Delaware Ivy High Income Opportunities Fund Announces Distribution

01 Dezembro 2022 - 7:28PM

Business Wire

Today, Delaware Ivy High Income Opportunities Fund (the “Fund”),

a New York Stock Exchange– listed closed-end fund trading under the

symbol “IVH,” declared a monthly distribution of $0.073 per common

share. The monthly distribution is payable December 30, 2022 to

shareholders of record at the close of business on December 23,

2022. The ex-dividend date will be December 22, 2022.

The distribution is expected to be paid from net investment

income (regular interest and dividends). The final tax status of

the distribution may differ substantially from this preliminary

information, which is based on estimates, and the final

determination of such amount will be made in early 2023 when the

Fund can determine its earnings and profits for the 2022 fiscal

year.

The Fund’s investment objective is to seek to provide total

return through a combination of a high level of current income and

capital appreciation. The Fund seeks to achieve its investment

objective by investing primarily in a portfolio of high yield

corporate bonds of varying maturities and other fixed income

instruments of predominantly corporate issuers, including first-

and second-lien secured loans (“Secured Loans”). In addition, the

Fund utilizes leveraging techniques in an attempt to obtain a

higher return for the Fund. There can be no assurance that the Fund

will achieve its investment objective.

Under normal circumstances, the Fund will invest at least 80% of

its Managed Assets (as defined below) in a portfolio of U.S. and

foreign bonds, loans and other fixed income instruments, as well as

other investments (including derivatives) with similar economic

characteristics. The Fund will invest primarily in instruments that

are, at the time of purchase, rated below investment grade (below

Baa3 by Moody’s Investors Service, Inc. (“Moody’s”) or below BBB-

by either Standard & Poor’s Rating Services (“S&P”) or

Fitch, Inc. (“Fitch”), or comparably rated by another nationally

recognized statistical rating organization (“NRSRO”)), or unrated

but judged by the Adviser to be of comparable quality. “Managed

Assets” means the Fund’s total assets, including the assets

attributable to the proceeds from any borrowings or other forms of

structural leverage minus liabilities other than the aggregate

indebtedness entered into for purposes of leverage. The Fund may

invest 100% of its Managed Assets in fixed income instruments and

securities issued by foreign issuers, and up to 25% of its Managed

Assets in fixed income instruments and securities of issuers in

emerging markets. Such foreign instruments may be U.S. currency

denominated or foreign currency denominated. Under normal market

conditions the Fund’s investments will consist predominantly of

high yield bonds and/or Secured Loans; however, the Fund’s

investments in fixed income instruments also may include, to a

lesser extent, debentures, notes, commercial paper, investment

grade bonds, loans other than secured loans, including unsecured

loans and mezzanine loans, and other similar types of debt

instruments, as well as derivatives related to or referencing these

types of securities and instruments. The Fund will not invest in

collateralized loan obligations or collateralized debt obligations.

The Fund will seek to dynamically adjust and hedge its duration

depending on the market opportunities available. Under normal

circumstances, the dollar-weighted average portfolio duration of

the Fund will generally range between zero and seven years.

The Fund is a non-diversified, closed-end management investment

company. The price of the Fund’s shares will fluctuate with market

conditions and other factors. Closed-end funds frequently trade at

a discount from their net asset values (NAVs), which may increase

an investor’s risk of loss. At the time of sale, shares may have a

market price that is below NAV and may be worth less than the

original investment upon their sale.

The Fund’s investments in below investment grade securities

(commonly referred to as “high yield securities” or “junk bonds”)

may carry a greater risk of nonpayment of interest or principal

than higher rated bonds. Loans (including loan assignments, loan

participations and other loan instruments) carry other risks,

including the risk of insolvency of the lending bank or other

intermediary. Loans may be unsecured or not fully collateralized,

may be subject to restrictions on resale and sometimes trade

infrequently on the secondary market.

About Macquarie Asset Management

Macquarie Asset Management is a global asset manager that aims

to deliver positive impact for everyone. Trusted by institutions,

pension funds, governments, and individuals to manage more than

$US508 billion in assets globally,1 we provide access to specialist

investment expertise across a range of capabilities including

infrastructure, green investments and renewables, real estate,

agriculture and natural assets, asset finance, private credit,

equities, fixed income and multi asset solutions.

Advisory services are provided by Delaware Management Company, a

series of Macquarie Investment Management Business Trust, a

registered investment advisor. Macquarie Asset Management is part

of Macquarie Group, a diversified financial group providing clients

with asset management, finance, banking, advisory and risk and

capital solutions across debt, equity, and commodities. Founded in

1969, Macquarie Group employs more than 19,000 people in 33 markets

and is listed on the Australian Securities Exchange. For more

information about Delaware Funds by Macquarie®, visit

delawarefunds.com or call 800 523-1918.

Other than Macquarie Bank Limited ABN 46 008 583 542

(“Macquarie Bank”), any Macquarie Group entity noted in this press

release is not an authorised deposit-taking institution for the

purposes of the Banking Act 1959 (Commonwealth of Australia). The

obligations of these other Macquarie Group entities do not

represent deposits or other liabilities of Macquarie Bank.

Macquarie Bank does not guarantee or otherwise provide assurance in

respect of the obligations of these other Macquarie Group entities.

In addition, if this press release relates to an investment, (a)

the investor is subject to investment risk including possible

delays in repayment and loss of income and principal invested and

(b) none of Macquarie Bank or any other Macquarie Group entity

guarantees any particular rate of return on or the performance of

the investment, nor do they guarantee repayment of capital in

respect of the investment.

1 As of September 30, 2022

© 2022 Macquarie Management Holdings, Inc.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221201006009/en/

Investors Computershare 866 437-0252

delawarefunds.com/closed-end

Media contact Lee Lubarsky 347 302-3000

Lee.Lubarsky@macquarie.com

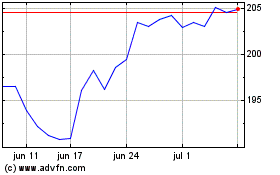

Macquarie (ASX:MQG)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

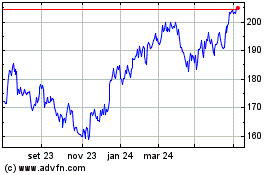

Macquarie (ASX:MQG)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024