Astrotech Corporation (Nasdaq: ASTC) (the “Company” or

“Astrotech”) reported its financial results for the second quarter

of fiscal year 2022, which ended December 31, 2021.

Astrotech had its best quarter since sales of 1st Detect’s

TRACER 1000™ began, with revenue related to the TRACER 1000 up 332%

compared to the same period one year ago. After garnering initial

traction in the cargo security market due to the TRACER 1000’s

near-zero false alarm rate, in the second quarter, 1st Detect

completed a major milestone by fulfilling its first purchase order

for airport security checkpoint and passenger screening. The TRACER

1000 is now deployed in 13 countries worldwide.

AgLAB has reached an important milestone with the completion of

its cannabis field trials for the AgLAB-1000-D2™ mass spectrometer.

The field trials successfully demonstrated that the AgLAB-1000-D2

can be used in the distillation process to significantly boost the

potency and weight yields of THC and CBD oil manufacturing. This is

a significant accomplishment as it fulfills our long-term vision to

start a family of “process control” instruments, methods, and

solutions.

BreathTech has completed the agreements required to begin the

COVID-19 pre-clinical breath trials with Cleveland Clinic. We have

also completed the development of the BreathTest-1000™ mass

spectrometer, including the development of the InBreath-1000™

prototype sample collection system needed to safely transfer the

infected patient breath to the mass spectrometer for testing.

Progress was delayed due to COVID-related materials shortages and

shipping delays, but we are optimistic that we will be able to

begin and complete the human trials within the first half of this

year. In preparation for the trials, we announced on February 2,

2022 that Dr. Karim Sirgi, MD, MBA and FCAP has joined BreathTech

Corporation as its Chief Science Officer. Dr. Sirgi will help lead

our research and development and regulatory efforts as BreathTech

looks to commercialize the BreathTest-1000.

Finally, in November 2021, Astrotech announced its plans to

actively pursue strategic and accretive acquisition opportunities

with the appointment of its board member, Tom Wilkinson, to Lead

Independent Director. Mr. Wilkinson will identify ideal acquisition

candidates for Astrotech that will complement or improve the

Company’s core technology, accelerate revenue growth, and/or reduce

time to market, while being accretive to earnings and therefore

shareholder value.

“This is an exciting period for Astrotech as we are

transitioning our mass spectrometer technology from government to

commercial applications. The first commercial market we have

entered is the hemp and cannabis distillation market with our

AgLAB-1000-D2 solution. The AgLAB-1000-D2 will be used in high

throughput biomass-to-oil applications designed to substantially

increase THC and CBD yields, which we believe will have a directly

proportional impact on customer revenues. The BreathTest-1000,

which has been designed to rapidly screen for COVID-19 or related

indicators within 60 seconds, is also soon to follow. Even with

15-minute tests available in the market, we believe they are still

too slow for many real-world applications, including commercial

facilities, airlines, hospitals, military ships and aircrafts,

cruise liners, schools, and many more. Like many companies, we have

had some supply chain challenges, but our clinical trials at

Cleveland Clinic are soon to begin. To lead this complex effort, we

have assembled a great team to be overseen by our Chief Science

Officer, Dr. Karim Sirgi, a highly regarded pathologist and program

manager. Dr. Sirgi will be working closely with Dr. Raed Dweik, the

Chairman of the Respiratory Institute at Cleveland Clinic, and his

team throughout the trials. We are also thrilled to see 1st Detect

winning passenger checkpoint opportunities. We expect this to lead

to more sales in the security sector as our markets continue to

expand. Finally, we are excited about completing our move from our

Houston facility to our new Austin facility while also completing

our transition from in-house manufacturing to contract

manufacturing with Sanmina Corporation. As we open new markets, we

are now well positioned with scalable manufacturing,” stated Thomas

B. Pickens III, Chairman and Chief Executive Officer of

Astrotech.

Second Quarter Fiscal Year 2022

Highlights

Management continues efforts to accelerate growth and optimize

resources.

- Astrotech’s balance sheet remains strong with $57 million in

cash and liquid investments which is anticipated to support our

expected organic growth and acquisition opportunities.

- For the second quarter, revenue for the TRACER 1000 is up 332%

compared to the same period one year ago, and 177% year-to-date

compared to fiscal year 2021.

- We delivered our first TRACER-1000 units to be deployed at an

airport security checkpoint.

- The AgLAB-1000-D2 has completed its cannabis oil processing

field trials with excellent results.

- The BreathTest-1000 pre-clinical trials are being held at

Cleveland Clinic and they will soon be underway with an experienced

team assembled to lead the effort.

- The transition to contract manufacturing by Sanmina is now

complete.

About Astrotech Corporation

Astrotech (NASDAQ: ASTC) is a mass spectrometry company that

launches, manages, and commercializes scalable companies based on

its innovative core technology through its wholly-owned

subsidiaries. 1st Detect develops, manufactures, and sells

trace detectors for use in the security and detection market.

AgLAB is developing chemical analyzers for use in the

agriculture market. BreathTech is developing a breath

analysis tool to provide early detection of lung diseases.

Astrotech is headquartered in Austin, Texas. For information,

please visit www.astrotechcorp.com.

About the AgLAB-1000™ and the BreathTest-1000™

This press release contains information about our new products

under development, AgLAB-1000 and BreathTest-1000. Product

development involves a high degree of risk and uncertainty, and

there can be no assurance that our new products will be

successfully developed, achieve their intended benefits, receive

full market authorization, or be commercially successful. In

addition, FDA approval will be required to market BreathTest-1000

in the United States. Obtaining FDA approval is a complex and

lengthy process, and there can be no assurance that FDA approval

for BreathTest-1000 will be granted on a timely basis or at

all.

Forward-Looking Statements

This press release contains forward-looking statements that are

made pursuant to the Safe Harbor provisions of the Private

Securities Litigation Reform Act of 1995. Such forward-looking

statements are subject to risks, trends, and uncertainties that

could cause actual results to be materially different from the

forward-looking statement. These factors include, but are not

limited to, the severity and duration of the COVID-19 pandemic and

its impact on the U.S. and worldwide economy, the timing, scope and

effect of further U.S. and international governmental, regulatory,

fiscal, monetary and public health responses to the COVID-19

pandemic, the Company’s use of proceeds from the common stock

offerings, whether we can successfully complete the development of

our new products and proprietary technologies, whether we can

obtain the FDA and other regulatory approvals required to market

our products under development in the United States or abroad,

whether the market will accept our products and services and

whether we are successful in identifying, completing and

integrating acquisitions, as well as other risk factors and

business considerations described in the Company’s Securities and

Exchange Commission filings including the Company’s most recent

Annual Report on Form 10-K. Any forward-looking statements in this

document should be evaluated in light of these important risk

factors. Although the Company believes the expectations reflected

in its forward-looking statements are reasonable and are based on

reasonable assumptions, no assurance can be given that these

assumptions are accurate or that any of these expectations will be

achieved (in full or at all) or will prove to have been correct.

Moreover, such statements are subject to a number of assumptions,

risks and uncertainties, many of which are beyond the control of

the Company, which may cause actual results to differ materially

from those implied or expressed by the forward-looking statements.

In addition, any forward-looking statements included in this press

release represent the Company’s views only as of the date of its

publication and should not be relied upon as representing its views

as of any subsequent date. The Company assumes no obligation to

correct or update these forward-looking statements, whether as a

result of new information, future events or otherwise, except as

required by applicable law.

Tables follow

ASTROTECH CORPORATION

Consolidated Statements of

Operations and Comprehensive Loss

(In thousands, except per share

data)

Three Months Ended

December 31,

Six Months Ended

December 31,

2021

2020

2021

2020

Revenue

$

561

$

130

$

748

$

270

Cost of revenue

441

128

616

241

Gross profit

120

2

132

29

Operating expenses:

Selling, general and administrative

1,728

803

3,154

1,729

Research and development

652

758

1,291

1,367

Disposal of corporate lease

—

—

—

544

Total operating expenses

2,380

1,561

4,445

3,640

Loss from operations

(2,260

)

(1,559

)

(4,313

)

(3,611

)

Other income and (expense), net

80

(63

)

104

(122

)

Loss from operations before income

taxes

(2,180

)

(1,622

)

(4,209

)

(3,733

)

Income tax benefit

—

—

—

—

Net loss

$

(2,180

)

$

(1,622

)

$

(4,209

)

$

(3,733

)

Weighted average common shares

outstanding:

Basic and diluted

47,482

15,864

47,455

11,769

Basic and diluted net loss per common

share:

Net loss

$

(0.05

)

$

(0.10

)

$

(0.09

)

$

(0.32

)

Other comprehensive loss, net of

tax:

Net loss

$

(2,180

)

$

(1,622

)

$

(4,209

)

$

(3,733

)

Available-for-sale securities:

Net unrealized loss

(197

)

—

(245

)

—

Total comprehensive loss

$

(2,377

)

$

(1,622

)

$

(4,454

)

$

(3,733

)

ASTROTECH CORPORATION

Consolidated Balance Sheets

(In thousands, except share

data)

December 31,

2021

June 30, 2021

(Unaudited)

(Note)

Assets

Current assets

Cash and cash equivalents

$

30,170

$

35,936

Short-term investments

27,106

27,351

Accounts receivable

92

5

Inventory, net:

Raw materials

1,135

1,056

Work-in-process

2

147

Finished goods

277

297

Prepaid expenses and other current

assets

516

318

Total current assets

59,298

65,110

Property and equipment, net

870

263

Operating leases, right-of-use assets,

net

206

249

Other assets

11

11

Total assets

$

60,385

$

65,633

Liabilities and stockholders’

equity

Current liabilities

Accounts payable

90

396

Payroll related accruals

741

344

Accrued expenses and other liabilities

853

888

Income tax payable

2

2

Term note payable - related party

500

2,500

Lease liabilities, current

227

81

Total current liabilities

2,413

4,211

Lease liabilities, net of current

portion

421

215

Total liabilities

2,834

4,426

Commitments and contingencies

Stockholders’ equity

Convertible preferred stock, $0.001 par

value, 2,500,000 shares authorized; 280,898 shares of Series D

issued and outstanding at December 31, 2021 and June 30, 2021

—

—

Common stock, $0.001 par value,

250,000,000 and 50,000,000 shares authorized at December 31, 2021

and June 30, 2021, respectively; 49,514,467 and 49,450,558 shares

issued and outstanding at December 31, 2021 and June 30, 2021,

respectively

190,641

190,641

Additional paid-in capital

78,769

77,971

Accumulated deficit

(211,591

)

(207,382

)

Accumulated other comprehensive loss

(268

)

(23

)

Total stockholders’ equity

57,551

61,207

Total liabilities and stockholders’

equity

$

60,385

$

65,633

Note: The balance sheet at June 30, 2021, has been derived from

the audited consolidated financial statements at that date but does

not include all of the information and footnotes required by the

United States generally accepted accounting principles for complete

financial statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220211005120/en/

Eric Stober, Chief Financial Officer, Astrotech Corporation,

(512) 485-9530

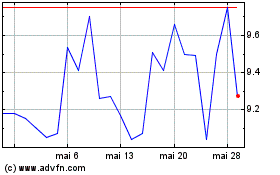

Astrotech (NASDAQ:ASTC)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Astrotech (NASDAQ:ASTC)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025