$19.6 Million in Revenue Represents

Year-Over-Year Growth of 28.3%

$5.7 Million Reduction in Operating Expenses, a

37% Year-over-Year Improvement

Company Identifies an Estimated $5 million in

Additional Cost-Savings and Margin Enhancements, Now Approximately

$20 Million Total

(All amounts are unaudited and in U.S.

dollars)

The Alkaline Water Company Inc. (NASDAQ and CSE: WTER) (the

“Company”), the country’s largest independent alkaline water

company and the Clean Beverage® company, today reported financial

results for the quarter ending September 30, 2022. The Company

reported record revenue of approximately $19.6 million,

representing the best quarterly revenue in company history and

28.3% year-over-year growth. The Company filed the corresponding

Form 10-Q with the SEC on November 14th, 2022, also available here:

ir.thealkalinewaterco.com

“In our first full quarter since we announced our Pathway to

Profitability, The Alkaline Water Company’s operating results show

the significant progress we are already making toward our goal of

profitability,” said Frank Lazaran, President and CEO of The

Alkaline Water Company. “We’ve reported record revenue, our

spending is down, and we are improving our gross margin, having

regained almost 300 basis points over last quarter.

“We grew revenue 28.3% year-over-year, to a record $19.6 million

while at the same time reducing operating expenses by $5.7 million.

We reiterate our revenue guidance of $70 million. Due to our

continued emphasis on executing our Pathway to Profitability

strategy, we project our gross margins will be between 26% and 27%

next quarter and 29% and 30% for the last quarter of the fiscal

year which ends March 31, 2023. This would amount to a gross margin

improvement of approximately 850 to 900 BPS over the course of the

year.”

Second Quarter Fiscal 2023 Financial

Highlights (all amounts in U.S. dollars)

(unaudited):

- Record revenue of $19.6 million, +28.3% year-over-year

compared to $15.3 million

- Gross Profit was $4.6 million, 23.7% of revenue, up 295 BPS

sequentially over first quarter

- Total Operating Expenses were $9.7 million, a 37% YoY

improvement

- Total Operating Loss was ($5.1 million), a 50% YoY

improvement

- Net Loss was ($8.4 Million), a $2 million YoY

improvement

- Net Loss Per Share of ($0.06) compared to ($0.11) in Q2 Fiscal

2022

- Cash Position on September 30, 2022 was approximately $2.3

million

Complete results for the Company’s Second Quarter Fiscal Year

2023 have been filed on EDGAR at www.sec.gov and on SEDAR under the

Company’s profile on www.sedar.com.

Pathway to Profitability

Update

The Company announced that an estimated $5 million in

additional cost savings and margin enhancements have been

identified. Total estimated savings, once fully implemented

throughout fiscal years 2023 and 2024, are now approximately $20

million compared to fiscal year 2022.

“We have examined and reexamined the cost of every single

component involved in the production and distribution of

Alkaline88, and we are doing everything we can to become a more

efficient company and rebuild our gross margin,” continued Mr.

Lazaran. “Non-essential General and Administrative expenses remain

frozen, saving us almost $2.7 million compared to last year and

Sales and Marketing expenses were reduced more than $3 million from

a year ago.

“Our total operating losses were reduced by over $5 million, a

50% improvement year-over-year. Our net loss improved by $2 million

from prior year quarter to $8.4 million which included

approximately $3.1 million, or $0.02 per share, in non-cash

nonrecurring other expenses. We’ve made significant progress toward

profitability in a very short time while increasing total revenue

by 28.3% and continuing to grow the Alkaline88 brand.”

The Company provided additional details on measures taken as

part of its Pathway to Profitability strategy:

- Reduction in Freight and Shipping & Handling

- Strengthened production and distribution network

- Lower fuel prices in Q2 vs Q1

- Renegotiated prices with primary transportation partners for up

to $1 million in potential savings per year at current shipping

volumes

- Decreased less-than-full-truckload shipments to high-volume

customers

- Freight cost per case shipped in the second quarter was down

approximately 20% year-over-year and 6% sequentially over last

quarter

- New Lower Prices for Raw Materials

- Renegotiated lower prices with multiple raw material vendors,

including bottles and packaging options

- The Company will begin to see the benefit of newly negotiated

lower prices on raw materials after more expensive existing

inventory is sold through in Q3 and Q4

- Inventory Reduction

- Over $800,000 reduction in overall inventory in Q2,

approximately $500,000 of which was raw materials

- Goal to reduce overall inventory by $2 million by end of

year

- Financing

- The Company has executed term sheets for $6-$7 million of

nondilutive financing, anticipated to close by year end

Second Quarter Fiscal Year 2023 Key

Business Highlights

The Company provided additional insight into the success of

Alkaline88® at retail and its trajectory for continued growth as a

brand within the Value-Added Water category.

- Nielsen Data Shows Strong Growth at Retail (for

xAOX+Conv. ending 10/08/2022)

- Alkaline88® grew 36.6% year-over-year in retail sales

for the trailing 52 weeks with sales totaling almost $90

million

- Alkaline88’s growth rate outpaced the category’s by 2.8 times

for the trailing 13 weeks

- Alkaline88’s 13-week retail sales were over $26

million

- New Stores

- Alkaline88 has closed deals to add over 11,000 new locations to

its retail footprint since the start of the calendar year

- Second quarter additions include Dollar Tree, BJs Wholesale

Club, AMPM, and Giant Eagle

- SKU Expansion

- Alkaline88 has closed deals to add new SKUs to existing clients

in over 18,000 locations since the start of the calendar year

- Second quarter additions include adding the Alkaline88 2-liter

in Rite-Aid nationally and H-E-B in Texas.

- Convenience Store Channel Growth

- Alkaline88 is now a top-15 brand in the convenience channel by

dollar volume according to 52-week Nielsen data

- Cases shipped are up 2.5 times in the first half of fiscal year

2023 over the same period from the previous year

- 12 states now have Direct-Store-Delivery coverage

- Alkaline88’s weighted distribution of less than 5% is one-tenth

the average of the larger brands in the channel, suggesting strong

opportunity for continued growth

“Alkaline88 is the largest independent enhanced-water brand in

the country,” continued Mr. Lazaran. “We are outpacing the

competition and showing strong growth at retail as a growing brand

in a growing beverage category, with products that consumers love.

This continued success at retail combined with the clear

improvements to our operating results make us very optimistic about

the future of The Alkaline Water Company.”

Second Quarter Fiscal Year 2023

Conference Call

The Company will host a conference call Tuesday November 15th,

at 8:30 AM Eastern Time.

Conference Call Details: Date: November 15, 2022 Time:

8:30AM Eastern Time (ET) Dial-in Number for U.S. and Canadian

Callers: 877-407-3088 Dial-in Number for International Callers

(Outside of the U.S. and Canada): 201-389-0927 Conference ID

Number: 13734370

Participating on the call will be the Company’s President and

CEO, Frank Lazaran, and Chief Financial Officer, David Guarino, who

will discuss operational and financial highlights for the second

quarter and the outlook for the second half of fiscal year 2023.

They will be joined for the question-and-answer portion of the call

by the Company’s Director of Sales and Operations, Frank

Chessman.

To join the live conference call, please dial into the

above-referenced telephone numbers five to ten minutes prior to the

scheduled call time.

A replay will be available for one week starting on November

15th, 2022, at approximately 12:30 PM (ET). To access the replay,

please dial 877-660-6853 in the U.S. or Canada and 201-612-7415 for

international callers and use Access ID: 13734370

About The Alkaline Water Company:

The Alkaline Water Company is the Clean Beverage® company making

a difference in the water you drink and the world we share.

Founded in 2012, The Alkaline Water Company (NASDAQ and CSE:

WTER) is headquartered in Scottsdale, Arizona. Its flagship

product, Alkaline88®, is a leading premier alkaline water brand

available in bulk and single-serve sizes along with eco-friendly

aluminum packaging options. With its innovative, state-of-the-art

proprietary electrolysis process, Alkaline88® delivers perfect 8.8

pH alkaline drinking water with trace minerals and electrolytes and

boasts our trademarked “Clean Beverage” label. In 2021, The

Alkaline Water Company was pleased to welcome Shaquille O’Neal to

its board of advisors and to serve as the celebrity brand

ambassador for Alkaline88®.

To purchase The Alkaline Water Company’s products online, visit

us at www.alkaline88.com.

To learn more about The Alkaline Water Company, please visit

www.thealkalinewaterco.com or connect with us on Facebook, Twitter,

Instagram, or LinkedIn.

Notice Regarding Forward-Looking Statements

This news release contains “forward-looking statements.”

Statements in this news release that are not purely historical are

forward-looking statements and include any statements regarding

beliefs, plans, expectations or intentions regarding the future.

Such forward-looking statements include, among other things, the

following: the statements relating to an estimated $5 million in

additional cost-savings and margin enhancements, now approximately

$20 million total (to be fully implemented throughout fiscal years

2023 and 2024) compared to fiscal year 2022; the statements

relating to the Company’s pathway to profitability and the

Company’s goal of profitability; the Company’s revenue guidance of

$70 million; the Company’s projection that the Company’s gross

margins will be between 26% and 27% next quarter and 29% and 30%

for the last quarter of the fiscal year which ends March 31, 2023

and that this would amount to a gross margin improvement of

approximately 850 to 900 BPS over the course of the year; that the

Company is doing everything it can to become a more efficient

company and rebuilding its gross margin; the statements relating to

the Company’s pathway to profitability strategy, including up to $1

million in potential savings per year at current shipping volumes

and goal to reduce overall inventory by $2 million by end of year;

that the Company will begin to see the benefit of newly negotiated

lower prices on raw materials after more expensive existing

inventory is sold through in Q3 and Q4; the Company’s trajectory

for continued growth as a brand within the Value-Added Water

category; the statement regarding proposed $6-$7 million dollars of

nondilutive financing, anticipated to close by year end; the

statement relating to strong opportunity for continued growth in

convenience store channel; and that the continued success at retail

combined with the clear improvements to the Company’s operating

results make the Company very optimistic about the future of The

Alkaline Water Company.

The material assumptions supporting these forward-looking

statements include, among others, that the Company’s cost-saving

and margin enhancement measures will be fully implemented and, once

implemented, they will be effective to reduce the Company’s annual

expense and enhance the Company’s margin to the extent anticipated

by the Company; that the Company’s burn rate to reach the level

anticipated by the Company as a result of the Company’s proactive

reduction in its monthly burn rate; that the demand for the

Company’s products will continue to significantly grow; that the

past production capacity of the Company’s co-packing facilities can

be maintained or increased; that there will be increased production

capacity through implementation of new production facilities, new

co-packers and new technology; that there will be an increase in

number of products available for sale to retailers and consumers;

that there will be an expansion in geographical areas by national

retailers carrying the Company’s products; that there will be an

expansion into new national and regional grocery retailers; that

there will be an expansion into new e-commerce, home delivery,

convenience, and healthy food channels; that there will not be

interruptions on production of the Company’s products; that there

will not be a recall of products due to unintended contamination or

other adverse events relating to the Company’s products; and that

the Company will be able to obtain additional capital to meet the

Company’s growing demand and satisfy the capital expenditure

requirements needed to increase production and support sales

activity. In addition, the Company’s fiscal year 2023 revenue

guidance is based on the Company’s expectation that the Company’s

topline to be driven by the momentum the Company is carrying

forward as one of the fastest-growing top-ten brands in one of the

fastest growing beverage categories; and the Company’s belief that

the Company will continue to see continued organic growth within

the Company’s existing retail clients and distribution expansion to

new clients throughout the country. Actual results could differ

from those projected in any forward-looking statements due to

numerous factors. Such factors include, among others, governmental

regulations being implemented regarding the production and sale of

alkaline water or any other products, including products containing

hemp/CBD; the fact that consumers may not embrace and purchase any

of the Company’s CBD-infused products; the fact that the Company

may not be permitted by the FDA or other regulatory authority to

market or sell any of its CBD-infused products; additional

competitors selling alkaline water and enhanced water products in

bulk containers reducing the Company’s sales; the fact that the

Company does not own or operate any of its production facilities

and that co-packers may not renew current agreements and/or not

satisfy increased production quotas; the fact that the Company has

a limited number of suppliers of its unique bulk bottles; the

potential for supply-chain interruption due to factors beyond the

Company’s control; the fact that there may be a recall of products

due to unintended contamination; the inherent uncertainties

associated with operating as an early stage company; changes in

customer demand and the fact that consumers may not embrace

enhanced water products as expected or at all; the extent to which

the Company is successful in gaining new long-term relationships

with new retailers and retaining existing relationships with

retailers; the Company’s ability to raise the additional funding

that it will need to continue to pursue its business, planned

capital expansion and sales activity; competition in the industry

in which the Company operates and market conditions; and the risk

that the proposed $6-$7 million of nondilutive financing may not

close by year end or at all. These forward-looking statements are

made as of the date of this news release, and the Company assumes

no obligation to update the forward-looking statements, or to

update the reasons why actual results could differ from those

projected in the forward-looking statements, except as required by

applicable law, including the securities laws of the United States

and Canada. Although the Company believes that any beliefs, plans,

expectations and intentions contained in this news release are

reasonable, there can be no assurance that any such beliefs, plans,

expectations or intentions will prove to be accurate. Readers

should consult all of the information set forth herein and should

also refer to the risk factors disclosure outlined in the reports

and other documents the Company files with the SEC, available at

www.sec.gov, and on the SEDAR, available at www.sedar.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221111005570/en/

The Alkaline Water Company Inc. Jeff Wright Director of

Investor Relations 866-242-0240

investors@thealkalinewaterco.com

Media Jessica Starman 888-461-2233

jessica@elev8newmedia.com

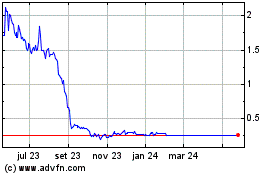

Alkaline Water (NASDAQ:WTER)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

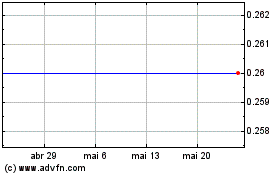

Alkaline Water (NASDAQ:WTER)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025