Announced record quarterly revenue of €62.9

million, up 27.3% year-over-year

VIA optronics AG (NYSE: VIAO) (“VIA”), a leading supplier of

interactive display systems and solutions, today announced

preliminary unaudited financial results for the third quarter ended

September 30, 2022.

Third Quarter 2022 Financial Highlights

- Total revenue increased 27.3% year-over-year to €62.9

million

- Display Solutions revenue increased 39.2% year-over-year to

€58.6 million

- EBITDA of €3.7 million compared to €2.0 million in the third

quarter of 2021

- Net income of €1.2 million compared to €0.1 million in the

third quarter of 2021

“We are pleased by the progress that we have made during the

third quarter of 2022. We are delighted to report record quarterly

revenue, exemplifying strong end-market demand for our display

systems and solutions as we continue to see increasing adoption of

more advanced, state-of-the-art displays in both electric and

traditional vehicles,” said Jürgen Eichner, CEO & Founder of

VIA. “Additionally, we are making great strides along our growth

path with the production ramp up and cost-savings initiatives that

should result in expanded profitability in the future.”

Third Quarter 2022 Financial Summary

Total revenue of €62.9 million increased 27.3% from €49.4

million in the third quarter of 2021. The increase was driven by

growth in the Company’s Display Solutions segment. Display

Solutions revenue of €58.6 million increased by 39.2% from €42.1

million in the third quarter of 2021, driven primarily by growth in

the automotive end market. Sensor Technologies revenue of €4.3

million decreased by 41.1% from €7.3 million in the third quarter

of 2021, due to ongoing lower demand in the consumer end market

after record turnover in the prior year.

- Revenue from the automotive end market grew 46% year-over-year

and accounted for 44% of Display Solutions revenue in the third

quarter

- Revenue related to the industrial and specialized applications

end market decreased 7% year-over-year and accounted for 27% of

Display Solutions revenue

- Revenue related to the consumer end market accounted for 29% of

Display Solutions revenue, compared to 17% of revenue in the third

quarter of 2021

Gross profit margin decreased to 8.6% from 13.8% in the third

quarter of 2021. Display Solutions gross profit margin of 8.9%

decreased from 11.6% in the third quarter of 2021, influenced by

ongoing margin pressure, material costs increase, inflation and

higher logistic costs. Sensor Technologies gross profit margin of

7.0% decreased from 26.0% in the third quarter of 2021, due to

changed market conditions and lower utilization.

Research and development expenses decreased slightly to €1.4

million from €1.5 million in the third quarter of 2021, in line to

support the Company’s future strategy. Selling expenses decreased

to €1.1 million from €1.2 million in the third quarter of 2021 and

general and administrative expenses decreased to €5.0 million from

€5.1 million in the third quarter of 2021 due further improvements

in the administrative cost structure.

Operating income was €2.1 million, compared to operating income

of €0.7 million in the third quarter 2021.

Net income was €1.2 million, or earnings of €0.27 per basic and

diluted share, compared to net income of €0.1 million, or earnings

of €0.02 per basic and diluted share, in the third quarter of

2021.

Total EBITDA was €3.7 million compared to EBITDA of €2.0 million

in the third quarter of 2021. Display Solutions EBITDA was €2.4

million compared to €1.5 million in the third quarter of 2021,

driven by operational performance as well as some one-time effects.

Sensor Technologies EBITDA was €(0.2) million compared to €1.1

million in the third quarter of 2021. Other Segments EBITDA was

€1.5 million compared to €(0.4) million in the third quarter of

2021, driven by the same aforementioned one-time effects.

Cash and cash equivalents were €54.3 million as of September 30,

2022, compared to €53.3 million at June 30, 2022. The increase was

driven by ongoing improvements in inventory management.

The Company has recognized an indication of an impairment during

the second quarter of 2022 due to a market capitalization of VIA

below equity as of June 30, 2022. As such, the Company has

commenced a goodwill impairment test according to IAS 36.8, which

is not yet finalized. The preliminary financial results for the

third quarter of 2022 should not be viewed as a substitute for the

Company´s third quarter 2022 results and do not present all

information necessary for an understanding of VIA's financial

performance as of September 30, 2022.

Outlook

For the fourth quarter of 2022, VIA expects to achieve total

revenue of between €37 million to €42 million. For the full year

2022, the Company expects to achieve revenue growth of between 10%

to 13% compared to 2021.

Dr. Markus Peters, CFO of VIA optronics, commented, “We had a

strong third quarter from a revenue standpoint, driven by a revenue

increase in our Display Solutions segment. This growth gives us the

confidence to increase our guidance revenue range for 2022. Strong

top-line growth, driven by a better utilization combined with

one-time effects resulted in better earnings in the quarter. We

will continue to strive to improve our operating performance which

includes further efficiencies in working capital management. Our

balance sheet remains strong, with cash and cash equivalents of

€54.3 million at the end of the third quarter, which provides us

with a solid basis to pursue our strategic initiatives.”

Conference Call

VIA will host a conference call to discuss its results and will

provide a corporate update at 12:30 p.m. Central European Time /

6:30 a.m. Eastern Time today, November 23, 2022.

The dial-in numbers for the call are 1-646-664-1960 (USA),

032-22109-8334 (Germany), 020-3936-2999 (United Kingdom), or +44

20-3936-2999 (Other). The access code for the call is 780257.

Please ask to be connected to the VIA Optronics AG call when

prompted by the operator.

The live webcast of the call, along with the Company’s earnings

press release, can be accessed through the VIA Investor Relations

website at https://investors.via-optronics.com. Following the

conference call, an archived version of the webcast will also be

available on the Investor Relations section of the Company’s

website shortly after the live call ends.

Investor Relations website.

About VIA

VIA is a leading provider of enhanced display solutions for

multiple end-markets in which superior functionality or durability

is a critical differentiating factor. Its customizable technology

is well-suited for high-end markets with unique specifications as

well as demanding environments that pose technical and optical

challenges for displays, such as bright ambient light, vibration

and shock, extreme temperatures and condensation. VIA’s interactive

display systems combine system design, interactive displays,

software functionality, cameras and other hardware components.

VIA’s intellectual property portfolio, process know-how, and

optical bonding and metal mesh touch sensor and camera module

technologies provide enhanced display solutions that are built to

meet the specific needs of its customers.

Non-IFRS Financial Measures

Our management and supervisory boards utilize both IFRS and

non-IFRS measures in a number of ways, including to facilitate the

determination of our allocation of resources, to measure our

performance against budgeted and forecasted financial plans and to

establish and measure a portion of management's compensation.

The non-IFRS measures used by our management and supervisory

boards include:

EBITDA, which we define as net profit (loss) calculated in

accordance with IFRS before interests, taxes, depreciation and

amortization.

Forward-Looking Statements

Statements in this press release about future expectations,

plans and prospects, as well as any other statements regarding

matters that are not historical facts, may constitute

“forward-looking statements.” These statements include, but are not

limited to, statements relating to the expected trading

commencement and closing dates. The words, without limitation,

“anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,”

“intend,” “may,” “plan,” “potential,” “predict,” “project,”

“should,” “target,” “will,” “would” and similar expressions are

intended to identify forward-looking statements, although not all

forward-looking statements contain these or similar identifying

words. Forward-looking statements are based largely on our current

expectations and projections about future events and financial

trends that we believe may affect our financial condition, results

of operations, business strategy, short-term and long-term business

operations and objectives, and financial needs. These

forward-looking statements involve known and unknown risks,

uncertainties, changes in circumstances that are difficult to

predict and other important factors that may cause our actual

results, performance or achievements to be materially different

from any future results, performance or achievements expressed or

implied by the forward-looking statement,, including, without

limitation, the risks described under Item 3. “Key Information—D.

Risk Factors,” in our Annual Report on Form 20-F as filed with the

US Securities and Exchange Commission. Moreover, new risks emerge

from time to time. It is not possible for our management to predict

all risks, nor can we assess the impact of all factors on our

business or the extent to which any factor, or combination of

factors, may cause actual results to differ materially from those

contained in any forward-looking statements we may make. In light

of these risks, uncertainties and assumptions, the forward-looking

events and circumstances discussed in this release may not occur

and actual results could differ materially and adversely from those

anticipated or implied in the forward-looking statements. We

caution you therefore against relying on these forward-looking

statements, and we qualify all of our forward-looking statements by

these cautionary statements. Any forward-looking statements

contained in this press release are based on the current

expectations of VIA’s management team and speak only as of the date

hereof, and VIA specifically disclaims any obligation to update any

forward-looking statement, whether as a result of new information,

future events or otherwise. Due to rounding, it is possible that

individual figures in this and other documents do not add up

precisely to the totals shown and that percentages presented do not

accurately reflect the absolute values to which they relate.

VIA optronics AG

Consolidated Statement of

Financial Position

September 30,

December 31,

Millions of EUR

2022 unaudited

2021

Assets

Non-current assets

26.8

27.8

Intangible assets

3.1

4.2

Property and equipment

21.2

21.5

Other financial assets

1.3

1.1

Deferred tax assets

1.2

1.0

Current assets

128.8

133.9

Inventories

32.0

35.9

Trade accounts receivables

33.9

31.1

Current tax assets

—

0.6

Other financial assets

—

—

Other non-financial assets

8.6

8.3

Cash and cash equivalents

54.3

58.0

Total assets

155.6

161.7

Equity and liabilities

Equity attributable to equity holders

of the parent

57.6

65.0

Share capital

4.5

4.5

Subscribed capital

—

—

Capital reserve

88.5

88.5

(Accumulated Deficit) / Retained

earnings

(30.6

)

(26.8

)

Currency translation reserve

(4.8

)

(1.2

)

Non-controlling interests

0.4

0.5

Total Equity

58.0

65.5

Non-current liabilities

8.3

8.8

Loans

2.0

0.7

Provisions

0.1

0.1

Lease liabilities

6.2

8.0

Deferred tax liabilities

—

—

Current liabilities

89.3

87.4

Loans

38.6

34.6

Trade accounts payable

27.4

33.4

Current tax liabilities

0.2

1.4

Provisions

1.1

1.1

Lease liabilities

2.4

2.0

Other financial liabilities

11.5

7.3

Other non-financial liabilities

8.1

7.6

Total equity and liabilities

155.6

161.7

VIA optronics AG

Consolidated Statements of

Operations Data

Three Months Ended

Nine Months Ended

September 30,

September 30,

Millions of EUR

2022 unaudited

2021* unaudited

2022 unaudited

2021* unaudited

Revenue

62.9

49.4

163.6

134.5

Cost of sales

(57.5

)

(42.6

)

(150.2

)

(116.8

)

Gross profit

5.4

6.8

13.4

17.7

Selling expenses

(1.1

)

(1.2

)

(3.7

)

(3.8

)

General administrative expenses

(5.0

)

(5.1

)

(16.9

)

(14.7

)

Research and development expenses

(1.4

)

(1.5

)

(4.6

)

(4.5

)

Other operating income

5.5

4.5

14.5

8.6

Other operating expenses

(1.3

)

(2.8

)

(5.0

)

(5.1

)

Operating (loss)/income

2.1

0.7

(2.3

)

(1.8

)

Financial result

(0.5

)

(0.2

)

(1.2

)

(0.8

)

(Loss)/Profit before tax

1.6

0.5

(3.5

)

(2.6

)

Income tax expenses

(0.4

)

(0.3

)

(0.4

)

(1.1

)

Net (loss)/profit after taxes from

continuing operations

1.2

0.1

(3.9

)

(3.7

)

Adjustments:

Financial result

0.5

0.2

1.2

0.8

Foreign exchange gains (losses) on

intercompany indebtedness

—

—

—

—

Income tax expenses

0.4

0.3

0.4

1.1

Depreciation

1.6

1.4

4.8

4.5

EBITDA

3.7

2.0

2.5

2.7

*Change in Functional Currency For the years ended December 31,

2020, and all prior periods, the functional currencies of the

Companies of the VIA Group were considered to be the respective

local currencies. Following a thorough analysis in 2021, VIA

determined that the functional currency for two of its major group

subsidiaries – VIA optronics GmbH and VIA optronics (Suzhou) Co.,

Ltd. should change as both subsidiaries currently generate revenues

and expend cash for supplies predominantly in US dollars. Based on

the development of these so called “primary indicators” the

functional currency of those companies was changed from Euro and

Renminbi, respectively to US dollars. In accordance with IAS 21,

changes in functional currency are accounted for on a prospective

basis, beginning January 1, 2021; therefore, interim figures

reported during 2021, using the local currency as the functional

currency,have been revised with respect to the change in functional

currency

VIA optronics AG

Earnings Per Share

Three

Three

Months

Months

Ended

Ended

September 30,

September 30,

Millions of EUR (except per share

data)

2022 unaudited

2021* unaudited

Income/(loss) after taxes from continuing

operations (attributable to VIA optronics AG shareholders)

1.2

0.1

Weighted average of shares outstanding

4,530,701

4,530,701

Earnings/(loss) per share in EUR

(basic and diluted)

0.27

0.02

*Change in Functional Currency For the years ended December 31,

2020, and all prior periods, the functional currencies of the

Companies of the VIA Group were considered to be the respective

local currencies. Following a thorough analysis in 2021, VIA

determined that the functional currency for two of its major group

subsidiaries – VIA optronics GmbH and VIA optronics (Suzhou) Co.,

Ltd. should change as both subsidiaries currently generate revenues

and expend cash for supplies predominantly in US dollars. Based on

the development of these so called “primary indicators” the

functional currency of those companies was changed from Euro and

Renminbi, respectively to US dollars. In accordance with IAS 21,

changes in functional currency are accounted for on a prospective

basis, beginning January 1, 2021; therefore, interim figures

reported during 2021, using the local currency as the functional

currency,have been revised with respect to the change in functional

currency.

VIA optronics AG

Segment Information**

2022:

Nine Months Ended

September 30, 2022 unaudited

Display

Sensor

Other

Total

Consolidation

Consolidated

Millions of EUR

Solutions

Technologies

segments

segments

adjustments

Total

External revenues

148.5

15.1

—

163.6

—

163.6

Inter-segment revenues

0.4

3.9

—

4.3

(4.3

)

—

Total revenues

148.9

19.0

—

167.9

(4.3

)

163.6

Gross profit

10.8

3.0

—

13.8

(0.4

)

13.4

Operating income (loss)

(1.3

)

(0.4

)

(0.6

)

(2.3

)

(2.3

)

Depreciation and amortization

3.1

1.7

—

4.8

—

4.8

EBITDA

1.8

1.3

(0.6

)

2.5

—

2.5

Net income (loss)

(3.3

)

(0.3

)

(0.3

)

(3.9

)

—

(3.9

)

Three Months Ended

September 30, 2022 unaudited

Display

Sensor

Other

Total

Consolidation

Consolidated

Millions of EUR

Solutions

Technologies

segments

segments

adjustments

Total

External revenues

58.6

4.3

—

62.9

—

62.9

Inter-segment revenues

0.1

1.0

—

1.1

(1.1

)

—

Total revenues

58.7

5.3

—

64.0

(1.1

)

62.9

Gross profit

5.2

0.3

—

5.5

(0.1

)

5.4

Operating income (loss)

1.4

(0.8

)

1.5

2.1

—

2.1

Depreciation and amortization

1.0

0.6

—

1.6

—

1.6

EBITDA

2.4

(0.2

)

1.5

3.7

—

3.7

Net income (loss)

0.3

(0.7

)

1.6

1.2

—

1.2

2021:

Nine Months Ended

September 30, 2021* unaudited

Display

Sensor

Other

Total

Consolidation

Consolidated

Millions of EUR

Solutions

Technologies

segments

segments

adjustments

Total

External revenues

115.2

19.3

—

134.5

—

134.5

Inter-segment revenues

—

3.0

—

3.0

(3.0

)

—

Total revenues

115.2

22.3

—

137.5

(3.0

)

134.5

Gross profit

12.5

5.2

—

17.7

—

17.7

Operating income (loss)

0.5

1.7

(4.0

)

(1.8

)

—

(1.8

)

Depreciation and amortization

2.5

2.0

—

4.5

—

4.5

EBITDA

3.0

3.7

(4.0

)

2.7

—

2.7

Net income (loss)

(1.0

)

1.1

(3.8

)

(3.7

)

—

(3.7

)

Three Months Ended

September 30, 2021* unaudited

Display

Sensor

Other

Total

Consolidation

Consolidated

Millions of EUR

Solutions

Technologies

segments

segments

adjustments

Total

External revenues

42.1

7.3

—

49.4

—

49.4

Inter-segment revenues

—

0.7

—

0.7

(0.7

)

—

Total revenues

42.1

8.0

—

50.1

(0.7

)

49.4

Gross profit

4.9

1.9

—

6.8

6.8

Operating income (loss)

0.5

0.6

(0.4

)

0.7

(0.1

)

0.6

Depreciation and amortization

0.9

0.5

—

1.4

—

1.4

EBITDA

1.5

1.1

(0.4

)

2.1

(0.1

)

2.0

Net income (loss)

—

0.4

(0.4

)

0.1

—

0.1

*Change in Functional Currency For the years ended December 31,

2020, and all prior periods, the functional currencies of the

Companies of the VIA Group were considered to be the respective

local currencies. Following a thorough analysis in 2021, VIA

determined that the functional currency for two of its major group

subsidiaries – VIA optronics GmbH and VIA optronics (Suzhou) Co.,

Ltd. should change as both subsidiaries currently generate revenues

and expend cash for supplies predominantly in US dollars. Based on

the development of these so called “primary indicators” the

functional currency of those companies was changed from Euro and

Renminbi, respectively to US dollars. In accordance with IAS 21,

changes in functional currency are accounted for on a prospective

basis, beginning January 1, 2021; therefore, interim figures

reported during 2021, using the local currency as the functional

currency,have been revised with respect to the change in functional

currency.

**Segments Operating segments are reported in a manner

consistent with the internal reporting provided to the Chief

Operating Decision Maker (CODM). The CODM is comprised of the CEO

and the CFO of VIA. Since the acquisition of VTS in 2018, the Group

reports two reportable segments: “Display Solutions” and “Sensor

Technologies”. Based on the further development of the Group and

the strengthening of the group-wide holding functions of VIA

optronics AG, VIA optronics AG is from 2021 on no longer aggregated

as part of the reportable segment Display Solutions but reported as

“Other segments”. Q1 2021, Q2 2021 and Q3 2021 figures have been

revised accordingly.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221123005123/en/

Investor Relations Sam Cohen or Lisa Fortuna Alpha IR

Group Phone: +1 312-445-2870 VIAO@alpha-ir.com Media Contact

Alexandra Müller-Pl�tz Phone: +49 911 597 575-302

Amueller-ploetz@via-optronics.com

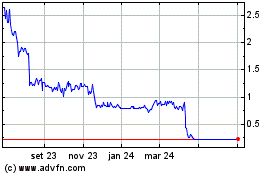

VIA optronics (NYSE:VIAO)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

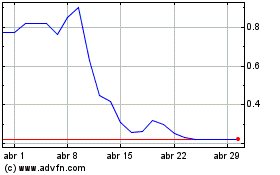

VIA optronics (NYSE:VIAO)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025