Canagold Resources Ltd. (“Canagold” or the

“Company”) (TSX: CCM; OTC-QB: CRCUF; Frankfurt: CANA)

announces that it has filed a rights offering circular (the

“Circular”) and a rights offering notice (the

“Notice”) with respect to Canagold’s offering of rights (the

“Rights Offering”) to holders of common shares (“Common

Shares”) of record as of the close of market on November 10,

2022 (the “Record Date”).

Pursuant to the Rights Offering, holders of Common Shares

(“Shareholders”) on the Record Date will receive one (1)

right (a “Right”) for each one (1) Common Share held. Each

two (2) Rights will entitle the holder to subscribe for one Common

Share of upon payment of a subscription price of $0.175 per Common

Share. Canagold expects to raise $7,985,215 under the Rights

Offering.

Sun Valley Investments AG (“Sun Valley”), an “insider”

and “related party” (as such terms are defined under applicable

securities laws) of the Company and the Company’s largest

shareholder, has advised the Company that it intends to exercise,

subject to relevant restrictions, all of its basic subscription

privileges. The Company has also entered into a standby guaranty

agreement with Sun Valley, pursuant to which Sun Valley has agreed

to purchase all of the Common Shares issuable under the Rights

Offering which remain unsubscribed under the basic subscription

privilege and the additional subscription privilege (the

“Standby Guaranty”). In August 2022, the Company obtained a

bridge loan of $2,500,000 (the “Bridge Loan”) from Sun

Valley as an advance payment for the Standby Guaranty. The Bridge

Loan is unsecured, bearing interest at the rate of 5.5% per annum,

is payable upon the earlier of (i) the completion of the Rights

Offering, (ii) 12 months after the date of the Bridge Loan

agreement and (iii) the termination of the Standby Guaranty.

The Rights will trade on the Toronto Stock Exchange under the

symbol “CCM.RT” commencing on November 9, 2022 and will trade until

12:00 p.m. (Eastern time) on December 9, 2022. The rights will

expire at 2:00 p.m. (Pacific time) on December 9, 2022 (the

“Expiry Time”), after which time unexercised Rights will be

void and of no value. Shareholders who fully exercise their Rights

under the basic subscription privilege will be entitled to

subscribe for additional Common Shares, if available as a result of

unexercised Rights prior to the Expiry Time, subject to certain

limitations as set out in the Circular. The Company expects to

close the Rights Offering on or about December 13, 2022, but in any

event no later than December 30, 2022.

The Rights will be offered to Shareholders resident in (i) all

provinces and territories of Canada except Quebec, (ii) each state

of the United States (excluding Arizona, Arkansas, California,

Minnesota, Ohio, Utah and Wisconsin), and (iii) in all

jurisdictions outside Canada and the United States excluding any

jurisdiction that does not provide a prospectus exemption

substantially similar to the exemption provided in Canada or that

otherwise requires obtaining any approvals of a regulatory

authority in such jurisdiction or the filing of any document by the

Company in such jurisdiction in connection with the Rights Offering

(collectively, the “Eligible Jurisdictions”).

Full details of the Rights Offering are set out in the Circular

and the Notice, which are available on the Company’s profile on

SEDAR at www.sedar.com or can be downloaded from the Company

website. The Notice and accompanying Rights direct registration

statements (the “Rights DRS”) will be mailed to registered

Shareholders in the Eligible Jurisdictions as of the Record Date.

To subscribe for Common Shares, registered Shareholders must mail

the completed Rights DRS, together with applicable funds, to the

Rights depositary and subscription agent, Computershare Investor

Services, Inc., prior to the Expiry Time. Shareholders who hold

their Common Shares through an intermediary, such as a bank, trust

company, securities dealer or broker, will receive materials and

instructions from their intermediary.

The proceeds of the Rights Offering are expected to be used to

repay the Bridge Loan, to advance the Company’s properties and for

working capital purposes.

About Canagold

Canagold Resources Ltd. is a growth-oriented gold exploration

company focused on advancing the New Polaris Project through

feasibility and permitting. Canagold is also seeking to grow its

assets base through future acquisitions of additional advanced

projects. Canagold has access to a team of technical experts that

can help unlock significant value for all Canagold

shareholders.

On behalf of the Board of Directors

“Catalin Kilofliski”

Catalin Kilofliski Chief Executive Officer

Neither the Toronto Stock Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the Toronto

Stock Exchange) accepts responsibility for the adequacy or accuracy

of this release.

Cautionary Note Regarding Forward-Looking Statements

This news release contains “forward-looking statements” within

the meaning of the United States private securities litigation

reform act of 1995 and “forward-looking information” within the

meaning of applicable Canadian securities legislation. Statements

contained in this news release that are not historical facts are

forward-looking information that involves known and unknown risks

and uncertainties. Forward-looking statements in this news release

include, but are not limited to, statements with respect to the

completion of the Rights Offering, future performance of Canagold,

and the Company's plans and exploration programs for its mineral

properties, including the timing of such plans and programs. In

certain cases, forward-looking statements can be identified by the

use of words such as "plans", "has proven", "expects" or "does not

expect", "is expected", "potential", "appears", "budget",

"scheduled", "estimates", "forecasts", "at least", "intends",

"anticipates" or "does not anticipate", or "believes", or

variations of such words and phrases or state that certain actions,

events or results "may", "could", "would", "should", "might" or

"will be taken", "occur" or "be achieved".

Forward-looking statements involve known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of the Company to be materially

different from any future results, performance or achievements

expressed or implied by the forward-looking statements. Such risks

and other factors include, among others risks related to the

uncertainties inherent in the estimation of mineral resources;

commodity prices; changes in general economic conditions; market

sentiment; currency exchange rates; the Company's ability to

continue as a going concern; the Company's ability to raise funds

through equity financings; risks inherent in mineral exploration;

risks related to operations in foreign countries; future prices of

metals; failure of equipment or processes to operate as

anticipated; accidents, labor disputes and other risks of the

mining industry; delays in obtaining governmental approvals;

government regulation of mining operations; environmental risks;

title disputes or claims; limitations on insurance coverage and the

timing and possible outcome of litigation. Although the Company has

attempted to identify important factors that could affect the

Company and may cause actual actions, events or results to differ

materially from those described in forward-looking statements,

there may be other factors that cause actions, events or results

not to be as anticipated, estimated or intended. There can be no

assurance that forward-looking statements will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such statements. Accordingly,

do not place undue reliance on forward-looking statements. All

statements are made as of the date of this news release and the

Company is under no obligation to update or alter any

forward-looking statements except as required under applicable

securities laws.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221107005918/en/

Knox Henderson, VP Corporate Development Toll Free:

1-877-684-9700; Tel: (604) 604-416-0337; Cell: (604) 551-2360

Email: knox@canagoldresources.com Website:

www.canagoldresources.com

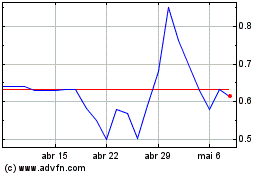

Concord Medical Services (NYSE:CCM)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Concord Medical Services (NYSE:CCM)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025