VIQ Solutions Announces Closing of US$4.8 Million Private Placement

21 Julho 2022 - 2:45PM

Business Wire

VIQ Solutions Inc. ("VIQ", “VIQ

Solutions” or the "Company") (TSX and Nasdaq: VQS) today

announces the closing of its previously announced private placement

with a current U.S. institutional shareholder and a new U.S.

institutional investor (collectively, the “Investors”) who

purchased, in the aggregate, 3,551,852 common shares of VIQ and

warrants to purchase up to 3,551,852 common shares of VIQ (the

common shares and warrants, together the “Securities”), at a

combined purchase price of US$1.35, resulting in total gross

proceeds of approximately US$4.8 million before deducting placement

agent commissions and other offering expenses. The warrants have an

exercise price of US$1.39, are exercisable any time after January

21, 2023 and will expire on July 21, 2027.

A.G.P./Alliance Global Partners acted as the sole placement

agent for the offering.

VIQ intends to use the net proceeds from the offering for

continuing development of product and service offerings, potential

future acquisitions as well as for working capital and general

corporate purposes.

The offer and sale of the Securities was made in Canada on a

prospectus exempt basis and in the United States in a transaction

not involving a public offering, and the Securities have not been

registered under the Securities Act of 1933, as amended (the

“Securities Act”), or applicable state securities laws.

Accordingly, the Securities may not be offered or sold in the

United States except pursuant to an effective registration

statement or an applicable exemption from the registration

requirements of the Securities Act and such applicable state

securities laws. Under an agreement with the Investors, the Company

agreed to file a registration statement with the U.S. Securities

and Exchange Commission (the “SEC”) covering the resale of

the common shares issued to the Investors (including the common

shares issuable upon the exercise of the warrants) and to use

commercially reasonable efforts to have the registration statement

declared effective as promptly as practical thereafter, and in any

event no later than 75 days following the closing date of the

offering in the event of a “full review” by the SEC.

This press release shall not constitute an offer to sell or a

solicitation of an offer to buy these Securities, nor shall there

be any sale of these Securities in any state or other jurisdiction

in which such offer, solicitation or sale would be unlawful prior

to the registration or qualification under the securities laws of

any such state or other jurisdiction.

About VIQ

VIQ Solutions is a global provider of secure, AI-driven, digital

voice and video capture technology and transcription services. VIQ

offers a seamless, comprehensive solution suite that delivers

intelligent automation, enhanced with human review, to drive

transformation in the way content is captured, secured, and

repurposed into actionable information. The cyber-secure, AI

technology and services platform are implemented in the most rigid

security environments including criminal justice, legal, insurance,

media, government, corporate finance, media, and transcription

service provider markets, enabling them to improve the quality and

accessibility of evidence, to easily identify predictive insights

and to achieve digital transformation faster and at a lower

cost.

For more information about VIQ, please visit

viqsolutions.com.

Forward-looking Statements

This press release contains forward-looking information and

forward-looking statements within the meaning of applicable

securities laws ("forward-looking statements"), including

statements with respect to the intended use of the net proceeds of

the offering and the filing of a registration statement with the

SEC. Forward-looking statements are based on certain expectations

and assumptions, including with respect to the Company’s

anticipated business plans, and are subject to known and unknown

risks and uncertainties and other factors that could cause actual

events, results, performance and achievements to differ materially

from those anticipated in these forward-looking statements.

Forward-looking statements should not be read as guarantees of

future performance or results. A more complete discussion of the

risks and uncertainties facing the Company appear in the Company’s

most recent Annual Information Form and other continuous disclosure

filings which are available on SEDAR at www.sedar.com and EDGAR at

www.sec.gov. Readers are cautioned not to place undue reliance on

these forward-looking statements, which speak only as of the date

of this press release. The Company disclaims any intention or

obligation, except to the extent required by law, to update or

revise any forward-looking statements as a result of new

information or future events, or for any other reason.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220721005906/en/

Media:

Laura Haggard Chief Marketing Officer, VIQ Phone: (800) 263-9947

Email: marketing@viqsolutions.com

Investor Relations:

Laura Kiernan High Touch Investor Relations Phone:

1-914-598-7733 Email: viq@htir.net

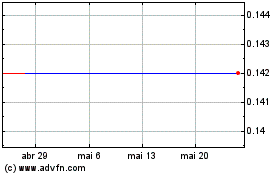

VIQ Solutions (NASDAQ:VQS)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

VIQ Solutions (NASDAQ:VQS)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025