Air Liquide: Share buyback

23 Março 2022 - 4:45AM

Business Wire

Regulatory News:

Air Liquide (Paris: Al) signed a share purchase agreement

with a financial institution in the context of its Share Buyback

Program, which was approved at the Combined Shareholders’ Meeting

of the Company on May 4th, 2021.

The terms of the agreement, signed on March 23rd, 2022, set a

volume of 1,200,000 Air Liquide shares (representing 0.25% of

the share capital of the Group as of 23/03/2022) for a maximum

price not exceeding the limits authorized by the Combined

Shareholders’ Meeting of May 4th, 2021 and the Board of Directors

Meeting held on September 29th, 2021 (i.e. €200 per share).

The initial purchase price (€150.74 per share) matches the share

price upon closing of the stock market on the day preceding the

signing date of the agreement, leading to an initial total purchase

price of €180,888,000. This initial purchase price will be adjusted

at the end of the share purchase period set in the share purchase

agreement, such an adjustment being subject to a dedicated press

release.

The shares purchased pursuant to this agreement shall in part be

canceled by the Company and in part be affected to the

implementation of performance share plans or employee share

ownership transactions of the Company.

Details on the Share Buyback Programme can be found in the 2021

Universal Registration Document (Chapter 6 - Board of Directors'

report on the resolutions presented to the Combined General

Meeting), available on the Company’s website.

A world leader in gases, technologies and services for Industry

and Health, Air Liquide is present in 75 countries with

approximately 66,400 employees and serves more than 3.8 million

customers and patients. Oxygen, nitrogen and hydrogen are essential

small molecules for life, matter and energy. They embody Air

Liquide’s scientific territory and have been at the core of the

company’s activities since its creation in 1902.

Air Liquide’s ambition is to be a leader in its industry,

deliver long term performance and contribute to sustainability -

with a strong commitment to climate change and energy transition at

the heart of its strategy. The company’s customer-centric

transformation strategy aims at profitable, regular and responsible

growth over the long term. It relies on operational excellence,

selective investments, open innovation and a network organization

implemented by the Group worldwide. Through the commitment and

inventiveness of its people, Air Liquide leverages energy and

environment transition, changes in healthcare and digitization, and

delivers greater value to all its stakeholders.

Air Liquide’s revenue amounted to more than 23 billion euros in

2021. Air Liquide is listed on the Euronext Paris stock exchange

(compartment A) and belongs to the CAC 40, CAC 40 ESG, EURO STOXX

50 and FTSE4Good indexes.

www.airliquide.com Follow us on Twitter

@airliquidegroup

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220323005406/en/

Corporate Communications media@airliquide.com

Group Financing & Treasury Director

Guillaume.Serey@airliquide.com

Investor Relations IRTeam@airliquide.com

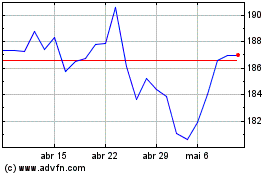

Air Liquide (EU:AI)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

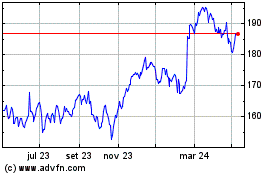

Air Liquide (EU:AI)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025