Second Quarter Highlights:

- Net income of $10.6 million and diluted earnings per share

(EPS) of $0.31, compared to $9.5 million and $0.28 per share,

respectively, for 2Q21

- Core net income(1) of $10.6 million and core diluted EPS(1) of

$0.31, compared to $8.5 million and $0.25 per share, respectively,

for 2Q21

- Loan production volume of $445.4 million in unpaid principal

balance (UPB), an increase of 73.6% from 2Q21

- Loan production volume for the first half of 2022 was over $1.0

billion in UPB, more than twice the amount originated over the same

period in 2021

- Total loan portfolio UPB of $3.1 billion as of June 30, 2022,

an increase of 49.3% from June 30, 2021

- Nonaccrual loans as a percentage of Held for Investment (HFI)

loans was 8.2% as of June 30, 2022, down from 15.3% as of June 30,

2021

- Resolutions of nonperforming loans (NPL) totaled $50.5 million

in UPB, realizing gains of $5.7 million or 111.4% of UPB

resolved

- Portfolio net interest margin (NIM) of 4.10%, compared to 4.83%

in 2Q21

- Completed three VCC securitizations in 2Q22 totaling $622.7

million

- Total liquidity(2) of $134.0 million as of June 30, 2022

- Book value per common share of $11.26 as of June 30, 2022

Velocity Financial, Inc. (NYSE: VEL) (Velocity or the Company)

reported net income and core net income of $10.6 million for 2Q22,

compared to net income of $9.5 million and core net income of $8.5

million for 2Q21. Earnings and core earnings per diluted share were

$0.31 for 2Q22, compared to $0.28 and $0.25 per share,

respectively, for 2Q21.

“Velocity’s second quarter results reflect our unique portfolio

model, solid market position and operational expertise,” said Chris

Farrar, President and CEO. “Our investment loan portfolio has grown

more than 49% over the past twelve months, driven by robust

origination volumes that contributed to solid earnings growth.”

Mr. Farrar continued, “During the second quarter we issued three

new securitizations totaling $622.7 million, demonstrating

Velocity’s differentiation in today’s market resulting from our

extensive securitization track record and reputation for

high-quality loan collateral. These securitizations allowed us to

further optimize non-recourse leverage and enhance our liquidity

position. While financing costs have increased along with market

volatility, we have been able to successfully increase rates on new

production while maintaining solid volume levels.”

Second Quarter

Operating Results

KEY PERFORMANCE INDICATORS ($ in thousands)

2Q 2022

2Q 2021

$ Variance

% Variance

Pretax income(a)

$

14,664

$

12,885

$

1,779

14

%

Net income

$

10,645

$

9,453

$

1,192

13

%

Diluted earnings per share

$

0.31

$

0.28

$

0.0

11

%

Core net income(b)

$

10,645

$

8,453

$

2,192

25.9

%

Core diluted earnings per share(b)

$

0.31

$

0.25

$

0.1

26

%

Pretax return on equity

16.42

%

22.57

%

n.a.

(27

)%

Core pretax return on equity(b)

16.42

%

20.19

%

n.a.

(19

)%

Net interest margin - portfolio

4.10

%

4.83

%

n.a.

3

%

Net interest margin - total company

3.54

%

3.98

%

n.a.

(35

)%

Average common equity

$

357,218

$

228,314

$

128,903

59

%

(a) Prextax income less net income attributable to noncontrolling

interests (b) Core income, core diluted earnings per share and core

pretax return on equity are non-GAAP measures. Please see the

reconciliation to GAAP net income at the end of this release.

Discussion of results:

- Net income in 2Q22 was $10.6 million, compared to $9.5 million

in 2Q21.

‒ 2Q22 net income was driven by an increase

in interest income from our loan portfolio, in addition to default

interest and fees realized from the resolution of nonperforming

loans

- Core net income(1) was $10.6 million, an increase of 25.9% from

$8.5 million in 2Q21

- Portfolio NIM in 2Q22 was 4.10%, compared to 4.83% from 2Q21,

resulting from a decrease in the weighted average portfolio yield

from lower interest rates on loan production in recent prior

quarters, partially offset by a decrease in the weighted average

cost of funds from lower securitization and warehouse financing

rates

- The GAAP pretax return on equity was 16.42% in 2Q22, compared

to 22.57% in 2Q21

‒ Driven by higher equity balance in 2Q22

TOTAL LOAN PORTFOLIO

($ of UPB in millions)

2Q 2022

2Q 2021

$ Variance % Variance Held

for Investment Investor 1-4 Rental

$

1,517

$

1,019

$

499

49

%

Mixed Use

410

293

117

40

%

Multi-Family

289

184

105

57

%

Retail

298

183

115

63

%

Warehouse

217

131

86

65

%

All Other

359

253

106

42

%

Total

$

3,090

$

2,062

$

1,028

50

%

Held for Sale Investor 1-4

Rental

$

-

$

8

$

(8

)

n.m.

Total Managed Loan Portfolio UPB

$

3,090

$

2,070

$

1,020

49

%

Key loan portfolio metrics: Total loan count

7,779

6,125

Weighted average loan to value

68.16

%

66.70

%

Weighted average total portfolio yield

7.97

%

8.90

%

Weighted average portfolio debt cost

4.34

%

4.81

%

Discussion of results:

- Velocity’s total loan portfolio was $3.1 billion in UPB as of

June 30, 2022, an increase of 49.3% from $2.1 billion in UPB as of

June 30, 2021

‒ Portfolio growth was driven by record loan

production volume over the prior twelve months ‒ Payoff activity

totaled $142.8 million in UPB in 2Q22, compared to $131.8 million

in 2Q21

- The weighted average loan-to-value of the portfolio was 68.2%

as of June 30, 2022, largely consistent with the 66.7% as of June

30, 2021, and the five-quarter trailing average of 67.5%

- The weighted average total portfolio yield was 7.97% in 2Q22, a

93 bps year-over-year decrease driven by lower interest rates on

new loan production over the period and payoff of older,

higher-rate loans

- Portfolio-related debt cost in 2Q22 was 4.34%, a decrease of 47

bps from 2Q21, driven by the collapse of older, higher-cost

securitizations and lower rates on the securitizations issued in

the second half of 2021

LOAN PRODUCTION VOLUMES

($ in millions)

2Q 2022

2Q 2021

$ Variance % Variance Investor 1-4 Rental

$

254

$

147

$

106

72

%

Traditional Commercial

164

95

69

73

%

Short-term loans

28

15

13

90

%

Total loan production

$

445

$

257

$

189

74

%

Discussion of results:

- Loan production in 2Q22 totaled $445.4 million in UPB, compared

to $256.5 million in UPB in 2Q21

‒ The year-over-year increase of 73.6%

resulted from balanced growth of Investor 1-4 and Traditional

Commercial long-term loan production

- Loan production volume for the first half of 2022 was over $1.0

billion in UPB, more than twice the amount originated over the same

period in 2021

- The weighted average note rate on 2Q22 loan production was

7.75%, an increase of 43 bps from 2Q21

HFI PORTFOLIO CREDIT PERFORMANCE INDICATORS ($ in thousands)

2Q 2022

2Q 2021

$ Variance % Variance Nonperforming loans(a)

$

252,253

$

315,542

$

(63,290

)

(20

)%

Average Nonperforming Loans

$

257,646

$

274,112

$

(16,466

)

(6

)%

Nonperforming loans % total HFI Loans

8.2

%

15.3

%

n.a.

(47

)%

Total Charge Offs

$

37

$

918

$

(881

)

(96

)%

Charge-offs as a % of Avg. Nonperforming loans(b)

0.06

%

1.34

%

n.m.

(96

)%

Loan Loss Reserve

$

4,905

$

3,963

$

942

24

%

(a)

Nonperforming/Nonaccrual loans include loans 90+ days past due,

loans in foreclosure, bankruptcy and on nonaccrual.

(b)

Reflects the annualized quarter-to-date charge-offs to average

nonperforming loans for the period. n.m. - non meaningful

Discussion of results:

- Nonperforming loans (NPL) totaled $252.3 million in UPB as of

June 30, 2022, or 8.2% of loans HFI, compared to $315.5 million and

15.3%, respectively, as of June 30, 2021

‒ The year-over-year reduction in NPL loans

was driven by the post-pandemic economic recovery and successful

loss mitigation activities by Velocity’s in-house special servicing

team

- Charge-offs in 2Q22 totaled $37.0 thousand compared to $917.6

thousand in 2Q21

‒ 2Q22 charge-offs were significantly lower

than the trailing five-quarter average of $350.7 thousand per

quarter

- The loan loss reserve totaled $4.9 million as of June 30, 2022,

a 23.8% increase from $4.0 million as of June 30, 2021, driven

mainly by portfolio growth

- Capitalized interest recovered on COVID forbearance loans

granted a deferral totaled $3.8 million since the program's

inception in April 2020, with a remaining balance of $7.1 million

as of June 30, 2022. None of the capitalized interest has been

forgiven.

NET REVENUES ($ in thousands)

2Q 2022

2Q 2021

$ Variance % Variance Interest income

$

59,243

$

44,978

$

14,265

32

%

Interest expense - portfolio related

(28,752

)

(20,566

)

(8,186

)

40

%

Net Interest Income - portfolio related

30,491

24,412

6,079

25

%

Interest expense - corporate debt

(4,182

)

(4,309

)

127

(3

)%

Net Interest Income

$

26,310

$

20,103

$

6,207

31

%

Loan loss provision

(279

)

1,000

(1,279

)

(128

)%

Gain on disposition of loans

1,776

2,391

(615

)

(26

)%

Other operating income (expense)

1,263

41

1,222

n.m

Total Net Revenues

$

29,069

$

23,535

$

5,534

24

%

Discussion of results:

- Total net interest income, including corporate debt interest

expense, increased by $6.2 million, or 30.9% from 2Q21

‒ Portfolio-related net interest income

(excluding corporate debt interest expense) totaled $30.5 million,

an increase of 24.9% from 2Q21, driven by higher net interest

income resulting from portfolio growth and the continued

realization of default interest and fees from NPL resolutions

- Gain on the disposition of loans totaled $1.8 million in 2Q22,

compared to $2.4 million in 2Q21

- Other operating income growth in 2Q22 was driven by valuation

gains in our mortgage servicing right (MSR) asset, driven by the

rise in interest rates during the quarter

OPERATING EXPENSES ($ in thousands)

2Q 2022

2Q 2021

$ Variance % Variance Compensation and employee

benefits

$

6,553

$

4,546

$

2,007

44

%

Rent and occupancy

426

430

(4

)

(1

)%

Loan servicing

3,290

1,922

1,368

71

%

Professional fees

1,062

795

267

34

%

Real estate owned, net

(251

)

1,039

(1,290

)

(124

)%

Other expenses

3,199

1,918

1,281

67

%

Total operating expenses

$

14,279

$

10,650

$

3,629

34

%

Discussion of results:

- Operating expenses totaled $14.3 million in 2Q22, an increase

of 34.1% from 2Q21

‒ Higher compensation expense resulting from

salesforce and production operations growth ‒ Servicing expense

growth was driven by the increase in securitizations outstanding to

17 as of June 30, 2022, from 13 as of June 30, 2021

SECURITIZATIONS ($ in thousands)

Securities

Balance at Balance at Trusts Issued

6/30/2022 W.A. Rate 6/30/2021 W.A. Rate

2014-1 Trust

$

161,076

-

-

$

19,973

7.86

%

2015-1 Trust

285,457

$

-

-

24,852

7.63

%

2016-1 Trust

319,809

28,021

8.24

%

43,925

8.12

%

2017-2 Trust

245,601

68,749

3.59

%

101,179

3.33

%

2018-1 Trust

176,816

52,281

3.95

%

79,377

4.02

%

2018-2 Trust

307,988

108,845

4.36

%

175,943

4.48

%

2019-1 Trust

235,580

103,860

3.92

%

159,345

4.06

%

2019-2 Trust

207,020

98,792

3.37

%

141,446

3.51

%

2019-3 Trust

154,419

81,996

3.10

%

112,848

3.28

%

2020-1 Trust

248,700

149,646

2.84

%

199,267

2.86

%

2020-2 Trust

96,352

67,446

4.59

%

97,601

4.44

%

2020-MC1 Trust

179,371

-

-

84,454

4.43

%

2021-1 Trust

251,301

214,835

1.74

%

250,109

1.73

%

2021-2 Trust

194,918

185,448

2.01

%

2021-3 Trust

204,205

195,308

2.46

%

2021-4 Trust

319,116

291,181

3.14

%

2022-1 Trust

273,594

264,936

3.91

%

2022-2 Trust

241,388

240,076

5.08

%

2022-MC1 Trust

84,967

80,931

6.94

%

2022-3 Trust

296,323

294,768

5.67

%

$

4,322,925

$

2,527,119

3.77

%

$

1,580,407

3.83

%

Discussion of results:

- The outstanding balance of Velocity’s securitizations as of

June 30, 2022, totaled $2.5 billion, up from $1.6 billion as of

June 30, 2022

- Completed three VCC securitizations in 2Q22, totaling $622.7

million

‒ The VCC 2022-2 securitization totaling

$241.4 million in April ‒ The VCC 2022-MC1 securitization totaling

$85.0 million in May ‒ The VCC 2022-3 securitization totaling

$296.3 million in June

- The weighted average rate on Velocity’s outstanding

securitizations decreased 5bps from June 30, 2021, primarily driven

by the collapse of older, higher-cost securitizations and the lower

rates on securitizations issued in 2021, partially offset by the

increased cost of securitizations issued in 2Q22

RESOLUTION ACTIVITIES LONG-TERM

LOANS RESOLUTION ACTIVITY SECOND

QUARTER 2022 SECOND QUARTER 2021 ($ in thousands)

UPB

$ Gain / (Loss) $ UPB $ Gain / (Loss) $

Paid in full

$

16,934

$

3,303

$

21,925

$

1,446

Paid current

17,407

129

14,949

219

REO sold

2,107

816

947

(2

)

Total resolutions

$

36,448

$

4,248

$

37,821

$

1,663

Resolutions as a % of nonperforming UPB

111.7

%

104.4

%

SHORT-TERM AND

FORBEARANCE LOANS RESOLUTION ACTIVITY

SECOND QUARTER 2022 SECOND QUARTER 2021 ($ in

thousands)

UPB $ Gain / (Loss) $ UPB $ Gain

/ (Loss) $ Paid in full

$

9,913

$

976

$

13,517

$

682

Paid current

2,877

22

7,794

59

REO sold

1,262

500

164

(73

)

Total resolutions

$

14,052

$

1,498

$

21,475

$

668

Resolutions as a % of nonperforming UPB

110.7

%

103.1

%

Grand total resolutions

$

50,500

$

5,746

$

59,296

$

2,331

Grand total resolutions as a % of nonperforming UPB

111.4

%

103.9

%

Discussion of results:

- Total NPL resolution activities in 2Q22 totaled $50.5 million

in UPB and realized net gains of $5.7 million, or 111.4% of UPB

resolved, compared to $59.3 million in UPB and net gains of $2.3

million, or 103.9% of UPB resolved in 2Q21

‒ Long-term loan resolutions in 2Q22 totaled

$36.4 million in UPB and realized gains of $4.2 million, compared

to $37.8 million in UPB and realized gains of $1.7 million in 2Q21

‒ Short-term loan resolutions in 2Q22 totaled $14.1 million in UPB

and realized gains of $1.5 million, compared to $21.5 million in

UPB and realized gains of $0.67 million in 2Q21

_____________________________________________

(1)

Core income and Core EPS are a non-GAAP

measures that exclude nonrecurring and unusual activities from GAAP

net income.

(2)

Available liquidity includes unrestricted

cash reserves of $46.2 million and available liquidity in

unfinanced loans of $87.8 million as of June 30, 2022.

Velocity’s executive management team will host a conference call

and webcast to review 2Q22 financial results on August 4th, 2022,

at 3:00 p.m. Pacific Time / 6:00 p.m. Eastern Time.

Webcast Information

The conference call will be webcast live in listen-only mode and

can be accessed through the Events and Presentations section of the

Velocity Financial Investor Relations website

https://www.velfinance.com/events-and-presentations. To listen to

the webcast, please go to Velocity’s website at least 15 minutes

before the call to register, download, and install any needed

software. An audio replay of the call will also be available on

Velocity’s website following the completion of the conference

call.

Conference Call Information

To participate by phone, please dial-in 15 minutes before the

start time to allow for wait times to access the conference call.

The live conference call will be accessible by dialing

1-833-316-0544 in the U.S. and Canada and 1-412-317-5725 for

international callers. Callers should ask to join the Velocity

Financial, Inc. earnings call.

A replay of the call will be available through midnight on

August 29, 2022, and can be accessed by dialing 1-877-344-7529 in

the U.S. and 855-669-9658 in Canada or 1-412-317-0088

internationally. The passcode for the replay is #9239674. The

replay will also be available on the Investor Relations section of

the Company's website under "Events and Presentations.”

About Velocity Financial, Inc.

Based in Westlake Village, California, Velocity is a vertically

integrated real estate finance company that primarily originates

and manages investor loans secured by 1-4-unit residential rental

and small commercial properties. Velocity originates loans

nationwide across an extensive network of independent mortgage

brokers built and refined over 18 years.

Non-GAAP Financial Measures

To supplement our financial statements presented in accordance

with United States generally accepted accounting principles (GAAP),

the Company uses non-GAAP core net income and core diluted EPS,

which are non-GAAP financial measures.

Non-GAAP core net income and non-GAAP core diluted EPS are

non-GAAP financial measures that represent our net income (loss)

and net income (loss) per diluted share, adjusted to eliminate the

effect of certain costs incurred from activities that are not

normal recurring operating expenses, such as COVID-stressed charges

and recoveries of loan loss provision, nonrecurring debt

amortization, the impact of operational measures taken to address

the COVID-19 pandemic and workforce reduction costs, and costs

associated with acquisitions. To calculate non-GAAP core diluted

EPS, we use the weighted-average number of shares of common stock

outstanding that is used to calculate net income per diluted share

under GAAP.

We have included non-GAAP core net income and non-GAAP core

diluted EPS because they are key measures used by our management to

evaluate our operating performance, generate future operating

plans, and make strategic decisions, including those relating to

operating expenses and the allocation of internal resources.

Accordingly, we believe that non-GAAP core net income and non-GAAP

core diluted EPS provide useful information to investors and others

in understanding and evaluating our operating results in the same

manner as our management and board of directors. In addition, they

provide useful measures for period-to-period comparisons of our

business, as they remove the effect of certain items that we expect

to be nonrecurring.

These non-GAAP financial measures should not be considered in

isolation from, or as a substitute for, financial information

prepared in accordance with GAAP. These non-GAAP financial measures

are not based on any standardized methodology prescribed by GAAP

and are not necessarily comparable to similarly titled measures

presented by other companies.

For more information on Core Income, please refer to the section

of this press release below titled “Adjusted Financial Metric

Reconciliation to GAAP Net Income” at the end of this press

release.

Forward-Looking Statements

Some of the statements contained in this press release may

constitute forward-looking statements within the meaning of the

federal securities laws. Forward-looking statements relate to

anticipated results, expectations, projections, plans and

strategies, anticipated events or trends, and similar expressions

concerning matters that are not historical facts. In some cases,

you can identify forward-looking statements by the use of

forward-looking terminology such as “may,” “will,” “expects,”

“intends,” “plans,” “anticipates,” “believes,” “estimates,”

“predicts,” “goal,” or “potential” or the negative of these words

and phrases or similar words or phrases that are predictions of or

indicate future events or trends and which do not relate solely to

historical matters. You can also identify forward-looking

statements by discussions of strategy, plans, or intentions.

The forward-looking statements contained in this press release

reflect our current views about future events and are subject to

numerous known and unknown risks, uncertainties, assumptions, and

changes in circumstances that may cause actual results to differ

significantly from those expressed or contemplated in any

forward-looking statement. While forward-looking statements reflect

our good faith projections, assumptions, and expectations, they are

not guarantees of future results. Furthermore, we disclaim any

obligation to publicly update or revise any forward-looking

statement to reflect changes in underlying assumptions or factors,

new information, data or methods, future events, or other changes,

except as required by applicable law. Factors that could cause our

results to differ materially include, but are not limited to, (1)

the continued course and severity of the COVID-19 pandemic and its

direct and indirect impacts, (2) general economic and real estate

market conditions, (3) regulatory and/or legislative changes, (4)

our customers' continued interest in loans and doing business with

us, (5) market conditions and investor interest in our contemplated

securitization and (6) changes in federal government fiscal and

monetary policies.

Additional information relating to these and other factors that

could cause future results to differ materially from those

expressed or contemplated in any forward-looking statements can be

found in the section titled ‘‘Risk Factors” in our Form 10-K filed

with the SEC on May 10, 2021, as well as other cautionary

statements we make in our current and periodic filings with the

SEC. Such filings are available publicly on our Investor Relations

web page at www.velfinance.com.

Velocity Financial,

Inc.

Consolidated Statements of

Financial Condition

Quarter Ended 6/30/2022 3/31/2022

12/31/2021 9/30/2021 6/30/2021

Unaudited Unaudited Unaudited Unaudited

Unaudited (In thousands)

Assets Cash and cash

equivalents

$

46,250

$

36,629

$

35,965

$

35,497

$

27,741

Restricted cash

9,217

10,837

11,639

9,586

7,921

Loans held for sale, net

0

77,503

87,908

0

7,916

Loans held for investment, at fair value

1,351

1,352

1,359

1,360

1,370

Loans held for investment

3,084,045

2,793,968

2,494,204

2,265,922

2,057,046

Net deferred loan costs

34,755

34,334

33,360

29,775

26,707

Total loans, net

3,120,150

2,907,157

2,616,831

2,297,057

2,093,039

Accrued interest receivables

15,820

14,169

13,159

11,974

11,094

Receivables due from servicers

75,688

78,278

74,330

57,058

73,517

Other receivables

1,320

4,527

1,812

870

10,169

Real estate owned, net

19,218

16,177

17,557

17,905

20,046

Property and equipment, net

3,632

3,690

3,830

3,348

3,625

Deferred tax asset

15,195

16,477

16,604

17,026

13,196

Mortgage Servicing Rights, at fair value

8,438

7,661

7,152

-

-

Goodwill

6,775

6,775

6,775

-

-

Other assets

11,036

7,345

6,824

6,843

7,257

Total Assets

$

3,332,739

$

3,109,722

$

2,812,478

$

2,457,164

$

2,267,605

Liabilities and members' equity Accounts payable and

accrued expenses

$

78,384

$

92,768

$

92,195

$

79,360

$

70,049

Secured financing, net

209,227

208,956

162,845

163,449

164,053

Securitizations, net

2,477,226

2,035,374

1,911,879

1,623,674

1,558,163

Warehouse & repurchase facilities

208,390

424,692

301,069

258,491

151,872

Total Liabilities

2,973,227

2,761,790

2,467,988

2,124,974

1,944,137

Mezzanine Equity Series A Convertible preferred stock

-

-

-

90,000

90,000

Stockholders' Equity Stockholders' equity

355,895

344,441

341,109

242,190

233,468

Noncontrolling interest in subsidiary

3,617

3,491

3,381

-

-

Total equity

359,512

347,932

344,490

242,190

233,468

Total Liabilities and members' equity

$

3,332,739

$

3,109,722

$

2,812,478

$

2,457,164

$

2,267,605

Book value per share

$

11.26

$

10.90

$

10.84

$

12.05

$

11.62

Shares outstanding

31,922

31,913

31,787

20,098

20,087

Velocity Financial,

Inc.

Consolidated Statements of

Income (Quarterly)

Quarter Ended ($ in thousands)

6/30/2022

3/31/2022 12/31/2021 9/30/2021

6/30/2021 Unaudited Unaudited Unaudited

Unaudited Unaudited Revenues Interest income

$

59,243

$

52,049

$

49,360

$

46,923

$

44,978

Interest expense - portfolio related

28,752

23,556

23,666

20,321

20,566

Net interest income - portfolio related

30,491

28,493

25,694

26,602

24,412

Interest expense - corporate debt

4,182

17,140

4,462

4,488

4,309

Net interest income

26,309

11,353

21,232

22,114

20,103

Provision for loan losses

279

730

377

228

(1,000

)

Net interest income after provision for loan losses

26,030

10,623

20,855

21,886

21,103

Other operating income Gain on disposition of loans

1,776

4,540

2,357

306

2,391

Unrealized gain/(loss) on fair value loans

6

11

11

0

20

Other income (expense)

1,257

1,097

249

33

21

Other operating income (expense)

3,039

5,648

2,617

339

2,432

Total net revenues

29,070

16,271

23,472

22,225

23,535

Operating expenses Compensation and employee benefits

6,553

5,323

4,720

4,738

4,546

Rent and occupancy

426

442

429

447

430

Loan servicing

3,290

2,450

2,480

2,014

1,922

Professional fees

1,062

1,362

1,716

736

795

Real estate owned, net

(251

)

(175

)

417

1,186

1,039

Other operating expenses

3,199

2,848

2,333

2,177

1,918

Total operating expenses

14,279

12,250

12,095

11,298

10,650

Income before income taxes

14,790

4,021

11,377

10,927

12,885

Income tax expense

4,019

790

3,024

2,905

3,432

Net income

10,771

3,231

8,353

8,022

9,453

Net income attributable to noncontrolling interest

126

110

-

-

-

Net income attributable to Velocity Financial, Inc.

10,645

3,121

8,353

8,022

9,453

Less undistributed earnings attributable to participating

securities

164

48

362

3,030

3,571

Net earnings attributable to common stockholders

$

10,481

$

3,073

$

7,991

$

4,992

$

5,882

Basic earnings (loss) per share

$

0.33

$

0.10

$

0.26

$

0.25

$

0.29

Diluted earnings (loss) per common share

$

0.31

$

0.09

$

0.24

$

0.23

$

0.28

Basic weighted average common shares outstanding

31,917

31,892

30,897

20,090

20,087

Diluted weighted average common shares outstanding

34,057

34,204

34,257

34,212

33,960

Velocity Financial,

Inc.

Net Interest Margin ‒

Portfolio Related and Total Company

(Unaudited)

Quarter Ended June 30, 2022 Quarter Ended June 30,

2021 Interest Average Interest

Average Average Income / Yield /

Average Income / Yield / ($ in

thousands) Balance Expense Rate(1)

Balance Expense Rate(1) Loan portfolio:

Loans held for sale

$

62,987

$

11,524

Loans held for investment

2,910,693

2,010,962

Total loans

$

2,973,680

$

59,243

7.97

%

$

2,022,486

$

44,978

8.90

%

Debt: Warehouse and repurchase facilities

$

318,960

4,115

5.16

%

$

166,981

2,361

5.66

%

Securitizations

2,332,340

24,637

4.23

%

1,543,295

18,205

4.72

%

Total debt - portfolio related

2,651,300

28,752

4.34

%

1,710,276

20,566

4.81

%

Corporate debt

215,000

4,182

7.78

%

166,335

4,309

10.36

%

Total debt

$

2,866,300

$

32,934

4.60

%

$

1,876,611

$

24,875

5.30

%

Net interest spread - portfolio related (2)

3.63

%

4.08

%

Net interest margin - portfolio related

4.10

%

4.83

%

Net interest spread - total company (3)

3.37

%

3.59

%

Net interest margin - total company

3.54

%

3.98

%

(1)

Annualized.

(2)

Net interest spread — portfolio related is the difference between

the rate earned on our loan portfolio and the interest rates paid

on our portfolio-related debt.

(3)

Net interest spread — total company is the difference between the

rate earned on our loan portfolio and the interest rates paid on

our total debt.

Velocity Financial,

Inc.

Adjusted Financial Metric

Reconciliation to GAAP Net Income

(Unaudited)

Core Income Quarter Ended ($ in thousands)

6/30/2022 3/31/2022 12/31/2021

9/30/2021 6/30/2021 Net Income

$

10,645

$

3,121

$

8,353

$

8,022

$

9,453

Deal cost write-off - collapsed securitizations

-

-

$

1,104

-

-

One-time Century Health & Housing Capital deal costs

-

-

$

624

-

-

Recovery of Loan Loss Provision

-

-

-

-

$

(1,000

)

Corporate debt refinancing costs

-

$

9,286

-

-

-

Core Income

$

10,645

$

12,407

$

10,081

$

8,022

$

8,453

Diluted weighted average common shares outstanding

34,057

34,204

34,257

34,212

33,960

Core diluted earnings per share

$

0.31

$

0.36

$

0.29

$

0.23

$

0.25

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220804005753/en/

Investors and Media: Chris Oltmann (818) 532-3708

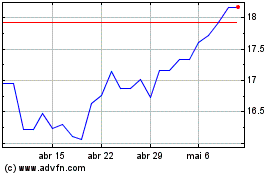

Velocity Financial (NYSE:VEL)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Velocity Financial (NYSE:VEL)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024