

distributed and consumed worldwide.

Forward-Looking Statements

This release contains forward-looking statements based on

current expectations or beliefs, as well as assumptions about

future events, and these statements are subject to factors and

uncertainties that could cause actual results to differ materially

from those described in the forward-looking statements. The words

“expect,” “will,” “estimate,” “anticipate,” “predict,” “believe,”

“potential” and similar expressions and variations thereof are

intended to identify forward-looking statements. These statements

appear in a number of places in this release and include, among

other things, statements related to the offering of Notes and

whether or not News Corp will consummate the offering. Readers are

cautioned that any forward-looking statements are not guarantees of

future performance and involve risks and uncertainties. Many

factors could cause actual results to differ materially from those

described in these forward-looking statements. The forward-looking

statements in this release speak only as of this date and we

undertake no obligation (and expressly disclaim any obligation) to

publicly update or revise any forward-looking statements, whether

as a result of new information, future events or otherwise, except

as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220208005714/en/

News Corp Investor Relations Michael Florin 212-416-3363

mflorin@newscorp.com

News Corp Corporate Communications Jim Kennedy 212-416-4064

jkennedy@newscorp.com

News (ASX:NWS)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

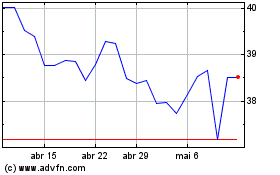

News (ASX:NWS)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024